Interview with Mitch Krebs, President and CEO of Coeur Mining Inc.: Generating Strong Cash Flow and Poised for Long-term Success

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/16/2017

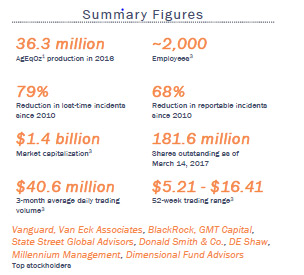

Coeur Mining, Inc. (NYSE: CDE) is the largest U.S.-based silver producer and a significant gold producer employing approximately 2,000 people with five wholly owned precious metals mines in the Americas: the Palmarejo silver-gold complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, the Wharf gold mine in South Dakota, and the San Bartolomé silver mine in Bolivia. We learned from Mitch Krebs, who is President and CEO of Coeur Mining that this year they expect to produce somewhere around 17 million ounces of silver and about 375,000 ounces of gold. According to Mr. Krebs, over the last three years the company managed to lower their all-in sustaining cost by about 25-30%, more than doubled their adjusted EBITDA margins and, with the help of the resulting cash flow, significantly reduced their debt. Coeur Mining is an attractive well-diversified and growing producer that runs in a very responsible, ethical way.

The Palmarejo mine, Mexico

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mitch Krebs, President and CEO of Coeur Mining. Could you give our readers an overview of Coeur Mining?

Mr. Mitch Krebs: Coeur Mining is a U.S.-based silver and gold mining company. We're listed on the NYSE with a ticker symbol of CDE. We have five precious metals operations in the U.S. and Latin America; one in Alaska, one in South Dakota, and one in Nevada here in the United States, and our biggest operation in Mexico, and also a silver operation in Bolivia. This year, we expect to produce somewhere around 17 million ounces of silver and about 375,000 ounces of gold. We have about 2000 employees. Our Headquarters here in Chicago and the United States, making up about two-thirds of our business in terms of production and revenue. We have done a lot to improve the political profile of the company with three of our five mines here in the U.S. In addition, we now have about 65% of our revenue coming from gold with the remaining 35% coming from silver. We have a good balance between the two main precious metals.

Dr. Allen Alper: That sounds great. Could you tell us a bit about your operations in the United States, Mexico and South America?

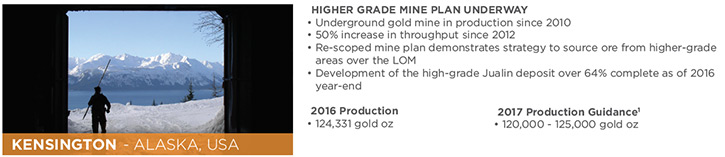

Mr. Mitch Krebs: Our mines in the United States from north to south are; Kensington in Alaska, an underground gold mine that's been in production since 2010. The real story at Kensington has been twofold. We’ve increased the mining and processing rates by about 50%, driving a higher production level and stronger cash flow. We have done a great job of identifying new, higher-grade gold through our exploration efforts.

Right now, we're investing money in the underground infrastructure that's necessary to access this higher-grade material. As we get into that higher-grade material later this year, that should give us a further bump in our production and a further drop in our costs. Kensington produces about 125,000 ounces of gold a year. Costs last year to produce the gold were about $800 an ounce. It's a good operation. Watch for the continuation of these higher-grade drill results, mining them, and delivering higher cash flow going forward.

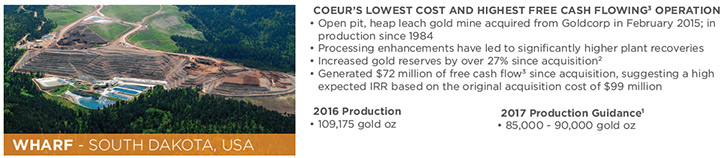

The mine in South Dakota is called Wharf, also a gold operation, open pit, heap-leach that we acquired in February of 2015 from Goldcorp, which is a large Canadian-based mining company. We paid them $99 million for that mine. Through the end of 2016, the mine has generated more than the $86 million in free cash flow, so we have almost fully recouped our investment already after less than two years of owning that mine. That means the rate of return for our investors from the Wharf acquisition is very high. Wharf has added about 100,000 ounces of gold production annually. It's our lowest cost operation. The costs there are in the $600 an ounce range to produce gold, so we're very pleased with that investment, that acquisition that we made a couple of years ago.

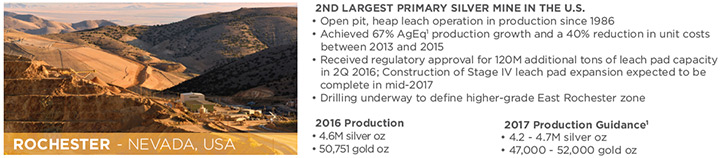

Rochester, our longest-running operation, since 1986, is an open pit, heap-leach silver and gold mine. It's Nevada's largest silver mine. We're investing money there this year to expand the leach pad capacity, where we stack the ore that we mine and then recover the silver and gold from that material. We have invested about $55 million in Rochester over the last three years or so to increase the mining rates and invest in all the infrastructure and equipment needed to mine at much higher rates, which gives us much higher efficiencies and lower unit costs. That will lead to higher cash flow as we go forward, especially once we have that pad expansion project completed in the middle of this year. Rochester produces about 4.5 million ounces of silver and about 50,000 ounces of gold per year, and it has a nice, long mine life ahead of it, expected to go out into the 2034 time frame. That's our third operation in the U.S.

In Mexico, Palmarejo, our largest mine, has seen a real resurgence. We've transitioned that mine over the last couple of years from formerly mostly an open pit, lower-grade, lower-margin operation to now 100% underground with much higher silver and gold grades. This year, in 2017, we expect the production rates of silver and gold to be up about 50% from last year, close to7.0 million ounces of silver and 115,000 ounces of gold, at costs per silver-equivalent ounce that should be below $10. We expect to see significant cash flow now, out of Palmarejo, starting this year and going forward.

We made an acquisition at Palmarejo two years ago, buying our next-door neighbor, a company that was called Paramount Gold and Silver, which gave us access to additional high-grade underground mineralization that we're now starting to mine. That's having a very significant positive impact on the growth we're seeing out of Palmarejo.

In Bolivia, we have one of the world's largest pure silver mines. It produces between 5.5-6.0 million ounces of silver annually. It has the shortest remaining life of all the mines in our portfolio, about three years. The costs there are running around $15 per ounce.

We make good money out of that operation, San Bartolome, but we'll continue to focus the business more on Mexico, the United States and, to the extent that we can find opportunities to grow in Canada, we will expand there as well. We are interested in the North American jurisdictions that are safe, predictable, and places where we're comfortable operating over the longer term. Bolivia's probably the first country that we'll see drop away. We've been focusing on condensing our footprint globally. We had a project in Argentina that we recently sold. We've had some other non-core assets we've monetized. Our focus now is on Mexico, the United States and Canada going forward.

Dr. Allen Alper: That sounds excellent. That sounds like you've had an excellent year in 2016, and it sounds like 2017 will even be a much more profitable and successful year.

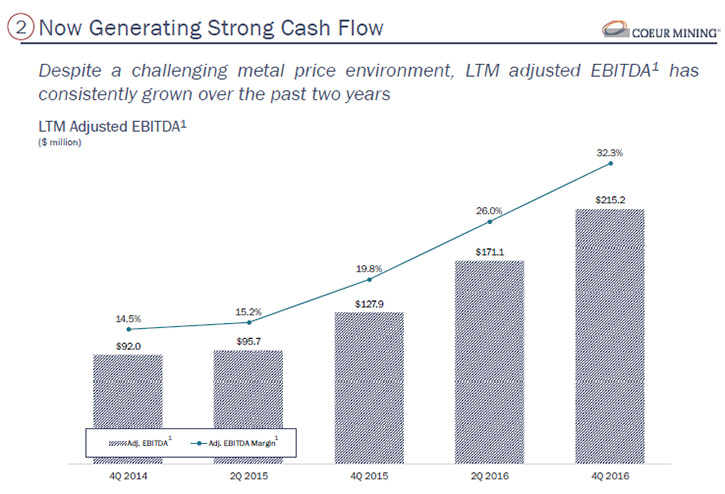

Mr. Mitch Krebs: Yes, our costs on a company-wide basis, over the last three years or so are down about 25-30%, which is an amount far greater than anybody else in the precious metals mining industry. Our adjusted EBITDA margins have more than doubled from below 15% to over 30% now. Just the sheer growth in cash flow, even though metals prices haven't really done much over the last few years, our EBITDA as a company has more than doubled from what was about $90 million in 2014 to now over $200 million. The cash flow is growing, costs are declining, and we have good, high-return, organic growth opportunities here inside the portfolio of mines that we own to carry us forward, providing growth over the next several years.

Dr. Allen Alper: That sounds excellent. It sounds like you really improved the performance of the company, and are very well positioned in 2017. Could you update our readers on your background, Mitch?

Mr. Mitch Krebs: I'm a finance guy. I came from the investment banking world, and joined this company quite a few years ago. Before I became the President and CEO, I was the chief financial officer. I assumed those responsibilities in 2008, which you'll recall was poor timing to become a chief financial officer, with the global financial crisis.

Dr. Allen Alper: That was a tough year.

Mr. Mitch Krebs: Tough year, tough time, but a great experience. I then became the President and CEO mid-2011. The first two years were spent reconstituting the management team, the company's board of directors, giving us a fresh start organizationally, which is paying dividends. We now have a high-quality team, and we're starting to have a track record of consistency, delivering on our commitments, and meeting or beating our guidance that we set out. This team we've had in place for about three years is really coming into its own and starting to deliver some really good things.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit more about your team and your board?

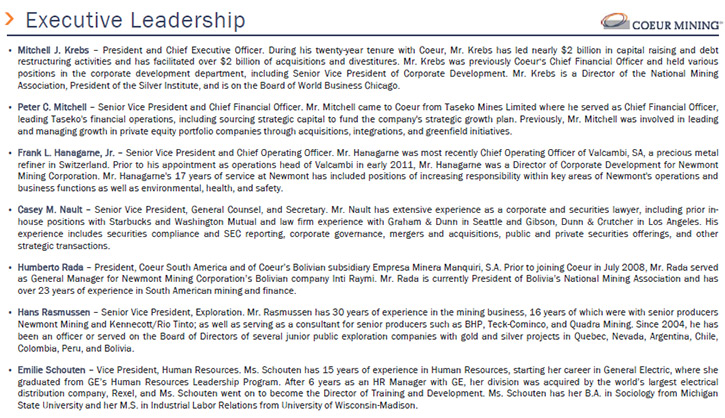

Mr. Mitch Krebs: Our chief financial officer, Peter Mitchell, came to us out of the copper mining industry. He has experience in the private equity world, balance sheets and liquidity management, along with his mining background. It makes for a great skill set in a seasoned chief financial officer like Peter.

Our chief operating officer, Frank Hanagarne joined us from Newmont Mining here in the U.S. He had a variety of operational and business development roles there over a long career. His background is in metallurgy. He's a metallurgist by training, and that has really been an area of focus for the company in terms of increasing the recovery rates at our existing operations as a way of boosting profitability and reducing costs. Frank has brought a great skill set to the business and some real operating discipline and solid planning, really reflected now in the company's performance.

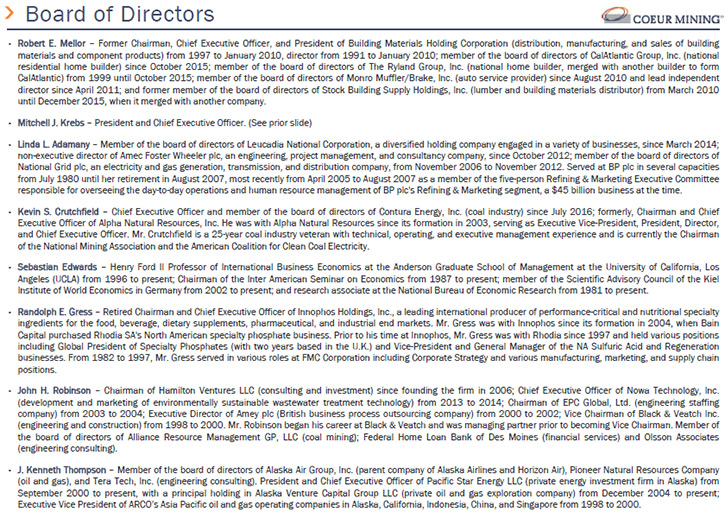

The chairman of our board, Rob Mellor, is an independent chairman. Separating the chairman and CEO roles is a good thing from a corporate governance perspective. Rob is a former corporate securities attorney as well as a former public company CEO. Like a lot of our directors, Rob has experience in cyclical, capital-intensive industries, including real estate and building supplies We have other directors who come from the coal mining space, from the phosphate mining business, from oil and gas, and some large companies as well. It's a well-rounded board, and very engaged. It's one that brings to the boardroom both mining and related industry experience. The company, our shareholders, and I have all been beneficiaries of the expertise and guidance our board provides.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your capital structure?

Mr. Mitch Krebs: We've made great strides in that area. We, as a company historically, had high-cost assets and too much debt on our balance sheet. We've done a really good job bringing our costs down, and we've also done a good job cleaning up this balance sheet. Now we have a very flexible, very conservative balance sheet. Only 18 months ago, this company had over $550 million of debt on the balance sheet. The annual interest expense from that debt was around $45 million a year. Today we have about $200 million of remaining debt, and our interest expense annually is only about $15 million.

The cash flow has grown, the debt has come down and our leverage ratios have plummeted by about 80%. Our interest expense savings, about $30 million a year, are now being allocated to things like exploration at existing mines. It's being used to fund some of this high-return organic growth at our existing operations. We're benefiting from having a flexible and conservative balance sheet because now we're able to fund the kind of growth that we need to fund with our own balance sheet and interest expense savings. We ended the year with about $165 million of cash on hand, so we have adequate liquidity. We feel really good now about the capital structure of this business.

Dr. Allen Alper: Sounds like an outstanding performance. Terrific! Could you tell me a bit about your share structure?

Mr. Mitch Krebs: We have 180 million shares outstanding. About 65% of those shares are held by institutions, the remainder by retail investors. There's a strong U.S. silver influence in our shareholder base. This has historically been known as a very liquid equity to own if you want exposure to silver and to precious metals. In the U.S. there's a large contingent of people, who want that. Our shares have provided those retail shareholders with that kind of exposure. Our largest shareholder is Vanguard, which is an index fund. We also have Van Eck, Blackrock, Fidelity, and some of the other larger institutions that you'd recognize as top holders.

It's a stock that trades a tremendous amount, so it has great liquidity. On a daily basis we trade something like $40 million worth of shares. It's widely held and provides excellent exposure to precious metals, and in a company that has been repositioned and is growing in a very high-quality way, not just growth for growth's sake. We're focused on high-quality growth, high-return growth, the kind of growth that's going to make the business better over the long term. I think we've put this company on that path now, and we're really excited about where we're going.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Coeur Mining?

Mr. Mitch Krebs: I think the diversification and balance that we have inside Coeur is an important consideration for investors. We're not a single country company. We're not a single asset company. We're not a single metal company. An investor, looking to own the shares of a company with a nice balance across multiple assets, multiple jurisdictions, and both silver and gold, might want to look closely at Coeur Mining. I think that's an important consideration for high- net-worth investors. I think the growth not only in production but in margins and in cash flow is an important trend.

I think the way we stack up against really anybody in the industry on those metrics makes us an attractive investment alternative within the precious metals sphere. I talked about the NYSE and the U.S. presence, good corporate governance. We run our company in a very responsible and ethical way. Look at our valuation relative to the sector. Whether you look at a cash flow multiple or a multiple of NAV, we trade at a pretty attractive level compared to our peers. We're cheap on a relative valuation basis. We're generating free cash flow, so there's an attractive free cash flow yield here at this company. Those are a variety of reasons I think high-net-worth individuals should take a look at Coeur Mining.

Dr. Allen Alper: That sounds excellent, very excellent reasons for our high-net-worth readers and investors to investigate and consider investing in Coeur Mining. Mitch, is there anything else you'd like to add?

Mr. Mitch Krebs: No, your questions were right on point, and I appreciate the opportunity. We're very pleased with the progress that we've made, and I think we're well positioned for the future. I think silver and gold prices have been fairly healthy this year, probably more healthy than a lot of people had expected. I see a lot more generalist investor interest in precious metals now, given the uncertainty and financial risk that is perceived both in the U.S. and globally. I think we're seeing some renewed interest in the space, and what's nice about our business is that we're now positioned to where we don't need higher prices to be profitable. We're making good money at current prices and we have a good trajectory for the company without any price increase, but if you factor in the potential of precious metal price increases, that would just be an added benefit for investors in our company.

Dr. Allen Alper: That sounds excellent.

http://www.coeur.com/

Coeur Mining, Inc.

Courtney Lynn, Vice President, Investor Relations and Treasurer

(312) 489-5837

|

|