Daniel Major, CEO of GoviEx (TSXV: GXU): Advanced Uranium Projects in Niger, Zambia and Mali with a Very Strong Team and Shareholder Base (PDAC Booth # 2146)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/2/2017

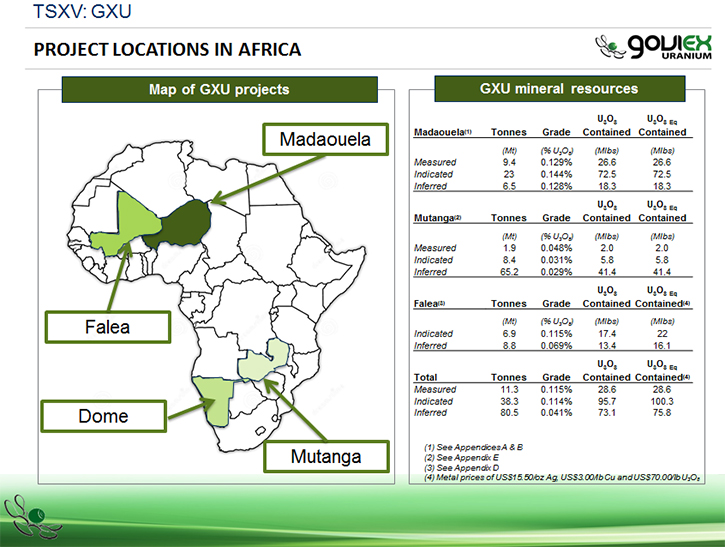

We talked with Daniel Major, CEO of GoviEx (TSXV: GXU), a uranium Development Company with three projects in Africa: one in Niger, one in Zambia, and one in Mali. Mr. Major tells us that the uranium price is positioned to increase with a serious market gap by 2020. The two GoviEx properties are fully permitted in an environment where it is increasingly hard to permit uranium mines, and its stock is likely to be significantly re-rated after mine construction.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Daniel Major, CEO of GoviEx Company, Uranium Company. Could you tell us a bit about what differentiates your company from other uranium companies?

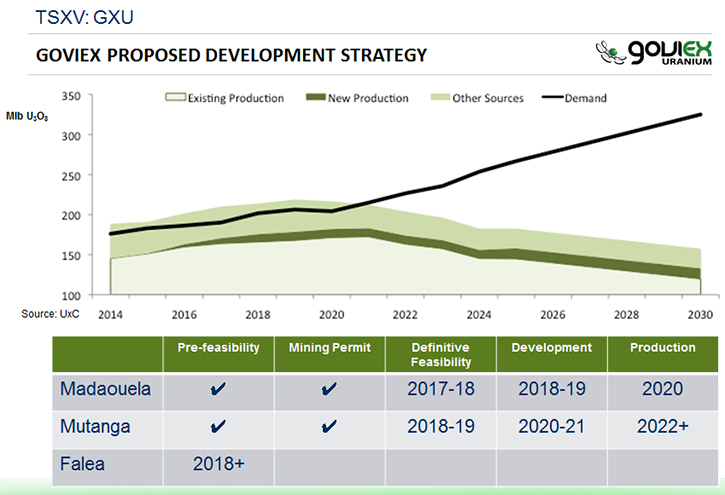

Daniel Major: Absolutely. The key differential is that we have two fully permitted projects. We have a very large resource in the ground. We have three projects, all in Africa: one in Niger, one in Zambia, and one in Mali. They are all sizeable from a resource point of view. They all have a lot of expiration upside still, targets already defined. But most importantly, the one in Niger and the one in Zambia are already fully permitted and are ready to go into construction, subject to the ever-improving uranium price. Our focus is to develop this portfolio of projects. Our plan is to start with Niger. We believe that around 2020 there will be a real supply demand gap opening up in this market. Where it takes seven to ten years for most projects to get through their permitting and ready for construction, we are already permitted, and we're already working on the optimization and financial structuring required to bring Madaouela into production in 2020. We have two other projects, one already permitted in Zambia and one advanced exploration projected in Mali.

Dr. Allen Alper: That sounds excellent. Could you tell me a bit more about your shareholders, yourself and your team?

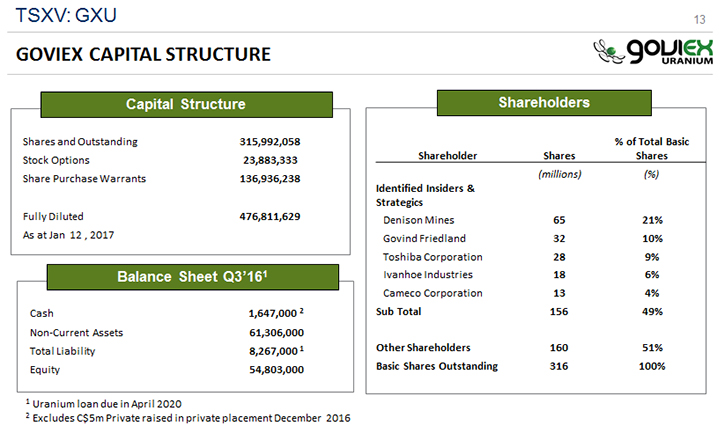

Daniel Major: Absolutely. Let me start with the shareholders. The major shareholders are strategic shareholders, who've all come into the project over various periods of time. They are very much from the “who's who” of the uranium nuclear industry. We start with the largest at the moment, which is Denison Mines. Denison Mines came into the company last year when they vended their African projects into our African projects. They were focused on the Canadian projects. They are part of the Lundin Group, so obviously, we now combine the Friedlands and the Lundins in a single company. They have a lot of skills in this business as well as a lot of experience. Obviously, Denison Mines also manages UPC, so that means a lot of experience in the uranium market.

We then have Toshiba Corporation. Toshiba owns Westinghouse, which is the largest reactor and nuclear services seller in the market. They have reactors being built or planned to be built in China, India and other parts of the world.

Cameco has been with the company since 2008. I don't think they need much of an introduction. Everyone knows they are one of the largest global uranium producers.

We then have Ivanhoe Industries, part of the Friedland Group. It's not Ivanhoe Mines – it's the industry's part, an investment vehicle based on application of advanced technology.

And then our Chairman is the largest individual holder, Govind Friedland, who's the founder of the company and who discovered the opportunity back in 2007.

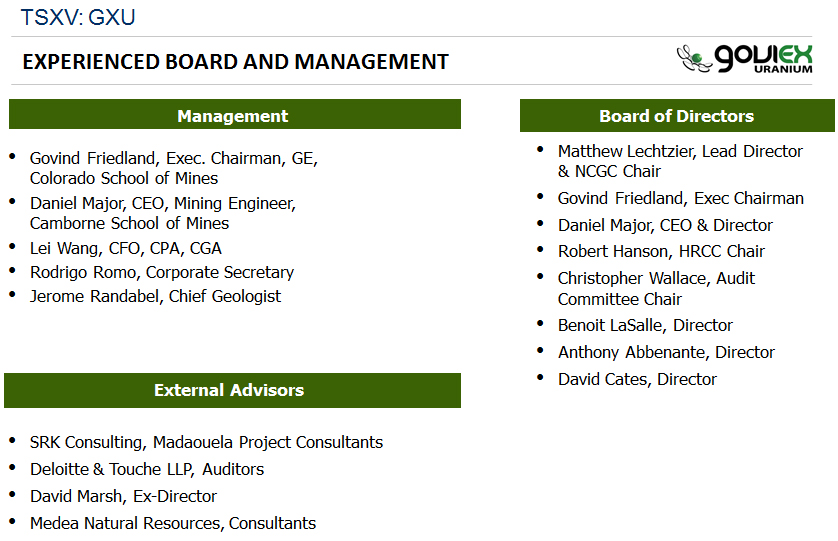

From a team point of view, my background is as a mining engineer. I started my career at Rossing Uranium, the Rio Tinto mine, a while ago. I then worked in open pit and underground mines. I have worked in production, planning, and I have worked in platinum, gold, iron ore, chrome, diamonds, and manganese. I've done exploration. I worked in various parts of Africa, Russia, South America, and Canada, so I've been all over.

My team is relatively small in relation to the project we have. We've kept a very tight team. The team working on the African projects are local nationals. We have a very small corporate team who looks after those projects. All have a lot of experience in the uranium industry, particularly our chief geologist, Jerome Randabel. He is a geologist who is almost totally uranium-focused. We've kept the team very local on a local basis and made sure, at the top, we got the right guys in the right places.

Dr. Allen Alper: That's great. You definitely have the right shareholders. You have a great group running the projects. You have a very large uranium project in both countries. Could you tell me what your plans are for 2017?

Daniel Major: Yeah, absolutely. We have a single focus, at the moment, which is reducing the incentive cost for our permitted Madaouela project. We are looking at reducing the uranium price required to justify the financing of a project. What we can do is try and reduce the operating and capital costs, so our focus this year is very much on trying to bring that incentive price down.

We're looking at some exploration work at our project in Niger, which is very much focused on trying to expand the open pit resource. The Nigerian project at Madaouela starts as an open pit and then goes underground. The underground mine development starts in about year five, and so our plan is to try and push that out to beyond year ten, and therefore make phase one, which is the primary debt period of lending, into just an open pit mine. That would obviously bring down the unit cost of production because an open pit mine costs less than an underground mine. This also defers the sustaining capital associated with the underground mine, which is expected to improve the NPV of the project.

We're looking to technologies to improve the unit cost. At the same time, we've already announced that we're working with the export credit agencies to try and structure a financing package to develop this project, and we've had a very positive response to date from the export credit agencies, hence the underlying lending banks that go with them. So, we're taking a 12 to 18 month program on a number of angles: one, structuring the debt; two, working on the projects and improving the incentivization; and three, we are also starting to work on building our offtake structure and then gradually the underlying equity part of the projects as well. So, that's where we are with Niger.

In the case of Mutanga, we are looking again at that project. We only acquired it last year, but we are trying to look at the economics on it in more detail and see what we can do to reduce its costs and reduce its incentive price. It's a very simple project. It is expected to be an open pit heap leach operation. We certainly think it's one that we should be very much focused on behind the Madaouela project.

And lastly there is Falea, which is at a much earlier stage, relative to the first two projects. At Falea, we will do much more exploration to expand the resource. Falea is, in development terms, behind the other two projects from a development point of view, but certainly has a lot of long-term potential.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit more about where your shares are listed and your capital structure?

Daniel Major: There are approximately 315 million shares on issue.

We are listed on the Toronto Venture Exchange under GXU. We are at OTC under GVXXX. We're Frankfurt under 7GU.

Dr. Allen Alper: That's very good.

Daniel Major: We trade, and that's one of the keys really. We trade on all of them and in quite high volume as well.

Dr. Allen Alper: That's excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Daniel Major: It's down to three reasons. One is the underlying commodity. Uranium last year went down to $18 a pound. It was $70 a pound in the last peak in 2011. It was $140 in 2007. There are a number of factors that would cause that event. There was surplus material in the spot market. Everybody was contracted up, and as a result, the price had just waned. This year, we've seen a real turnaround. We've seen that the inventories there are illiquid. We're looking forward to term contracts coming to their end and having to be replaced. We have seen Kazakhstan announce a 10% production cut.

But most importantly looking forward, we're looking at, long-term, a 3% per annum growth in uranium usage, but we're actually looking at about half a percent decline in production per year. Over the next five to ten years a very wide supply and demand gap is going to develop in the market for uranium. It takes about seven years to get a permit and get a mine up and going, so, given the price where it is now, nobody is making any money on a total cost basis. Nobody is incentivized to go out and build a uranium mine, and so the uranium price has to rise to enable new projects to be developed.

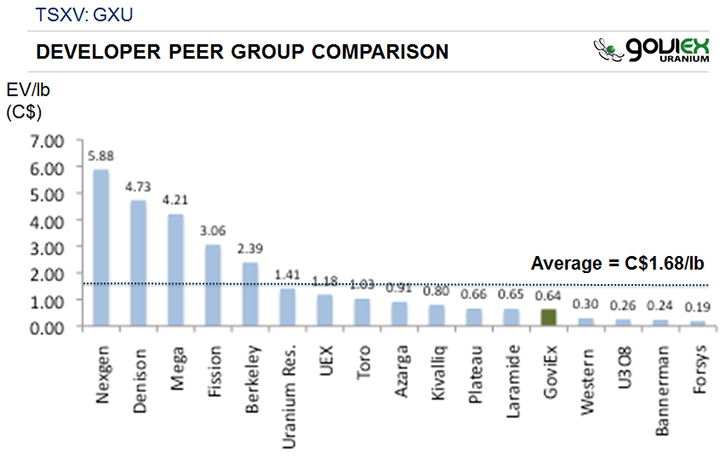

So, number one is rising price. Number two: if you think that price is rising and there is a supply gap, then you have to be looking for the companies that can actually build a mine, and we already have two permitted projects. Canada is getting more difficult to permit, where a lot of the big projects are. Some projects have taken anywhere between five, ten, even fifteen years to permit in that part of the world. So, number two, we're permitted, so we can build into this gap in the supply and demand. And thirdly, we're trading at about a quarter of our peer group on the development basis average. People are not giving credit to our projects because we've been in a weak, declining market. People tend to avoid the slightly higher, riskier regions, but when markets tend to improve, people tend to come back and realize real values are to be had in these regions.

I'll give you an example. One of the best stocks in the last cycle was a company called Paladin Resources. Paladin Resources was Africa-only focused. It went from 10 cents to 10 dollars in the cycle, and what it did was build two mines in Africa. Once the cycle gets up and going, people go to where the projects can be built, and we're sitting at a big discount to our peers at the moment. So, those would be the three reasons I would give your investors to buy our shares: price movement, being permitted and able to build, and a massive discount to our peers.

Daniel Major: I think that covers the last three important points to consider.

Dr. Allen Alper: Sounds great! Sounds like you have great properties and a bright future ahead with uranium getting scarcer and scarcer. Sounds excellent!

Daniel Major: Okay. Perfect.

http://www.goviex.com/

Email: info@goviex.com

Phone: 604-681-5529 (Vancouver, Canada)

Daniel Major, Chief Executive Officer

Email: DanielM@goviex.com

Disclaimers and Cautionary Statements

This interview may contain forward-looking information within the meaning of applicable securities laws. All information and statements other than statements of current or historical facts contained in this interview are forward-looking information. Such statements and information may be identified by words such as "about", "approximately", "may", "believes", "expects", "will", "intends", "should", "plans", "predicts", "potential", "projects", "anticipates", "estimates", "continues" or similar words or the negative thereof or other comparable terminology. Forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in the Company's periodic filings with Canadian securities regulators. Information provided in this interview is necessarily summarized and may not contain all available material information.

Forward-looking statements include, without limitation, statements regarding the expected timing of the development and potential advancement to production of the Company’s mine-permitted projects in Niger and Zambia, the potential for off-take agreements to be concluded for the Company’s project in Niger and long-term uranium contracts needing to be filled by uranium consumers. Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties and contingencies.

Assumptions upon which forward looking statements are based include an impending depletion of uranium inventories giving rise to increased demand and an increased uranium price, the long-term fundamentals of the uranium market remaining strong thereafter, the Company’s various projects resulting in a pipeline of project development, the continuation of support of the mining industry in general and the Company’s projects in particular by the local governments in the jurisdictions where the Company’s projects are located, the Company’s ability to secure the requisite financing and, generally, the price of uranium remaining sufficiently high and the costs of advancing the Company's projects sufficiently low so as to permit it to implement its business plans in a profitable manner.

Important factors that could cause actual events and results to differ materially from the Company’s expectations include those related to market fluctuations in prices for uranium; the Company’s inability to operate without additional financing, develop its mineral projects or obtain any necessary permits, consents, or authorizations required for its activities in the various jurisdictions where the Company operates; as well as the Company’s inability to produce minerals from its projects successfully or profitably. In addition, the factors described or referred to in the section entitled "Financial Risks and Management Objectives" in the MD&A for the Company for the year-ended December 31, 2015, available at www.sedar.com, should be reviewed in conjunction with the information found in this interview.

Although the Company has attempted to identify important factors that could cause actual results, performance, or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance, or achievements not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate or that management's expectations or estimates of future developments, circumstances, or results will materialize. As a result of these risks and uncertainties, the results or events predicted in these forward looking statements may differ materially from actual results or events. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this interview are made as of the date of this interview, and the Company disclaims any intention or obligation to update or revise such information, except as required by applicable law.

Cautionary Note to United States Investors: This interview and the disclosure contained herein does not constitute an offer to sell or the solicitation of an offer to buy securities of GoviEx Uranium Inc.

|

|