Leigh Curyer, CEO of NexGen Energy Ltd. (TSX: NXE, OTCQX: NXGEF): The Largest Undeveloped Uranium Deposit in Canada with a Very High Grade Core of 164.9M Lbs Grading 18.84% U3O8.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/25/2017

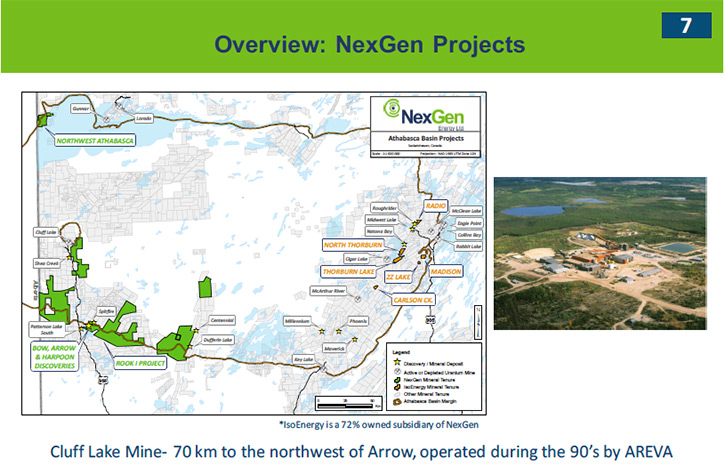

NexGen Energy Ltd. (TSX: NXE, OTCQX:NXGEF) is a British Columbia company with a portfolio of highly prospective uranium exploration assets in the Athabasca Basin, Saskatchewan, Canada. The company is currently focused on the Arrow Deposit hosting an Indicated mineral resource of 179.5 M lbs U3O8 contained in 1.18 M tonnes grading 6.88% U3O8 and a very high grade core of 164.9 million pounds at 18.84% U3O8 contained within 0.40 M tonnes with an additional 122.1 M lbs U3O8 at 1.30% U3O8 contained within 4.25 M tonnes in the Inferred mineral resource category. We learned from Leigh Curyer, CEO and Director of NexGen, that 2016 was an exciting year for the company, with the largest drilling program in Canada for a uranium project of just under 100,000 meter but that 2017 should be even better. Plans for this year include aggressive drilling, engineering and environmental studies. According to Mr. Curyer, even though Arrow is the largest undeveloped deposit in Canada, they are still in the very early stages of understanding the true scale of the deposit.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Lee Curyer who is the CEO and Director of NexGen Energy Ltd.

I know you've been having an exciting year. Could you update our viewers, give them an overview of your company and what differentiates NexGen from other uranium companies?

Mr. Leigh Curyer: Absolutely. Thank you for having me.

As your readers are probably aware, Arrow is a very unique uranium deposit and truly a strategic mineral asset. Unlike all other major uranium projects globally, Arrow does not suffer from any major sovereign or technical risks. This is due to the fact it is located in Saskatchewan which was recently rated the top mining jurisdiction in the world by the Fraser Institute and because it is contained wholly within the competent basement rocks and is land-based, meaning there are no water bodies on top of Arrow.

We recently updated our mineral resource estimate on March 6, 2017 which continued to illustrate Arrow is, in fact and as some pundits say, a generational asset. In the updated resource we converted 89% of the maiden Inferred pounds over into the Indicated category going from 201.9 M lbs at 2.63% all Inferred to 179.5 M lbs at 6.88% all Indicated. We also saw tremendous growth as a result of infill drilling within the A2 High Grade which grew from an Inferred resource of 120.5 M lbs at 13.26% to an Indicated resource of 164.9 M lbs at 18.84% which is truly astonishing and elevates Arrow to the top tier of mining projects globally. We also have another 122.1 M lbs at 1.30% of Inferred material. Included in that Inferred material is a relatively new and fast growing high grade portion of the A3 shear which hosts 28.2 M lbs at 8.74%.

In summary, even though our resource estimate ranks Arrow as the largest undeveloped deposit in Canada, we know it's already out of date. Given recent results, we have seen material growth at Arrow already in early drilling during winter 2017 especially within the A2 and A3 high grade zones. We are still in the very early stages of truly understanding what the ultimate size of the Arrow deposit is eventually going to be.

Dr. Allen Alper: That sounds great. That's really great news. A great accomplishment! Could you elaborate a bit more on your plans for 2017?

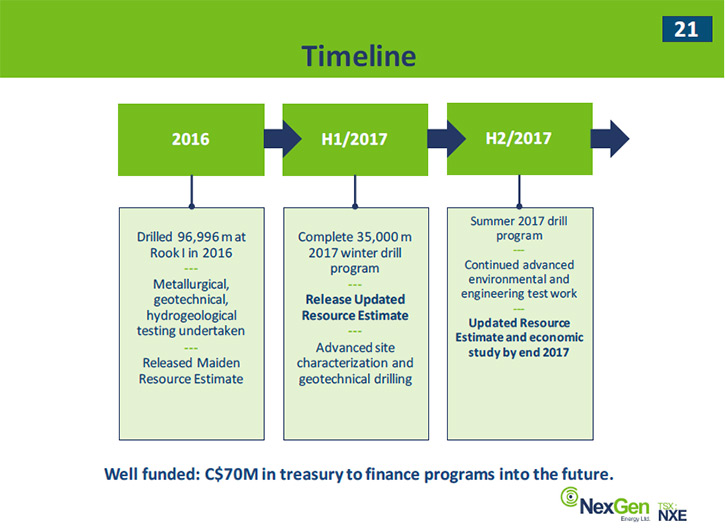

Mr. Leigh Curyer: We have initiated the 2017 program, which commenced in late January. It's a winter program, with a minimum of approximately 35,000 meters. In 2016, we drilled just under 100,000 meters. I think you'll see the number of meters in the same range again during 2017. In parallel to the drilling, we're going to be testing for further boundary extensions of Arrow, and also continue in-filling. We are conducting a number of engineering and environmental studies, which will form the basis of the pre-feasibility study, which will be published late this year or early next.

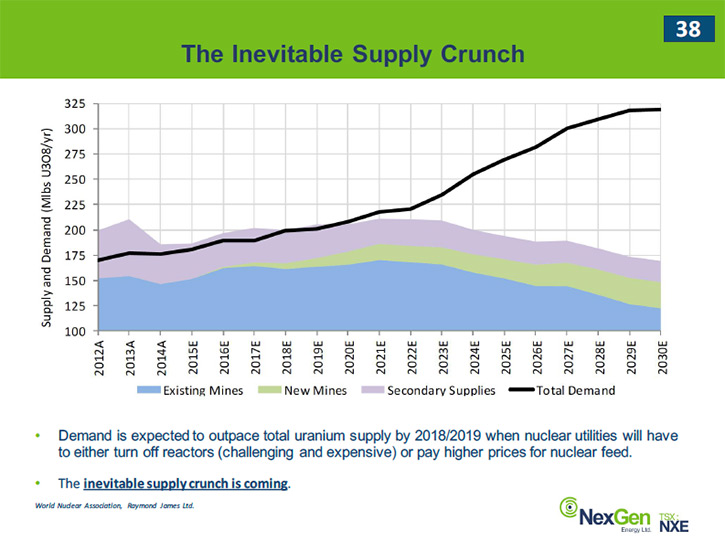

On the corporate front, we have an application in to list on the NYSE. We have very strong interest from U.S. institutions with respect to the project, and with respect to uranium. The spot price has increased 45% over the last few months from the lows in November of $17.50 per lb to $25.50 per lb today. This material price move coincided with Kazakhstan cutting back production by at least 10% this year. They are currently the world's largest producer. Cameco has made some supply cuts as well, putting their Eagle Point mine and US ISR assets on care as well as others. This is all due to the uranium price being too low to incent producers to supply nuclear utilities with fuel at these low levels. Hence, the uranium price needs to rise in order to encourage new production for the growing demand and supply gap that is expected to materialize post 2019.

Dr. Allen Alper: That sounds very good. Could you elaborate on the forecast for the uranium market in the future?

Mr. Leigh Curyer: We have a situation where the world has been predominantly relying on Kazakhstan, which currently accounts for about 40% of the annual mined production. What you're seeing in other parts of the world, in Australia, Africa and parts of Canada, is the closure of, or the exhausting of long-term producing mines. We have Rio Tinto’s Rossing mine in Namibia, which has been a significant supplier of mined uranium for over 30 years. Also Rio Tinto’s Australian mine, Ranger, is coming to the end of its life. Furthermore, Cameco’s Eagle Point mine, has been put on care and maintenance. It had produced approximately 200 million pounds since going into production.

Africa, Canada and Australia’s mine supply has traditionally made up a large percentage of the world's supply, but they are coming offline. Coinciding with Kazakhstan cutting back production because they aren’t making enough of a margin, should put significant upward pressure on the uranium price in the near term.

The forecast for demand in uranium is quite easy because it takes time to permit and build a new reactor. Then you don’t know for how many decades that reactor will be operable and how much uranium it will consume annually. So when you look at the demand curve, it should grow steadily at about two to four percent annually, not including Japan bringing back their reactors. I think you can add Japan on top of that. When you have this steadily growing demand, and heavily risked supply-side with major historical sources of uranium exhausting or needing materially higher prices to sustain current production, you have a perfect storm forming. This supply crunch is likely to continue to widen quite significantly. It is forecast to materialize from about 2019, 2020, onwards, and put significant upward pressure on the uranium price, before the gap actually forms. Here we are only 12-36 months away from a forecasted major supply deficit forming and the price needs to move materially. We aren’t talking about a 20-40% move that’s required; we need 100-200% increase in the price to bring on new production.

Dr. Allen Alper: That sounds like a very favorable outlook for uranium. Could you tell our readers a bit about your background, your team’s, and your board’s?

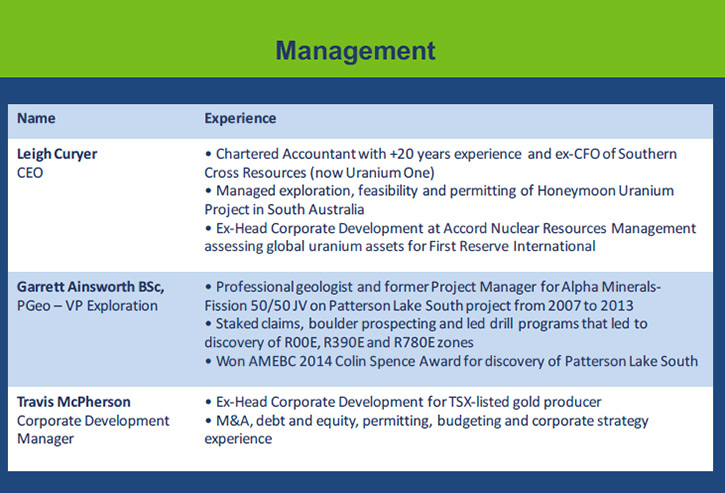

Mr. Leigh Curyer: I was originally, and still am, a Chartered Accountant. I started as a Chief Financial Officer for a company called Southern Cross Resources back in 2002. I oversaw the development of our ISR uranium project in South Australia. It was a small project, but we went through a permitting and feasibility process successfully. Then we merged our company with Aflease to form Uranium One. Uranium One went on to become the second largest producer, globally, before privatizing early this decade. I left Uranium ONE six months after its creation to join the world’s largest energy private equity firm, First Reserve International where I headed up their nuclear investment platform, where we looked for producing, development and exploration assets in the uranium sector.

Having reviewed hundreds of projects in the Athabasca Basin in Canada, once the fund wound down, we created NexGen Energy to acquire, explore and develop high grade, high tonnage uranium assets. Then, in February 2014, we discovered Arrow and now it is far and away the largest development-stage uranium asset in Canada.

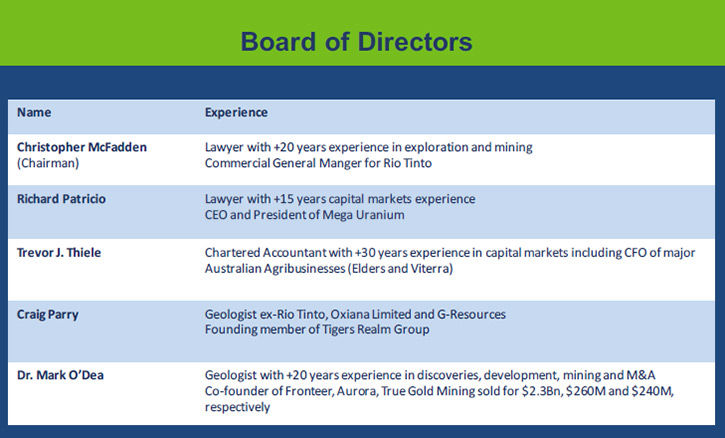

Our Chairman, Chris McFadden, was in charge of business development for Rio Tinto’s energy division. Our Board and Executive also covers geological, financial, capital markets, corporate governance and project management experience.

Hence, we cover all the disciplines from discovery, development, permitting, feasibility, raising the construction capital, and production. We're unique for an explorer/developer, in the sense that we have all the disciplines to take this through to production. We made a conscious decision to come back to the exploration end of the market after cutting our teeth at large companies, with the objective of finding a strategic asset, then bringing it all the way through into production. With Arrow, now we are confident in stating that our goal is to become the worlds leading supplier of mined uranium.

Dr. Allen Alper: That's an excellent team, very strong. Could you tell me a little bit about your share structure?

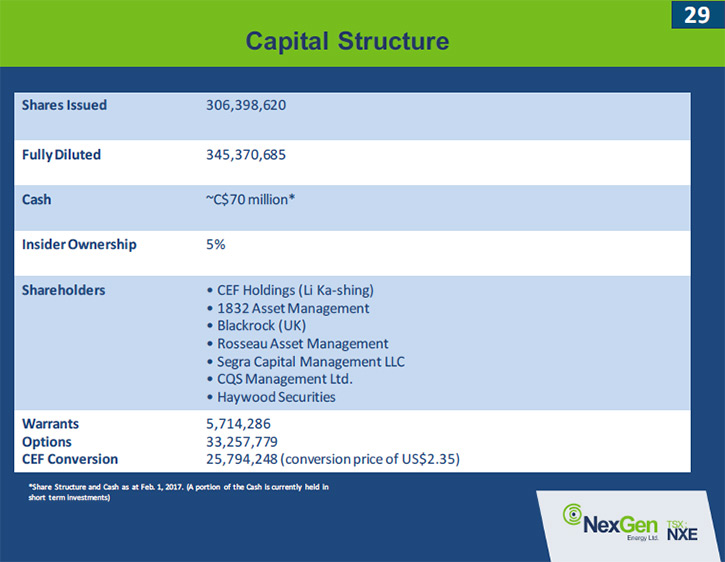

Mr. Leigh Curyer: We have approximately 306 million shares issued. With warrants and options, that's about 370 million shares fully diluted. We're very tightly held institutionally. I estimate that our institutional holding is approximately 75% with the balance being retail. Half a dozen of those institutional shareholders account for around 45% of the stock.

We also have a convertible note with CEF Holdings, which is a partnership between CIBC and Li Ka-Shing. Li Ka-Shing is the richest individual in China, and has an unparalleled record of investing. CEF is acutely aware of the need for nuclear power in the Asian region, specifically. CEF’s knowledge of the sector and mineral assets really does validate our project as a tier one asset. Additionally, given their geographical base and knowledge, I think it's a very good validation of the future of nuclear moving forward.

Dr. Allen Alper: That sounds excellent. You had a rather outstanding year I could see. As far as your stock performance, could you say a little bit about that?

Mr. Leigh Curyer: We're the leading stock performer in our sector and we were just added to the largest Index in Canada.

With the updated resource estimate highlighting Arrow’s continued growth and also the clear conversion from lower confidence categories to higher ones, I think has led to some good stock performance, and the really encouraging aspect is the caliber of the funds that have entered the stock lately. They've been watching this for a long time, because you just can't ignore some of the intercepts we're getting and how we’ve advanced the project at such an unprecedented speed and low cost. We host the majority of the top ten intercepts ever drilled for a uranium project in the Athabasca Basin. Which means you hold that title worldwide, given the high-grade nature of the deposits in the Athabasca Basin.

Those large funds have obviously seen how this project's developed, and believed in the future of nuclear energy and the demand for uranium. Hence, have also entered the stock in recent times.

Dr. Allen Alper: That's excellent! You can be very proud of your performance.

Mr. Leigh Curyer: Yeah, we're very proud of it, and the team sincerely appreciates the support we get from our shareholders. We still have a lot of work to do. Even though the stock performance has been good, you're going to see no shift in the daily approach to developing this project and optimizing the value that this project obviously has now and in the future.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Leigh Curyer: It's two-fold, two main reasons.

One, this is a special asset in resources and it transcends the commodity. This is a generational discovery that we are on to with Arrow. These simply do not come along often and I can’t think of one that is owned 100% by a non-diversified or major mining company. We own 100% of Arrow.

This is going to be a terrific asset over multiple decades. I think when it is in production, it is likely to be the number one supplier of mined uranium globally. We'll be one of the preeminent mines from which the U.S. utilities are going to want to source uranium.

On top of that, there is a fantastic fundamental future for uranium, given the supply side and demand. It looks like we're in the beginning of a very strong, violent up-tick in the price of uranium. When you combine those two together, it's a very exciting investment proposition today moving forward.

On top of that, we're a team that's continually demonstrated that we have a fantastic asset, but we're not just satisfied with that. We really do focus on how we optimize that. When you look at the maiden resource, Arrow's been one of the lowest cost discoveries in the sector, on a per-pound basis because of the speed and efficiency with which we have developed the project. Investors can rest easy. The project's stewardship is in very good and experienced hands.

Dr. Allen Alper: Well those are excellent reasons our high-net-worth readers/investors should consider investing in your company. You have a great track record. Excellent! Is there anything else you'd like to add, Leigh?

Mr. Leigh Curyer: No, I think we've covered the main points. In summary we have a very exciting year ahead, both project-wise and corporately. We look forward to delivering that to investors and continuing to add value everyday.

http://www.nexgenenergy.ca/

NexGen Energy Ltd.

3150 - 1021 West Hastings Street

Vancouver, BC V6E 0C3

Tel: 604.428.4112

Fax: 604.259.0321

|

|