Revitalized Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF): Potential to be a Large, Low-Cost Open Pit Producer of Platinum, Palladium, Nickel, Gold, Copper and Cobalt; Diane Garrett, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/23/2017

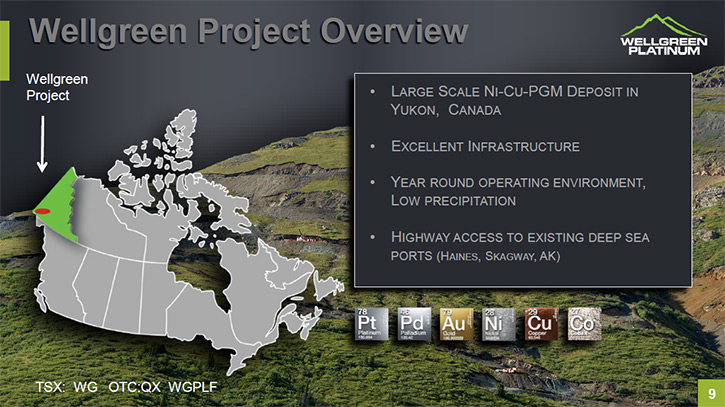

Wellgreen Platinum Ltd. (TSX: WG, OTC-QX: WGPLF) is a Canadian mining exploration and development company, focused on its 100%

owned Wellgreen platinum group metal (PGM) and nickel project, located in the Yukon Territory, Canada. Based on 2015 PEA, the

Wellgreen PGM and nickel project has the potential to become a large, low cost, open-pit producer of platinum, palladium, gold,

nickel and copper. We learned from Diane Garrett, President and CEO of Wellgreen Platinum, the project is predominantly nickel, but

also has a very large PGM component. The company is currently in the process of updating the geologic model and the resource and is

working towards the pre-feasibility stage. Plans for 2017 include a new 43-101 resource update, which should come out in the third

quarter of this year. The Wellgreen property is accessible from the paved Alaska Highway, which leads to year-round deep sea ports in

southern Alaska.

Wellgreen Project, Yukon, Canada

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. Diane Garrett, President and CEO of

Wellgreen Platinum. Diane, could you give our readers/investors an overview of Wellgreen Platinum?

Dr. Diane Garrett: Wellgreen Platinum is developing our flagship asset, the Wellgreen Project, located in the Yukon,

Canada. It's a very large polymetallic deposit, but it also has a substantial PGM content, which makes it nearly unique and different

from your typical polymetallic project. We're located in the Yukon, with excellent infrastructure, right off the Canada-Alaska

Highway. We're currently in the process of doing the necessary work to take the project through to the pre-feasibility stage.

Dr. Allen Alper: Sounds great! Could you elaborate a bit more on your plans for 2017?

Dr. Diane Garrett: Sure. We've just completed all of the metallurgical test work, which essentially takes that work to

the pre-feasibility level. Now we’re in the process of updating the geologic model, the block model and our resource. We anticipate

having a new 43-101 resource update available in the third quarter of this year. We are also taking a new look at the mine plan,

looking at various throughput rates and optimizing the economics of the project. We intend to initiate an infill drilling program

this summer, to continue moving ounces into the measured and indicated category, and then also the reserve category.

Dr. Allen Alper: That sounds great. Could you tell me some of the metals that are present in your project?

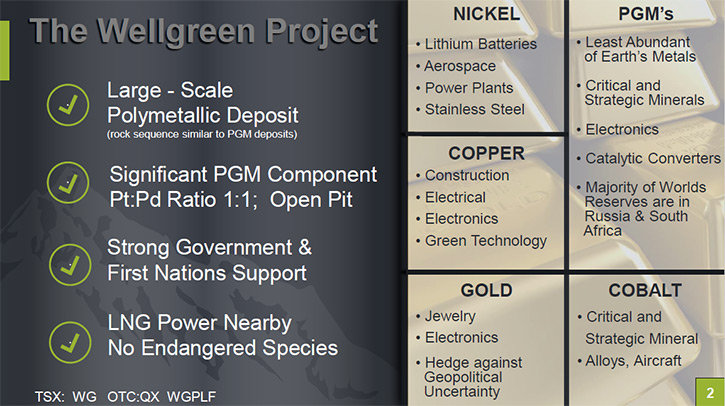

Dr. Diane Garrett: We're quite unique in that we do have six payable metals. Approximately half our revenue will come

from nickel, roughly 30% from the platinum group metals and gold, about 20% from copper. We also have some silver and cobalt. So it

is a very unique project with a lot of significant metal content.

Dr. Allen Alper: That's excellent. Could you tell me a bit about how you're revitalizing Wellgreen Platinum?

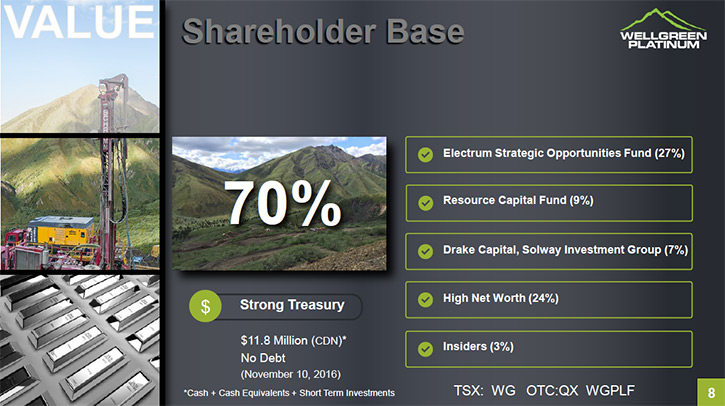

Dr. Diane Garrett: Coming in with the new management team last year, were two very significant private equity funds,

Electrum Strategic Opportunities Fund, which owns 27% of the company and Resource Capital Funds, which owns 9% of the company. We are

now in a position to have the kind of financial support we need in order to advance the project properly. In addition, we’ve added to

the depth and expertise of the Board of Directors.

Our new strategic initiative is getting all of the baseline permitting information completed. We're on a fast track to get

our permits in a position to be filed next year, probably towards the second half of the year. Also, there are some key components

you need when you take a project forward and get it ready for permitting and construction. That starts with metallurgy, so we've done

that. Now we're doing the resource work. Our new strategic initiative is looking at the project in terms of what provides the best

cashflow up front. The ore body will typically tell you exactly the rate at which it needs to be mined. We're taking a whole new look

at the mine planning. We think we can implement some efficiencies and cost savings. It's a new team taking a fresh look and having

the financial resources and the backing to be able to take it all the way through development.

Dr. Allen Alper: That's excellent. It's great to have the financial backing of two big financial groups. Could you tell me a

bit more about your background, your management team, your board?

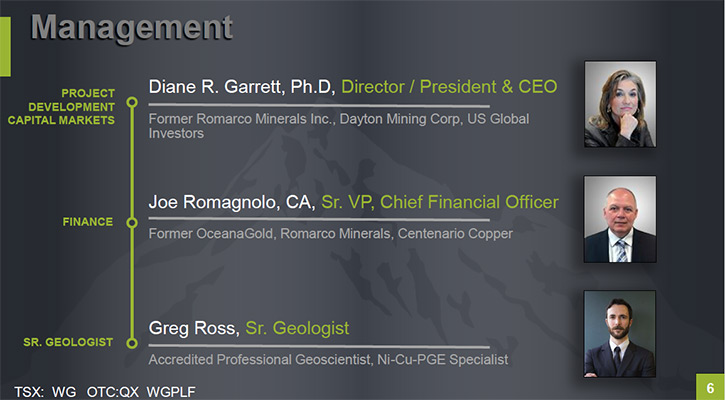

Dr. Diane Garrett: Sure. My background is engineering, and I started out on the buy side with U.S. Global Investors. I

have been with Dayton Mining and Romarco Minerals, both companies developing projects such as this and put them into production.

Romarco was a very big success, with the Haile gold mine in South Carolina. We took that company from 20 million market cap to over

$1 billion. We were ultimately acquired by OceanaGold in 2015.

I looked at a number of CEO opportunities and found this project to be extremely fascinating. It checks all the boxes: large

scale, base and precious metals, excellent infrastructure and a mining friendly jurisdiction. It is, in my opinion, very undervalued.

I feel, with the skillset I bring to the table of project development and putting a good team together, we can add some real value

here. That's the track we're taking. We know commodity prices are down from when the PEA was published in 2015 but I’d rather be de-

risking the project and moving it towards production in this environment than chasing a rising commodity price environment and not

have filed for permits yet. We feel bullish on the metals.

I also brought in Joe Romagnolo who worked for me in finance at Romarco Minerals. He's now our CFO. For the moment, I’ve

built a team of consultants to complete the current studies. We'll plan to start layering-in a full-time development team, once we

get the next few months behind us in our studies.

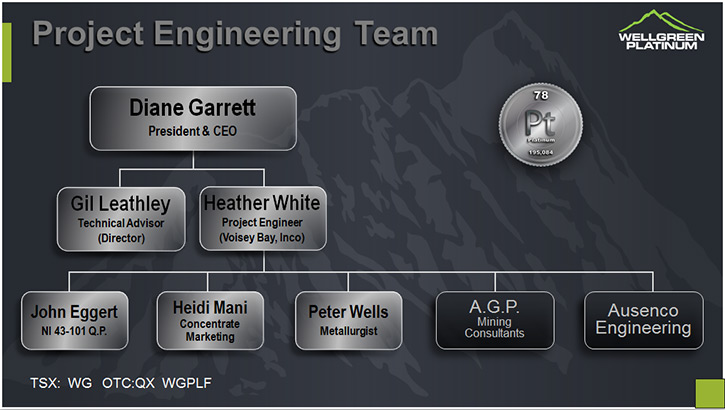

That consulting team is led by Heather White, who's a project engineer. She designed and built the Voisey's Bay Mine. She's been in

nickel for about 15 years and is a very, very talented mining engineer. We're also using Ausenco Engineering and AGP Mining

Consultants, who are very well recognized in mine planning studies and optimization of projects.

Dr. Allen Alper: That sounds great. Could you tell me a little bit more about the mineral resources?

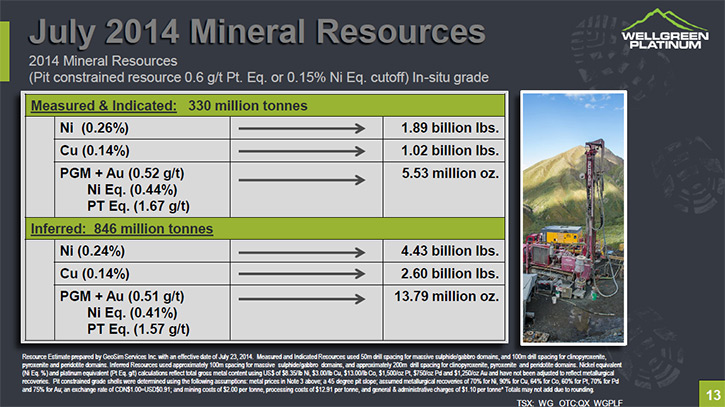

Dr. Diane Garrett: Sure. The Measured and Indicated category, from the 2014, NI 43-101 resource study, demonstrated 1.9

billion pounds of nickel, a billion pounds of copper, and 5 and a half million ounces of PGM’s and gold. In the inferred category, it

was over 4 billion pounds of nickel, just under 3 billion pounds of copper, and another 14 million ounces of PGM’s and gold. A

staggeringly sizable deposit!

Now we're in the process of taking a new, fresh look at that mine plan. We’re using all the detailed studies we've completed,

and certainly looking at various commodity prices.

Dr. Allen Alper: That's a huge deposit with many very, very valuable metals.

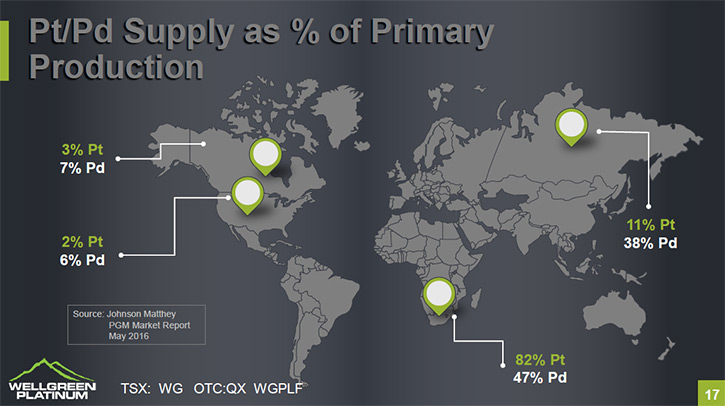

Dr. Diane Garrett: And it's in the Western Hemisphere, which makes it very unusual having PGMs in the Western

Hemisphere. And it's very unusual to have a PGM deposit open-pit. It's also very unique to have a platinum-palladium ratio of 1 to 1.

That's virtually unheard of in PGM deposits. So this deposit really has a lot of things going for it.

Dr. Allen Alper: Well, that's really excellent. Could you say a bit more about your share structure and where you're listed?

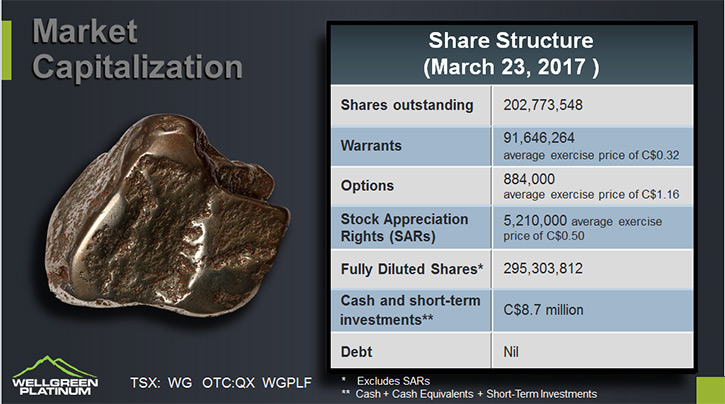

Dr. Diane Garrett: Sure. We are listed on the Toronto Stock Exchange under the symbol WG. We are also listed on the

OTCQX under the symbol WGPLF. We have about 200 million shares outstanding. We have approximately $9 million Canadian in the bank. We

have no debt. We have about 95 million warrants outstanding. Those are, predominantly, with our two largest shareholders, with a

strike price of 34 cents, another million and a half in options and some stock appreciation rights of 5 million. On a fully-diluted

basis, we're just shy of 300 million shares outstanding.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider

investing in Wellgreen Platinum?

Dr. Diane Garrett: There are very, very few nickel sulfide plays out there. If you believe that commodity prices are

going to turn, and they always do, they're cyclical - always have been, always will be. We just don't know when. We do know, when

nickel turns, it turns very quickly. For a play to have something very unique, which is a nickel sulfide deposit in North America, in

a mining-friendly jurisdiction, with excellent infrastructure and something of huge size is very important. But then, you layer on

the precious metals component with the gold and also the PGMs, which is rare to find in the Western Hemisphere and it becomes an even

more strategic play. We've seen the issues that South Africa's having with the PGM production and their mines. The opportunity to

have a precious metals and base metals play of such significant size, in a great, safe political jurisdiction, is really quite rare.

There're not many opportunities like this.

Plus if you don't know the management team and are not familiar with any of us, look where two of the biggest private equity funds

have put their money. They're clearly in this story in a big way and they're very pleased with the work we're doing. That should be a

good incentive for shareholders to want to participate as well.

Dr. Allen Alper: Those seem like excellent reasons to consider investing in Wellgreen Platinum. Is there anything else you

would like to add, Diane?

Dr. Diane Garrett: We'll have a number of catalysts coming up during the year. So I would just encourage investors to

follow our news and see the progress we're making. We intend to make this company very successful.

Dr. Allen Alper: That sounds excellent!

http://www.wellgreenplatinum.com/

Diane Garrett

President & Chief Executive Officer

1-416-304-9318

dgarrett@wellgreenplatinum.com

info@wellgreenplatinum.com

|

|