Christopher Jones, President and CEO, Uranium Resources Inc. (NASDAQ: URRE; ASX: URI): Developing a New Lithium Business and Advancing Uranium Business as Prices Rise

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/12/2017

Uranium Resources, Inc. (NASDAQ: URRE; ASX: URI) focused on expanding its energy metals

strategy, which includes developing its new lithium business, while maintaining optionality on

the future rising uranium price. We learned from Christopher Jones, President and CEO of Uranium

Resources, over these past 4 years they have restarted and reset the company, with a new team

and a new focus and have taken the company to be debt free. Their prospective lithium brine

exploration projects are located in Nevada and Utah. In addition, URI remains focused on

advancing the Temrezli in-situ recovery (ISR) uranium project in Central Turkey, when uranium

prices permit economic development of this project.

Lithium Claim Staking & Soil Sampling

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing

Chris Jones, President and CEO of Uranium Resources. Could you give our readers/investors an

overview of your company, Chris?

Chris Jones: Certainly. Thanks. Uranium Resources has been around since the late 70s

as a former uranium producer in Texas. We've been listed on the NASDAQ for close on 40 years.

This team took over in 2013, after the company had fallen upon some less-than-stellar times. The

company hasn't produced uranium since 2009.

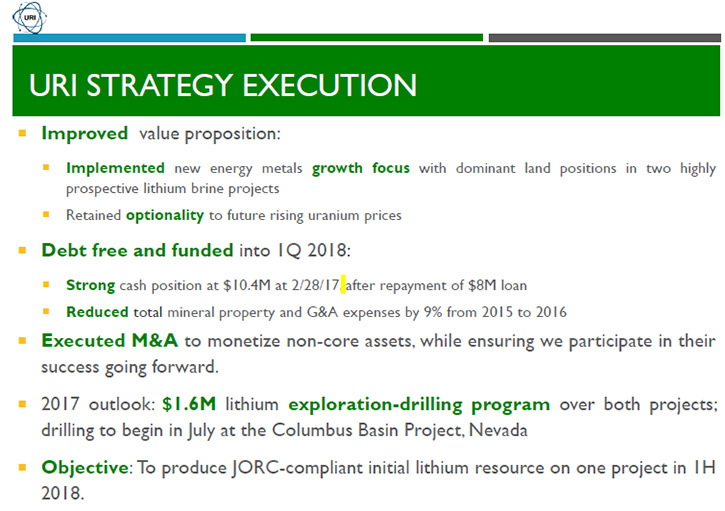

We've, over these past 4 years, restarted and reset the company with a new team and a

new focus. We have been working very hard to bring this company into good shape. And I want to

tell you this team has done a great job. Over these last several months, we have taken the

company to be debt-free. We've cashed up. We have sold non-core properties for significant

income, and acquired some very low-cost uranium and lithium assets in Turkey and the United

States. We're pretty proud really of what we've done so far.

Dr. Allen Alper: That sounds excellent! Your team has done very well in a short period of

time. Could you tell our readers/investors a little bit more about where your properties are and

what you're doing?

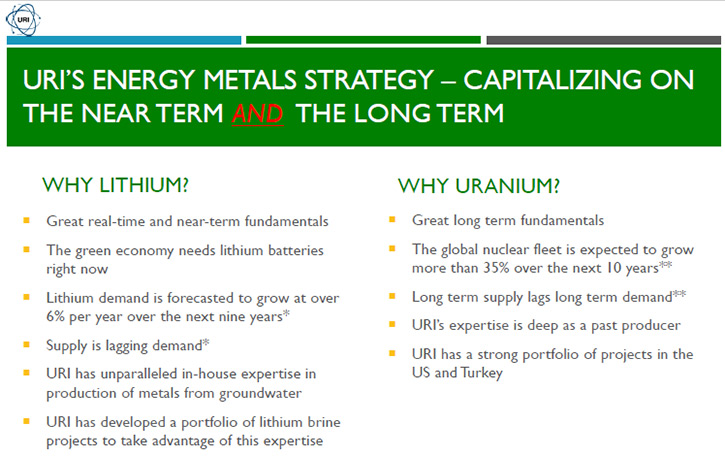

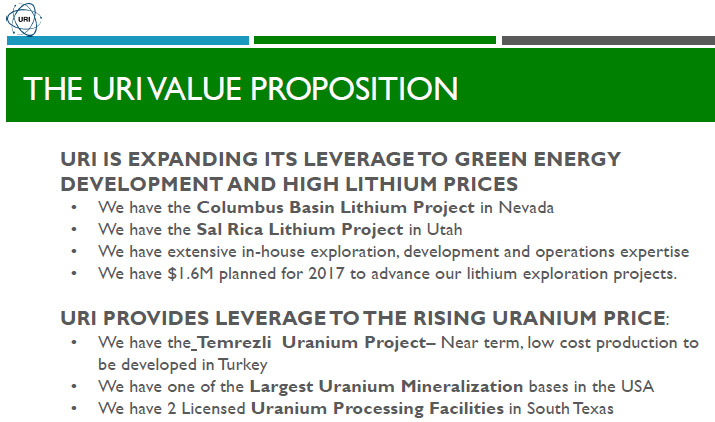

Chris Jones: The Company is now focused on two pieces of the energy metals business.

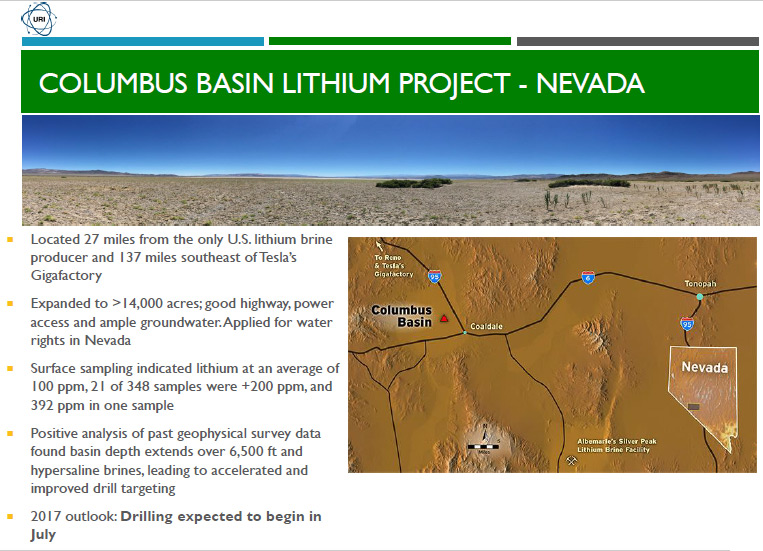

Our lithium properties are located in Nevada and Utah. So we have our Columbus Basin project

down near Tonopah, not very many miles from the only producing brine operation in the United

States. Ours is an exploration project. Our surface sampling and geophysical studies have shown

that there are some hypersaline brines at the surface and at considerable depth. We will be

testing those brines as early as July when we put the drills to work.

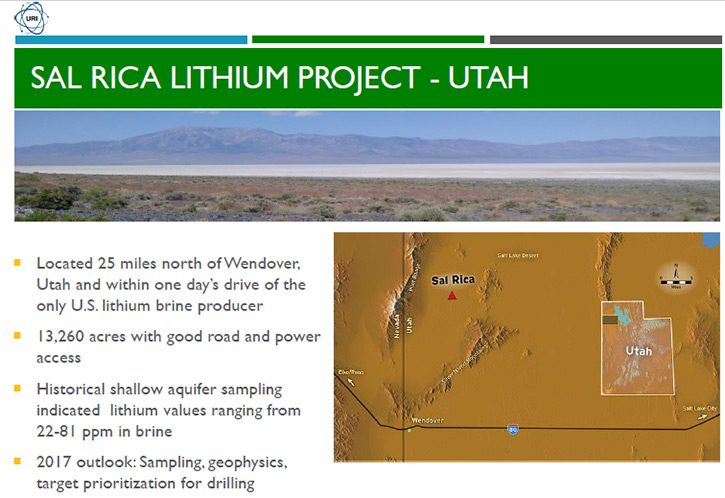

With regard to our Sal Rica project in Utah, previous sampling has shown lithium values at

shallow depths in brine. Once we have results back from Columbus Basin, we'll take a look and

see what we're going to do with Sal Rica going forward.

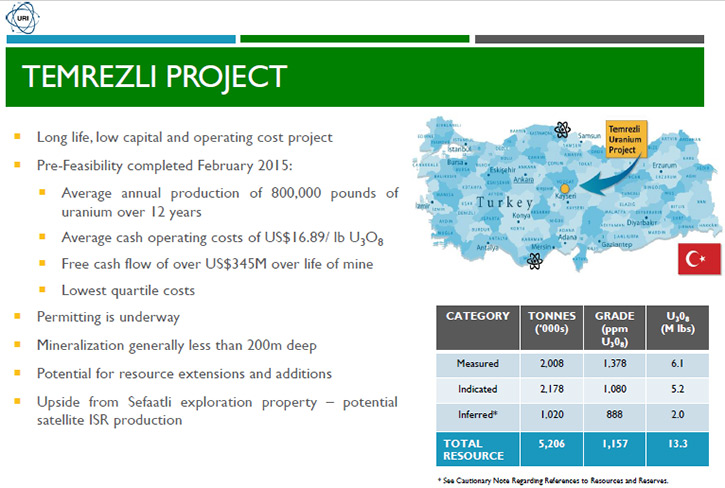

On the uranium front, we have three basic classes of properties. Our very low cost Temrezli

project in Turkey, with cash costs around $17/pound, all in sustaining probably around $25 or

$30/pound. Basically that property is waiting on price. With over 13 million pounds in the

ground there, the pre-feasibility study has already been produced by the former owners. We're

working to tweak that pre-feasibility, and then produce a definitive feasibility study. We are

presently working on improving our knowledge of the basic geology out there.

Again prices are not your friend in the uranium market right now, so we're proceeding at a

careful pace. Thankfully our holding costs in Turkey are quite good. Our middling grade of

uranium assets are in Texas, taking about $40-$43 a pound to produce. We have two plants down

there on standby and fully licensed. Our higher cost, large resource assets, like Cebolleta,

Juan Tafoya and others in New Mexico really need a price of $50 a pound before they are ready to

develop.

Dr. Allen Alper: Sounds like you are well positioned. You seem to have a very bright

future. Sounds like your lithium properties are in an excellent area. Could you tell me a little

bit more about your plans for 2017 going into 2018?

Chris Jones: We are working to explore our Columbus Basin project. The geophysical

results have indicated hypersaline brines at reasonable depths. Drilling will be our focus on

that particular project. The remainder of our focus is on completing reclamation activities in

Texas and making sure the refinancing and the complete financial revamping of the company stays

intact and is further enhanced going forward.

Dr. Allen Alper: Sounds very good! Could you tell our readers and investors a little bit

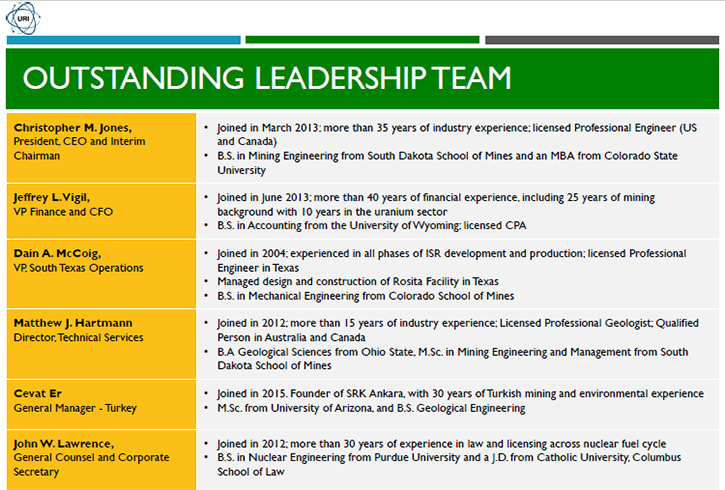

about your background and your team?

Chris Jones: I came to Uranium Resources from a varied career in the mining business.

I've been doing this for almost 40 years. I started in the coal business and moved on to the

moly business, back into the coal business and into the copper-silver-oil-sand spaces in the

United States and Canada.

As to the rest of our team, our CFO Jeff Vigil, has extensive experience in the uranium

business, coming to us from Energy Fuels and the manufacturing and coal sectors. Our general

counsel, is a former nuclear engineer turned attorney. We have veterans in the business like Ted

Wilton, our Chief Geologist. He's been in the business something over 40 years. Matt Hartmann,

our Director of Tech Services, came to us from SRK and other stations. Add to that our VP Ops in

Texas, a mechanical engineer from Colorado School of Mines. He's been with us going on a decade

now. He runs all our Texas operations, built the Rosita plant on time and budget. Cevat Er, in

Turkey, came to us from SRK and other duty stations, and is a University of Arizona trained

geologist. He's our GM Ops over in Turkey, running a crew of five people.

These are all top-notch experienced professionals in the business. It's pretty exciting,

really, for me to be working with this kind people.

Dr. Allen Alper: Sounds like you have a very strong and experienced team. Really great!

Could you tell me a bit about your view of the uranium market and also the lithium market, your

focus, your vision?

Chris Jones: The demand side of the uranium market fundamentals are terrific. There

are approximately 400 nuclear reactors in the world. There are 170 or so nuclear reactors either

under construction now or on the drawing boards. From the demand side of the equation, we see a

very good future for uranium. On the supply side of the equation however, the events of the last

several years have caused an overhang to some extent in the supply side of the market. What we

see to try to take care of that overhang is production attenuations at places like KazAtomProm

and CAMECO.

We see these as healthy signs, producers removing some uranium from the market. We even

see some of the producers here in the United States buying uranium on the spot market and

putting them into their contracts, saving their metal for later, also, removing some of that

supply. So from the supply side of the equation, we see green shoots of good things happening.

We believe in the next two to five years, the supply and demand lines will cross. The result

will be terrific pricing for uranium over the midterm.

The reason we started our lithium business was two-fold. One, we had in-house expertise.

Secondly, while waiting for the price of uranium to recover, we're developing the lithium

business to take advantage of what is a very robust, high demand situation in lithium. The

lithium market is growing by leaps and bounds right now, due primarily to transportation

batteries. Pricing has spiked from $4 or $5,000 a ton to sometimes $12,000 a ton. We don't think

that high price is realistic over the long run. But even if you use an $8,500 a ton price, as

CRU International projects over the long run, these brine operations we contemplate building are

going to have 100% operating margins at $4,000 cost.

That's the reason we've jumped into the business. We can use the ISR and the refining

process that we use for uranium and adapt it to pumping these brines out of the ground and

refining them at the surface. Pretty exciting for us!

Dr. Allen Alper: Sounds great! Sounds like you have a great team to apply their knowledge

to both lithium and uranium. Could you tell me a bit about the capital structure of your

company?

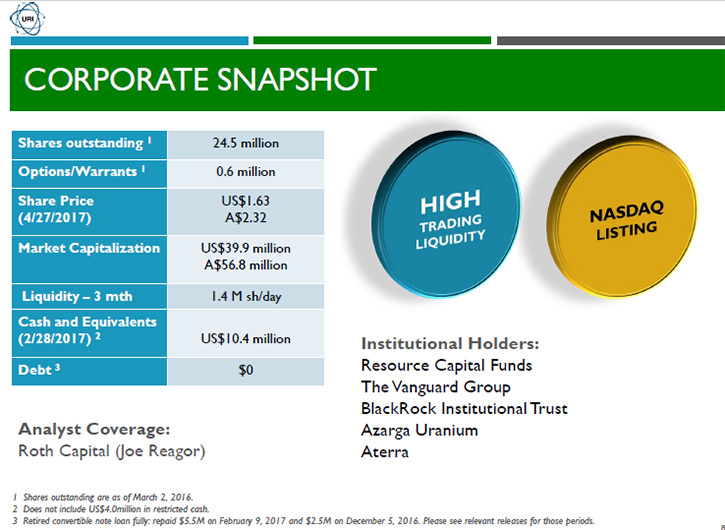

Chris Jones: Presently, we have 24.5 million shares outstanding. We're trading at

$1.50 a share, of course with no debt. That's us in a nutshell. We have a little over 8 million

dollars’ worth of cash. We're fully funded through 2017 into 2018. In addition to that, we have

an ATM in place as an insurance policy. So if the markets for uranium stocks or energy metal

stocks temporarily dried up, we can always use the ATM to get us over the hump.

Dr. Allen Alper: Sounds very good. What are the primary reasons our high-net-worth

readers/investors should consider investing in your company?

Chris Jones: There are three. First of all, our team of people at URI has completely

turned this Company around through an awful lot of hard work. We have completely revamped the

capital structure and set that up as a terrific platform for success. Secondly, our lithium

business in the near term, provides a very attractive exploration story and development story to

follow. We're explorers and developers of lithium right now. So if people want to capitalize on

that story, this is a terrific place to start. And third, over the longer run, we have the

uranium story. We have one of the largest mineralized uranium bases on earth. We are a terrific

option on the price of uranium going forward led by our very low cost Temrezli project in

Turkey.

Dr. Allen Alper: That sounds excellent. Those are very good reasons for our high-net-

worth readers/investors to consider investing in your company. Chris, is there anything else you

would like to add?

Chris Jones: If your readers have any questions at all, we'd encourage them to go to

info@uraniumresources.com and we'll find a way to answer them.

Dr. Allen Alper: Okay. That sounds great.

http://www.uraniumresources.com/

Christopher M. Jones,

President and CEO

303.531.0472

Info@uraniumresources.com

|

|