Dr. Jack Regan, Founder, CEO, and Chairman of LexaGene Inc. (OTCQB: LXXGF; TSX.V: LXG): Unprecedented Ease-of-Use, Sensitivity, and Breadth of Pathogen Detection

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/8/2017

Typically, I focus my reviews on metal and mining companies, but I recently encountered a new company outside the typical scope of Metals News. I found this company’s story to be very interesting and felt that my readers might likewise enjoy it and appreciate the opportunity to consider investing early in a growing company that appears to be positioned for exceptional long-term growth.

LexaGene Holdings, Inc. (TSX.V: LXG, OTCQB: LXXGF) is a biotechnology company developing a fully automated rapid pathogen detection system for use at the site of sample collection, which offers unprecedented ease-of use, sensitivity, and breadth of pathogen detection. We spoke with Dr. Jack Regan, founder, CEO and Chairman of LexaGene, who also happens to be the scientist that invented the LexaGene’s patented microfluidic system. We learned from Dr. Regan that they are currently in the early stages of product development and expect to have their alpha prototype built and ready to show by November 2017.

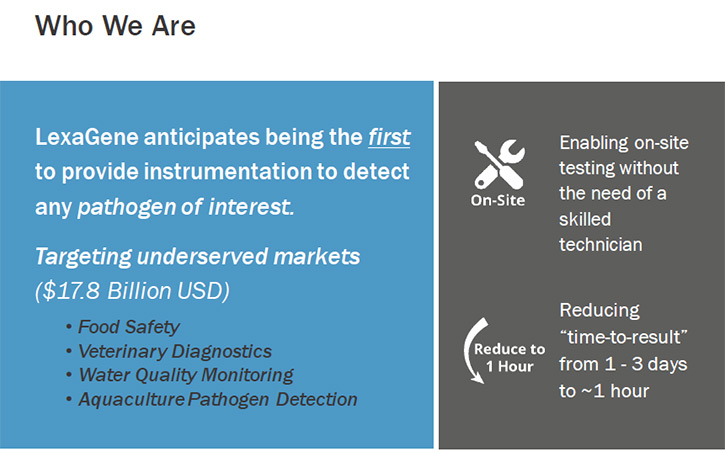

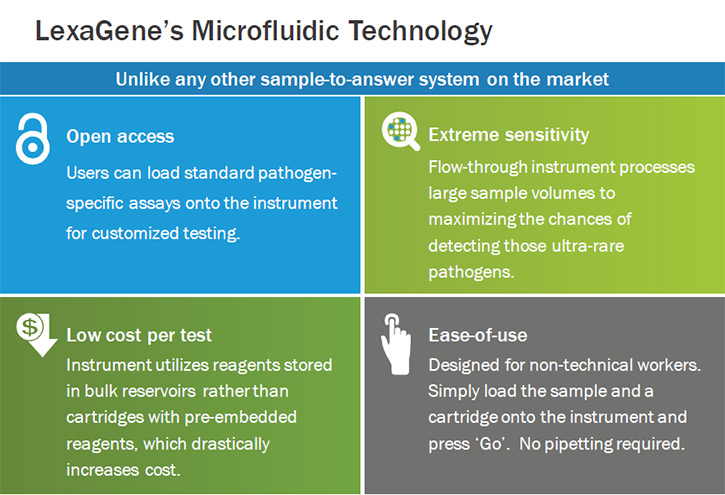

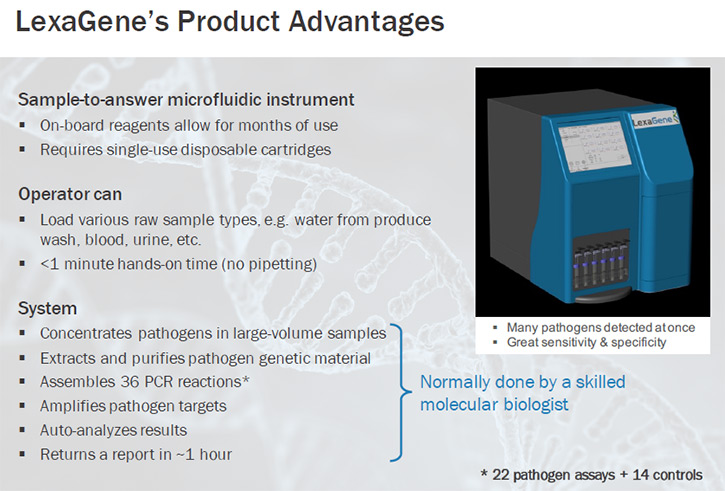

According to Dr. Regan, the key features LexaGene’s technology allows are: the processing of large volume samples, which improves the ability to detect the low titer pathogens; the greater breadth of pathogen detection, which will improve the number of tests returning a positive result; the ability to customize the instrument to screen for any pathogen of interest; the low cost per sample tested; and the extreme ease-of-use. LexaGene’s technology aims to transform the way to prevent and diagnose disease in multi-billion dollar "underserved" markets such as food safety, veterinary diagnostics, water quality monitoring, aquaculture pathogen surveillance, and more.

LexaGene has been selected to be featured in an upcoming episode of Innovations with Ed Begley Jr. The show will air in the third quarter of 2017 on the FOX Business Network, which is viewed by approximately 85 million households worldwide. “Of the thousands of biotech companies out there, to be selected and invited by DMG Productions to participate in Innovations with Ed Begley Jr. is quite an honor. We are very excited to have the opportunity to show the world the features of our technology that separates us from the competition and will enable us to make a positive impact on so many different industries.” said Dr. Jack Regan, LexaGene’s Founder and CEO.

Michele Nehls, Producer for Innovations said, “My team is constantly looking at the biotech space for stories that we think are compelling. We ran across LexaGene and were excited to learn that the company is building an open-access platform to bring automated diagnostic to fields that are currently not being supported by the bigger companies. Their technology has the potential to make a big impact on food safety, veterinary diagnostics, and even pandemic prevention; and we think the general public will enjoy learning about this company and the technological advances they are making.”

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Dr. Jack Regan, who is the founder and also the CEO and chairman of LexaGene Holdings Inc.

Could you give me an overview of the company, and what your plans and goals are?

Dr. Jack Regan: Sure. LexaGene Holdings is a biotech company. We are focused on providing automated instrumentation for rapid pathogen detection. Right now, we're in the early stages of product development. We expect to have our first prototype, called the alpha prototype, built and ready for outside viewing by November of this year, 2017. That is the first stage of the three stage process in getting a product commercialized. Then we are going to create a beta, which we will send to customers to evaluate. Shortly after the beta and getting feedback, we will create a commercial unit to be sold.

Once we have the commercial unit, we will target "greenfield markets” that have certain requirements that aren't met by other suppliers of automated instrumentation; and as a result these markets are underserved in regards to automated molecular testing.

One of the key features our technology allows for is the processing of large volume samples. This is particularly important if you want to check low titer pathogens. These are bugs that are very rare, but nonetheless, may be present and capable of causing infection. As somebody concerned with pathogens, you do not want to have a false negative result, which some of the other technologies would be prone to if they cannot process a larger sample. The processing of the larger sample really improves the ability to detect these low titer pathogens.

Our technology allows for this. We think it will have exceptional sensitivity. The ability to detect a true positive when the sample is, in fact, positive. It is also expected to have great specificity. The ability to make sure that you don't have a false positive. You call a negative, a negative.

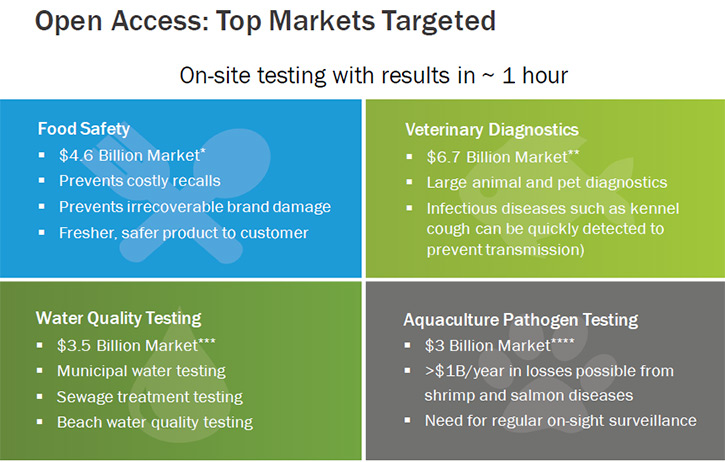

We think our technology is very well suited for markets that are underserved. First, we're targeting food safety. Food safety is a market where, traditionally, they've relied solely on culture, which is a very slow and antiquated way to do detection. Cultures take time as you have to wait for the bacteria to grow, after which subsequent analysis is often required. This multi-tiered process, from a ‘potential’ positive to a ‘presumptive’ positive can take 3 days to get an answer regarding the safety of the food.

The problem is food producers and food packaging facilities want to be able to sell their product to customers immediately and not wait two or three days to get an answer back. They're looking for faster ways to screen their food for safety. Our technology is very well suited because it is designed be placed in the facility that's processing the food and operated by facility personnel.

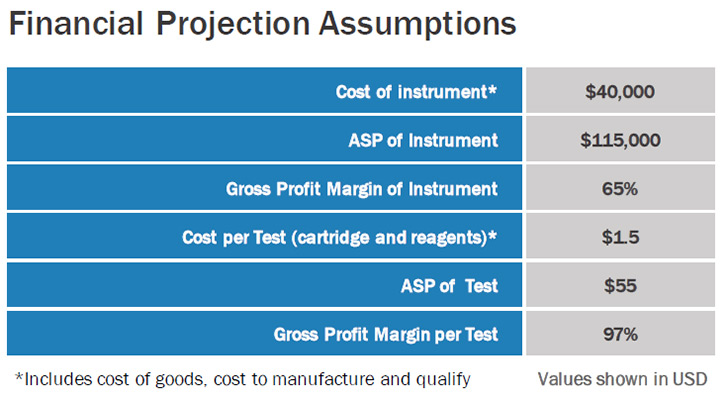

For example, a facility worker will collect 50 milliliters of water that have been used to wash vegetables prior to packaging and load this sample onto the instrument. The worker will also load a single-use disposable cartridge on to the instrument, and press "go." It really is that simple. The automated instrument will do everything else from there. First it will concentrate the pathogens in the sample. It will then purify the genetic material in that concentrated portion. It will next assemble 36 PCR reactions. These are very sensitive molecular genetic tests, which look for the presence of very specific bacterial and viral genetic code. If it sees that code, it will amplify the genetic material about a billion-fold for easy optical detection. The instrument auto-analyzes the data, generates a report, and adds these data to previously collected data so that historical trend data can be monitored.

You can imagine a facility, like a food processing plant, where they are constantly looking for E. coli and salmonella and indicative species. Indicative species are just bugs that are ubiquitously present in the environment and expected to be there. You just monitor their level over time. It's just an indicator of how good your cleaning process is. You can imagine a facility running tests regularly throughout the day and developing trend lines for the level of indicative species detected; making sure there are no spikes that would indicate a break down in the process has occurred. Also, making sure there's no spike in the detection of E. coli or salmonella, which would indicate a potential risk. If that risk were high enough, they would possibly divert those food items to a holding facility and wait for culture to verify whether or not there's any viable pathogens there that are a concern.

In addition to food safety, we are also planning on targeting veterinary diagnostics. We think this is a great market opportunity for us. People view pets as members of the family and provide them the same level as care as person. Pets get sick just like humans do and sometimes they get infected with pathogens that have antibiotic resistant genes. Our technology should be able to detect very rapidly if a pathogen is present and whether or not it is resistance to commonly used antibiotics. In which case, you'd use a different class of antibiotic. By providing the answers very quickly, veterinarians can prescribe the therapeutic most likely to work the first time around and not get into a cycle of prescribing the medicine, then finding out the pathogen is resistant to that medicine, and having to change treatment. By doing so, sometimes, you can spend weeks trying to resolve an infection that should have been resolved in just a couple of days.

We’re confident our technology will be first-in-class. I've compared our technology to our competitors’ technologies and believe we can offer a better value to the end user. We're excited to get our instrument built so we can perform side-by-side comparisons to show our value.

Dr. Allen Alper: That sounds very good. Could you tell me a bit about your background and your team?

Dr. Jack Regan: Sure. I'm formally trained as a virologist. I actually studied the influenza virus. It was a specialty within a larger program called Biomedical Sciences. I received my doctorate from the University of California, San Francisco.

My professional career started studying viruses, particularly the flu virus. I became very interested in the virus because influenza is the most deadly pathogen ever to be recorded over the history of time. People often forget that in 1918 influenza killed between 20 and 50 million people over the span of 18 months, and this pandemic really helped bring World War I to a close.

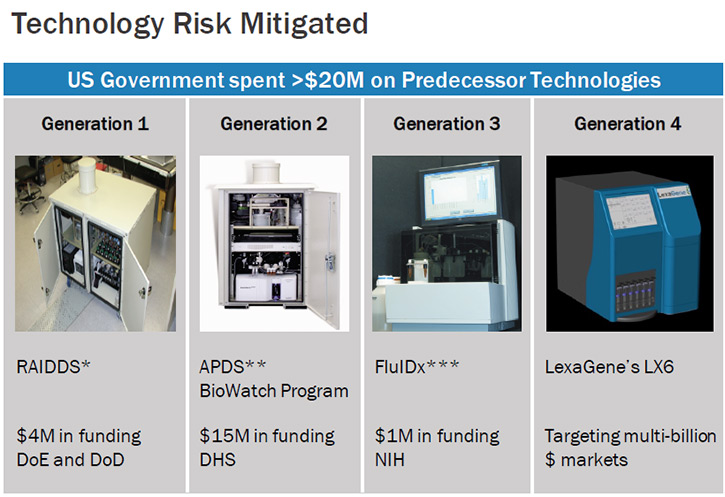

Through my interest in influenza, I went on to do a postdoc at Lawrence Livermore National Laboratory where I focused on pathogen detection. There I ended up working on respiratory pathogen detection, not just flu, but other common ailments that cause flu-like illness. We developed an instrument called FluIDx to detect respiratory pathogens. It was tested at the U.C. Davis Medical Center.

We also developed another instrument called APDS; it stands for Autonomous Pathogen Detection System. This particular instrument was funded by the Department of Homeland Security. It was in response to the 2001 terrorist attacks. Folks, of course, remember the four planes that were hi-jacked by terrorists and that is ingrained in people's memories. People often forget that a week after those plane attacks, there was a bio-terrorist attack where anthrax was mailed to certain news agencies and politicians. This event alerted the federal government to the fact that we are woefully under-prepared for a bioterrorist attack. The government started putting aside money to improve our ability to detect an attack. In all, about 20 million dollars were invested in instrumentation to do automated surveillance.

I am the lead author on manuscripts describing the APDS and FluIDx instruments. These two instruments are designed to run an automated genetic test. Those instruments were both successful in their own right, but I felt that in order to become commercially viable, improvements needed to be made. I set out to design better instruments. I ended up designing an instrument, which I expect will outperform these on multiple fronts.

To go down the list of attributes, the instrument is anticipated to have a higher throughput. That means we can process more samples at the same time. We'll be able to process each sample in about one hour’s time, whereas these other instruments were processing them over a three hour time period. We're going to be able to detect more pathogens at once and we'll be able to do so with greater sensitivity and specificity. The new instrument's design is also expected to be more robust components as we’ve eliminated some of the more fragile components that were in the predecessor instruments. Also, the cost of reagents required to perform testing will be lower, so we should be able to pass on some of these cost-savings to the customers. Taken together, we’re confident we have a very attractive technology upon which to found a company.

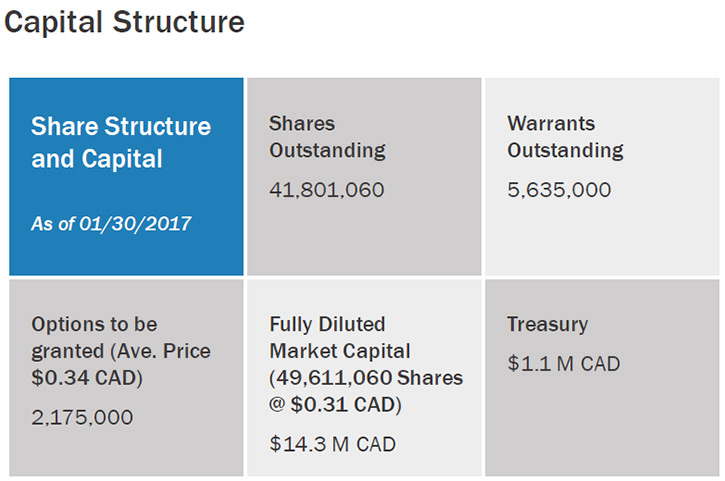

Once the patents protecting this IP were issued, I decided to start a company to develop the technology. We financed the company through a reverse takeover, which facilitates raising money to support product and company development. We are traded on the TSX Venture Exchange (TSX.V), a Toronto based exchange under the ticker symbol LXG. We recently have been granted a U.S. trading symbol (OTCQB: LXXGF) and are also now trading on the OTCQB market, which makes it much easier for US investors to purchase our stock.

Dr. Jack Regan: One of the earliest investors in our company was Boston Engineering in Waltham, MA. The company’s owner was inspired by the technology and wanted to become a shareholder and help make the company a success. We felt that immediately tapping into their staff of over 70 professional engineers was a smart move for our company, as it allowed us to really jump start product development. This was a much faster approach than if we had attempted to hire all the engineers with the breadth of expertise we needed for full system development.

We are now in the processing of raising $2M so we have enough funds to complete alpha prototype development, which is scheduled for this November.

Dr. Allen Alper: Could you say a few words about your new president, Daryl Rebeck?

Dr. Jack Regan: Yes, I hired Daryl Rebeck in early January. He is an expert in capital markets and corporate finance. He's experienced in managing share structure and growing value in companies. He has a tremendous track record and is very respected in the industry.

When you're a publicly traded company, it's important to think of the shareholder constantly. We want to grow the value of the company in a responsible way that is commensurate with our development. He and I are working closely together in strategic planning so we control the growth of the company. We have been very careful in selecting shareholders that are interested in the long-term success of the company, and have excluded shareholders that are looking to make a quick buck.

We realize that we have certain milestones to meet, and we want our valuation to be reflective of passing these milestones, which indicates the additional risk has been mitigated successfully. We are looking for a slow and gradual build in stock value. We want to avoid artificial spikes in value, which undoubtedly are followed by a market correction. If we can manage to do this successfully, we can provide the best return for our shareholders. Ideally, we want all our shareholders to hold their stock for years, so they can have the satisfaction of seeing the impact this technology can have on improving safety and health.

In our non-brokered private placements, we do our best to thoroughly vet potential investors. We are looking for investors who believe advancements in engineering and science can improve the world we live in. We are looking for individuals who also believe in LexaGene’s mission and recognize building this instrumentation, testing it, and commercializing it is going to take some time. So they need to be patient and interested in long-term value gain rather than the short-term value gain.

Right now, our first prototype is scheduled to be finished in November. We will apply lessons learned from the alpha to building a beta prototype, which will be shipped to selected potential customers for feedback. This information is then incorporated into building the commercial unit, which will be marketed and sold.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Dr. Jack Regan: First of all when you look at a company, the things you want to look at are:

One, the people running the company. What's their track record? I encourage you to look at my LinkedIn profile, look at my background. There's more to my background than I mentioned. I've also been involved in another startup called QuantaLife, which was bought by a big bio-tech company for 162 million dollars in 2011. I was part of the effort to get that company acquired. Aside from myself, Daryl is extremely good at what he does and has a tremendous track record. We have also engaged one of the best engineering firms in the world.

As we continue to grow, we will add more talented people to the team.

Two, the technology is sound and we believe it will be first-in-class, meaning that it will provide higher quality testing for a lower cost than our competitors. The majority of the risk has been mitigated through prior work I've done at Lawrence Livermore National Laboratories, where we built and tested instruments for bio-threat and viral detection. Additional risk has been mitigated by the early work completed by Boston Engineering. Once the alpha prototype is completed, we will be able to claim that all the risk has been mitigated, and then we expect a nice bump in company valuation.

Third, we are targeting very large-value markets. Food safety is a 4.6 billion dollar market and veterinary diagnostics is a 6.7 billion dollar market. Not to mention water quality monitoring, which is a 3.5 billion market and aquaculture pathogen surveillance, which is a 3 billion market. Collectively, these account for a 17.8 billion market opportunity. We are striving to be the first-to-market in some of these markets. With first-to-market advantage, we will be able to provide good value return for our shareholders. It is an investment for people who, not only are looking for return of their dollar value, but also people who are looking to invest in companies where their company is doing good things.

LexaGene’s missions are to prevent illness in the food safety market, and in the veterinary diagnostics market, to provide rapid diagnostics that help in the treatment of infections, which will lower the cost of care, not to mention minimizing suffering.

Our long term goal is to get into human clinical diagnostics. We anticipate entering those markets after we have gained some success in these other markets. The only reason we are postponing that effort is because the regulations involved getting clinical approval are quite extensive and costly.

Dr. Allen Alper: That sounds very good. Excellent!

Dr. Jack Regan: Looking at the road ahead from a technical standpoint and a business development standpoint, I'm really happy. I feel we're making steady progress towards our goals. There may be challenges, but we've been able to overcome the challenges we've encountered so far. We're optimistic that the future is bright for LexaGene and its shareholders.

Dr. Allen Alper: An excellent project! Your shareholders should feel very proud. I congratulate you on your successes to date. This company seems well positioned for long term growth. I expect making an investment now, has I good chance of paying dividends down the road. I’ve found your story and technology to be very compelling. Best of luck to you and your team. I look forward to monitoring your progress and seeing the impact LexaGene can have on society and the markets you mentioned.

http://lexagene.com/

100 Cummings Center, Suite 207-P

Beverly, MA 01915 USA

Jack Regan

Chief Executive Officer

jackregan@lexagene.com

|

|