Interview with Ingrid Hibbard, President and CEO of Pelangio Exploration Inc. (TSX-V: PX; OTC PINK: PGXPF): Acquiring and Exploring Camp-Sized Land Packages in World-Class Gold Belts, Ghana, West Africa

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/26/2017

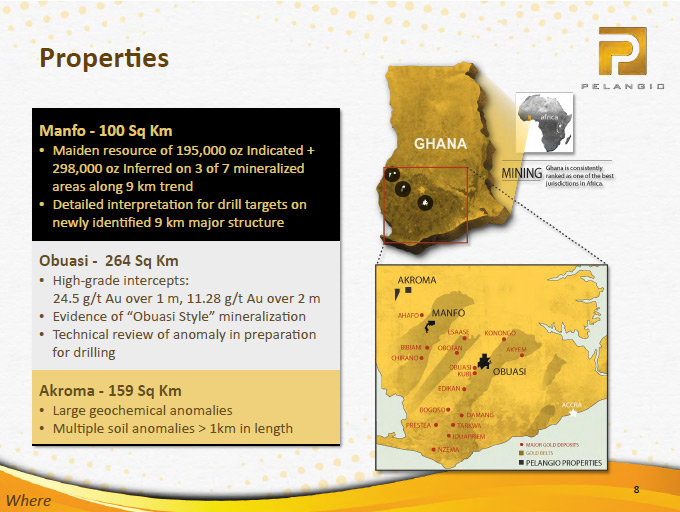

Pelangio Exploration Inc. (TSX-V: PX; OTC PINK: PGXPF) is a junior gold exploration company that successfully

acquires and explores camp-sized land packages in world-class gold belts. The Company primarily operates in

Ghana, West Africa, an English-speaking, common law jurisdiction that is consistently ranked amongst the most

favorable mining jurisdictions in Africa. The three wholly owned projects, on which Pelangio is currently

focused, are; the Manfo Property, the site of seven recent near-surface gold discoveries, the Obuasi Property,

located four kilometres on strike and adjacent to AngloGold Ashanti’s prolific, high-grade Obuasi Mine, and the

early stage Akroma Property. According to Ingrid Hibbard, President and CEO of Pelangio Exploration, they have

the best property portfolio in Ghana in areas where there's already been significant production. Mrs. Hibbard

believes we are coming out of one of the worst downturns she has ever seen. The company was able to use the

downturn wisely and bought projects at the bottom of the market.

Pelangio Exploration Manfo Property

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ingrid Hibbard,

President and CEO of Pelangio Exploration Inc. I wonder if you could give our readers/investors an overview of

Pelangio.

Ingrid Hibbard: Pelangio really has what we view as the best property portfolio in Ghana, West Africa.

We have 500 square kilometers in three properties. Our Manfo property is our most advanced property. Obuasi is a

very exciting and extremely well located property. Akroma is our earliest stage property.

Our most advanced property, Manfo, is 100 square kilometers located on the Sefwi belt, 14 kilometers away from

Newmont, the Ahafo mine, which is about a 15 million ounce mine. It's one of the giant mines. We have been

working on a nine kilometer geochemical trend, where we've made seven discoveries. We have an initial resource

on three of those, 195 thousand ounces in the indicated category and another 298 thousand ounces in the inferred

category.

Most importantly, during this downturn, when you have time to really do some detailed interpretation and

quite frankly, thinking, we have now identified another 9 kilometer trend. In fact, this would be a major

structure, a major fault. We have now developed a detailed interpretation for drill targeting along that newly

identified nine kilometer trend. Excited about that! We have the original nine kilometer trend, and now a second

nine kilometer trend.

Obuasi, a 264 square kilometer land package, which is located directly contiguous to one of the great

mines of the world, AngloGold, Ashanti's Obuasi mine, which is a 50 million ounce deposit. We are directly

contiguous to that and on strike. During the downturn, we have identified Obuasi-style mineralization on the

property. We've had some high grade intercepts of 24 grams over a meter and 11 over two meters. That's all

within a kilometer long anomaly, we've been doing some technical review of that in preparation for drilling,

further down the line.

Our most grass roots property, Akroma, is two parcels. Dormaa is one of those two parcels. It's a very

early stage project, but we have teamed up with Roscan Minerals Corporation who is funding the work on the

project. They are going to fund $2 million to earn a 50% interest in the Dormaa property. We recently announced

that we've received $300 thousand from them, so we're now preparing for the drilling and mobilizing to start a

drill program this summer.

Dr. Allen Alper: That sounds good. Could you tell our viewers what your strategy is and what your vision

is for what you're doing in Ghana, and how it might compare to the success you had at Detour Lake?

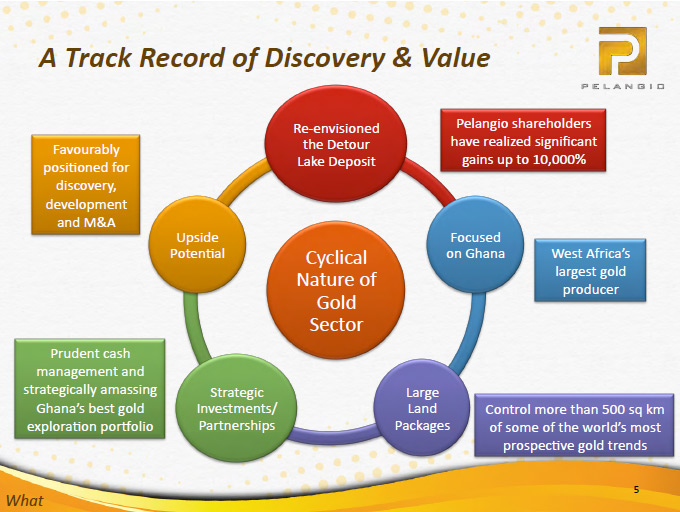

Ingrid Hibbard: After Detour, we were looking for big land packages on prolific belts. The first way to

reduce risk is to be looking in areas where you know there's already been significant production. You can see

that both Obuasi and Manfo meet that criteria. They're big land packages. That was the first part of the

strategy.

The second part of the strategy is to take into account the fact that we're in a cyclical business. You

either fight it or you go with it. We've decided that the way to go and the way to best position yourself is to

take advantage of those downturns. We believe we are coming out of one of the worst downturns certainly that I

have ever seen. People who'd been in the industry longer than I say it's the worst they've ever seen for the

gold sector, anyway. It does feel like we're coming out on the other side. We've put that time to good use. At

Detour, that's how we were able to buy the project. We were able to buy it at the bottom of the market.

What we've done here is use the time to develop the targets and to reinterpret things. Really, it was the

downturn, along with having the information from the drill programs before and the time and the willingness to

really dig into the data that allowed us to identify that new nine kilometer structure.

The other thing we did is we've identified a drill rig that we thought was particularly suited for our

needs. Where we're operating in Ghana, particularly Manfo, is in cocoa farms. If you can reduce your

environmental footprint and reduce the number of cocoa trees you cut down, that's a very good thing. This is a

small, modular, multi-purpose rig. We teamed up with a local Ghanaian firm to help them acquire that rig. In

return for that, we have preferential drilling rates and a preferential arrangement with them. We think that

it's going to have a significant impact on our drilling costs on a go-forward basis.

You do know that, as the market gets hotter, it gets harder to access drill rigs and the price seems to

rise. We think we're really well positioned now, with the work that we've done during the downturn, technically,

the deal on this rig, and Roscan, who is funding the early stage exploration. We think we are really well

positioned for where we're headed now.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your background, your

team, and your board?

Ingrid Hibbard: Absolutely. I have been at this since I was nine years old. I started working, helping

out my dad, who was a prospector. I guess you get a little hooked on the search for gold. Our team, similarly,

has years of experience.

Our VP Exploration, is Warren Bates, who has 30 years of experience, both in Canada and internationally.

He really deserves the credit for the discoveries at Manfo and for identifying this new structure.

We've recently appointed Sam Torkornoo as our VP Africa. He had been our country manager. Sam has a

geological engineering degree out of Ghana, as well as an MBA in resource management out of Freiberg, Germany.

Having a strong local team is critical to your success.

During the downturn and along the way, we've been training some younger geologists, as well. They're

coming along really well. We have a great team in Ghana.

Most of our board have been together for quite a few years. We have Ian Shaw and Carl Nurmi, who are

accountants, with that expertise. I'm a lawyer by training. David Mosher and Phil Olson are geologists. A new

addition is Kevin Thompson who just joined the board. He lived in Ghana for 12 years and he worked both for

Newmont and Perseus, doing exploration in Ghana. We're excited to welcome him to the board. We think that it's

going to bode well for us in the future.

Dr. Allen Alper: I know you have a great background of giving and returning high returns to your

shareholders and a great background in general. You've assembled a very strong board and team. Sounds excellent!

Ingrid Hibbard: We are explorationists. As much as possible, a big part of our strategy is to focus on

that. Our strategy would be, at the appropriate time, to either bring in the team or spin out an asset, as we

did with Detour, to people who have the development expertise and the capital raising expertise. As it moves

forward to a bigger development or a project that requires major capital.

We did that at Detour and our strategy worked very, very well. We spun Detour out to a new company

Detour Gold. We owned 50% of that new spin-out. As they increased the resources by drilling, the value of our

50% share of that company increased, as well. It was a great strategy and it really did well for our

shareholders.

Dr. Allen Alper: That sounds excellent. Sounds like you have a great location, a great team, and

excellent strategy. Sounds like you and your group have a lot going for you. Could you tell our

readers/investors a little bit about your stock and your share and capital structure?

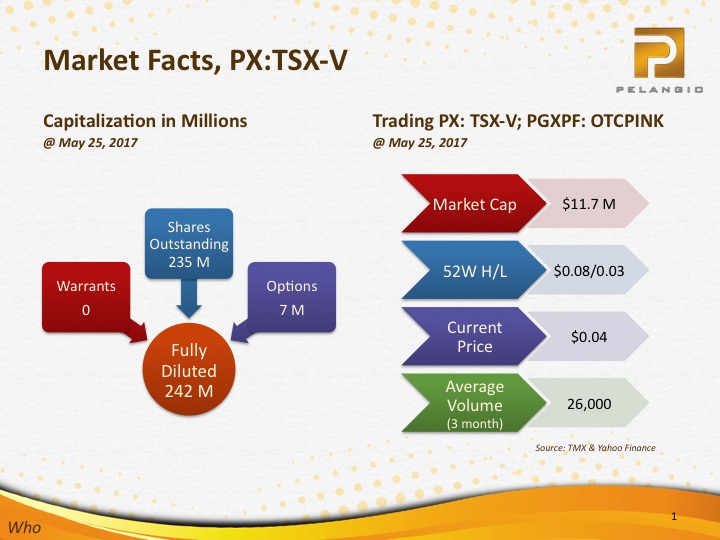

Ingrid Hibbard: We are trading at 4.5 cents. We have a market capital of about $11 million. This

downturn has been brutal. There's no other way to put it. For the asset base we have, we think we're

tremendously undervalued, but we think the market is turning. We recognize that the market's cyclical. We think

investors need to recognize that, too. This is an opportune time.

We're probably not the only one out there, but we have great assets and many, many drill targets are

ahead of us. That's important. At Manfo, we have well in excess of 30 drill targets. As the market turns, we're

positioned. We have the drill targets ready to go. We have a resource we can add to.

Our most recent discovery was in Nkansu, and it is coming in very, very well. We can be adding to that, as well

as looking at that whole new nine kilometer structure. We think we're very well positioned. With our share price

at this level, we think it's an opportunity for investors.

Dr. Allen Alper: Well, that does sound like a big opportunity. Could you summarize the primary reasons

our high-net-worth readers/investors should consider investing in Pelangio?

Ingrid Hibbard: We have a slide in our presentation on the website, Al, which really talks about how the

time is now. We believe that the cycle has turned. Last cycle, we re-envisioned and monetized Detour, a single

camp size project. This time, we have three camp sized projects. At Manfo, we've made significant discoveries

and we have seven mineralized areas. We've developed a maiden resource, we identified this new nine kilometer

trend, our exploration programs are designed and our new rig arrangement is in place. The rig is commissioned

and ready to go. We're following up on a resource with additional discoveries on a new nine kilometer trend. The

cycle is turning.

My analogy is, I feel like a race horse at the starting gate. I'm just waiting for the gun to go off. We

have all our ducks in a row, and we're ready to get going. At Manfo, we have a two stage exploration program

planned to target the belt- bounding structure and the existing mineralized area. At Obuasi, we have a drilling

program planned with eight drill-ready targets all ready. At Akroma, which is being funded by Roscan, there's a

five thousand meter program being funded by them, targeting multiple geochemical anomalies.

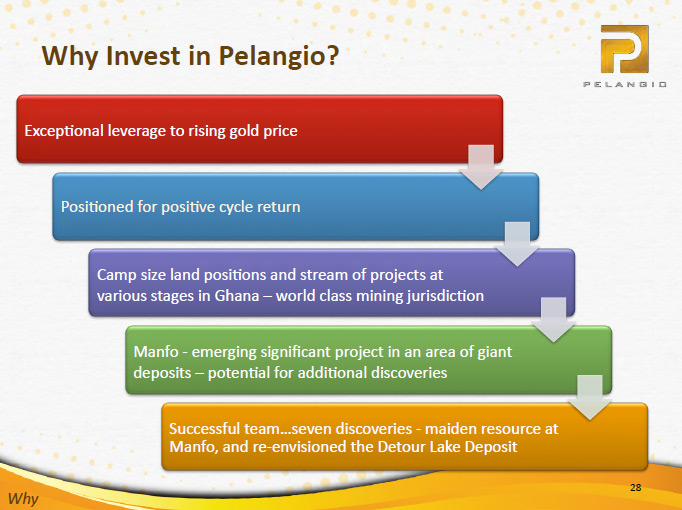

Why invest in Pelangio? Exceptional leverage to a rising gold price! We're positioned for the positive cycle

return. We have camp-sized land positions and a stream of projects in various stages in Ghana, which is a world

class mining jurisdiction. Manfo is an emerging, significant project in an area of giant deposits, with the

potential for multiple additional discoveries. And, we have a successful team that has already made seven

discoveries and, a maiden resource at Manfo, the team that re-envisioned the Detour Lake deposit.

Dr. Allen Alper: Well, that sounds excellent! Could you tell our readers/investors a little bit about

operating in Ghana?

Ingrid Hibbard: Ghana has a mining history that goes back centuries. The Obuasi mine itself hasn't gone

back centuries, but it did start in 1897. That's the mine that we're right next door to, with our biggest land

package at Obuasi. In Ghana, there are a couple universities that graduate mining engineers and geologists. They

have a mining history that goes way back. Most importantly, Ghanaians have a belief and an understanding of the

wealth generation from gold mining. You have access to trained and talented people. You have an intensity of

potential.

There are multiple five million ounce deposits in Ghana. We have to remember that it's the size of the

state of Michigan or southern Ontario. In 2013, anyway, it ranks in the top 10 of gold producers. It's eighth in

terms of ounces. You're comparing Ghana, the size of the state of Michigan, to all of Canada or all of the US or

all of China or all of Russia. It punches above its weight, that's for sure. It's a small country with

significant, significant gold endowment.

Dr. Allen Alper: That sounds fantastic! Is there anything else you'd like to add?

Ingrid Hibbard: We have three great projects, a resource, and multiple discoveries along that nine

kilometer trend.

The thing we're really excited about is nine kilometers of a major belt-bounding structure. Typically,

at Sefwi as elsewhere, major faults are significant because to find the larger deposits and the higher grade

deposits, you want to be looking within one kilometer of a major fault. To have identified that major fault

along nine kilometers across our property, that's significant.

I did a presentation up at Timmins, comparing favorably our land packages to what it would look like if

you had that kind of a land position along the Abitibi greenstone belt.

Ingrid Hibbard: We find a lot of people in North America can identify better with North America, and the

Abitibi greenstone belt has such a storied history. I think we covered the highlights.

Dr. Allen Alper: It sounds excellent. Sounds like you have an opportunity of repeating Detour!

Ingrid Hibbard: It's very exciting, where we are now.

Dr. Allen Alper: That's great. I think so too.

http://www.pelangio.com/

Ingrid Hibbard, President & CEO or

Warren Bates, Senior Vice President Exploration

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

|

|