Interview with Scott Donaldson, Director and CEO of BMC (UK) Limited: Kudz Ze Kayah project (KZK) a High-Grade, Moderate-Sized VMS Deposit in the Southeast Yukon

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/10/2017

We learned from Scott Donaldson, Director and CEO of BMC (UK) Limited (PRIVATE:BMC), the parent company of BMC Minerals, that they started off as a strategic relationship between Global Natural Resources Investments (GNRI) and the management team. Their key asset, the Kudz Ze Kayah project (KZK) is a high-grade, moderate-sized VMS deposit in the southeast Yukon, which came with 20 years of environmental work out of the project and two complete baseline studies, roughly 20 years apart. The BMC executive team has a strong track record of discovery, development and operation of independent zinc, copper and other base metals projects worldwide. Recently, the government of Yukon awarded them the Robert E. Leckie award for environmental excellence. According to Mr. Donaldson, BMC has a very strong financial backing, thanks to their relationship with GNRI, and their business plan is fully funded through to the point of construction, and a little bit past that.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Scott Donaldson, Director and CEO of BMC (UK) Limited, the parent company of BMC Minerals. Could you tell me a bit about your strategy and the focus of BMC Minerals?

Mr. Scott Donaldson: I can. BMC started off as a strategic relationship between Global Natural Resources Investments, who at that stage had a different name, and management team. We had set out to find and acquire zinc-rich VMS deposits that were worthy of being taken forward into development, and then into production.

Dr. Allen Alper: That's great. Could you tell me a little bit about your KZK project?

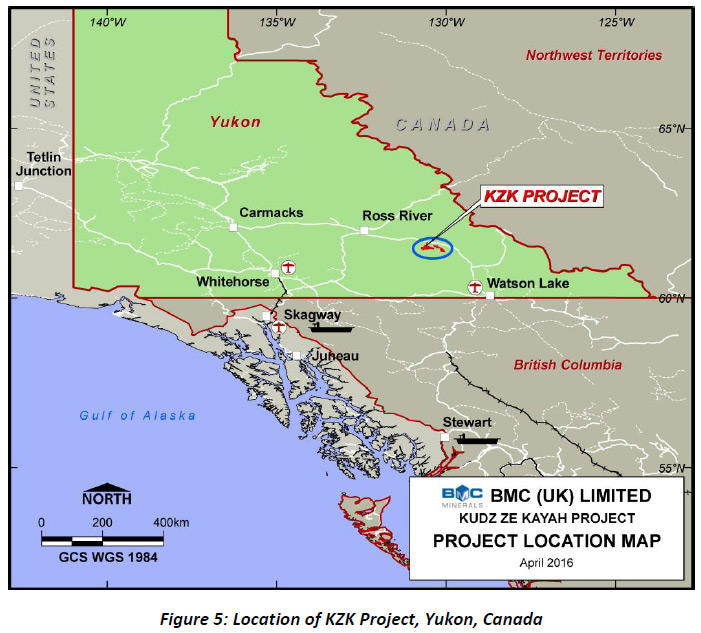

Mr. Scott Donaldson: KZK is short for Kudz Ze Kayah. It is a high-grade, moderate-sized volcanogenic massive sulfide (VMS) deposit in the southeast Yukon that sits within a good sized mineral field, where we are the major mineral claim holder. When we first formed the company, we had a list of projects around the world that we thought we would like to acquire. By happy coincidence, Kudz Ze Kayah was at the very top of our list. It was owned by Teck, who had picked it up when they took over Cominco, and they were willing sellers.

It's an interesting project, because it's a project that in 1998 went through an environmental assessment process and was awarded a Type A water permit, which allowed it to start mining. For various corporate reasons, Cominco and then Teck didn't develop the project, and so it sat there unloved, unwanted really, unnoticed perhaps, until we picked it up in January 2015.

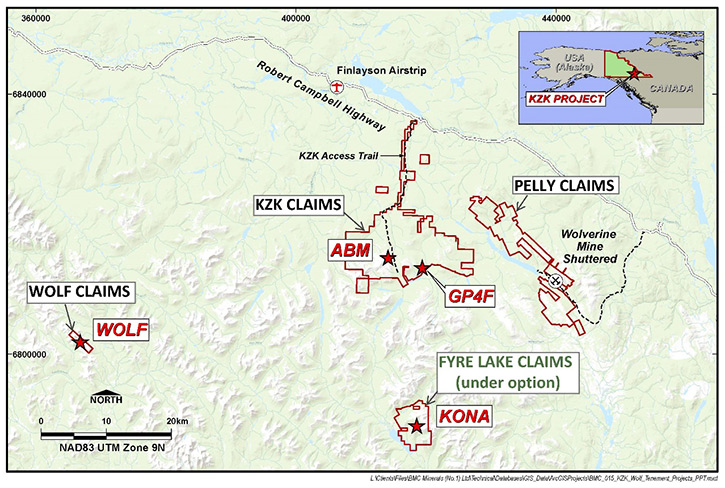

The project had an Inferred Mineral Resource estimate on it, conforming to JORC guidelines, of about 11 and a half million tonnes. It had some other drilling around it, which didn't have resources calculated. In 2015 we drilled around 25,000 meters on the project. We defined a new and hitherto unknown lode that was a fault offset of the main ABM deposit. We called that Krakatoa. We also drilled out the nearby GP4F mineralization. At the end of 2015 we had around 20 million tonnes of mostly Inferred Mineral Resources on the project. We completed that drilling in 2015 and we also commenced metallurgical test work, baseline environmental studies. The environmental work is interesting because clearly Cominco had already done environmental baseline work 20 years before and Teck had continued some of it. We have 20 years of environmental work out of the project and two complete baseline studies, roughly 20 years apart, so that's a very interesting data set that you don’t normally have the luxury of seeing.

In 2015, we also carried out geophysical (EM and other work) over all of our mineral claims that make up the project. In late 2015 we made the decision to carry out a Pre-feasibility Study over the ABM deposit.

So in 2016 we were about completing the pre-feasibility study, following up on the early geophysical work, carrying out sufficient additional drilling on the ABM deposit to take the largely Inferred Mineral Resource to an Indicated and Inferred classification in line with both NI 43-101 and JORC (2012) guidelines. By the end of the year we had 95% of the mineral resource classified as Indicated. We also completed all of the technical work for the PFS and consequently we now have an Ore Reserve for the project in line with both JORC (2012) and NI43-101 guidelines.

In the next 30 days, we will be putting the finishing touches on the PFS documentation, and we'll also be submitting our application for a mining permit. That will be submitted to YESAB around the end of February.

During 2016, we also acquired the nearby Wolf project, which once again is an historic project, dating back to the ‘90s that nobody had done any work on for the last 15 to 20 years. The Wolf project is Zn/Pb/Ag-rich and is about 35km west of KZK. We believe that this is a natural fit and we will carry out some work on that next year in an effort to provide a potential project pipeline for KZK.

In January 2017: we announced that we had acquired an option to purchase the Fyre Lake copper-gold project, which is just to the south of Kudz Ze Kayah. Kudz Ze Kayah is a zinc and precious metals rich copper-lead-zinc-silver-gold project. Wolf is a lead-zinc-silver project, but they're all VMS deposits. They're all good grade and together they take our regional resource base to over 34 million tonnes.

Dr. Allen Alper: Do you plan eventually to take the KZK project into production?

Mr. Scott Donaldson: Yes. The KZK project is a high grade project with great prospects. We've done a lot of work in the last 2 years and we have over 34 million tonnes in resources within the district now. We have around 20 million tonnes at the ABM deposit alone, which provides a good base for an initial project development. We have a likely ten year project with significant additional resources. We’ll take it into production. That's what we do right? We buy projects. We develop them. We take them into production. I personally have spent the last 25 years just taking projects from early stage exploration into production.

Dr. Allen Alper: That's very good. Do you have a feel for what the capital cost might be?

Mr. Scott Donaldson: We're not talking publicly about the results of the pre-feasibility study just yet. Whilst we have finished all of the technical studies and we actually have finished the financial study: that study is with Ernst Young at the moment. They're doing an economic analysis on the project. Once we've had them confirm what we think the project is, in six weeks, we'll be able to announce the pre-feasibility study results.

Dr. Allen Alper: No problem. We'll still be around.

Mr. Scott Donaldson: OK, I am happy to do a follow up interview.

Dr. Allen Alper: Sure. I’d be pleased to do an update after you have the pre-feasibility study results.

I noticed you received an environmental award from the Yukon, could you tell our readers a little bit about that?

Mr. Scott Donaldson: Sure. It's the Robert E. Leckie award for environmental excellence. The way we do our business is receiving recognition, which is very pleasing. The Robert E. Leckie award for environmental excellence was received by us just a month ago, and that's a real credit to the Canadian team.

BMC is an English company, and our subsidiary BMC Minerals is actually the developer of the Kudz Ze Kayah project. They're a great team. They deserve a lot of credit in the way they go about their daily work. The discipline, the controls they have in place, and their excellent commitment to making sure that when we finish our exploration programs the reclamation of those programs is in real time. We don't leave it and say "Oh we'll come back to that." We do it as we go. It's progressive, and consequently we've been recognized for it, which is fantastic. Those sorts of awards and that sort of behavior is important, because when we go into the permitting process, the permitting authority is going to have some confidence that when we say we're going to do something in our application then we actually will deliver on it.

Dr. Allen Alper: That's very good. Could you tell me a bit about your background and the board?

Mr. Scott Donaldson: Sure. I'm a mining engineer. I'm actually a New Zealander. I attended the Otago School of Mines in New Zealand, and then the Western Australia School of Mines in Western Australia, which is where I graduated. I followed that up with a post-graduate qualification in business. And Neil Martin, who is one of the other founding directors, has a PHD in Geology and Neil actually did his PhD on VMS deposits, so in actual fact he's a specialist in this field and one of the reasons why we've been such a successful team over the last ten years. Neil is a highly intelligent exploration geologist who can sniff out a good ore body. That's what matters, right? If you don't find the ore body then the rest of it's a bit academic. Gary Comb is a mechanical engineer. Gary's been involved with mining and mining contractors for almost his entire career. If he's not been with a mining contractor, he's been with an operating mining company. So all three of us are very much, get your hands dirty in the field and make it happen, sort of guys. And we're backed up by GNRI, Global Natural Resources Investments, an international resources fund based out of London. They also have three members on the board. They have their chairman, Mark Brown, their managing director, David Ellis, and Richard Jennings, who's a very practical corporate lawyer. So a very strong board, with a lot of experience that knows what it takes to develop projects.

Dr. Allen Alper: That's great. That sounds like a very strong board and you have a great background. You and Neil Martin are a winning combination to take your company and the project forward.

Mr. Scott Donaldson: You know, I think between us, we've developed about six projects in the last 25 years, roughly four years per project.

Dr. Allen Alper: Could you give us an example of some of those projects. I know about Jaguar and some of the others.

Mr. Scott Donaldson: Jaguar is an interesting one. That was the last one we did together. Jaguar was a VMS deposit, but it's interesting in that it was covered by 250 meters of transported cover. The ore body started 300 meters from the surface. Just finding that ore body was quite a challenge. I can't take credit for that, we didn't find it, it was part of a joint venture with Inmet. The Inmet guys found it. Then they decided that they'd sell out of it, and so Jabiru Metals was the company who owned it. Gary was the managing director, Neil was the exploration manager and I was the COO. So we had the project. We were a small exploration company with a project and we built the project successfully.

Just after we took the project to production, we discovered the nearby Bentley ore body. Neil had always said, “There's another ore body and it is over there”. It took us a couple of years to find it, but he knew it was there. That ore body is still in production today, it's been a highly successful mine.

Jabiru Metals was taken out in a friendly takeover in 2010 or 2011 by the Independence Group, and that mine is still operating today. I think it's been highly successful for us, and highly successful for them. That's been good.

I was also involved in the early stages of development of the Pillara lead-zinc mine. I think the top of that ore body started at around 300 meters from the surface as well, coincidentally. We've been involved in some bigger mines, in some smaller mines, but the thing is there's a certain discipline that's required to develop projects successfully. A financial discipline, but also a discipline in terms of the technical work that needs to be done, and timelines, and all of those things. A lot can go wrong, but crossed-fingers, so far we've generally got it right.

Dr. Allen Alper: That's excellent. That's a great track record.

Mr. Scott Donaldson: Yes.

Dr. Allen Alper: You can be very proud of your record of accomplishments. Could you summarize what differentiates BMC from others, and what makes your company of interest, and your project of interest?

Mr. Scott Donaldson: Sure. There are a number of things that differentiate us from other companies. Number one is that the guys in the company are all very experienced. But, importantly, we don't come from a large company background. We weren't just part of a 30 person team that built a mine. In smaller companies those 30 person teams are six person teams, five person teams, eight person teams. That means that everyone has to have two or three hats.

So one of the things that differentiates us from some of the other people, or companies, is that we've done it, but more importantly that we've done it ourselves getting our hands dirty - every aspect of building mines. We've personally done the technical studies. We've personally done the feasibility studies. We've personally done the permitting. We've personally done the construction activities. We're the guys, who are onsite making it happen. We've personally commissioned these projects, and the commissioning is a key step, if you get it wrong, then it's all for naught. So we've personally been involved in the commissioning.

All of us have been involved in actually operating mines. The reason I say that bit about operating the mines is that there's a tendency for people to put together a construction team, and the construction team builds mines and that's all they've ever done. But the problem with that is if you don't know what an operating mine looks likes, and you don't know what the issues are that operators face when they are operating a mine, you can't appreciate the long term effect when you're making construction decisions that are going to affect the downstream process or the next team, when you're building the mine. What we find is that when we build a mine, we are able to say we have three options we might take at this particular juncture in time, but we're going to go with option A or we're going to go with option C because we know that later on down the mine life they're going to be thankful that we took this option. I think that's a really important differentiation. That we actually know, not just how to build mines, but how to run them after that.

The other thing that does set us apart is that because of our relationship with GNRI we have a very strong financial backing. That's not to say that's the only thing that they provide us, but we have for example an undrawn US$75 million line of equity provided by GNRI that's there and available. So our business plan is fully funded through to the point of construction, and a little bit past that in fact. So I think that's a very solid point of differentiation as well.

Dr. Allen Alper: That's great. Could you summarize why you feel KZK is going to be a very worthwhile project?

Mr. Scott Donaldson: Yes. We always say that the bedrock of any project is the geology. That's the first step. If the geology's not right, then it's very difficult to get anything else right. The fundamentals have to be there. There are probably half a dozen points that I would make. First of all we have a great project. We have a high grade, high quality project that if it were located anywhere else in the world would have already been developed and mined. The fact that it's in the southeast Yukon, it's been unnoticed, but it's there.

Second thing is we have a very experienced management team, not just the directors. The guys that are immediately under the directors, the guys that are running the Canadian end of the operation, highly experience guys. Jim Newton for example, our chief engineer, he's operated in four countries and two continents and is a highly successful engineer. A very experienced management team with a track record of successful mine development. We have no debt, so we have a fully funded business plan right through into the construction phase.

The Yukon is really underrated in terms of a mining region, for permanent mines in the Yukon and good infrastructure. You'd be surprised at how good the infrastructure is. Our relationship with the local people, the First Nations, is very strong. We engaged with the local First Nations people before we even bought the project, and they provided great support. Their local businesses have provided much needed support for the project. The Kudz Ze Kayah project itself was previously permitted. So we're re-permitting the mine. Obviously the regulations have changed slightly, so the permit to construct was never enacted by the owners. Therefore, we've made the decision to go back and re-permit the mine, but we're supported by the fact they already had a permit once, and they did 20 years of baseline studies.

The project has strong margins even though we haven't quite finished the audit process on the pre-feasibility study, the work we've completed shows that it's high grade. It has very strong gold and silver credits, it's low cost, and consequently has high operating margins. That means that it's going to withstand downturns in the middle market. Speaking of which, the largest dominant metal at the project is zinc. We're going to be delivering this project into a rising zinc market. The zinc market is rising now, it will continue to rise. There is a shortage of zinc. We are strategically placed, both in location, and into a market with a deficit.

Dr. Allen Alper: Well that sounds very good. Excellent reasons!

http://bmcminerals.com/

6th Floor,

60 Gracechurch Street,

London EC3V 0HR

Phone: +44 (0) 20 7264 4366

Fax: +44 (0) 20 7264 4440

|

|