African Queen Mines Ltd. (TSX.V: AQ, Frankfurt: QM0.F): Advancing their Flagship Yellowjacket Gold Project in the Atlin Area, British Columbia, Interview with Irwin Olian, President & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/23/2017

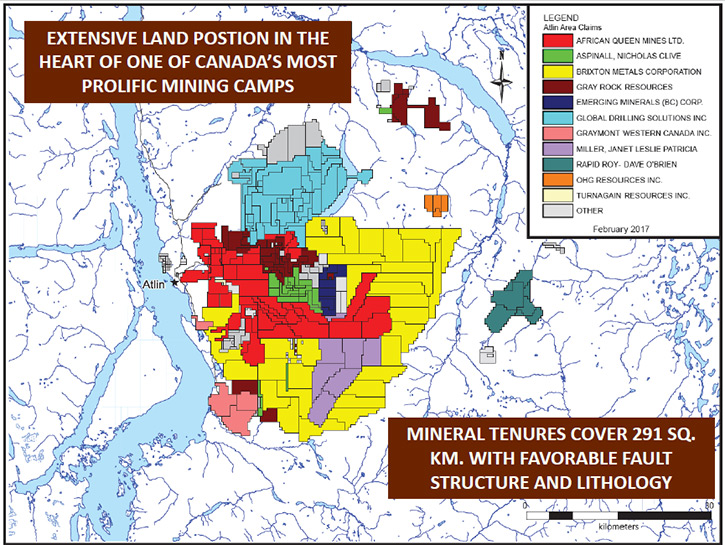

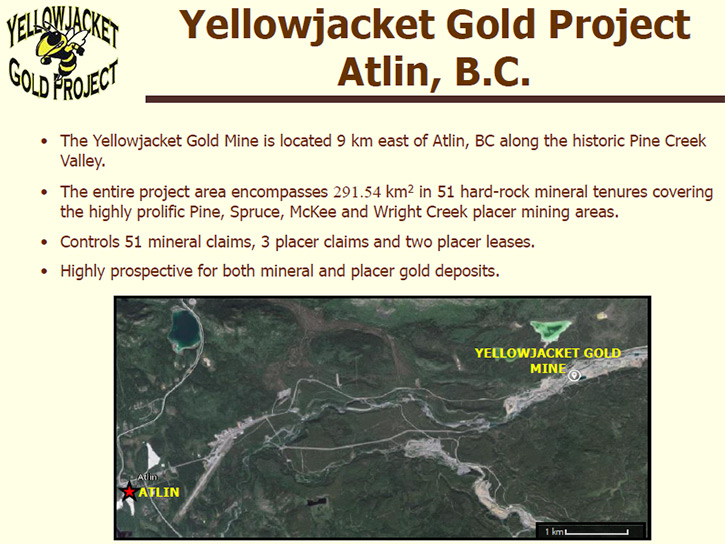

African Queen Mines Ltd. (TSX.V: AQ, Frankfurt: QM0.F) is advancing their flagship Yellowjacket gold project that covers an aggregate of approximately 291.54 sq. km in Atlin area, British Columbia and has a fully permitted past producing mine. We learned from Irwin Olian, CEO of African Queen Mines, how they bought the property in 2015 for a very favorable price, which gives them tremendous upside as they manage to consolidate a very large exploratory portfolio and develop the geological model that gives them an idea of the potential gold deposits in the region. Mr. Olian expects a big work season in 2017. He is very proud of his terrific team that he feels is second to none from a geological standpoint.

Irwin Olian, President & CEO of African Queen Mines, Carrie Howes, Corporate Communications, Lee Dunston, Marketing Director, in African Queen’s Booth at PDAC 2017

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Irwin Olian, who is CEO of African Queen Mines Ltd. Could you give our readers/investors an overview of African Queen and what's happening?

Mr. Irwin Olian: Hi Al, thank you very much. A number of your investors invested successfully in our previous deal, which was called Pan African Mining Corp. Pan African, a company that I founded in 2003, was the largest explorer in Madagascar. We went into Madagascar, established a property position, which covered 22 different projects.

We did our first raise at 25 cents a share, then took that company public in 2004 on the TSX Venture exchange. Four years later, we sold the company for $4.50 a share. During that period, we had accumulated several projects outside of Madagascar, in which the new buyers weren't interested. So we retained those, and as part of the buy-out of Pan African Mining Corp., we spun those assets out into a new company called African Queen Mines.

Yellowjacket Gold Project Atlin, B.C.

Each of our Pan African shareholders received $4.50 a share in cash plus one share in a new company, African Queen Mines, which at that time, had projects in southern Africa. We went on with African Queen to start trading publicly at 10 cents a share in 2008, 2009, it went up all the way to 75 cents a share.

We had a strong gold project in Ghana. We had projects in Kenya, as well as several other countries. Well a funny thing happened, the market started to collapse, fell off the cliff in 2010, 2011, and we found ourselves, like so many other early stage juniors, in a position where the market suddenly was no longer willing to finance any of our projects.

I quickly recognized that a new environment had emerged. We cut all of our expenses to the bare minimum, shut down our exploration programs and I started to liquidate those African assets. We were fortunate enough to sell our Ghana project for a million dollars. That money, together with the cost cutting measures we undertook, enabled us to survive the entire five year mining recession, debt free and give us an opportunity to restart the company in a better environment. That's exactly what we've done.

African Queen stock at it's very low was down to half a penny. People just assumed that we were going to go broke, which if they knew me, they wouldn't have assumed.

Dr. Allen Alper: You didn’t give up. You made good financial decisions and road out the 5 year mining recession. You can be very, very proud of that.

We started looking for production or near production assets in British Columbia or in other friendly jurisdictions. We looked in the US, and about a year and a half ago we were fortunate enough to come upon the Yellowjacket gold mine, which is a fully permitted mine that actually had been in production in 2010. We bought it for what we thought was a very, very favorable price, which gives us tremendous upside. That formed the basis for the rebooting of African Queen, with a focus on the Atlin, BC region.

Dr. Allen Alper: That sounds great. What makes you very interested in this area?

Irwin Olian: Atlin has been one of the largest placer producing camps in North America for a 120 years. It started in the 1890's. To this day, tens of thousands of ounces are pulled out of Atlin every summer. Typically, it is placer gold. There are 20 to 30 major placer operators working in Atlin each season and millions of ounces have come out of here.

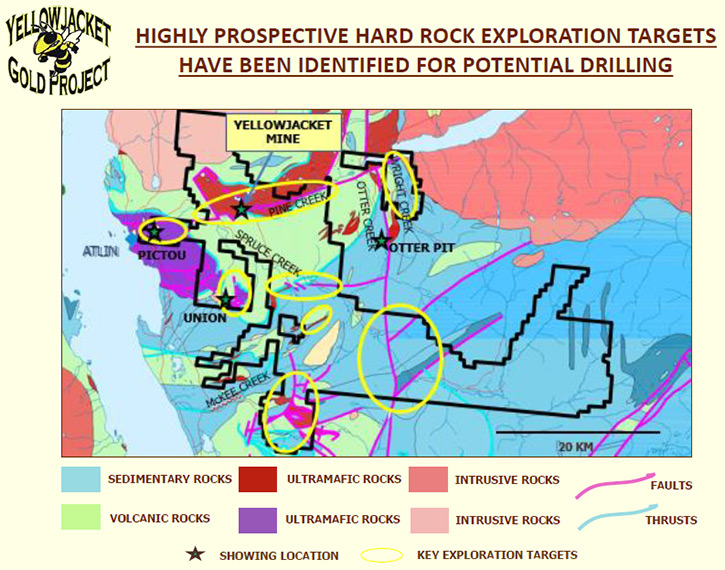

No one has successfully found the hard rock sources of most of this placer gold. The Yellowjacket mine on Pine Creek, clearly has been the source of a lot of the Pine Creek placers. We control that now, but the rest of it has remained a mystery to this day. However, we've developed a geological model. Now the British Columbia Geological Survey has come out with a full report, essentially espousing the same model, which is the following.

There was a geological event billions of years ago, called the Surprise Lake batholith, like a volcano but not a volcano, it never penetrated the surface. But as that batholith rose to the surface of the Earth, it created a super-heated environment in the region, which caused gold in liquid form to rise from the Earth's mantle up, up, up. It intruded into the region through the fault system, the cracks in all the rocks. This fault system, which is essentially characterized by a lot of shales that are fractured and rocks amenable to hosting gold, now has created more than a dozen targets.

Once we had become excited about this geological model, we immediately embarked on a program of land acquisition. We made four or five different acquisitions, which essentially gave us 291 square kilometers of ground that's characterized by a lot of faults and fault intersections as well as lithology, that is, rock types, that are amenable to hosting the gold. We now have a very large exploratory portfolio of opportunity based on what we feel are structurally controlled potential gold deposits in the region.

We have two real opportunities for our company to hit it out of the park. We have the potential reopening of the old Yellowjacket mine, putting it back into production. There is an established historic resource of 150,000 ounces, grading over 10 grams per ton and that was just in the first 140 meters. If you believe this geologic model, which suggested the gold came up, through the fault system then there's a strong likelihood we're going to find gold going down those faults to great depth.

So the 150,000 historic resource estimate may just be the tip of the iceberg at the Yellowjacket mine. I'll say, as I always must, this is a non 43-101 compliant resource established by the work, the drilling programs and so forth that were done by Homestake. In 2008, the subsequent owner of the property Prize Mining did a bulk sample, about 4100 tons of material and they found that the grade they were getting was about 9.45 grams per ton, very similar. That gives us a lot of comfort that the work done by Homestake was reliable.

In any case, two opportunities for us, A, Reopen this mine, B, look at these great targets on a regional basis to try and make another major discovery of what could be a world class mine in the Atlin district.

Dr. Allen Alper: That sounds great.

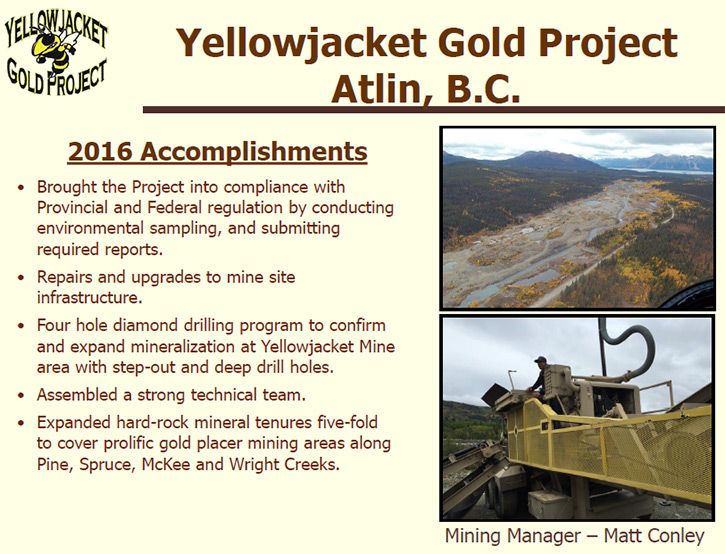

Irwin Olian: We're excited and looking forward to a big work season this year in 2017. We took over the project at the end of 2015. We had, what I consider to be, a very productive year at the project in 2016. Briefly, on a very small amount of money, we raised $400,000. We increased our land holdings fivefold. From 55 square kilometers up to 291, in order to encompass a lot of these great targets with bulk structures and good lithology.

We had to do a lot of environmental work, and file environmental reports to bring the project back into environmental compliance with the federal and provincial regulators. The previous owners had neglected to make a lot of those filings for a period of years. We spent a considerable amount of time, energy and money doing that.

We also had to upgrade the actual infrastructure at the mine, rebuild the bridge, fix some roads, clean up the camp, deal with first aid and all of the things that have to be done to bring it up to best industry standards. We did that. We put together a wonderful technical team, which includes some of our key people like Dr. Reinhard Ramdohr, who was the head of exploration for Pan African in Africa. So we have a terrific team that I feel is second to none from a geological stand point.

Linda Dandy has worked in Atlin for over 25 years, senior geologist, she gives us a great on-the -ground presence, right in Atlin, very familiar with this project. She had been involved in some of the earlier drilling, the earlier sampling programs. Then we did a four hole, core drilling program, which successfully expanded the old Yellowjacket zone 15 meters to the east and 15 meters to the west.

We found gold extending beyond the previously delineated zone. So all in all, we had a great 2016. Our stock is now trading about six cents a share and we think it's a terrific opportunity, based on both the discovery potential as well as the potential for opening up this permitted mine.

Dr. Allen Alper: Well that sounds great. What are the primary reasons our high-net-worth readers/investors should consider investing in African Queen?

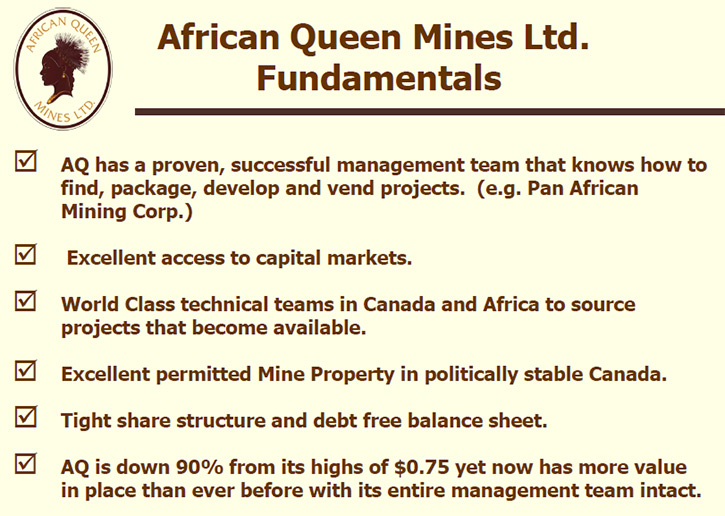

Irwin Olian: We have a proven management team that went into Africa in Madagascar, took a massive portfolio of grass roots properties, and successfully developed three of them. We were able to package them and sell that company at a huge uplift. If you had bought the stock at 25 cents, you would have made 15 or 20 times your money, had you stayed with it.

We know how to take a project and develop it to where it can be sold successfully. I think we have managed to put together a great property package here in Atlin, which is one of Canada's most promising mining camps, with a long history of success. You've heard them say, “The best place to find gold is where there's already gold”? No one has really exploited the hard rock opportunity here in Atlin and that's what we're here to do.

So I think, between a proven management team, a highly prospective property package and a fully permitted mine, with the potential of being reopened, we have a lot of ways to reward our shareholders with a big win.

Dr. Allen Alper: That sounds great.

Irwin Olian: Thank you, Al.

Dr. Allen Alper: Sounds like very good reasons for our high-net-worth readers/investors to consider investing in African Queen.

http://www.africanqueenmines.com/

1153 56th Street

Box 19040

Delta, B.C.

V4L 2P8

CANADA

Tel: (604) 788-0300

info@africanqueenmines.com

Irwin Olian

President and CEO

E-mail: tigertail@africanqueenmines.com

Phone: (604) 899-0100

Fax: (604) 899-0200

|

|