Integra Gold Corp. (TSX-V: ICG; OTCQX: ICGQF): New PEA Indicates a 135,000 Ounce Per Year High Margin Project; Discussion with Chris Gordon

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/4/2017

Integra Gold Corp. (TSX-V: ICG; OTCQX: ICGQF) is a junior gold exploration company, advancing the Lamaque project in Val-d’Or, Québec, one of the top mining jurisdictions in the world. We learned from Chris Gordon that Integra is a company that's exploring aggressively, at the same time, also advancing their project and moving forward with a potential production decision to be made by the second half of 2018. The new PEA shows they will be able to build a 135,000 ounce-per-year high margin project for a relatively low price tag, which is extremely rare in the industry. Also, the mine life was extended from five years to ten and a half years. Plans for 2017 include updating the resource estimate, commencing underground exploration, and reviewing the results of bulk sampling while drilling the Lamaque Deep target.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Chris Gordon, from Integra Gold Corporation. Chris, could you give our readers an overview of Integra Gold.

Mr. Chris Gordon: Sure. Integra Gold is a unique story and a rare investment opportunity in the junior mining sector. The reason, Allen, that I say that is because typically you're either an explorer or you're a developer and it's very rare to actually be both, and that's exactly what Integra Gold is. We're a company that's exploring aggressively, at the same time, we're also advancing our project and moving towards a production decision that will come in the back half of 2018.

Dr. Allen Alper: Well that sounds great. Could you tell me a little bit about your preliminary economic assessment and what it indicates and shows? I know it's an amazing story.

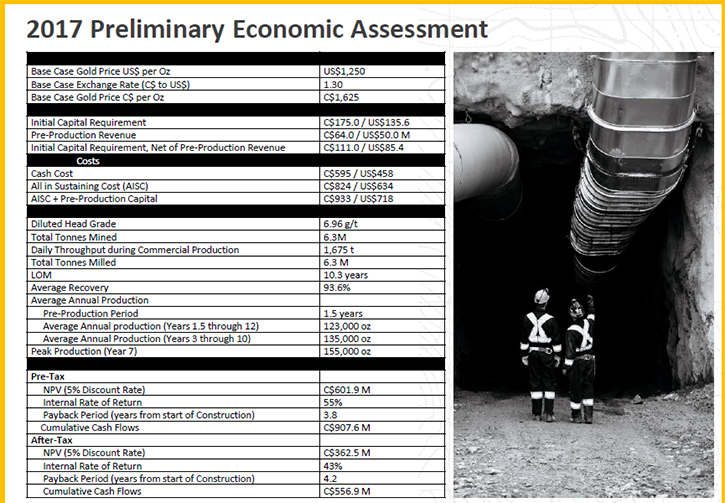

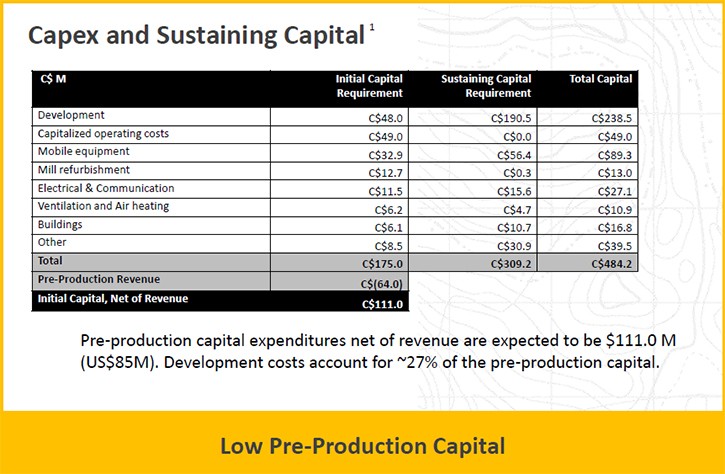

Mr. Chris Gordon: Yeah, sure I'd love to talk about that. We announced our updated PEA February 27th. We're very pleased with the results. They've exceeded our expectations. We're looking at producing about 135,000 ounces per year with an after tax NPV of $363 million; an after tax IRR of 43%. Being able to build a 135,000 ounce a year high margin project, for the price tag that we're looking at, of about $111 million Canadian, is extremely rare in the industry.

Some of the other highlights would be: The mine life was extended from five years to ten and a half years. The life of mine production has gone from 500,000 ounces, to 1.3 million ounces. We were able to increase the annual production profile. All this with just an initial capex of 111 million. When you look at the all in sustaining cost per ounce, in terms of US dollars, we're looking at $634. This is a project that stands out and makes sense, whether gold goes up or down from the current price.

Dr. Allen Alper: That sounds great. That's a great preliminary economic assessment. Could you tell us more about plans for 2017?

Mr. Chris Gordon: Yes, most certainly. In March 2017, Integra released an updated resource estimate on Triangle which incorporated 117,000 metres of new drilling at the deposit. The indicated resource grew 100% and 105% at a 3 g/t cut-off and 5 g/t cut-off respectively. Inferred resources decreased, which was expected, but only by a small percent. This is important to note because it means the Company geologists were able successfully, to convert inferred resources to indicated resources, while replacing resources in the inferred category. The Triangle resource estimate is now 1.4 M oz Au and 1.1 M oz Au at a 3 g/t cut-off and 5 g/t cut-off respectively.

It is important to remember that the updated resource estimate at Triangle is not included in the PEA released in February 2017. The PEA used a resource at Triangle from November 2016.

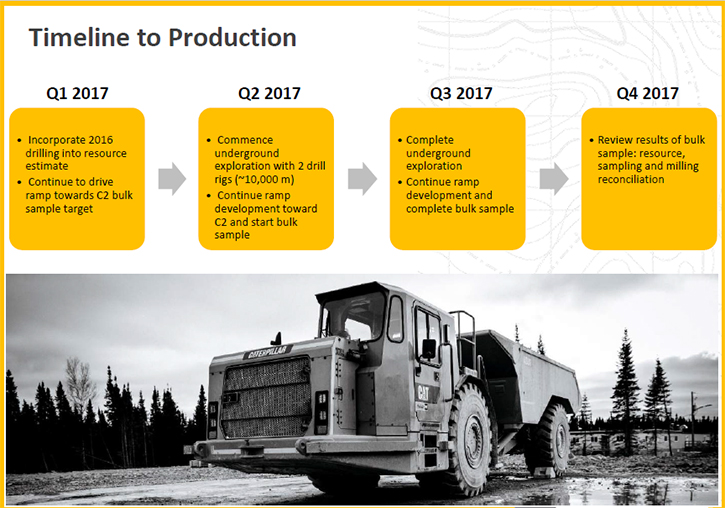

In Q2 this year, we'll commence underground exploration, with two drills underground. We're going to drill approximately 10,000 meters underground. At the same time, the ramp development will continue towards C2 and we'll be able to start the bulk sample in Q2-Q3. The results of the bulk sample will be available in Q4.

In Q4, we'll review the results of the bulk sample and plan next steps. On the exploration front, we have five drills operating at the moment. Three of those are turning at the Triangle deposit, one drill is turning at the No. 4 Plug, which is located 500 meters to the north of the Triangle. That's a deposit, with which, we'd be able to use the same existing underground infrastructure, to be able to access the No. 4 Plug.

Then we have one drill turning at Lamaque Deep target as well. There's going to be no shortage of news flow for us.

Lamaque Deep is a unique target for us, in that the top 1,000 meters of the Lamaque Mine produced 4.5 million ounces of gold, over a 50 year plus period. We're testing approximately the next 1,200 meters below that mine, to see what is down there. Those results will probably become available in the next two to four months.

Dr. Allen Alper: That's great. We’re including your Faces of Integra slide. Would you tell us a bit more about your team?

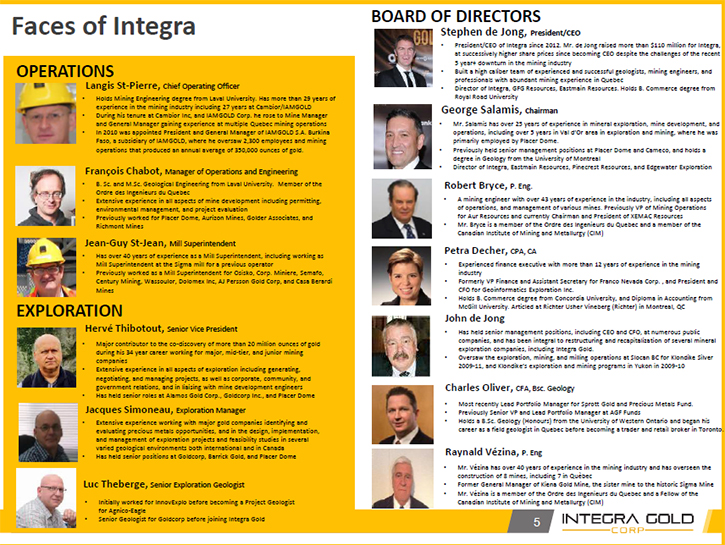

Mr. Chris Gordon: We have a very experienced team, with many having worked for companies such as IAMGOLD, Goldcorp, Richmont and Placer Dome among others.

We've always conducted ourselves like a much larger company, even back when our market cap was only 30 or 40 million. That's enabled us to have a very high level of confidence in the work that we do, on the exploration and the development. Looking at our operations and our exploration team, if you include George Salamis, our Chairman five of those members actually worked on the Sigma Mine (4.5mm oz), which is located on our property.

The reason that's really relevant, is because they mined what Sigma used to call the "P" Shears and we call our shear zones the C Structures. A very similar type of a shear zone. We have a lot of relevant experience in mining the exact same type of rock that we're getting into now.

One recent key addition to the board was Raynald Vézina. He's a bit of a legend in the Quebec mining space because, between 1980 and 1995, he played a major role in bringing seven mines into production. Every two years, he played a significant role in bringing a mine online. That's a pretty amazing track record.

We've also recently added Andree St-Germain, as our CFO. She'll be joining us in March. She was most recently with Golden Queen Mining. She was their CFO through the build-out and the development, ultimately getting into production. She brings a wealth of experience in a CFO role, to a company that's moving in towards production.

Dr. Allen Alper: That's great. Could you say a few more words about Steven de Jong?

Mr. Chris Gordon: Steve has done a pretty amazing job. He's in his mid-thirties and he doesn't have as many gray hairs as a lot of CEO's in the business do. However, he's built a name for himself, over the last five, six years as the driving force behind moving Integra from a small exploration company to a development level project with a market cap of $350+ mm. He also has a great ability to be able to attract top-notch people and bring them into the fold, as evidenced by our operations and exploration team and the board, with which he's surrounded himself.

He also sees opportunities extremely well. When Integra was a smaller company, we were basically able to acquire the Sigma Lamaque Mine and Mill Complex out of bankruptcy, for pennies on the dollar. Steve spearheaded that acquisition, an opportunity for us to bring a mill in that would cost a $100 million to build, for fewer than $8 million dollars, with most of that just being an all share transaction. He's also raised $125 million in the last four or five years, a lot of that in what's been called one of the worst Bear Markets on record.

Dr. Allen Alper: Excellent! Could you tell us a bit more about your background, Chris and your position?

Mr. Chris Gordon: Yeah, I certainly can. I started in the mining business in 2008, with an outsourced investor relations firm. That, for me was kind of where I cut my teeth, working with various companies. Helping them to market and raise capital. One of the more prolific companies was West Timmins Mining where I had the opportunity to work with Darin Wagner, who now runs Balmoral Resources. I've been helping mining companies raise awareness through marketing campaigns and bring cash in for close to a decade now.

Dr. Allen Alper: That sounds very good. Could you tell us a bit more about your time line to production?

Mr. Chris Gordon: Certainly. Once the bulk sample is completed in Q4, that's going to give us a much clearer indication. A bulk sample is basically test mining. We're permitted for a 5,000 ton bulk sample right now. Last year we applied to increase the bulk sample to up to 50,000 tons. We should find out, in the next couple months, exactly how much larger the bulk sample will become.

We're on pace, right now, to be able to get into production in the next 18 to 24 months. This of course is pending financing, which is approximately $111 M Canadian, net of pre-production revenue. Once we conduct our bulk sample, we can complete a small permitting study for the Quebec government. This study will allow us to convert the claim on the Triangle deposit to a mining lease.

The project already has all its environmental permits in place and most of the mining permits are in place as well. Just waiting on the last one, at Triangle (expected soon).

Dr. Allen Alper: That sounds excellent. Could you talk about your share structure?

Mr. Chris Gordon: Yes, of course. Our last financing, back in early December, where we brought a large European gold fund, M&G into the financing, at a dollar, brought issued and outstanding to 485 million shares. There's no overhang from warrants. Market cap currently sits around 385 million. We have 38 million in cash. We have 5 million in marketable securities, which represents what's remaining in the investment we made into Eastmain resources, spring of last year.

Typically, we trade, on average throughout the year, about a million shares a day. During busy market times, we'll trade as many as two to five million shares a day. When things slow down a bit, we might move down to 500,000 shares a day. So we are a very liquid stock. We're listed on the TSX Venture exchange (ICG). We're also listed on the OTCQX, as ICGQF. We're about 70% institutionally held, with two of the larger positions being Eldorado Gold, at about 12.5% and VanEck at about 8% of the stock. Other institutional holders are; Oppenheimer, Sprott, Mackenzie, Lombard Odier, AGF, Colonial, First Street and BlackRock, to name a handful of them.

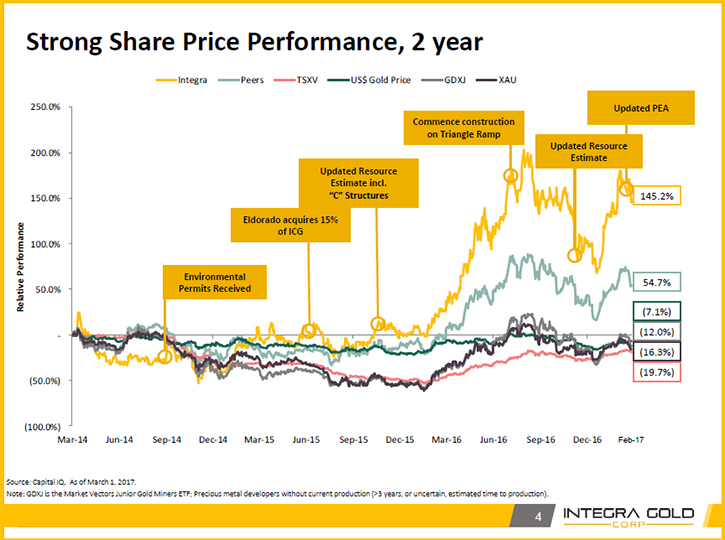

Dr. Allen Alper: That's excellent. Could you mention a bit about your share price performance during the last couple years?

Mr. Chris Gordon: From January 2015 until January 2017, the stock has appreciated at approximately 185%. When you compare us to our peers, to the TSX venture, the price of gold in the GDXJ, we've outperformed all of those. We've had a pretty successful past two years. We hope to continue in that trend going forward. Right now, we're trading at about 80 cents.

Dr. Allen Alper: That sounds great. That's wonderful performance. You have very lucky shareholders. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Chris Gordon: We are exploring at the same time we're advancing the project. Typically when a junior company moves into the development phase, the stock kind of flat lines for a period of time, during the build out of the mine. Once it starts getting into production, the institutions come back in again. We're offering the opportunity to have exposure to a junior company at the development stage, but at the same time, still exploring.

Last year for example, we drilled 120,000 meters and started ramp construction in the summer. Integra provides an opportunity to buy into a company that has been significantly de-risked through the acquisition of the mill, having environmental permits, and very advanced stage permitting. Those are usually two big hurdles a lot of junior companies experience.

You have a de-risked project. You have upside growth on the main asset, which is very high grade, at around nine grams per ton, indicated on the Triangle deposit. We haven't found the edge of any of the shear zones on the Triangle deposit yet. It's open in multiple directions. It's open at depth as well. That continues to grow. You're getting exposure to potential new discoveries through a host of numerous other targets such as, the Lamaque Deep target that we're currently testing and targets from the gold rush competition we held last year.

Our team has prioritized the top 20 targets, that came from the gold rush competition. Of course, our team's always had a host of their own targets on the property as well, so there's a lot of room for growth.

14 analysts cover us now, all the way from RBC, Raymond James and down the line. The common thought is there's a lack of advance stage projects out there and the pipeline for most of the majors, two, three years out, is diminishing.

We're in a situation where we have a target on our back, according to a lot of analysts and third party individuals. With that in mind, one of the ways we're looking to increase value for shareholders is through exploration drilling, new targets and older ones. The mill will be able to accommodate more feed than we need to manage the current production profile, so why not fill the mill up and increase the annual production profile. We also have a number of deposits, with varying sized resources on them for additional feed to the mill.

Dr. Allen Alper: That's excellent. That's just an excellent story and excellent reasons for our high-net-worth readers/investors, to consider investing in Integra Gold.

Mr. Chris Gordon: Thanks for your interest in Integra Gold.

https://www.integragold.com/

Suite 2270, 1055 West Georgia St

Royal Centre, P.O. Box 11144

Vancouver, BC

Canada, V6E 3P3

Email: info@integragold.com

Phone: 604-629-0891

Fax: 604-229-1055

|

|