Dave Moylan, Dataram's (NASDAQ:DRAM) Chairman and CEO and Ed Karr, CEO of US Gold and Director of Dataram Discuss US Gold Corp. Great Gold Exploration Potential in Nevada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/7/2017

Dataram (NASDAQ:DRAM) is a leading independent manufacturer of computer memory products and technology oriented performance

solutions. Recently, to diversify their operations and enhance shareholder value, the Company decided to acquire US Gold Corp.

along with the advanced stage Copper King gold exploration project that has a 43-101 technical report, and a PEA done in 2012.

Dataram is in the process of updating the PEA with the new gold, copper and energy prices, by the end of the summer. According to

Ed Karr, CEO of US Gold and director of Dataram, the project is very viable and robust, with real economic potential. It has about

926,000 ounces of measured indicated gold, 174,000 ounces of inferred gold plus additional 223 million measured and 62.5 million

indicated pounds of copper. In addition, the mineralization extends both North and South, holding upside potential for additional

exploration discoveries. The company's VP of Exploration is Dave Mathewson, the world-class geologist, who is credited with

discovering Nevada's Rain mining district. He brought with him another exciting project called the Keystone property that has

potential to become the next great gold discovery in Nevada. We learned from Mr. Karr, US Gold's business model is to buy good high

potential exploration properties, advance them towards production, and then ultimately do a deal.

Dave Mathewson and David Rector on Keystone

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Mr. Dave Moylan, Dataram's Chairman

and Chief Executive Officer. Could you fill my readers in on your company, where you are and what your philosophy was acquiring US

Gold?

Mr. Dave Moylan: Absolutely. I'd be more than happy to do so. To give you a little bit of backdrop, Dataram is a leading

independent manufacturer of computer memory products and technology oriented performance solutions. It's been around since 1967 and

publicly traded since after its formation. The company is about 50 years old. The Company has had a great run, but over the last

few years, it saw some challenges which were driven in part by the economy and also, declining margins within the industry. Since I

joined the company in January 2015, we have been working to improve the company’s general performance and put the difficult times

behind us. As part of this effort, we have been looking to grow both organically and through acquisition. And we have been

looking for ways to diversify outside of computer memory manufacturing, or more broadly speaking, semiconductor manufacturing.

Over the last year and a half, we've been actively looking for growth opportunities, notably through acquisition-related

efforts. We have looked at a number of different opportunities both with the technology sector, and also across sectors and

geographies, with the intent being to enhance our revenue, expand our capabilities, and help diversify our business and risks. We

came across the opportunity to acquire US Gold, and based on our intentions and analysis, believed it to be a good fit. We entered

into a definitive agreement with US Gold in June 2016 and secured shareholder approval in March 2017 approval to merger with US

Gold. We are nearing completion of this transaction and expect this to close in the next few weeks.

The strategy for Dataram, has been traditionally focused on computer memory solutions, semiconductor manufacturing and

related efforts. But we know that industry is becoming more and more competitive, and has become more commoditized over time. It

has seen a notable push of manufacturing operations offshore, notably to Asia. As a result, and as a public company, it's incumbent

on us to look for opportunities which will accrete value to our shareholders. In this case, acquisition is preferred over organic

growth. We've looked at a number of opportunities over the last year and a half, within the technology sector and across a number

of different sectors and geographies. The definitive agreement we entered into with US Gold Corp. is indicative of our efforts to

grow and diversify. Moreover, the acquisition will benefit Dataram because of the nature of the natural resources industry, the

precious metals segment and the stage of development of US Gold Corp. It will give us a very good opportunity to accrete value for

our shareholders.

Dr. Allen Alper: That sounds great. Sounds like the timing is really great. The gold market and gold price has improved.

Mr. Dave Moylan: It is. One of the questions people always ask us is, why US Gold? What value does US Gold bring to the

table, with the table defined as traditional Dataram? From a Dataram perspective, we're not looking at the US Gold acquisition as

something that's going to extend our products and services. It's not going to introduce complimentary solutions to our portfolio.

However, it will do a couple of things. It's going to help increase the overall general size or value of the company. I think

that's very important to help us break out of what we would call the “Lower Market Space”. It will also diversify our business

model.

More importantly, there's a notable cost or “tax” associated with being a public company. As a small company, that tax can

sometimes be rather significant. By increasing the size of the business and bringing another business into Dataram, we're able to

share that cost across a much larger base. That's a good thing for all parties.

We believe it's also a good opportunity for US Gold shareholders, in that it gives them access to the public markets. It

also helps enable capital raise efforts, which will be important for US Gold as we bring the various properties into production,

which Ed Karr can speak to.

Dr. Allen Alper: That sounds excellent. Ed, could you elaborate on what differentiates your Company from others, the

projects you're working on and the potential?

Mr. Ed Karr: Sure, Al, I'd be happy to. Thanks for taking the time to talk with us today. We're really excited about US

Gold. The company was founded in February of 2014 by a bunch of private investors. I'm one of them. We had an opportunity to pick

up a project located in Wyoming called The Copper King Project. Copper King is an advanced stage exploration and development

property, well-known in Wyoming. It had a lot of geological and technical work done. As your readers will probably know, Wyoming

and Nevada are two very friendly locations and jurisdictions for mining. This property is actually located in the Silver Crown

Mining District, Southeast Wyoming, and has very favorable support from the local government over the years.

Development PlansWe are planning to advance the Copper King project through a Pre-Feasibility Study and permitting strategy, and then continue to

expand upon our current 1.5-million-ounce gold equivalent resource.2016Update PEA for Current Cost Inputs

Assemble Top Technical Team to Advance Project

Initiate Permitting Strategy

2017Work with Local Politicians for Project Support

Move Project To Pre-Feasibility Study

Continued Project Advancement

With Copper King, all the claims are on State of Wyoming land so we do not have to deal with the federal authorities, with the BLM.

The state of Wyoming also gets quite a nice royalty on the project. That royalty on the project, the county where it's located, is

Laramie County. The royalty, they actually use for schools and hospitals. With the decline in the coal industry, Wyoming is quite

excited about this project, to put it into production, to get a royalty to make up for some of those lost revenues. It's in a great

jurisdiction, and is a great project.

The project itself, Copper King, has had a lot of historical geological work done. It actually has a full published 43-101

technical report, and a preliminary economic assessment. The PEA was prepared by Mine Development Associates MDA. You probably know

MDA as one of the premier consulting, engineering and geological companies out there. That PEA shows a pretty substantial resource

on the Copper King project. The last time it was done was in 2012.

Their input prices on the PEA at that time were $1,100 gold, and $3 copper. Also, in 2012, the price of fuel, energy, was

higher. It's come down since then. A lot of the expenses would be higher. We're having MDA (Mine Development Associates) rerun the

numbers on the PEA now, and we will have an updated PEA (Preliminary Economic Assessment) with current gold, copper, and energy

cost input prices. That'll come out probably towards the end of this summer. Copper King is pretty exciting because at $1,100 gold

and $3 copper, the way the project looks, it has a net cash flow of about $273 million. The net present value on the project, using

a 5% discount rate, is $159,500,000. That all equates to an internal rate of return to 31.2%

Very viable! Very robust project. The project is about 926,000 ounces of measured indicated gold, 174,000 ounces of

inferred gold. In total, 1.1 million, and an additional 223 million measured and 62 and a half million pounds of indicated copper.

When you look at copper on a gold ounce equivalent, the whole project is well over 1.5 million ounces of gold. Most of us believe

we're going into a new bull market in gold and natural resources, especially in gold.

We saw with the Brexit volatility, gold was up $60 an ounce. We're trading above the $1,300 mark now. We believe that with

all the significant increases in capital and currency units, banks have essentially been printing and putting into the world

through quantitative easing, there's going to be a lot more volatility. People are ultimately going to get scared of banks and the

banking system. Gold is the ultimate store of value. We project gold will go higher, to $1,400 maybe, perhaps by the end of the

year, and higher from there. These bull market cycles, tend to last for five, six, seven years on the upside. And even with a real

bad bear market since the high of 2011, down to the beginning of 2016. But in those really, really difficult bear markets, the

opportunities come out.

The Copper King project, the way that we acquired it, I think it's interesting to know the history. Copper King was

acquired and a lot of geological work was done by a company called Strathmore. Strathmore acquired the project from Saratoga Gold.

Strathmore was predominantly in the Uranium business. Strathmore was taken over by Energy Fuels. They're a Uranium company as well,

publicly traded, based out of Denver, Colorado. Strathmore was publicly traded, listed in Canada. When they did that, they found

that they wanted the Uranium properties and Uranium assets at Strathmore. They were left with this non-core asset of Copper King. A

couple other private investors struck a deal with Energy Fuels, and we acquired the Copper King project privately. Originally, we

acquired a 50% interest, and then we acquired the whole project outright.

That project, Copper King became the basis of US Gold Corp. as a private company. We've been advancing the project going

forward. We knew, as a private company, we needed a couple things to be successful. Number one, we needed capital to advance our

projects. Number two, we needed a management team with experience with these sorts of projects, and even on the project itself.

Number three, we didn't want to be a one-project company. We needed to look at additional acquisitions. I believe, right now in the

baseball analogy, we're in the first inning of a nine inning ball game. I think this ball game, this bull market's really going to

run. It's really going to rip. My own personal belief is that gold will go up to a new all-time high before this cycle's over. It's

a real exciting time.

Believing that, the management of US Gold wants to be acquiring high potential exploration assets now, while the cycle is

at its low and these properties are on sale. In the natural resource business it's all about location, location, location, of our

projects. We're really excited about Copper King as that initial base. This gives us real substance.

Moving that forward is our operational plan. In 2016, we're going to update our PEA for current cost inputs. We're going to

assemble a top, technical team to advance this project. We're going to initiate a permitting strategy. Ultimately, what we're going

to do is move this project to a Bankable Feasibility Study. Once we get a Bankable Feasibility Study done, there's plenty of bank

finance money out there now, and interest rates are so low, you can borrow project finance money at 3%, 4%, and we won't have to

dilute the equity of the company. The PEA actually shows this project needs all-in, about $105 million of capital to build a full

facility and get it into production, actually start generating cash flow. We'll need to work with local authorities for project

support. We'll need to get the permitting. We'll just continue to advance this project towards production. In addition, in the

Copper King project, there is really one deposit that has been defined geologically. On our claims, the mineralization extends in

two different directions, both North and South. There is potential on this property, alone, for additional exploration discoveries.

We'll be moving on there.

Our business model is to buy good high potential exploration properties, continue to build them up, advance them towards

production, and then ultimately do a deal. We could do a deal with a major, maybe a mid-tier firm. As this bull market heats up, I

think a lot of the mid-tier producers, and even the major producers are going to have to look for ounces. They've been depleting

the ounces on the balance sheet. There's been no exploration going on in the industry in the last four or five years because of the

very difficult, bear market cycle. As the prices start to increase, and this cycle starts to take off, these guys are going to have

to make acquisitions, rather than go out and just start blue sky exploration.

We believe a project like Copper King is going to be a fantastic acquisition. If someone comes in a year from now, and they

want to offer us a check for the Copper King project, we would certainly consider that. We could spin that off and sell it off.

Dr. Allen Alper: That sounds like an excellent approach. Your property is very exciting.

Mr. Ed Karr: Just like being in the market. You buy low, and you sell high. That's the secret to success. If we can buy

this property reasonably, build it up, and attract one of the mid-tiers to come in and give us an offer. Who knows, a lot of these

projects have traded 70-80% of NAV, so we would be very happy. Obviously, that NAV's going to increase with tremendous leverage to

the gold price.

Another way to unlock shareholder value could be a potential joint venture. You could have a joint venture with a large

company. It could be a Barrick, it could be a Newmont, a GoldCorp. It could be a mid-tier, like Premier Gold, Silver Standard,

moving into gold, even Coeur Mining. Their latest presentations have shown more and more their revenues are coming from gold. We

could do a joint venture with someone out there, who wants to get that cash flow. They'd have the operational expertise. We work

out a deal, they go in, put it into production.

We're excited to have the Copper King project as a base for the company. We

didn't want to stop at one project. We were looking around from the very beginning to put a management team in place, and look at

other acquisitions. I'm also on the board of another publicly traded company, which is a gold development company. We're putting

the Relief Canyon Mine into production in Nevada. That company is called Pershing Gold.

One of the people, who work with us at Pershing Gold, is Tim Janke, a seasoned mining professional. I've known Tim several

years. He has nearly four decades of experience in mining engineering and operations. He has a proven track record of leading teams

to succeed in mines and mining start-ups. Tim was former COO for AUX Ventures, responsible for all the operational planning and

development of the Long Canyon project. He has super extensive operational experience. He was General Manager of Marigold, of

Florida Canyon, of Ruby Hill, of the Pinson Mines. He was special project engineer at the Round Mountain Mine. Now he's Chief

Operating Officer of Pershing Gold.

Tim was actually the consultant to Strathmore Mining when they acquired Copper King. Tim knows Copper King very well. He's

been there a long time, has operational experience on the property. He knows the two gentlemen at MDA on a first name basis, the

consultants responsible for the PEA. He was responsible for putting that PEA together in the beginning. Tim's the right guy to have

here, and we have brought him onto the board of US Gold. His responsibilities are helping me manage the Copper King project. I'm

the current CEO of US Gold.

In addition, I'm also a director of Dataram. That's how Dataram saw this opportunity in the first place. As Dave Moylan mentioned,

we've been trying to be opportunistic for the last couple of years, looking at some different acquisition opportunities, in a

number of different industries. Then I said to Dave, "Look, we might want to consider US Gold because I really believe the natural

resource market's going to take off, and this could be a way to create some shareholder value for the Dataram shareholders." I

actually had to recuse myself because I was on both sides of the transaction. They set up a special committee at Dataram. They set

up a special committee at US Gold, and got to a deal. Here we are moving forward.

Another gentleman at US Gold is David Rector, our COO. David Rector has tremendous experience with publicly traded

companies. He has been on the board of a lot of different natural resource, publicly traded companies. He's very good at

accounting, administration, handling all the nuts and bolts, external CFOs, auditors, bank accounts, things like that.

That was the history of US Gold. I always knew I wanted to build the company out with more than the one project. I have

some good relationships, myself, in the exploration field. I'm predominantly an investor. My company's based in Switzerland. I have

a couple of different asset management companies. We are big natural resource bulls, and we've invested in this sector for the last

twenty years. We know it's very cyclical. There's a time to own them and there's a time to fold them. Now, is the time to own them.

I really believe that.

I went out there, and through my relationships, I re-contacted a very well-known Nevada exploration geologist, named Dave

Mathewson. I've known Dave for twelve to fifteen years now. He used to run the whole Great Basin exploration program at Newmont

Mining, from 1989 through 2001. He had major discoveries during that time period, including Tess, Northwest Rain, Saddle, South

Emigrant Springs. Dave Mathewson is credited with discovering the whole Rain mining district.

From '99 to 2001, Mathewson and his team at Newmont led to the extension of Newmont's gold quarry and gold deposits. Those

were major extensions and well noted discoveries. I did a deal with Dave at one point. Dave had a publicly traded company that he

set up himself several years ago called Tone Resources. Tone Resources was actually acquired by Rob McEwen. At the time, Mr.

McEwen’s company was called US Gold. He did a consolidation on the Carlin Trend. He bought four companies, and Mathewson's Tone

Resource was one of those four companies. After Dave left Newmont, he was acquired by Rob McEwen.

Being a seasoned and well-respected exploration geologist, Dave Mathewson is constantly in demand. Gold Standard Ventures was

founded with a project called Railroad in the Rain district. They asked, "Who's the best Nevada geologist in the Rain district?"

This was in 2008, maybe 2009. Dave Mathewson became the Head of Exploration and Vice President of Gold Standard Ventures. He put

together the whole exploration program that defined the North Bullion Deposit at Railroad. It's been a huge exploration success in

Nevada.

Gold Standard Ventures did their original raise at about a $15 million market cap. Today, the company has a $500 million

(Canadian) market cap. Gold Standard, today, has two major shareholders, Oceana Gold and Gold Corp. and they have $40 million cash

on the balance sheet. That is primarily due to Dave Mathewson’s exploration success and the team he put together. He saw the Rain

district, the Railroad project. He went out there, he did a geophysics program, seismic program, gravity surveys, soil sampling to

find those drill targets. Gold Standard Ventures, on the eighth drill hole, is credited with the discovery hole of the Railroad

North Bullion Deposit. From there, it's built up and grown.

When you hit a deposit in these districts in Nevada, it's probably pretty substantial. It's the old analogy, "If you want

to find an elephant gold deposit, you have to go into these major gold trends of Nevada, because that's where the big gold deposits

are." You have the Carlin trend, the Cortez Trend, the Battle Mountain and the Eureka Trend. Dave Mathewson has been in Nevada for

forty years.

He had great success in Gold Standard Ventures, did really well. About a year ago, maybe a year and a half ago, Dave

Mathewson decided to leave Gold Standard Ventures because Railroad deposit, North Bullion, was really well on its way. It was a big

discovery. Mathewson, by heart, is a true explorer. He's an entrepreneur. He likes to go out there and find the next big

opportunity. He's not a mine developer. He's a guy who wants to go find the next gold deposit. That's Dave's thing, proving up the

next gold deposit.

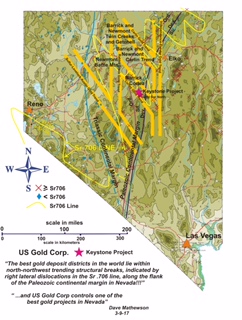

Highlights“The Keystone Gold is the best exploration project I have seen in my career... reminds me of the Railroad project on steroids” –

Dave Mathewson

Keystone Gold District’s initial target is >1 million ounces of gold

Project potential > 10 million ounces of gold

Keystone Gold District is located in “Nevada Elephant Country” with numerous > 20-million-ounce gold deposits

Nevada hosts some of the world’s most prolific gold mining belts and remains the cornerstone to Barrick and

Newmont’s gold production

Over the past 50 years, the Cortez and Carlin trends in Nevada have produced more than 245 million ounces of gold

There's a project in Nevada called Keystone, located about ten miles south of the Pipeline and Cortez Hill's deposits, Barrick's

two biggest producing mines in North America. These are two of the largest mines in North America. I mean major operations.

Pipeline is a 20 million ounce deposit, and they're still mining. Cortez Hills is a 14 million ounce deposit, producing 1 million

ounces a year and still going. Between these two monsters, you're looking at 50 million ounces of gold. Right on the exact same

geological trend, ten miles south, is a property called Keystone.

Mathewson has been on and off the Keystone project for the last forty years of his career in Nevada. He really likes the

geological setting, the rocks, and he likes everything about it. The problem is, multiple different companies have had different

claims on the property over the years. No one company has ever had control of the district. McEwen Mining had some of the claims,

Newmont, at one point, had some of the claims, Barrick had some of the claims, other juniors had some of the claims, and Mathewson

really sees the potential here. He likes this area, he likes this project tremendously.

Mathewson, over the years, is very tenacious. He's had his eye on this. He went down, he started staking some claims

himself. Last September, September 2015, Dave put a call in to McEwen Mining. McEwen Mining still had the majority of the claims in

the district, in Nevada, it's small. Everyone has good relations. They all know each other. Dave asked him, "Hey. Are you going to

drop those claims or renew them?" McEwen Mining said, "No. You know, Dave, we're probably going to drop them." McEwen Mining has

been focusing more on their Mexican operations, getting a little bit out of Nevada. They still control Tonkin Springs, close by.

Dave picked up these claims, and with a partner, he got control of this whole property, of Keystone. It's the first time in the

last forty years, any one company has controlled the entire Keystone district. Dave is really, really excited about this.

Mathewson is 72 years old. He's been in this game for fifty years, in Nevada for forty years. He's an old-hand Nevada exploration

geologist. Mathewson is not a promoter; he doesn't exaggerate or over-play anything. He told me, "Ed, I am so excited about

Keystone. Ed, I'm telling you, Keystone is Railroad on steroids."

When I heard that, I thought, "Wow. Dave, we have to do a deal." I've known Dave a long time. He likes me, I like him. He

needed some money to fund the exploration program. We did a deal together. We acquired Keystone into US Gold for cash and equity

consideration. Now, Dave Mathewson is a significant shareholder of US Gold, and he's also our Vice President of Exploration, and

Head of Nevada Exploration. He is going to be heading this Keystone project going forward.

Keystone, today, is a complete blue sky exploration opportunity. There's no 43-101, there's no PEA, and it’s all blue sky.

However, there has been historical drilling done on the property. Keystone is a big, big property. We're talking a district scale

opportunity here, ten square miles, approximately 6400 acres. The property occurs along a strong North, Northwest trend. That also

includes the Gold Bar Deposit to the Southeast, and Pipeline and Cortez Hills to the North. There's an extensive hydrothermal

alterations system, with about 140 historical drill holes on the property. All of those drill holes have been pretty shallow, down

to a depth of 300 feet, but there have been some untested, up to 27 parts per million, gold ore grade gold targets. The target,

overall, is like a Cortez Hills type deposit, at shallow to moderate depths.

This is almost a carbon copy of Railroad. Mathewson's doing the exact same exploration program that he put in place for

Railroad. Mathewson has a real defined methodology that he applies to his exploration successes.

In my experience, most geologists have found no major gold deposits. I could name probably a handful of world class

explorers in Nevada, who have found the majority of the gold. I know I'm exaggerating a little, but there are guys credited with

five, ten, twenty million ounces of discoveries. Those are the world class geologists. Mathewson's one of those guys. The reason

he's so successful is because of how he approaches his exploration, drilling very selectively, based on knowledge and know-how.

At Keystone, Mathewson has acquired all the historical analog data. He has all the data, old drill cores, all the notes, historical

drill holes and he's digitizing that into an updated database. He's creating detailed geological maps, correcting maps that he

believes are wrong, (actually identify the wrong rocks), and he's updating the maps. After that, he's going to do a gravity survey.

He'll be using Jim Wright, Wright Geophysics. Mathewson's worked very closely with him. He's a big believer in gravity. He credits

the gravity studies for defining his drill targets and his success at Railroad. We're doing a complete gravity survey over the

property right now as we speak.

In addition, he'll be doing soil sampling. He'll be doing rock chip sampling. He'll be doing some IP, some other

exploration techniques. With all of these methods, Mathewson will be developing targeted geological maps. He will use that

information to define down the drill targets. Mathewson believes in the Keystone gold district. He believes the initial target is

at least a million ounces of gold, but the project potential is well over ten million ounces of gold. That's according to Dave. I

mean, Keystone, the whole Keystone gold district, is in what we call Nevada Elephant Country, with numerous, over 20 million ounce

gold deposits. You look at Pipeline, Cortez Hills, Gold Bar, et cetera. These are big ones. It's a great position. We're excited

about it.

Mathewson has to go out and put together this exploration program. We believe there will be several different drill areas

on the Keystone property that will be of interest. 2016 is going to be focused upon all the geological and geophysical work. We'll

permit, probably, for a five-acre disturbance, and we could get in several drill holes in the 2016 field season at Keystone, until

about the end of September. Sometime after that the mountains get snow and it starts to get muddy and you can't access the property

anymore.

This year is really defining the whole exploration program to set up 2017 for a very comprehensive drill program, probably

up to 20-30 core drill holes in 2017which can help prove up the potential deposits Mathewson believes exist there. If he drills,

and he puts some results on the board like he did at Gold Standard Ventures - wow. I think it'll be interesting because they're

currently trading today at a $500 million Canadian market cap. As this cycle continues to build, all of the majors will be watching

what's going on in Keystone. They all know Dave Mathewson.

The majors, in the last 20-30 years, have decimated all of their exploration crews, divisions and departments so that they

don't even have them anymore. The industry has moved all of that exploration out to the juniors. The majors would rather let the

juniors, like US Gold, go out and spend money, and if we are successful in hitting something, the Barricks, the Newmonts, the big

companies can come in and potentially buy us. They'd rather pay up for those ounces knowing they're there.

In addition, Mathewson has other properties he has staked, within his own personal portfolio. We will be doing additional

acquisitions as US Gold. I'm very happy with our two projects right now. I don't want to take on more at the time being. I think we

have a lot with both Copper King and Keystone to keep us busy in 2016. If the right project comes to us at the right price, we are

certainly looking to selectively acquire some other opportunities.

With shareholder approval secured and our management team defined, we look forward to closing the merger transaction with

Dataram within the next few weeks. Once completed, we'll be part of a publicly traded company. We're very excited about that.

Dave pointed out we can share those operating costs of a publicly traded company. We will have two different divisions,

which are both really exciting. For US Gold, being a part of a NASDAQ company is great because that gives us access to the capital

markets. It will be easier to raise money, to get awareness, to bring in a lot of different institutional investors and gold funds.

A lot of the Europeans, can't buy these lower level exchanges, bulletin board, or pink sheets, so that full NASDAQ listing really

gives the company a lot of credibility.

We're excited about the company. We think we're in the right place at the right time with two great properties, a fantastic

exploration platform and management team to execute. Of course, these companies are high risk, but we think we're in a good

position to deliver the results. I'd say, just keep your eyes on the news flow, Al. Your readers should put this one on the radar

screen. They should watch it, and continue to monitor all the news about the exploration success. Mathewson being 72 years old,

this is his last kick at the can. He wants to go out with a Hurrah, he wants to really solidify his name and reputation in the

great leagues, you know, the John Livermores, et cetera of Nevada gold exploration. He thinks that he's going to do it with

Keystone. We're really excited to have him be part of our team going forward.

Dr. Allen Alper: That sounds really exciting. It's very impressive, what you've told me, both your Wyoming project and also

your Nevada project.

http://www.dataram.com/

777 Alexander Rd, Suite 100

Princeton, NJ 08540

P: 800.328.2726

F: 609.799.6734

|

|