Redstar Gold Corp. (TSX.V: RGC, OTCQB: RGCTF, FRA: RGG): Advancing One of the Highest-Grade Gold Projects in Americas; Interview with Peter A. Ball, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/26/2017

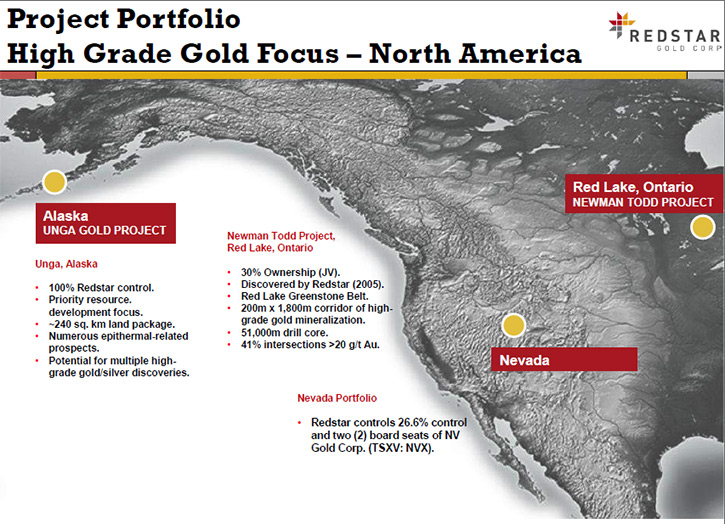

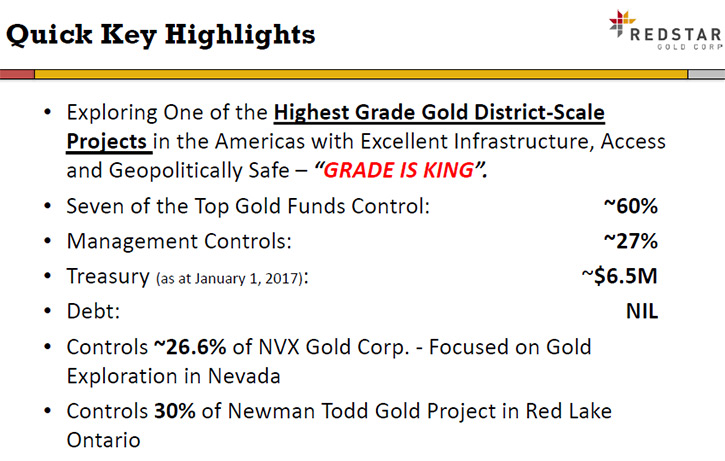

Redstar Gold Corp. (TSX.V: RGC, OTCQB: RGCTF, FRA: RGG) is a well-financed Vancouver based junior exploration company, focused on high-grade gold exploration in North America. In Alaska, the Company is exploring the high-grade 100% owned Unga Gold Project. We learned from Peter A. Ball, who is President and CEO of Redstar Gold Corp. that the company is ~ 60% owned by a number of well-known, knowledgeable investors including; Jacques Vaillancourt, the Executive Chairman and the major shareholder, along with Eric Sprott and several other institutional investors. Redstar Gold controls a 240 square kilometers district in Alaska, where conditions allow operating all year round on the 55th degree latitude location, with nearby one mile long paved airstrip, deep sea port facilities, and by-weekly barge schedules from Seattle. The new exploration program is commencing the end of March, early April this year. According to Mr. Ball, the company has 6 million dollars in the bank and zero debt.

PDAC 2017: Peter Ball, President and CEO of Redstar Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Peter A. Ball, President and CEO of Redstar Gold Corp. Could you give us an overview of your company?

Mr. Peter Ball: Good to see you again Allen, and we are having a solid response at PDAC. Redstar Gold Corp. is focused in Alaska. First of all let’s review a little bit about the history. In 2011, we picked up the project, but it needed some cleaning up with multiple owners, a costly earn in program, state and patented lands needed to be consolidated, native/first nation agreements to be settled, and the Company required financing to continue operations. A fund manager, a gentleman out of London, named Jacques Vaillancourt, who is now our largest shareholder and executive chairman, was reviewing projects globally to finance, and a close colleague, and geologist, who was familiar with a project called Cerro Negro, mentioned the Unga Project to Jacques, and indicated it has all the similarities to the Cerro Negro high-grade intermediate-sulfidation epithermal system.

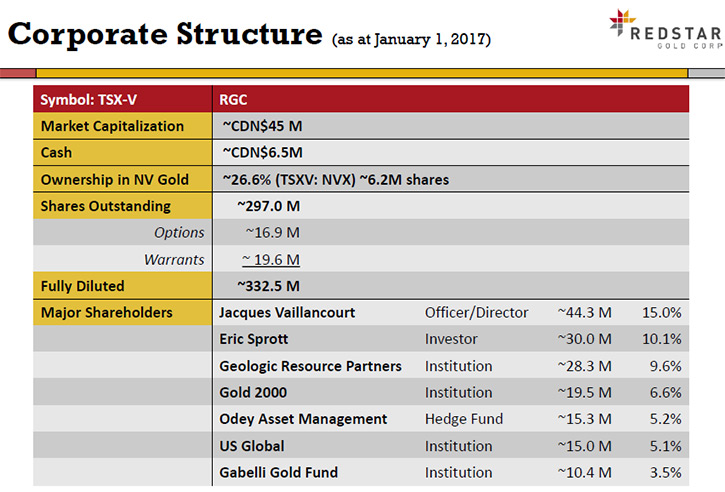

Since 2013, the state claims and patent claims were purchased, the management teams and board of directors were changed with a newly energized management board of directors, including myself at the end of 2015. We now have just over six (6) million dollars in the bank and no debt, we are about to head up to complete one of our largest exploration programs in 5 years, and with the change in the market and positive sentiment behind or backing us. The groups behind Redstar are well known and most companies our size are lucky to have one investor from this group. They control ~60% of the company, and include Jacques Vaillancourt (or Mount Everest Finance (15%), Eric Sprott (10.1%), George Ireland (which is Geologic Resource Partners ~9.5%), Gold2000 Fund, Odey Asset Management, US Global, and Gabelli Gold.

The first question people ask is “Where in Alaska? How do you get up there?” We are located at the 55th degree latitude, which is the same latitude as the location of Stewart BC. The location provides temperate conditions, so we can pretty much operate all year round.

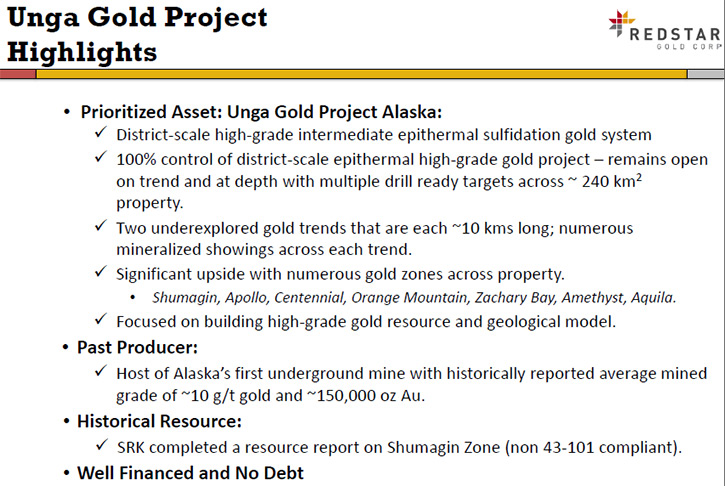

There is a one mile paved airstrip on site, along with a deep sea port. Barges from Seattle make regular trips past our site, and one day we could potentially barge a mill up to site, cheaper than most other locations globally. We control a 240 square kilometer intermediate epithermal district, where we have counted over 15 different gold zones.

Together, the total line strike of all different mineralize systems adds up to about 35+line kilometers, and previously hosted the first underground gold mine in Alaska's history on the Island called the Apollo-Sitka Operation, which operated in the 1800's to early 1900's. A hundred years later, we're up there again, and nowhere better to find a deposit than next to a historical operation.

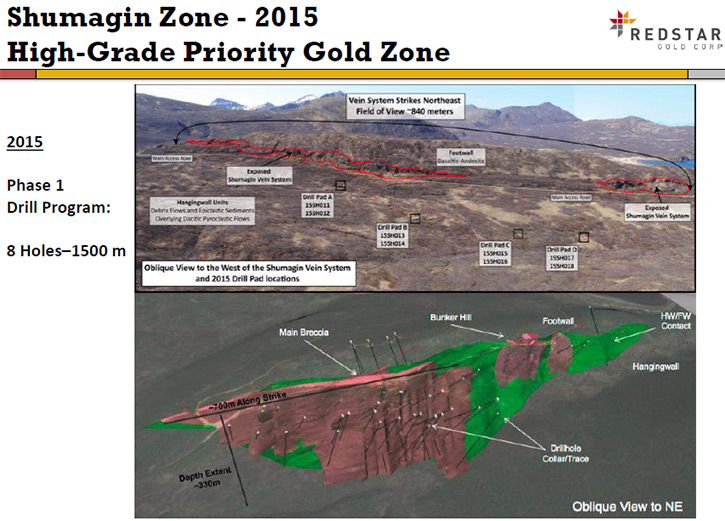

There are two key trends, each spanning approximately 9.5 km in length, named the northern Shumagin Trend and the southern Apollo-Sitka Trend. We are focused on the Shumagin Trend, where the Shumagin Gold Zone has intersected some very positive drill results including 1.9 meters of 202 grams, 5.5 meters of 24 grams.

We have been able to define a panel currently about a kilometer in length, to a depth of ~330 meters, and open in all directions. The northern trend appears to be very similar in nature to the southern trend, with drill results yielding multi-ounce material, with less than 1% sulfides. Another example of a promising drill hole indicting grade potential was 1.2 meters averaging 365 g/t gold. Multi ounce material coming to surface, and open in all directions, looks positive. So what are we going to do?

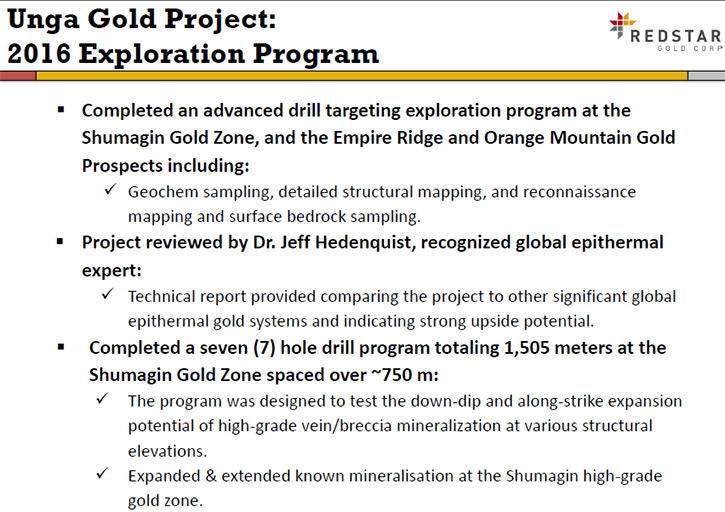

In the summer of 2016, we engaged Dr. Jeff Hedenquist, the globally respected expert on intermediate and epithermal gold systems, and received an independent technical and positive review of the Unga Project with comparisons to other large scale gold deposits. The report was a very positive indication of the potential of the island and also opened many doors and attracted some interesting investors.

So…in early April 2017, we will be back up on site at the Unga Gold Project, and we will look to commence our exploration season, after being in the planning stages over the last couple months, since our Fall 2016 drill program, which helped us expand the system by the drill bit from 350 meters in strike to close to one kilometer. Initially will be completing a geophysical program over the existing known Shumagin mineralized system, to define and understand its “signature” or “foot print”. We will then re-apply this geophysical knowledge and signature across an untested south western extension to determine where the structure leads, and define potential drill targets. We want to ensure, as we allocate funds to the program, we are spending our shareholders dollars in the right location. If the structures line up, we will look to complete a step-out test hole to the southwest, and continue along strike to determine the size of the mineralized envelope. We will monitor closely the results and regroup in May or June to determine and define a potentially much larger drill program to showcase fully the Shumagin Gold Zone. We must not forget that this Shumagin Gold Zone, believed to be potentially 2-4 kms in length, is only one of multiple gold zones on the island, and makes up part of the total measured and perceived 35+ km in total combined strike length of the multiple vein systems.

There are many places we can drill across the island, with the 15 plus gold zones, and currently we are focused on Shumagin. We are also looking to complete a technical report, which will be a heavily relied upon document for current and new shareholders.

We have had multiple site visits by major mining companies, noting the resource potential and discovery potential of the project, and have some follow up visits this year. The mining friendly location, the scale and size of the district, the high grade nature of the gold veins, the accessibility, and the temperate conditions all make it an attractive project.

Dr. Allen Alper: That sounds like a great story. You have big backing. Sounds like you have a very interesting and excellent property. Now with the new administration, you'll be able to advance your project even more quickly.

Mr. Peter Ball: Absolutely. We also have strong support from The Aluet Corp., which is the Alaskan native corporation, which controls the sub surface rights off from our State and Patented Lands we control on the island.

Dr. Allen Alper: That's great news.

Mr. Peter Ball: Absolutely.

Dr. Allen Alper: That's great. Could you tell me a little bit about your background, your team’s background, your board?

Mr. Peter Ball: Yeah. My background, I started off in engineering in the late eighties. I spent about 11 years working as a mining engineer, and then entered the corporate world and worked for companies such as Eldorado Gold, Sherritt Gordon Mines, Echo Bay Mines, Hudson Bay Mining & Smelting, and recently was with Columbus Gold as Senior Vice President. I also worked with Argentex Mining Silver, as President, in Argentina, and we successfully advanced the Pingüino epithermal high grade polymetallic asset through drilling, resource estimate, PEA, and found a large investor. I'm actually a fifth generation mining kid, following in the steps of my father, cousins, uncle, grandfather, and great grandfather, and have had the opportunity to live in most of the mining camps …so I guess it’s in my blood. My uncle actually ran Homestake Mining until it was sold to Barrick.

Dr. Allen Alper: That's great!

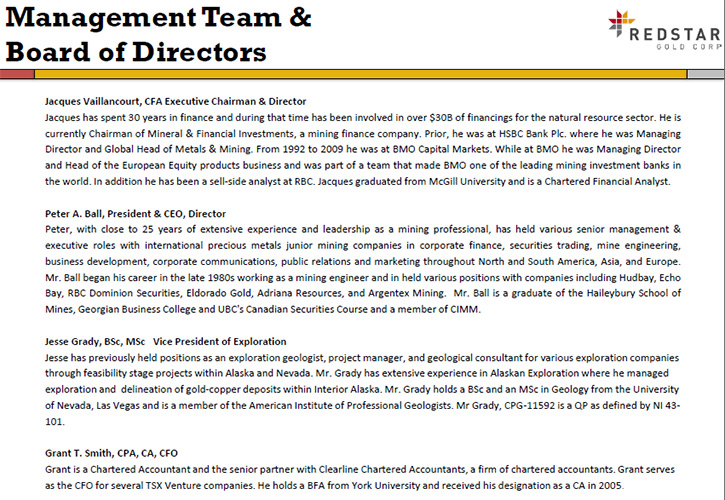

Mr. Peter Ball: Yes, thank you Allen. So a little bit about our Board composition. Our executive chairman is Jacques Vaillancourt, out of London, England. He ran the BMO and the HSBC mining and global equities desks in London for 30 years, and has helped raise close to 35 billion dollars.

Dr. Allen Alper: An amazing person!

Mr. Peter Ball: Absolutely. He is a very solid supporter, and brings extensive financial and banking experience to our team. We also recently added Mr. George Ireland from Geologic Resource Partners to our board, and he was a very large investor in the Cerro Negro gold project in Argentina. Cerro Negro was another intermediate high-grade epithermal gold system that had interesting results similar to our Unga Project, then they hit that one hole, amazing hole and the rest was history. Goldcorp came in and bought the project from Andean Resources for $3.6 billion.

We also have Rob McLeod he's with IDM Mining, and was co-discoverer of a large resource in the Yukon, that was sold to Kinross Gold. We also have Sean Keenan. He used to work for Resource Capital Funds out of Denver, and now is based out of Australia with another group. Finally, we have Ken Booth, who used to be a BMO investment banker, and myself on the board.

We have a small but dedicated management team including myself as President and CEO, Jacques Vaillancourt as our Executive Chairman (and the largest shareholder), and finally our key technical leader Jesse Grady, as our VP of exploration. He’s a great geologist and he has been helping us understand the Unga Project over the last three years.

Dr. Allen Alper: Sounds like a great, great team, great support. You seem to have a lot of great things going for you. Could you tell us a bit about your share structure?

Mr. Peter Ball: It's controlled ~60% by institutions, as I mentioned earlier. We have a total of 296 million shares out, but knowing where your shares are located defines a solid share structure, as we count on ten fingers about 80% to 85% of our shares, and a lot of our board and management team controls a significant portion.

Dr. Allen Alper: Great, that's a great position to be in. You know you have that support from these great, strong shareholders from all locations. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Peter Ball: Number one is always management and who controls and is invested in the stock so far. Management and directors have put in 27% of their own money. Another key thing is seven of the top gold investors in the industry, including Eric Sprott, George Ireland, Gold 2000, US Global, Odey Asset Management, and Gabelli Gold. Each one of these groups have vetted the assets on a technical basis and the opportunity for discovery. Having some of the most respected investors believe in an asset allows new investors to feel at ease, when making an investment in Redstar. All these investors have put their money into Redstar for this year, noting it’s going to be our biggest exploration season in our history, and we may be one hole away from something very interesting for all those who are watching.

We also have just over 6 million dollars in cash and we have zero debt, and a very low burn rate compared to most other junior exploration companies. There's just myself and one VP of Exploration, we don't carry the weight of a fancy office, and thus cash goes into the ground. So low burn rate, strong institutional shareholding, no debt, and the drill rig is about to turn.

Dr. Allen Alper: A great story and great reasons for our high-net-worth readers/investors to consider investing in your company. Compelling story!

Mr. Peter Ball: Thanks.

Dr. Allen Alper: That's great. Thank you.

http://www.redstargold.com/

Peter A. Ball, President and CEO

T: +1.604.245.5861

Toll Free: 877.310.3330

E: pball@redstargold.com

|

|