Mark Morabito CEO, Logan Resources Ltd. (TSX.V: LGR): Exploring Nine Gold Properties in Nevada & Utah, United States Under Option Agreement from Pilot Gold Inc (PDAC Booth # 2749)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/6/2017

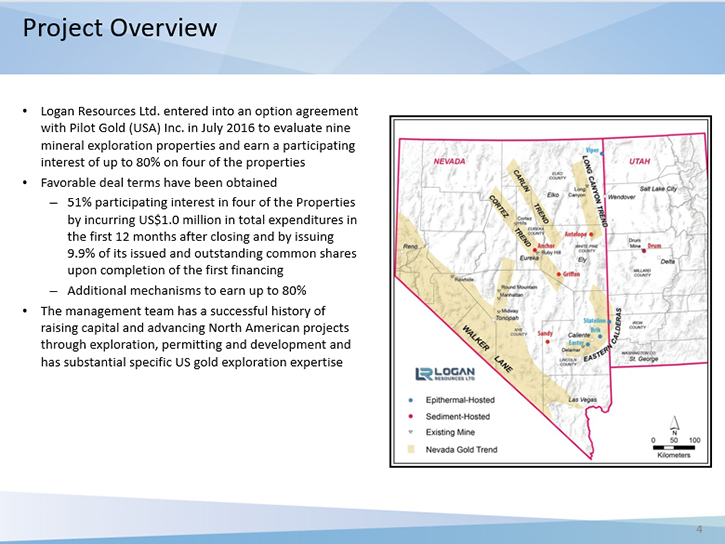

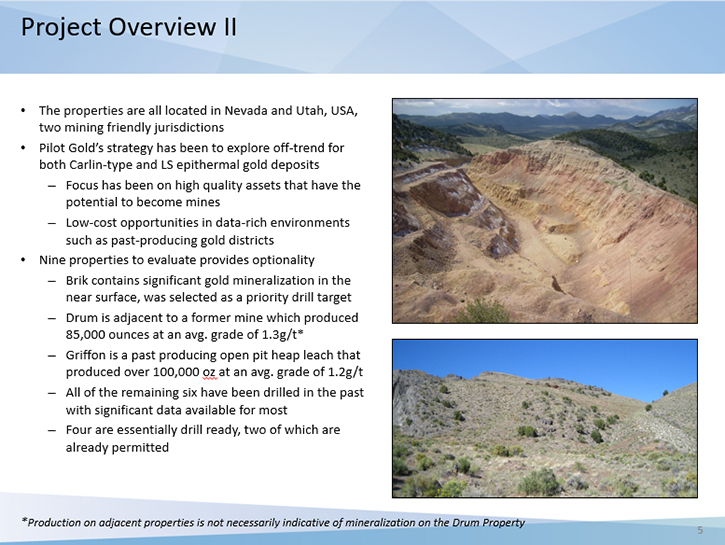

Logan Resources Ltd. (TSX.V: LGR) is a junior exploration company in the business of acquiring and advancing mineral properties. We learned from Mark Morabito, CEO and Director of Logan Resources, that all of the company's projects are located in Nevada and Utah. Logan's focus is on actively exploring nine gold properties that are under option agreement from Pilot Gold Inc., earning a participating interest of up to 80% on up to four of the nine properties. Plans for 2017 include evaluating the drill results from the Brik Project, which contains significant gold mineralization near surface.

Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mark Morabito, CEO and Director of Logan Resources Ltd., and also Jennifer Paterson, Investor Relations and Manager of Corporate Development. Mark, I wonder if you could give me an overview of your company.

Mr. Mark Morabito: Logan Resources Ltd. is a junior mineral exploration company focused on gold properties in Nevada and Utah, USA through an option agreement with Pilot Gold.

The cornerstone of our portfolio came from a more senior company, Pilot Gold Inc. Pilot has a strong technical team with a lot of experience and as such, they’ve built a solid reputation in the industry. Pilot has a large portfolio of properties, with a number of them in the advanced drilling stage. The fact of the matter is they simply couldn't concentrate on drilling out the resources on these other projects, which are more advanced, and maintaining their exploration programs on the portfolio that they'd assembled. So they agreed to farm out their exploration portfolio, as a lot of companies do when they're faced with this dilemma. It happens a lot in our business if you're successful.

Logan entered into an option agreement with Pilot in July 2016 to evaluate nine of Pilot’s gold properties, with the right to earn a participating interest of up to 80% on up to four of them. We get to work on all nine properties for a year, under our care and control, and cover the costs of holding the properties. This August we will then make our selection and continue earning up our interest in those properties. We are not required to take four, we could take just one if it was the only property we wanted to develop. The others then go back to Pilot, giving us the pick of the litter.

All of them have gold mineralization that's already been identified through past exploration so it's just a matter of advancing the work that's already been done.

Allen Alper: That's sounds great. Could you tell me a little bit about your plans for 2017?

Mr. Mark Morabito: In late 2016 we conducted a drill program on the Brik Project, so we want to evaluate those results which have just come out. We’ll likely go back and continue working on that project. The Brik Project does contain significant gold mineralization near surface and was selected by us as a priority drill target.

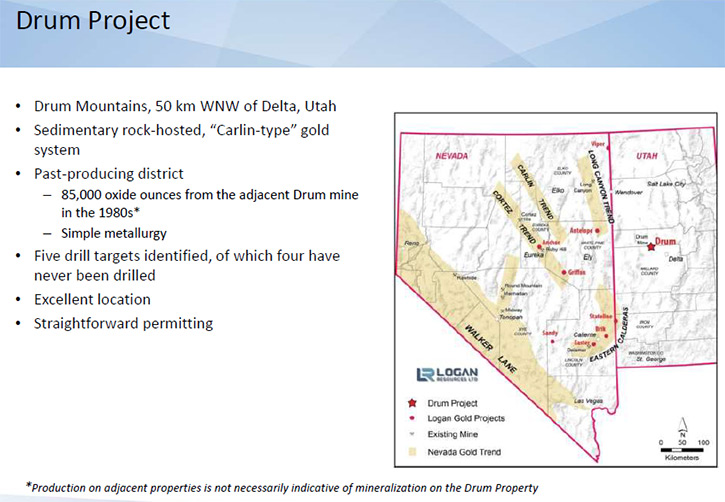

We also have the Drum Project, which is adjacent to a former mine in Utah, so that is a high priority drill target for us.

Although we have these projects from Pilot, we're continuing to look for other opportunities in Nevada and Utah. We have a considerable amount of experience and working knowledge of that region so we want to stay focused in that area. We want to leverage our human capital and our relationships in the region to continue to assemble prospective projects and work them through, in the hopes that one of these will prove to be economic.

There's no better part of the United States to be in to develop a gold project. I think that whatever issues some people may have with President Trump’s message from the new administration, it is a friendlier environment for the resource industry.

Allen Alper: That should be very helpful. Could you tell me a little bit about your background and your team and your Board?

Mr. Mark Morabito: My professional training was as a lawyer. I was a corporate finance and securities lawyer for eight years. In 2000, I established my own company as a merchant banker and venture capitalist concentrating on the mining and technology sector. I've raised over $700 million for a number of different mining projects, such as Excelsior Mining, which is an advanced copper project in Arizona that I've been with since the beginning. It's now in final stages of permitting and going into production next year. Alderon Iron Ore, another company I have been with since the beginning, is now one of the world's largest undeveloped but fully permitted iron ore projects.

I’ve taken Alderon and another past project, Crosshair, from early stage exploration all the way to being listed on the New York Stock Exchange. My experience ranges from the very early stages to more advanced projects but I enjoy the early stage projects the most because that's where the real adventure is.

Allen Alper: That sounds great. Could you tell me a little bit more about the other members of your team?

Mr. Mark Morabito: Dr. Craig Bow, Ph.D., has about 40 years’ experience in the business. He is our VP of exploration. Most of his experience is with much larger companies. We have a number of other people. There’s also Carlo Valente, Chief Financial Officer, Jennifer Paterson, who manages our Corporate Development, and Larry Poznikoff, our Geotechnical manager. Logan is part of the King and Bay West Group, which backs the Company, along with Excelsior and Alderon and a few others.

Allen Alper: That sounds great. Could you tell me a little bit about your share structure?

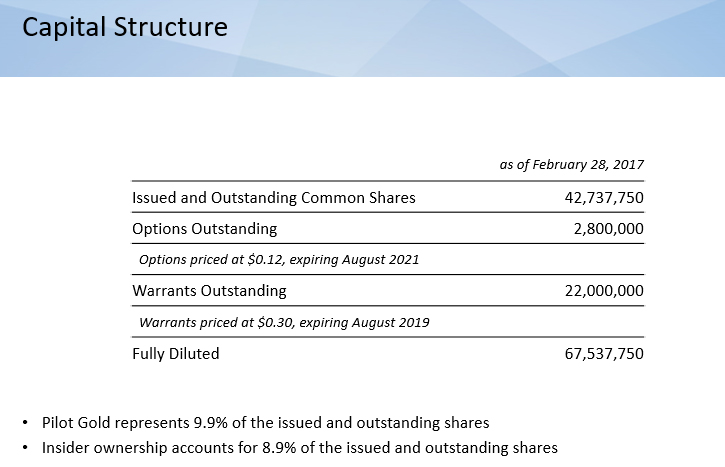

Mr. Mark Morabito: There are 42.7 million issued in outstanding common shares. Management and Pilot own close to 20% of those shares. There are 22 million warrants outstanding and 2.8 million options out so fully diluted is 67.5 million.

Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Mark Morabito: Junior gold companies are always risky because you're exploring, and anytime you're exploring even if you find something, the odds are against you that what you find is going to prove to be economic. However, the upside is unlimited if in fact you do find something. We're trading at 10 cents. The downside risk on 10 cents is extremely low and the upside is extremely high.

There's very low downside risk, meaning one could make the argument that Shell companies that are listed typically trade in the range of 5 to 10 cents, so we're not getting a lot of credit right now in today's market for our gold exploration portfolio. But if any of these properties prove up the way we think they will, you're looking at significant price increases.

Allen Alper: Why do you feel these properties have potential? Could you elaborate a little bit on that?

Mr. Mark Morabito: These properties were assembled by the Pilot team. They are regarded as one of the best in the industry from a project generation standpoint and have had significant successes on properties that they have acquired, based on their due diligence and technical experience.

In our case, the portfolio of properties all have shown tremendous potential. Some of them have had drilling on them with very strong intercepts. I think we have an excellent opportunity to turn that potential into something that we can prove up.

We have a low entry point with a CDN $0.10 stock price and management that's fully invested.

Allen Alper: That sounds very good. Is there anything else you'd like to add Mark?

Mr. Mark Morabito: No I think we've covered it.

Allen Alper: Excellent!

http://www.loganresources.ca/

1240 - 1140 West Pender Street

Vancouver, BC

V6E 4G1

Tel: 604-681-8030

Fax: 604-681-8039

Toll Free: 1-866-683-8030

Investor Relations:

Jennifer Paterson, Manager of Corporate Development

Tel: 604-681-8030 (ext.248)

Email: info@loganresources.ca

|

|