Interview with David Cole, President and CEO of Eurasian Minerals (NYSE MKT: EMX, TSX-V: EMX) Update on Eurasian’s Royalty Generation Model (PDAC Booth # 2651)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/6/2017

David Cole, President and CEO of Eurasian Minerals TSX-V: EMX updates us on the Eurasian royalty generation business model. Eurasian acquires prospective mineral rights around the world and adds value through the geological process, and then sells those properties keeping a royalty. They have promising portfolios in Russia, Arizona and Northern Europe. Eurasian has a strong management team, with excellent technical backgrounds that are perfectly suited to identify highly prospective properties worldwide. During the downturn in the mining market, EMX management and other insiders showed their commitment to and confidence in the company by increasing their share in EMX.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing David Cole, who is president and CEO of Eurasian Minerals. I was wondering if you could tell our readers what your business model is.

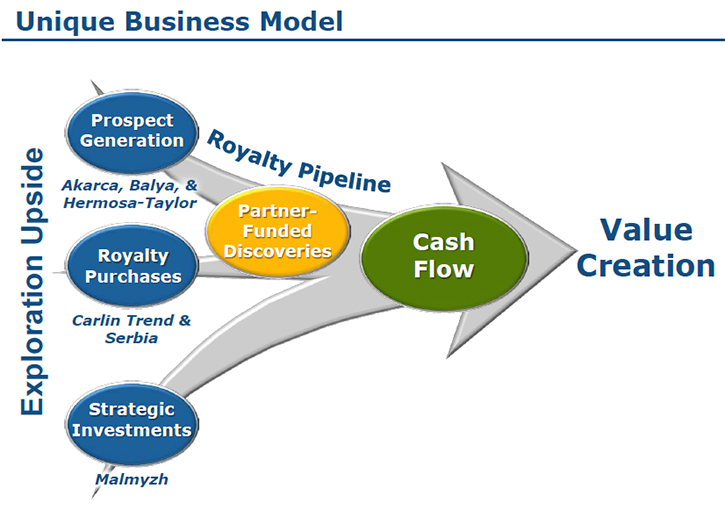

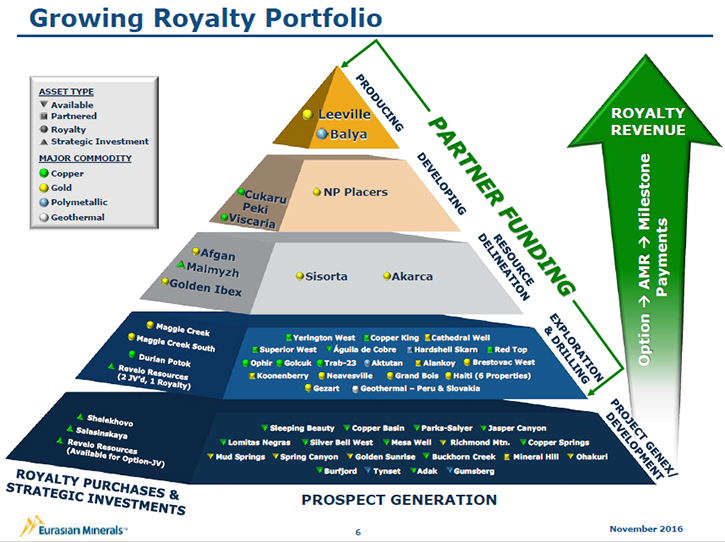

David Cole: Happy to do that, Al. You know I'm quite passionate about the business model, and it's oftentimes what I talk about the most, when I talk about Eurasian Minerals. Our bread and butter is the execution of the prospect generation business model. This model is where we acquire prospective mineral rights around the world, add value through a variety of geologic investigations, then sell those properties and keep royalties on them. That is the way we organically grow a royalty portfolio in a decidedly accretive manner, Al.

To augment our organic growth of royalties, we also purchase them when we can find them for sale at favorable pricing levels. Thirdly, utilizing the same team that we have globally executing our organic growth, we occasionally come across compelling investment opportunities, where we make a strategic investment in a company within our sector.

One of the most important assets we have in the portfolio is a strategic investment in the IG Copper Company of which we own 35% of. It's a private company that is advancing a very large copper-gold discovery in Far East Russia called Malmyzh. This three-pronged approach of organic growth of royalties, purchasing royalties, and making strategic investments is a very powerful way to approach our sector.

Dr. Allen Alper: That sounds great. That's an excellent approach. That allows you to give your investors more value and protection.

David Cole: We have a diversified portfolio and increasing royalty income flow in addition to solid growth prospects, I believe.

Dr. Allen Alper: That's great. Maybe you could elaborate a little bit on your portfolio, and the royalties you're receiving, and some of the properties you own.

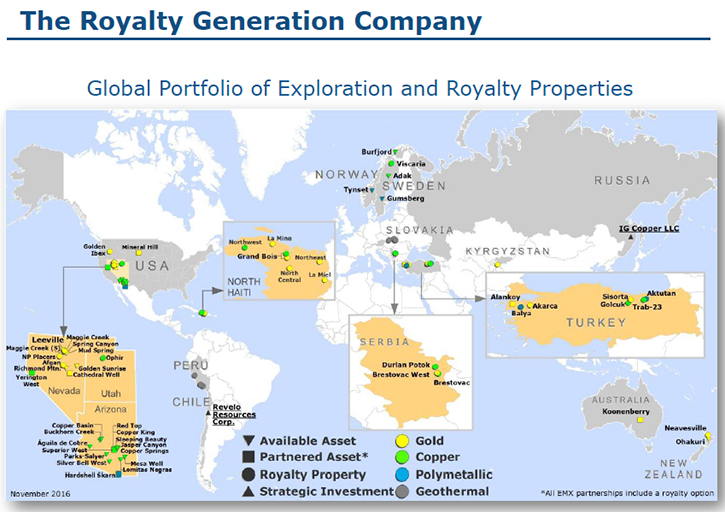

David Cole: I'd be happy to. Our most advanced asset is a royalty on a number of Newmont Mining Corporation's assets in the northern portion of the Carlin Trend. Newmont just recently completed a new $300+ million shaft at the Leeville complex to augment the two previous shafts. We receive a 1% gross royalty from that operation. Our 1% royalty covers the Leeville deposit, a portion of the Turf deposit, the Four Corners deposit, and other deposits that they have within the region. Very importantly they continue to announce new discoveries within our royalty footprint. Those cash flows contribute nicely to our treasury, providing us with capital to advance our global organic growth.

Also within the United States, Al, we're the third largest mineral rights landholder in Arizona. We've joint ventured and sold a large number of those properties to major mining companies, who are advancing those projects from which we hold back a royalty. They are dominantly targeting copper deposits, within the copper belts, within the state. We're utilizing our considerable geological knowledge, generated by a host of our PhDs from the University of Arizona. That model is working very, very well.

Dr. Allen Alper: That sounds excellent.

David Cole: It is an excellent illustration of the execution of the business model. Another example is our portfolio of projects in Sweden and Norway. We have recently executed the sale of a number of properties to a new exploration company, where we receive shares in the soon to be publicly traded company, coupled with royalties on the projects. We think that's a smart way to execute the model and take advantage of the leverage that we've created through asset ownership and geological expertise. The systems that we have there are polymetallic, copper, gold, lead, zinc and silver. This is a very prospective part of the world to work in.

Another prospective region of the world that we've worked in for years is Turkey. In the history of our operations in the country, we've cycled through over 200 different exploration assets, and along the way we've made a few discoveries. We're quite pleased to see the business model mature into advancing royalty income flow. We have a couple of quite interesting gold projects that are being advanced by capable companies, in addition to a lead-zinc-silver deposit, which has recently commenced production. We are looking forward to some good production increases on that property in the future.

Dr. Allen Alper: That sounds excellent.

David Cole: Very importantly, we hold a piece of a huge discovery ongoing in Serbia called Cukaru Peki. It's within the Timok Magmatic Complex of Serbia, which is the largest historic copper and gold producing region in Europe. We were involved in advancing some of those prospects early on after the cessation of the Balkan Wars. We worked closely with the Serbian government on the drafting of their concession legislation and became one of the first investors within the mineral business in Serbia. Part and parcel to our business model, we sold off the assets while keeping royalties. We've also purchased some royalties to augment that portfolio. It's a good example of a combination of purchasing royalties and growing them organically. We are exceedingly happy with the extraordinary discovery being advanced on our royalty grounds. This is a key asset for Eurasian Minerals.

Al, we have discussed this previously, but the project in Russia is incredibly exciting for us. The company of which we own over a third, announced an inferred resource on that project last year of 1.66 billion tons of .34% copper and .17 grams per ton gold. This is a massive ongoing copper-gold discovery. We fully expect that to continue to grow by leaps and bounds as the property is advanced with additional drilling.

Dr. Allen Alper: That sounds very, very exciting. That's excellent. How about Australia?

David Cole: We have been active in Australia and we do have prospects that we have sold off and kept royalties on, but nothing that is a huge value driver within the portfolio. Of course we keep our fingers crossed on those because one never really knows. All told, we have about 70 projects worldwide covering 1.4 million acres or 566,000 hectares.

Dr. Allen Alper: That's amazing.

David Cole: It is. The great thing about it is that it's being advanced largely with other people's money. In properties that we have partnered or sold, the partner or the operator continues to invest in the asset and we ultimately reap the benefits via royalties. That is an enviable position to be in, and it is a durable, long term business.

Dr. Allen Alper: That's very good. Could you refresh our readers on your background and your team?

David Cole: My pleasure to do so Al. My education is in economic geology. I went to work for Newmont Mining Corporation and stayed there for 18 years before leaving to found Eurasian Minerals. I left to pursue my passion of value creation through the discovery process. My belief is, the best way to actuate value creation in the sector is through royalty ownership. The royalty holder gets the benefit of work done by the operator, with no capital outlay themselves. We've seen that reflected in the strong stock performance of major royalty companies, over time. Our objective is to become one of those major royalty companies.

Dr. Allen Alper: That's excellent. I know you have a very large team of professional geologists. Could you tell me a little about that?

David Cole: Of course. Dr. David Johnson manages the America's for us, is a PhD from the University of Arizona. He is a fabulous guy and expert in porphyry copper deposits as well as various aspects of gold deposits. He is one of our geo-savants. Dr. Eric Jensen, also a PhD from the University of Arizona, manages the world outside of the Americas. He has a particularly strong background in alkalic gold deposits as well as gold and copper porphyry systems.

The core aspect of our business model is to have very astute geologists. We leverage their expertise into mineral property ownership and advancing geological models on those properties. We are then able to sell those properties and keep royalties and carried positions on them. Those two guys are consummate representations of pronounced laterally thinking.

To augment that, our people on the commercial side include Jan Steiert; our chief legal officer. She does a fabulous job handling the business and legal side by insuring that our agreements are well constructed and positioning us well into the future. She is a former president of the Rocky Mountain Mineral Law Foundation.

Dr. Allen Alper: That's excellent, very strong team. Could you tell me a little bit about your share and capital structure?

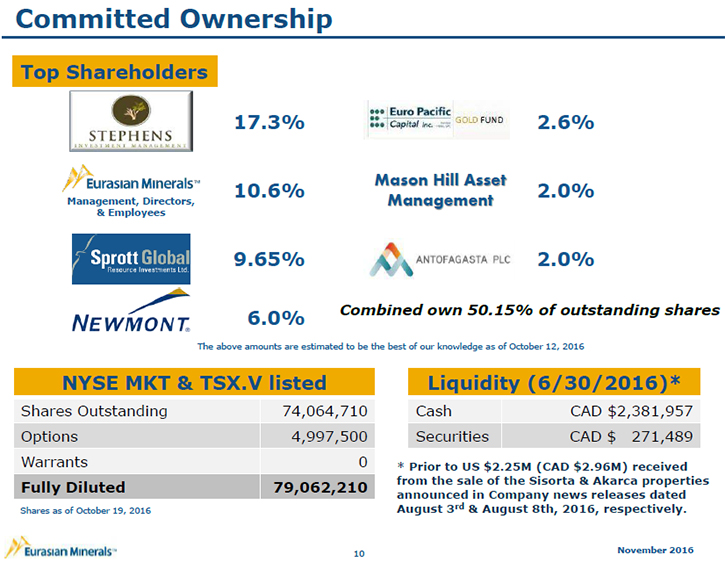

David Cole: We are quite proud of the fact that, with our sizable portfolio of assets, we only have about 80 million shares issued and outstanding, including the modest, recently announced, equity financing of $7 million Canadian, allowing the issuance of 5 million additional shares and 2.5 million warrants. This is the first time we have financed since March of 2011. We are fortunate to have large shareholders that hold their shares very tightly. We have seen a lot of insider buying, which you have mentioned to me previously. We have also seen a lot of insider buying over the last few years, particularly when the stock prices in the sector got hammered as a result of flagging commodity prices. Paul Stephens, a very astute investor in the mineral sector, has accumulated a large position in Eurasian Minerals. He is a huge supporter of the company. He now owns over 18% of our shares, and the vast majority of that he's purchased on the open market. We are very pleased to have such a successful investor on board.

Dr. Allen Alper: You also have Sprott, I believe.

David Cole: Yes, and Sprott is a significant shareholder in the company as well, through Exploration Capital 2000, which is a private fund managed by Rick Rule.

Dr. Allen Alper: Also, the management team has a significant ownership.

David Cole: Yes, and you'll see the management team, including myself, has had a fair amount of insider buying over the last couple of years.

Dr. Allen Alper: That's excellent, shows you believe in your company, and also you have strong support by very knowledgeable investors. Very good signs. Could you tell us where your stock is listed for our readers?

David Cole: I am happy to. We are listed both in Canada and the United States. We trade on the New York Stock Exchange MKT under the ticker symbol EMX, and the same ticker symbol on the TSX Venture Exchange. It is noteworthy that our ticker symbol in New York recently changed from EMXX to EMX, which is great, as now both our trading symbols are identical.

Dr. Allen Alper: That's very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

David Cole: We employ a very well thought out; accretive, durable business model, largely funded by our development and royalty partners. This is coupled with a strong track record of tweaking and executing that model over the past 13 years.

Dr. Allen Alper: Sounds like excellent reasons to have our high-net-worth readers/investors consider investing in your company! Is there anything else you'd like to add, David?

David Cole: Al, the one thing I'll add, is that I'm always available to talk to folks that would like to learn more about the company. You can find my contact information by clicking on the “Contact” tab on our website. I'm always delighted to talk with folks that would like to learn more about the company, ask me hard questions about our various projects around the world, how we filter our acquisitions, how we market our projects to ultimately grow our royalty portfolio and ways that we positioning the company to take advantage of commodity price moves in the future.

Dr. Allen Alper: That's great.

http://www.EurasianMinerals.com/

Suite 501 - 543 Granville Street

Vancouver, British Columbia

Canada V6C 1X8

Phone: +1 (604) 688-6390

inquiry@eurasianminerals.com

|

|