Nevada Zinc Corporation (TSX‐V: NZN): One of the Few High-Grade Open-Pit Zinc Projects in the World and a Yukon Gold Portfolio, Interviewed Bruce Durham, President and CEO of Nevada Zinc

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/25/2017

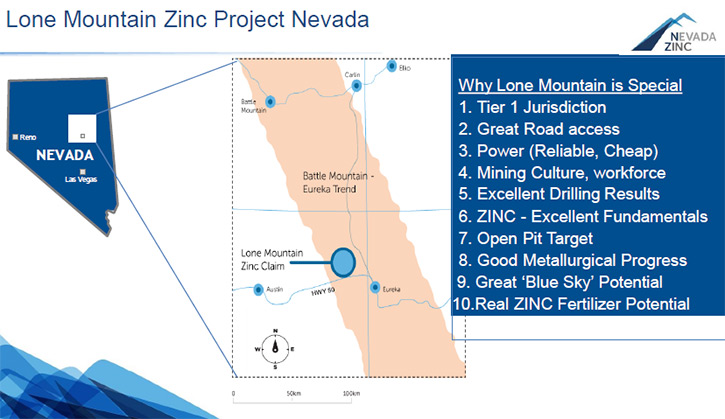

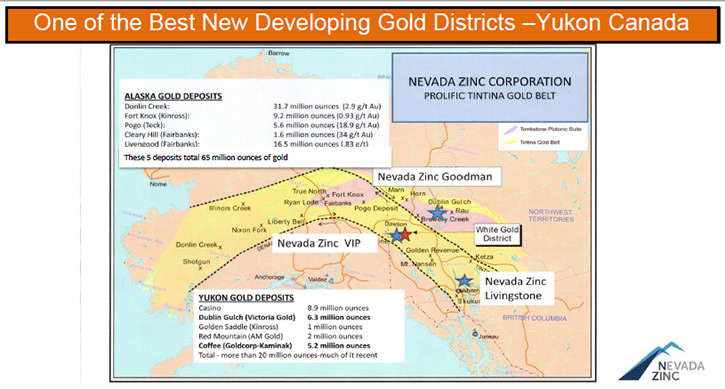

Nevada Zinc Corporation (TSX‐V: NZN) is a mineral exploration company with zinc and gold properties located in Nevada and Yukon,

the world’s best regions for mining. The company's 100% owned Lone Mountain Zinc project in Nevada is a new discovery, with near-

surface low-cost large-scale high-grade potential. We learned from Bruce Durham, who's President and CEO of Nevada Zinc, that Lone

Mountain is one of the few high-grade open-pit zinc projects in the world. Plans for 2017 include more drilling in April-May that

should result in the 43-101 resource estimate by the end of June. In addition to Zinc the company has several large gold properties

in Yukon, one of which has camp scale potential, based on finding the source of the very large gold nuggets that placer miners have

been finding in the locals creeks.

Lone Mountain Zinc project, Nevada

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bruce Durham, President and CEO of

Nevada Zinc.

This is a great time for Nevada Zinc. Could you give our readers an overview of your company?

Bruce Durham: For sure. We started on this zinc project in 2014. So we've been at the zinc side of things for some time.

The company actually was founded around a portfolio of gold projects in the Yukon that we started acquiring in 2010. We went

public in 2011. And we have several large properties, including one adjacent to the west side of Kaminak, which was taken over by

Goldcorp. A large property adjacent to Victoria Gold that’s raised in excess of $50 million in the last 12 months. And then, we have

an entire gold district down at a place called Livingstone, where people have been finding extremely large gold nuggets, in fact,

weighing up to 5 and 10 and even up to 20 and 30 ounces for the last 100 years. So we're really excited about that one as well.

When we went public with the portfolio of gold projects, I was always looking for a project we could work on in the off

season because the Yukon has a fairly short field season. We ended up with this zinc project, which is turning out to be very

exciting, we think it has lots and lots of potential.

Dr. Allen Alper: That sounds great. Could you tell us a bit more about your zinc project? And what differentiates it from

other projects?

Bruce Durham: Certainly, Allen. It's new in that it's actually a new discovery. It's something that's a little bit unique

in the zinc space these days in that it has large drill intersections, actually quite close to surface. Some of them starting right

at surface and extending down to about 250 meters in vertical depth. And we've had intersections that go anywhere from several meters

up to, in excess of 100 meters, or 350 feet in thickness.

Those thicknesses are quite unusual in the zinc space. And these intersections are close enough to surface that we think

we're going to be able to get them out with an open pit.

People like Teck, in some of their presentation materials, will tell you that 80% of the world's zinc is now mined underground. There

are very few open pits left. There's also a declining grade of zinc mines. The zinc mine grade now is less than 5%, even when you

include the underground mines. So we think the zinc space is going to continue to be quite an excellent place to be.

This mineralization that we've intersected is actually a non-sulfide zinc; it is a series of oxide and carbonate mineralized

zones. So it's smithsonite and hemimorphite, which are a bit unusual now, although 80% of the world's zinc used to be mined from

these types of deposits. They were right at surface and people typically mined them out. Now generally, we're mining all the deeper

sulfides.

So it's a little bit unique. One of the things I wanted to do early on was understand the metallurgy and how we would process

this mineralization. Those initial tests have gone very well so it's looking like quite a unique project for sure.

Dr. Allen Alper: Sound very, very exciting. That's excellent. Could you tell me a little bit about your plans for 2017?

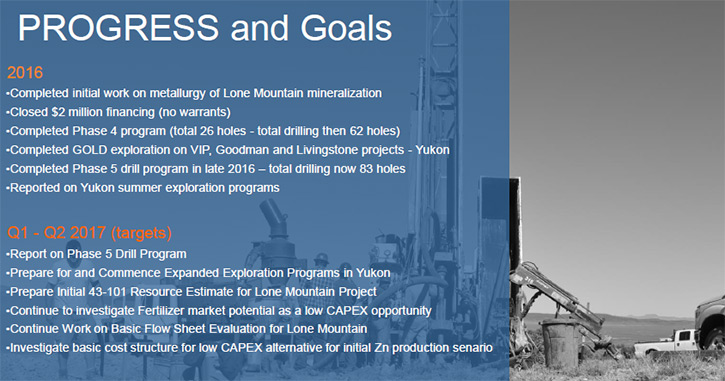

Bruce Durham: Certainly, to date we've completed about 83 drill holes. We expect we'll go back with an additional round of

drilling probably in April, May of this year. That should set us up to do a follow-up to the technical report we just completed and

filed on SEDAR. That will be a 43101 resource estimate. We expect to have that completed by the end of the second quarter, the end of

June.

Then we'll carry on with additional metallurgical work as well as expansion drilling beyond that into the second half of the year.

Then through the summer, we'll also be working on our Yukon projects.

Dr. Allen Alper: Great! It's excellent to be in two great areas: one in gold and one in zinc. Outstanding! Could you tell us

the grade of the zinc project?

Bruce Durham: We think when we do the resource estimate, it's going to be between 5% and 10% zinc, which would compare

favorably with the current zinc mines in the world, particularly on the open pit side. That's a very good grade given that we're

working in one of the lowest cost jurisdictions in the world and one of the most stable. Because there have been a couple of

feasibility studies done on projects not that far away from us, we can benchmark what we think our mining costs are going to be and

they're probably on the order of about two dollars per ton.

We know we have access to roads and power and lots of infrastructure. There's no camp required because we're just outside the

town of Eureka, about a half hour drive by car. So it's a very, very well located project.

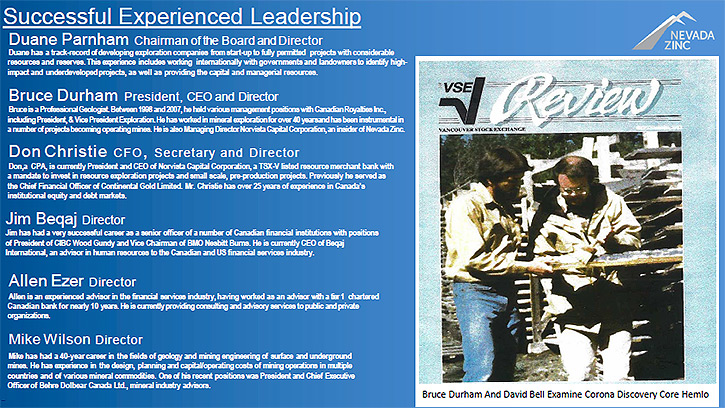

Dr. Allen Alper: That's excellent. Could you tell us a little bit about your background and your team and your board?

Bruce Durham: It’s a bit of a long story, Allen. When you’ve been around this industry for 40 years, you end up in lots of

different places, with lots of different projects. I have a broker friend, who refers to me as, "The luckiest geologist" he's ever

met. I like to take that as a compliment, but I think it's partly due to good analytical skills.

I've been involved in at least six discoveries that have gone on to be significant operating mines. That would include two of

the three operations in Hemlo. I worked, in the very early days, for a guy by the name of Murray Pezim. Then went on to work for a

gentleman by the name of Richard Hughes, on Goliath and Global Sceptre and watched those projects’ share prices go from pennies to a

hundred dollars. That made me really interested in the junior mining side of things.

We found Bell Creek, the mine in Timmins, in 1978. We found the Redstone nickel deposit in 1977. We put all the land together

in the west end of Timmins that became Lake Shore Gold in the mid-1990s. Then we went on to do a project up in the northern tip of

Quebec in Canada, where we found eight different nickel deposits over a period of about five years, with a company called Canadian

Royalties, which was eventually sold to a Chinese group.

So I have a long history of being, “a serial explorer”. I tell people it's like being a kid on a treasure hunt for your whole

career. That's what I really like to do, be in the early stage, have that optionality, try to identify really good projects, and then

follow through, and watch them become operating mines.

But the operation side is not my forte and not what we're really interested in doing. So I tend to try to find special

opportunities, where people have done good work, but maybe missed something. And I try to surround myself with a good team. We have

Don Christie, our CFO. He was with Continental Gold. Duane Parnham was with companies like Forces Metals and UNX Energy. Mike Wilson

is a geologist and a mining engineer. He's a guy I've known since my university days, so I’ve known him for a long time. Then we have

an independent director by the name of Alan Ezer. So we keep a very small team.

On our technical side, because we operate very frugally and we're really focused on finding things, we don't keep a large staff

around. We've a group of younger geologists, whom I mentor and that's how we attack things. I think we're doing a pretty good job.

Dr. Allen Alper: Sounds excellent. You have a great background, you can be very proud of your record of accomplishments and

the strong teams you’ve assembled.

Could you tell our readers/investors a bit more about why zinc is important?

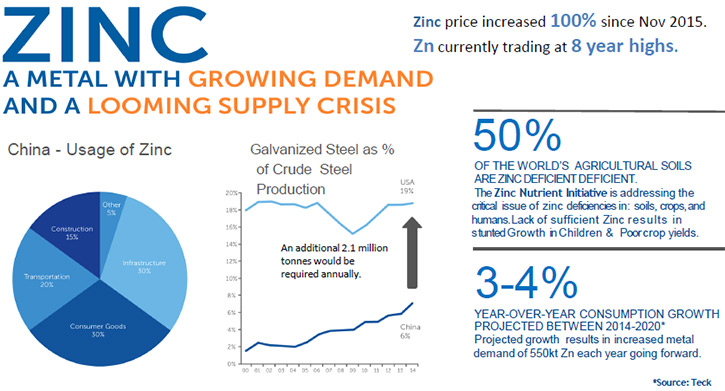

Bruce Durham: Well that's a subject I'm still learning about. Zinc is used in so many different applications, the list just

goes on and on. But over half of it goes into galvanizing steel, which is the best way to keep steel from rusting at a reasonable

cost. So we use it in everything from bridges, guardrails, light posts. We're even starting to use it now in galvanized rebar instead

of rebar rusting in the concrete and disappearing in about 50 years. If you galvanize the rebar before it goes in, it lasts about 150

years. We use it in white goods, so washers, dryers. We use it in paints, ceramics, healthcare, all kinds of different applications.

So it has a very broad spectrum of use. Over time the zinc price didn't get the big run-up that the copper price had before

2008 and even a little bit after that. So there really wasn't much money that went in to finding new zinc deposits. Now a lot of the

big zinc deposits that geologists were pretty good at finding, are on their last legs and they're starting to close one after

another. The most recent couple to close were Century, which was the world's third largest zinc mine in Australia, and Lisheen, which

was in Ireland, and also closed. To add to that, we had Nyrstar shut down about five operations. Glencore consciously took five to

six operations offline to try to tighten the market. That's one of the reasons we're seeing a rise in the zinc price. If you listen

to someone like Don Lindsey, who runs Teck, the world's largest zinc company, he thinks the zinc price is going to go through its old

highs. He said that in a BNN interview about a year and a half ago.

Dr. Allen Alper: Wow, it sounds very exciting, very promising. Could you elaborate a little bit on your Blue Sky opportunity?

Or your Yukon gold portfolio?

Bruce Durham: Yes, that's very dear to my heart. I really do like the project that we have in the Yukon. We started out

with a portfolio of about 40 some odd properties. We actually explored all of them. We've gone through and found the best of those.

We have about six we think have real potential. We focus on three on our website.

We started staking the ground adjacent to Kaminak before they had drilled their first drill hole. We have a large land position

adjacent to Victoria Gold, who are out now trying to raise production financing for what will be the Yukon's largest gold mine. I'm

really intrigued by the area down by Livingstone, where we've had placer mines. Mining gold nuggets up to several ounces, and some of

them with quartz attached to them. It doesn't look like they moved very far. Yet no one has gone to the top of the ridge and ever

drilled a hole to see where the gold's coming from. We went in there and started exploring. We've actually now, found gold in place

in quartz veins and the geo-chemistry of what we've found actually matches the geo-chemistry of the gold nuggets in these five

streams that come off a ridge that's about 10 kilometers long. So, it's a really exciting project.

Dr. Allen Alper: It sounds great. Excellent. Could you tell us a bit about your capital structure?

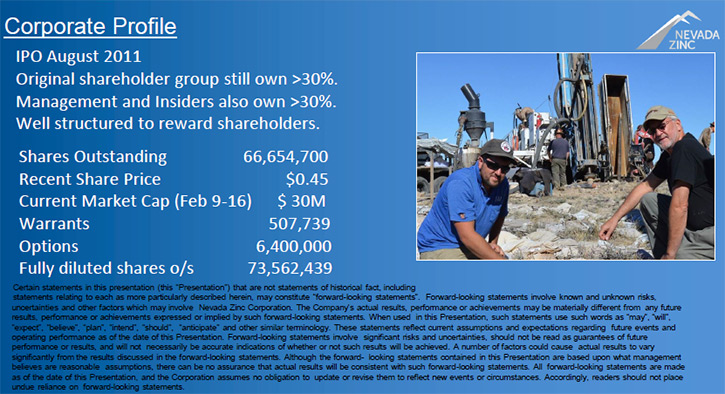

Bruce Durham: On the capital structure side, we went public in August of 2011, about the time the junior mining industry

was starting to fall on hard times. We managed to explore over 40 properties in the Yukon. And to date, we still only have 66 million

shares outstanding and a market cap of about $27 million. Of those 66 million shares, management and the insiders own about 31% or

32%. And similarly, our original shareholder group out of Calgary, Canada — one large broker out of Canaccord — between himself and

his clients, they own about the same amount, so 31% to 32%. So the stock is actually quite tightly held by people who are long-term

shareholders and who believe in the management team and the projects we have.

Dr. Allen Alper: That sounds great. Good to see the management team is confident in Nevada Zinc Corporation and has put their

own money and funds into the company and also that you have long-term shareholders. What are the primary reasons our high-net-worth

readers/investors should consider investing in your company?

Bruce Durham: We have a management team that has a long history of finding things and being successful. We put our money

where our mouth is and we are significant shareholders and will continue to be. We think we've created a very unique opportunity for

investors in that we have almost a development kind of project, at the same time we've maintained all of the Blue Sky in the company,

with our gold projects in the Yukon.

Even on the zinc project in Nevada, we've only drilled off a short strike length of this mineralized zone. We know the geo-

chemistry target extends beyond that. And we have yet to drill any deep holes to look for deep sulfide deposits the way Arizona

Mining worked on their project, one state over from us in Arizona. And in fact, what they started off with was non-sulfide zinc

mineralization not dissimilar to what we've found. When they started drilling deep drill holes, they got into, what they called their

Taylor deposit.

So we think we've kept all the Blue Sky in the company. And at the same time, we've worked away at the metallurgy. We think,

in doing that metallurgy, we may be able to make end products onsite. We think this mineralization can be upgraded using dense media,

and leached either with acid or with ammonia to make end products right onsite without going to a smelter, which is a huge cost

saving.

And these are not large, large projects. We think these are going to be low capex, low operating cost opportunities that a

junior company can still tackle.

So we think we've created something very, very special.

Dr. Allen Alper: Very strong reasons for our high-net-worth readers/investors to consider investing in your company. Is there

anything else you'd like to add Bruce?

Bruce Durham: One of the products we're looking at, through the metallurgy and the dense media separation that we've done,

is zinc-sulfate. If you can upgrade this mineralization and concentrate it a bit and get rid of some of the calcite and dolomite,

then you can take this mineralization and you can leach it with acid. And when you leach this style of mineralization with acid, you

end up with zinc-sulfate. I didn't know anything about zinc-sulfate when I started on this journey. But I learned we've identified

50% of the world's soils are actually deficient in zinc. And one of the best ways to get zinc back into the soil is by applying

zinc-sulfate. There is a growing demand for zinc and particularly zinc-sulfate in the fertilizer industry.

So as the world's population is growing and we're demanding more and better food all the time, zinc in the soil makes the

agricultural product more resistant to disease. It improves the productivity as well. This is something we're seeing as a growing use

of zinc, and particularly zinc-sulfate. It's going to continue to be an interesting opportunity for us.

Dr. Allen Alper: Sounds great.

http://www.nevadazinc.com/

Suite 1660, 141 Adelaide St. West Toronto, Ontario M5H 3L5

Tel: 416‐504‐8821

Bruce Durham, President and CEO bdurham@nevadazinc.com

|

|