Ely Gold & Minerals Inc. (TSX-V: ELY, OTC: ELYGF): A Project Developer, Royalty Generator and Exploration Company, Focused Primarily in Nevada; Interview with Trey Wasser, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/25/2017

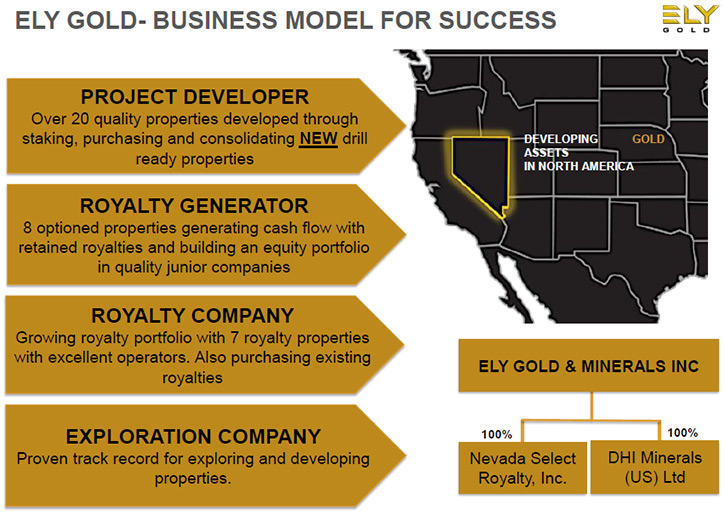

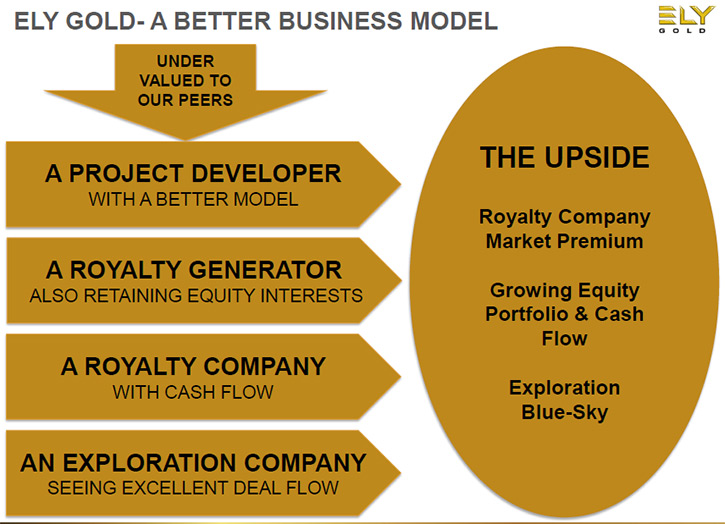

We learned from Trey Wasser, who is President and CEO of Ely Gold & Minerals Inc. (TSX-V: ELY, OTC: ELYGF) that they are a project developer, focused primarily in Nevada with a portfolio of about 20 consolidated properties. Ely Gold is focused on developing recurring cash flow streams, through the acquisition, consolidation, enhancement, and resale of highly prospective, un-encumbered North American precious metals properties. Ely Gold’s property development efforts maximize each property’s potential for third party acquisition, while reserving significant royalty interests. Plans for 2017 include more property deals with the goal of 2 million dollars in revenue from these deals.

PDAC 2017: Trey Wasser, President and CEO of Ely Gold & Minerals Inc

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Trey Wasser, who is President and CEO of Ely Gold. Could you give our readers/investors an overview of Ely Gold?

Mr. Trey Wasser: We're a project developer, focused primarily in Nevada. Currently we have a portfolio of about 20 properties. We've consolidated both the data and the claim packages. We sell or option those properties out to exploration companies, juniors, mid-tiers, and majors for them to explore, and we keep back royalties.

Dr. Allen Alper: Sounds great. Could you tell us a bit about the properties and what differentiates them?

Mr. Trey Wasser: Our properties are primarily spread across the state of Nevada. What differentiates our properties is, for the most part, they have not seen much modern exploration. These aren't recycled properties. The reason our properties have not been explored is, for the most part, they have been in a fragmented claims situation. One of our areas of expertise is doing a lot of deals to consolidate patented and unpatented claims and put packages together that haven't been put together in this cycle; since the 80s and 90s for the most part.

Dr. Allen Alper: That sounds very good. Can you tell our readers a little bit about your background and your team?

Mr. Trey Wasser: My background is on the finance side. I spent 20 years with Merrill Lynch, and Kidder Peabody, and Paine Webber, in investment banking. My partner Jerry Baughman is a geologist, lives in Nevada, has been staking claims, and auctioning them out to companies for over 30 years. Between the two of us, we have a great mix of geology, a database of properties, and Jerry's expertise in claim-staking and property consolidation.

Dr. Allen Alper: Could you tell me a bit about your plans for 2017?

Mr. Trey Wasser: In 2016 we closed our transaction with Jerry's company and purchased his property portfolio. That closed in April. In 2016, we did about six different property deals, which generated a little over 1.2 million dollars in income for the company. This year we expect to do more deals than that. We've already done four deals this year that have generated about $600,000 in revenue so far. Our goal is to do 2 million dollars in revenue from property deals. Our royalty portfolio has grown too, we now have 15 properties that are optioned, and or, sold where we've retained royalties.

Dr. Allen Alper: That's excellent. Could you tell me a bit about your share structure?

Mr. Trey Wasser: Our share structure is pretty tight. We have 75 million shares outstanding. About another 10 million in warrants and options. Our market cap is currently very low, we think, about 13 million dollars, but of that we have our large property portfolio. We have about 4.2 million dollars in cash and about a million and a half in equity shares from our partnered companies.

Dr. Allen Alper: That sounds great. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Trey Wasser: If somebody is looking for a gold equity investment, we offer very good leverage to the price of gold. When the price of gold goes up the value of our property portfolio goes up. The value of our royalty portfolio goes up and the value of our shares in producing gold equities that we hold from our partner companies goes up. Meanwhile, we have a business model that is generating cash, so we're not in the market issuing new shares. In fact, we are a positive cash flow company with leverage in three different ways to the price of gold.

Dr. Allen Alper: That sounds great. Is there anything you'd like to add?

Mr. Trey Wasser: I think we're in a very interesting market here. We're really happy to be at the PDAC for the first time and we're seeing tremendous interest from companies all around the world looking for projects in Nevada. We think there's a renaissance of companies and activities going back and expanding in the Nevada area. So, we're very excited about the prospects for Ely Gold in the next several years.

Dr. Allen Alper: Sounds excellent!

Mr. Trey Wasser: Great. Thank you.

https://elygoldinc.com/

trey@elygoldinc.com

972-803-3087

|

|