Silver Standard Resources Inc. (NASDAQ: SSRI, TSX: SSO): A Canadian-Based Precious Metals Producer, with Three Wholly-Owned and Operated Low-Cost Mines; Interview with W. John DeCooman Jr., Vice President, Business Development and Strategy

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/20/2017

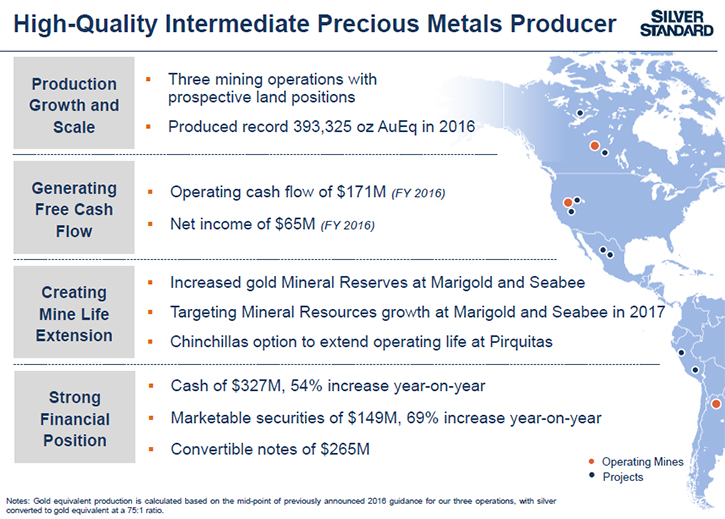

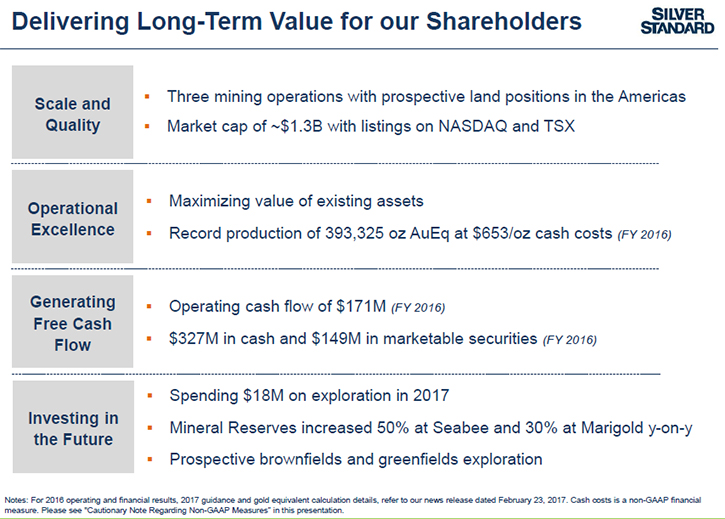

Silver Standard Resources Inc. (NASDAQ: SSRI, TSX: SSO) is a Canadian-based precious metals producer, with three wholly-owned and operated low-cost mines, including the Marigold gold mine in Nevada, U.S., the Seabee Gold Operation in Saskatchewan, Canada and the Pirquitas silver mine in Jujuy Province, Argentina. We learned from W. John DeCooman, Jr., Vice President, Business Development and Strategy of Silver Standard, that they are an approximately $1.5 billion US market cap company and in 2016 they produced nearly 400,000 gold equivalent ounces at cash costs below $700 per ounce, generating over $170 million of operating cash flow, over $115 million of which they put on their balance sheet. According to Mr. DeCooman, Silver Standard's combination of a very seasoned, deep team of experts, quality assets, and capital provides internal growth and M&A opportunities with very attractive downside protection and liquidity should the markets get difficult.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing W. John DeCooman, who is the Vice President of Business Development and Strategy of Silver Standard Resources Inc. Could you give me an overview of your company, John?

John DeCooman: We're an approximately $1.5 billion US market cap company, with two gold mines, one silver mine and a portfolio of projects. Our three mines are located throughout the Americas -- Canada and the US, and in the southern hemisphere of Argentina. In 2016 we produced nearly 400,000 gold equivalent ounces at cash costs below $700 per ounce, generating over $170 million of operating cash flow, which enabled us to put over $115 million of cash on our balance sheet. The balance sheet, at December 31st, 2016, has in the neighborhood of $325 million in cash, nearly $200 million of marketable securities, and a $265 million convertible note that is callable to the company in 2020.

Dr. Allen Alper: That’s really excellent! Could you tell me a bit more about your operations?

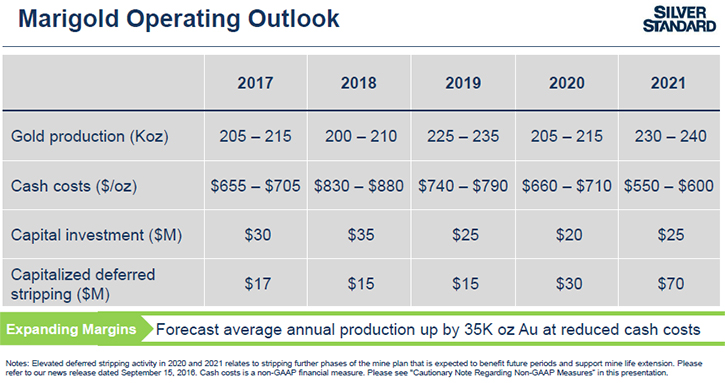

John DeCooman: Our Marigold mine in Nevada is by far the largest of our three operations. It's slated to produce in 2017 in the neighborhood of 210,000 ounces of gold at a cash cost of about $700 an ounce, so it's a reasonably large-sized open-pit gold operating mine in Nevada. The distinguishing feature at Marigold is our ability to mine at fairly low material movement costs. That's really been the game changer for that asset over the last two to three years, with our operation. It also represents one of the more important facets of our company, as it relates specifically to the operational excellence programs that we bring to all of our operations. The asset is well positioned in 2017. Not a lot of capital required, good exploration potential, and a healthy sized operation that has about an eight year mine life. That's due, in part, to exploration success in 2016 that saw a 30% increase in just our reserves alone. That was in our Mineral Reserves statement that we published in February of 2017.

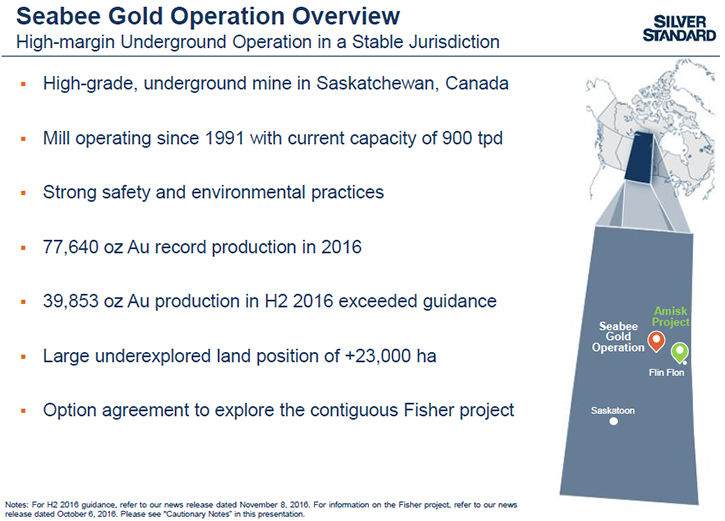

We also have another operating mine, but this is an underground mine located in Saskatchewan, Canada. It's a gold only producer, much like Marigold. It produced in the neighborhood of 80,000 ounces in 2016 and is scheduled to produce a similar amount again in 2017. The distinguishing factor, with the Seabee Gold Operation, beyond being underground, is that it operates at lower costs. Our cash costs in 2016 were nearly $600 per ounce, and in 2017 they're expected to be below or in the neighborhood of $600 an ounce and it's a steady producer. It is a smaller sized, medium scale operation, and it's one that has an attractive exploration portfolio because of the relatively sizeable land position that has not been overwhelmingly explored to date. We think we have some pretty attractive exploration upside potential at Seabee.

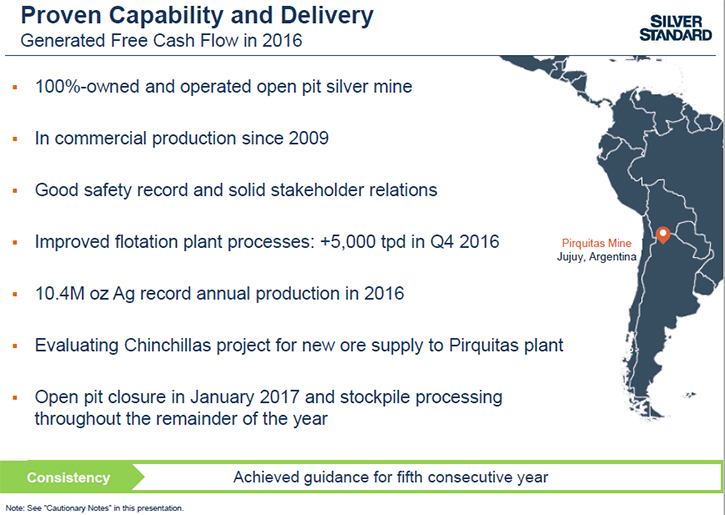

Then the final mine that we have is the Pirquitas mine in Argentina. It's a silver producer. It's one of the larger silver operations in the world, or silver dominant operations in the world. In 2016, it produced about 10.4 million ounces of silver, so fairly large scale, and it certainly generated substantial amounts of cash flows in 2015 and 2016. The important part to remember with this, however, is that in January of 2017 it concluded mining operations. We will be processing stockpiles for the most part in 2017. We're scheduled to produce somewhere in the neighborhood of 5 million ounces at cash costs under $15 an ounce, and the important facet of the Pirquitas mine is the option that we have with Golden Arrow for their Chinchillas property. Should we elect to enter into that joint venture, it would have the potential to extend the operating life of Pirquitas for 5+ years. That really is, I think, a fairly comprehensive overview of each of our operating mines, Al.

Dr. Allen Alper: Those sound like excellent mines and very well run. Could you tell me a bit more about your development activities and your exploration?

John DeCooman: Certainly, from an exploration standpoint, in 2017 we have budgeted about $18 million. More than $10 million of those dollars is going into brownfields exploration at both Marigold and at the Seabee Gold Operation. Where we have some earlier stage drilling, we have the opportunity to do some wildcat drilling at our Perdito property in California. We've optioned some new land, just south of our Seabee Operation, but contiguous to Seabee and with the shear zone that we observe in the Seabee mine descending down into this property. So two relatively greenfields exploration opportunities that have us excited for 2017.

Then the last bit that I would add, while the two assets San Luis in Peru and Pitarrilla in Mexico are on care and maintenance for the moment, they are two feasibility stage properties. The San Luis project is awaiting community agreements, which is not unusual in Peru. So we are actively pursuing the cooperation of the communities. At Pitarrilla, it's a larger scale open-pit-able project that has historically also had some underground concepts evaluated. We're reevaluating that mine plan to see if, for one of the largest undeveloped silver deposits in the world, with over 500 million ounces of resources, there is a way we can find an earlier win, with a feasibility that might take it maybe to the underground, smaller operation and still preserve the optionality of the bigger resource.

Dr. Allen Alper: Could you tell me a little bit about your background and the team?

John DeCooman: Certainly going back a number of years, where we had had the important building blocks of any good company being management, assets, and capital. We've talked about the assets. We've talked in general about the capital base of the company. Management is a very important part of these two elements of assets and capital, dating back more than five years. It was a focus to build upon the exploration expertise that had made the Silver Standard name so successful and had in part created such a diverse portfolio of silver opportunities.

What we had focused on historically had been exploration. We wanted to build on that with an operating base of individuals that have South American and North American operating expertise and development expertise, and so we have a number of executives whether it be through our financial and accounting area, through our development, or through our executive management and operations teams that have come from large mining companies. They have been able to effectively modify, from the typical mentality and operating culture that might come along with a very large, more bureaucratic business and apply that to a smaller cap, mid-sized producer. You really do get both smaller company execution and larger company expertise at the board level as well as the management team level – a fairly seasoned, robust group. Our executives are demonstrating the importance of operational credibility as well as the importance of capital discipline in this industry.

Dr. Allen Alper: Could you tell me a bit more about Paul Benson?

John DeCooman: Paul joined us about 18 months ago. He is a mining engineer by training and has worked primarily underground during his operating days. He started his career with Renison. Renison is a tin and gold producer from historical decades past in Australia and Tasmania. From there he went on and had time at Rio Tinto and BHP, and prior to joining us at Silver Standard had been the CEO for about seven years of a small cap mining company with operations in both Argentina and Brazil – so was able to bring an appreciation for what comes along with being a smaller scale company, along with the expertise or the nuances that go into also working in South America and big companies.

Dr. Allen Alper: Could you elaborate a little bit on your background, John?

John DeCooman: I've been with Silver Standard for approximately seven years. I’m not only responsible for business development, I've been integrally involved in the acquisition of Marigold and the acquisition of Seabee, with general responsibilities for strategy and investor relations. So it's been an incredible evolution for the company to go from that exploration base and expertise and evolve into a more mature, intermediate size precious metals producer. My degrees are in mineral economics. I was attracted to the company originally because of its access to capital and its broad base of projects. It's been a real delight to see the evolution of the management team and the evolution of the operating base for such a successful company today.

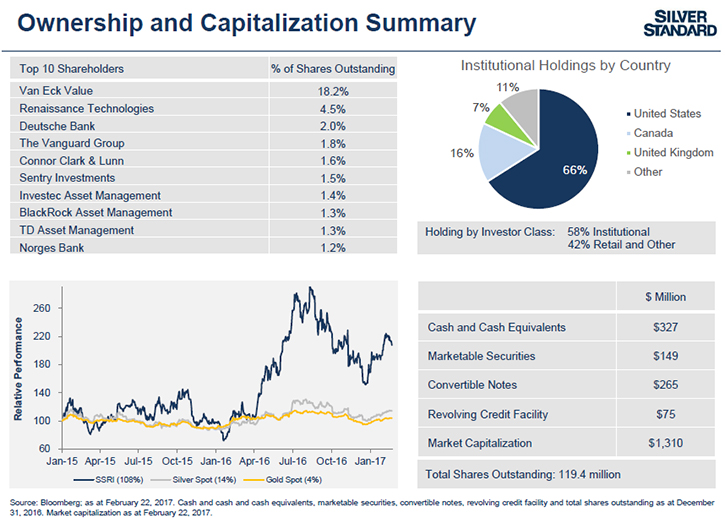

Dr. Allen Alper: Could you tell us a bit about your ownership and capitalization?

John DeCooman: We have approximately 119 million shares issued and outstanding, and only a couple of million more on a fully diluted basis, so a fairly reasonable share base given the 70-year history of the company. In December of 2016 we celebrated our 70th corporate anniversary. We have approximately $327 million of cash, another $150+ millions of marketable securities. We have an undrawn credit facility of $75 million. Finally, we also have $265 million of convertible notes. They have a coupon of just a little less than 3%, and so we have a cash pay coupon per year of approximately $7 million, and those are puttable to the company in the year 2020 at exercise price of US$20. Overall, a really strong balance sheet which continues to set us apart from others.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in Silver Standard?

John DeCooman: It really comes down to the building blocks for any one company, management, assets, and capital. I think we have a very seasoned, deep team that has demonstrated both discipline when it comes to allocating capital as well as operating and exploration expertise, if you look at the results that we've had. The management team is now going on the fifth consecutive year of achieving or exceeding our guidance that we've made to the market. So we deliver on our promises.

Secondly, when you look at the operating base of this company, we have a good cost structure that is not overly capital intensive and that is a significant size that provides investors liquidity, as well as growth through that asset base, considering our exploration potential at both Marigold and Seabee, and our M&A opportunities.

I think it is that combination of management, assets, and capital that provides very attractive downside protection and liquidity should the markets get difficult, with a very complimentary set of attributes for the upside on the exploration side, as well as the production growth side that makes for a more differentiated story relative to our intermediate peers.

Dr. Allen Alper: What are your thoughts about gold and silver going out into the future?

John DeCooman: I'm probably not a very good prognosticator on where the metals prices are going. It can be a very complicated macro and micro equation. Where we tend to focus, Al, is on what we can control, and that's really our cost structure, managing our people, and managing our capital to try and deliver on what we've said we're going to deliver on. How that relates to inflationary impacts that might drive up the prices of gold and silver, we are very well positioned to take advantage of that upside. I would argue both personally and even professionally that the sense is that gold and silver still have the possibility of increasing, but for those investors, concerned about downward fluctuations, if they're not long-term holders, I think we have a very robust balance sheet that would protect those individuals and keep that investment well positioned to take advantage of future increases.

Dr. Allen Alper: That sounds very good. Is there anything else you'd like to add, John?

John DeCooman: We're delivering on what we promised. We have exploration upside, we have production upside potential, and I think we have a very stable base of capital that should give investors a lot of confidence that whether it be either in the short term or in the long term, they should be able to see appreciation along with the appreciation in gold and silver prices. So thank you.

Dr. Allen Alper: Sounds excellent! Thank you.

http://www.silverstandard.com/

Suite 800 – 1055 Dunsmuir Street

PO Box 49088

Vancouver, BC

Canada V7X 1G4

Telephone: 1-604-689-3846

North America toll-free: 1-888-338-0046

Fax: 1-604-689-3847

|

|