Ascot Resources (TSX.V: AOT): Gold and Silver Explorer Near-Term, High-Grade, Advanced Exploration Premier/Dilworth Project in the Golden Triangle Area of Northwest British Columbia; Interview with Bob Evans, CFO and Director, and Graeme Evans P. Geo, Con

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/20/2017

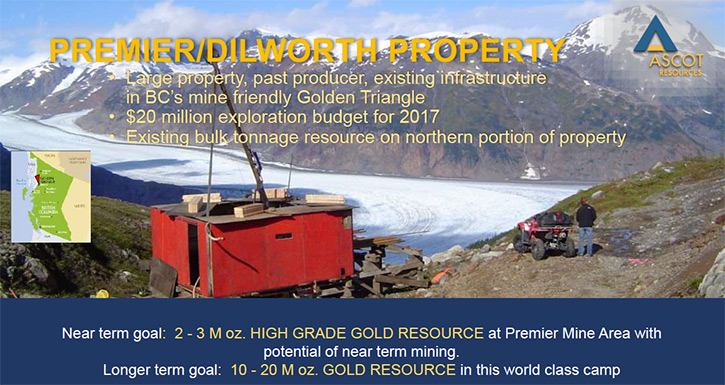

Ascot Resources (TSX.V: AOT) is a gold and silver explorer focused on their near-term, high-grade, advanced exploration Premier/Dilworth project in the Golden Triangle area of Northwest British Columbia. This is a large past producer that had produced over two million ounces of gold. We learned from Bob Evans, CFO and Director, and Graeme Evans P.Geo, Consulting Geologist from Ascot Resources, the main features that make their project exciting are the spectacular high grades and the potential size of the resource. Plans for 2017 include a $13million surface resource program with the goal of coming up with the initial high grade resource, and another $7 million underground drilling program. Collectively they're talking 170,000 meters of drilling. According to Bob Evans, if you believe in gold, Ascot is one of your best opportunities around.

Graeme Evans, Consulting Geologist, Lisa M. Chapman, V.P. Communications, Robert Evans, CFO & Director, and Lawrence Tsang, Project Geologist at PDAC 2017

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Bob Evans, CFO, and Graeme Evans, Consulting Geologist, both from Ascot Resources doing great things up in Canada. Bob, would you like to give our readers/investors an overview of Ascot?

Bob Evans: Certainly, Dr. Alper. Our Flagship Property is the PREMIER/DILWORTH, which is in the Golden Triangle area of Northwest BC. We are about 20 kilometers outside the town of Stewart. Our property is a large one, it's about 105 square kilometers. It's an past producer, it's produced over two million ounces of gold and 44 million ounces of silver. We've been working on this property for a number of years now, and we fully believe that it could be the next producer in the Golden Triangle.

Dr. Allen Alper: That sounds great. There's a lot of gold then?

Bob Evans: There's a lot of gold, you should talk to Graeme about that.

Dr. Allen Alper: Okay, Graeme, could you tell me what differentiates this area from other areas? Tell me about the geology of the region, and then specifically, the geology of your properties.

Graeme Evans: I think the big thing, is the whole Golden Triangle is kind of unusual. It's a Jurassic arc complex with a really unusual abundance of high grade gold. You are familiar with Pretium Resources, and the high grade gold numbers that have been reported there. We have the same sort of gold populations as Pretium’s Bruce Jack, and it makes this environment at the Golden Triangle really stand out on a global scale.

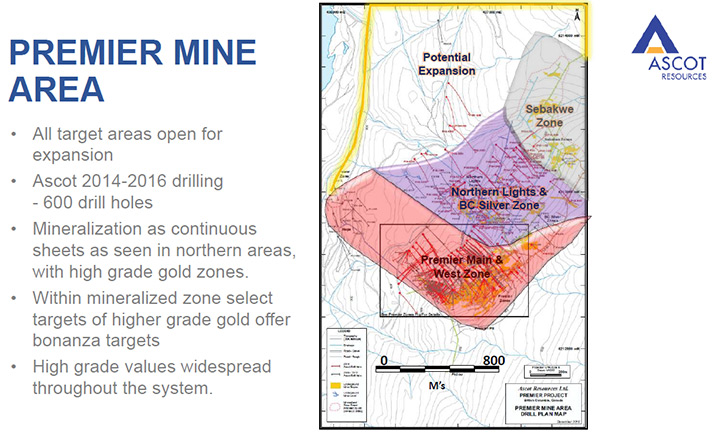

Premier is probably the next property in the Golden Triangle that will see production. We're really excited about the size potential of the system, but within that, it is the widespread Pretium type thousand gram gold grades, that make this property standout. Historically, in the Northwest BC, zones didn't link together very well. But our work on the northern portion of our property shows these mineralized systems cover neighborhoods of up to 10 square kilometers. We don't know the physical limits of them right now.

In the last three years we've been focused on the southern portion of our property around the old Premier mine area. We have put together a large historic database there, and our drilling shows the same sort of kilometer scale system, but at gold grades significantly higher than on the northern part of the property.

Dr. Allen Alper: Sounds great. What could you say about the resources?

Graeme Evans: Right now, the only formal resource we have is for the Northern area, and between indicated and inferred, it's about four million ounces of gold, and about 39 million ounces of silver. That is a pit constrained low grade resource, sort of gram type material, but within it there are much higher grades. Down at the Premier Mine, we do not have a formal resource yet. That's what we're leading up to with this year’s drill program. We're looking at high grade underground potential, so it'll be an underground resource not a bulk tonnage resource.

Historically, the Premier Mine itself produced 2.1 million ounces of gold, and about 45 million ounces of silver. What we're learning out of the whole Premier Mine is, that was just a very small portion of a large system, and we're getting a handle on the large system and seeing the same sort of high grades that they had historically. Historically, the underground mining averaged about a third of an ounce, so 10 or 11 grams, with some spectacular high grades within that. We're seeing the same thing in our drilling. A lot of 100 gram plus intersections. The nice thing is, the high grade gold also has lower, say five to ten gram gold within the quartz breccias, so it provides a very discreet high grade target to focus in on. There is a lot of conventional high grade gold with very high grade nuggets within the system, so we have the best of both in that regards.

Dr. Allen Alper: Sounds great.

Graeme Evans: Yes, it's pretty exciting. You don't see these very often.

Dr. Allen Alper: It's a lot of fun to go to work and get out of bed and drill and look at the samples.

Graeme Evans: Yes, you're always looking for that fatal flaw in your project and something that's going to hurt it, but this property has kept delivering the goods every time.

Dr. Allen Alper: Could you tell me, Graeme, a little bit about your background?

Graeme Evans: I've been working as a geologist for 30 plus years now. I've mainly worked for large mining companies. Most recently I was with Teck Resources for 18 years, it wasn't until 2009 that I started consulting to the junior companies and Ascot was one of the first groups I started working with. It's essentially led into full time with them. I come from a large company perspective, but I've really been enjoying working with a smaller, more flexible company, it has been great.

Dr. Allen Alper: That sounds great. Small companies, sometimes you have to wear more hats.

Graeme Evans: Yes, I kind of have inherited a lot of different roles, haven't I, Bob?

Bob Evans: Yes. You're like the company spokesman right now.

Graeme Evans: One of the biggest ironies is, I'm actually not a gold fan, I'm a base metal guy. I'm actually pretty conservative on my gold-mania. But this project is about as exciting as you could hope to get involved with, so I am happy.

Dr. Allen Alper: Well, you are having a nice career. It is good to have golden nuggets and more golden nuggets.

Graeme Evans: Yes, but it's not often you work on a project where you will never be able to test all or even most of the targets because there are so many. Usually you are focused and narrowing in on one discrete zone, but with this project we just can't. There are too many areas to test, it's a nice problem to have.

Bob Evans: Tell Al about the size of this year’s exploration and development budget.

Graeme Evans: We're going to spend about $20 million this year. More than half of it's going to be for a surface drill program. We're planning on about 120,000 meters of surface drilling with the goal of coming up with an initial resource of two to three million ounces of high grade underground material. Our healthy cash position also allows us to do about 20,000 meters of earlier stage drilling, probably on the northern part of the property. Then we're also looking at getting into the underground and doing some underground drilling. There are some high grade targets that have been in the news the last couple years. We'd like to turn those into better defined resources, heading towards production and reserve status. It's a multi-faceted program.

Dr. Allen Alper: Sounds super! Very ambitious program! Excellent!

Graeme Evans: Yes, we are one of the bigger programs in BC, if not Canada this year. Collectively we're talking 170,000 meters of drilling.

Dr. Allen Alper: That's amazing! Really great!

Graeme Evans: Ascot owns their own drill rigs and our drill costs are enviable anywhere in Canada. They're probably $70 a meter for all in costs including assaying, about a third of the industry average.

Dr. Allen Alper: Bob, could you tell our readers/investors, update them on your background?

Bob Evans: I'm an accountant by background. I got my CA back in 1974. I came to Canada that same year, I wanted out of England. I went to Calgary, I worked in the oil and gas business, stayed there for about 13 years, then got into the junior mining business. I enjoyed mining exploration so much that I have been in it ever since.

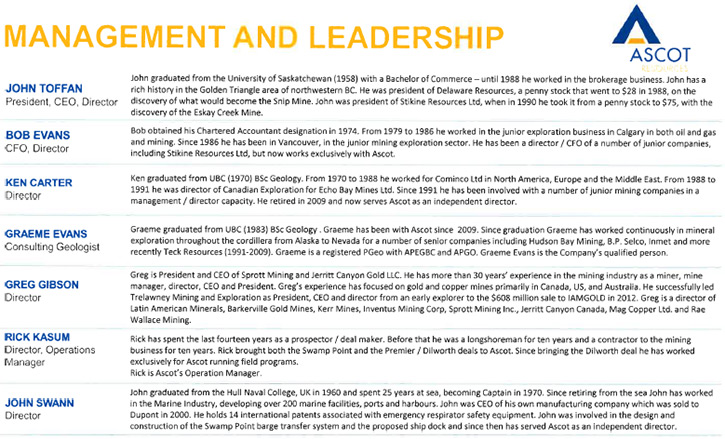

I met John Toffan, who's our current CEO in 1989. I was CFO of Stikine Resources and John was CEO when Stikine found the Eskay Creek deposit which went on eventually to become the Eskay Creek mine producing 3.27 million ounces of gold at a head grade of an ounce and a half per ton.

Dr. Allen Alper: That sounds great. Do you want to say little bit more about John's background?

Bob Evans: John's background was in the brokerage business originally. He became an independent businessman, running his own junior companies in about 1986. His first success was Delaware Resources which discovered the Snip Mine, the stock went from $0.25 to $28. This was followed by Stikine which went from pennies to $75. His current focus is Ascot.

Dr. Allen Alper: That's great. That's an excellent focus. So would you like to say anything more about your board?

Bob Evans: We have a couple of independent directors, Ken Carter, who's a geologist and John Swann who’s a maritime consultant. We have Rick Kasum, who is operations manager up at Stewart. He is a Stewart local and he's the guy that runs our programs there. Finally, we have Greg Gibson, who is a nominee of Eric Sprott. When Eric made his $20 million placement in Ascot last year, he got the right to nominate a director and that's Greg Gibson.

Dr. Allen Alper: Well that's excellent. Could you say anything more about your share structure?

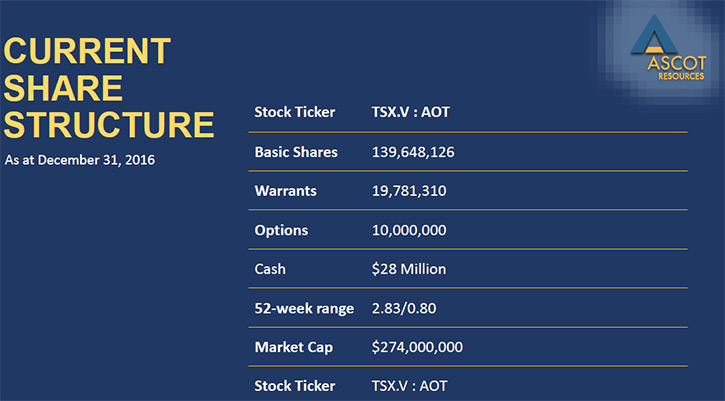

Bob Evans: Very simple share structure. We have about 140 million shares out, trading about $1.70. So the capitalization is about $250 million.

Dr. Allen Alper: Oh, that's a great story. What are the primary reasons our high-net-worth readers/investors should consider investing in Ascot?

Bob Evans: If you believe in gold, I'm not going to try and convince anyone to believe in gold, but if you believe in gold, this is one of your best opportunities around. This is going to be a high grade producer.

Dr. Allen Alper: Sounds great! Sounds like a great reason to evaluate putting your money in Ascot. Sounds excellent! Well, you have an outstanding story. Good luck to you all. You have an exciting year before you. There's a lot of information. Lots of news!

Graeme Evans: Yes, lots of news.

Bob Evans: Should be a pivotal year. We expect to see things happen this year. You can't spend $20 million and not see things happen.

Graeme Evans: Yes.

Dr. Allen Alper: That's great! Thank you. A really exciting and enjoyable interview!

http://www.ascotgold.com/

#1550-505 Burrard Street Vancouver, B.C. V7X 1M5

778-725-1060

778-725-1070

info@ascotgold.com

|

|