Stuart W. Rogers, President and Director of TerraX Minerals Inc. (TSX-V: TXR; Frankfurt: TX0; OTC Pink: TRXXF): Recent High Grade Drill Results Indicate Potential for a World-Class Gold District (PDAC BOOTH # 2304)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/24/2017

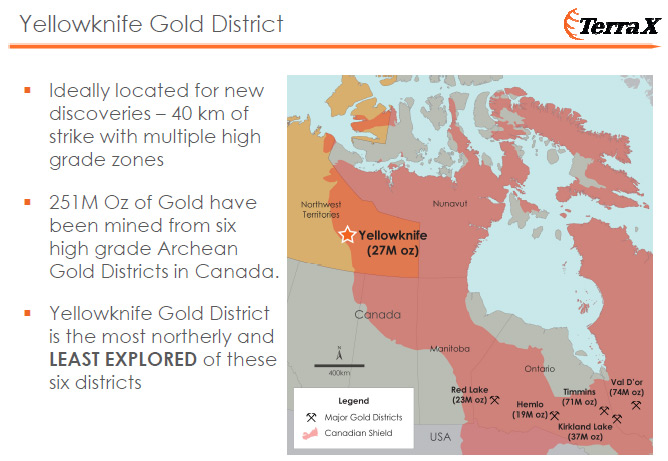

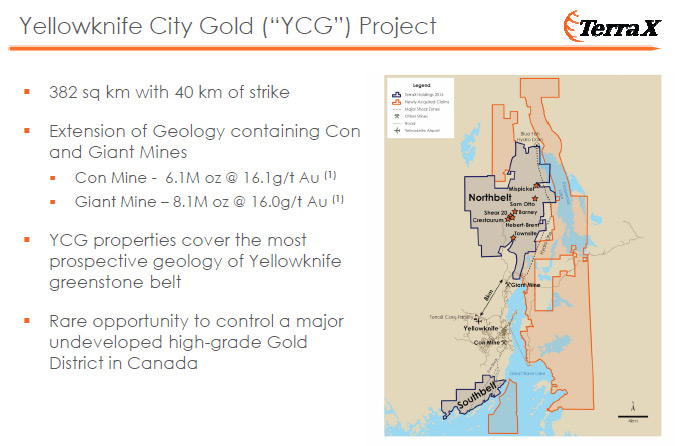

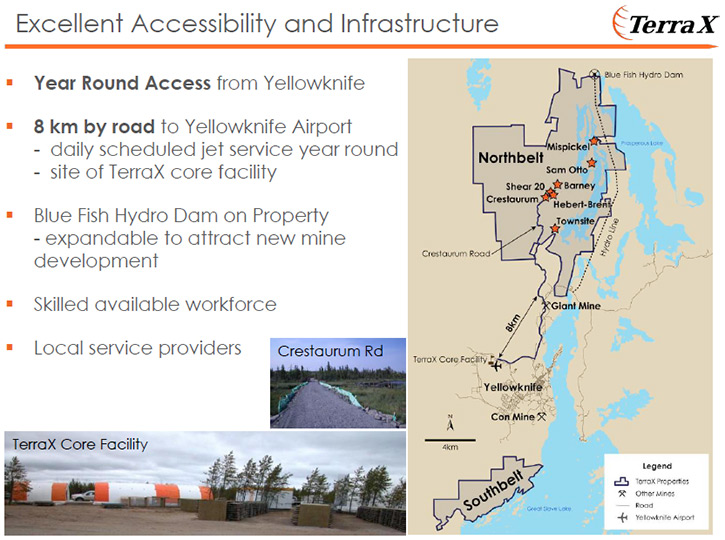

TerraX Minerals Inc. (TSX-V: TXR; Frankfurt: TX0; OTC Pink: TRXXF) is focused on the Yellowknife City Gold ("YCG") project, located on the prolific high grade Yellowknife greenstone belt, immediately north and south of the City of Yellowknife in the Northwest Territories. The project area contains innumerable gold showings. Recent high grade drill results serve to indicate the project's potential as a world-class gold district. We learned from Stuart W. Rogers, President and Director of TerraX Minerals, that since our last discussion, the company's experienced technical team has tripled the size of the property and assembled a district in the mining friendly jurisdiction, with excellent infrastructure, near two past producing world class mines. Plans for 2017 include a fully funded winter drill program that will generate a steady flow of positive news, beginning in March and continuing through the spring.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Stuart W. Rogers, who is President and Director of Terex Minerals. Could you give us an overview of your company? Update our readers and investors?

Mr. Stuart Rogers: Our Company is focused on the Yellowknife City Gold project, adjacent to the city of Yellowknife in the Northwest Territories. We have assembled a district over the last few years. Since our last discussion, Allen, we have tripled the size of the property. We went from 129 square kilometers to now 382 square kilometers. We cover 40 kilometers of the strike length, north and south of two past producing mines. We have acquired additional ground, so that we basically surround the two major past producing properties. These were world class mines, operated for 60 years, the Con and the Giant Mine, between the two of them they produced approximately 14 million ounces of gold at an average grade of 16 grams a ton.

We have a management team that's done this before. Joe Campbell, our Chairman and Chief Executive Officer, has done this before with a project called Meliadine in the Nunavut territories up in Canada, which is a similar type geology to what we have here. He discovered and developed the project and introduced it to Agnico Eagle and it's now one of their fastest growing projects. They acquired it in 2010 for just under 700 million dollars in cash and shares.

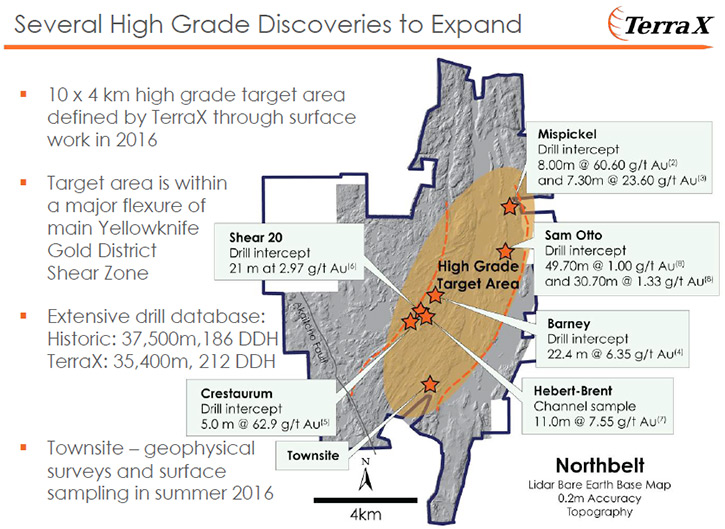

The key to our project is that we have assembled a district. We have an experienced technical team. We’re in one of the premier world political jurisdictions, that's Canada. We are in the Northwest Territories, which is a mining friendly jurisdiction, it's their main source of industry. We're right beside a mining town that actually was developed based on two mines in the past and is now the supply center for all the mining in the north. So we have excellent infrastructure and we also have high grade gold. With the work we have done over the last four years, we have over 70 thousand meters of drilling into the project. We are working on developing resources, but we are also continuing to make new discoveries.

So that is a quick snapshot overview of what we are doing.

Dr. Allen Alper: That sounds excellent! It really sounds like you have made great progress and you have a great resource there. Could you give me a bit more information about your deposits?

Mr. Stuart Rogers: Well what we have is a similar type of geology to Timmins Lake, Kirkland Lake or Val-d'Or. It’s primarily Archean lode gold deposits. Those were primarily what were mined at the Con and Giant Mine. One main structure we focused on, was the same shear structure that hosted the Con and the Giant Mine. It was called the Barney Shear, on our property, by the prospector that used to own this property. On that structure, we've drilled the same grades of gold that they mined in the old mines. We had one intercept that was twenty-two meters of six grams a ton, but within that was five meters of eighteen grams a ton. The old mines were high grade mines and their cutoff grade was ten grams a ton. They would have mined the five m by eighteen g/t interval and left the rest. In our case, obviously, with the price of gold where it is now, the lower grades are now economic underground.

We have numerous deposits, it's a large area, but it's in the core gold area where we are currently focused. There is a map on our website, with a number of deposits we've identified on which we're developing resources, and they're all within a 5 kilometer diameter area. So essentially that is a mine footprint. That's where we're looking at developing our initial resources, while we're also testing for other deposits in the area.

Dr. Allen Alper: That sounds excellent. Could you tell me a bit more about your plans for 2017?

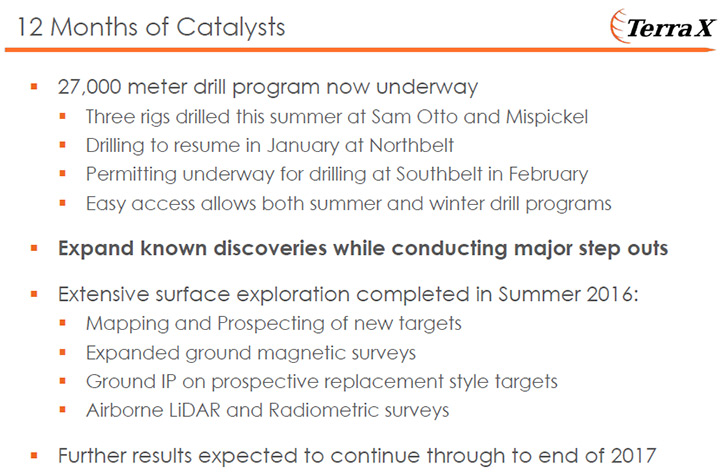

Mr. Stuart Rogers: In early February we started our winter drill program. I think one aspect of our project, the fact that we are in northern Canada, surprises people. We are able to work all year round. Northern exploration projects used to be shut down in the winter. We are right beside a city, the people that work on our project, the drillers, drive in and out every day. We're able to work all year round because we don't have to fly to our property. The problem in the north is right in the dead of winter you don't have enough light to be able to properly get in and out of a project area. In our case we can drive there even on the darkest days, we can work round the clock, and we can work in the winter just as easily and in some cases more easily than we can in the summer.

So because of that we are back on the property drilling again. We started drilling the first week of February, with our first drill rig on the property and we've moved two more in. As of February 20th we have 3 rigs turning on the Northbelt property. By the end of February we will have another drill rig at the Southbelt property, for which we received a permit in January. We're just getting the access trails put in and we'll be on that project area drilling before the end of February. And that's something new, Southbelt. We did have it when we talked last Allen, but we did not have a drill permit on it. Now we're going in to test that area that was formerly owned by the Con Mine. It's immediately south of and adjacent to the Con Mine. We have followed the structures on the Con property, like their namesake Con shear, for up to 5 kilometers on our property.

A number of other structures that they mined extend onto our property. We've gone into the archives at the Geoscience Center in Northwest Territories. We acquired data from the old Con Mine which has now been reclaimed and all the data went to the Geoscience Center. They did a lot of work around our property and actually drilled through it, and we're seeing some very interesting targets develop there. So that's a new area for us that we're quite excited about and very much looking forward to drilling at the end of the month.

The drill program is fully funded. We currently have about $8.5 million in the bank. We have planned a 17,000 meter drill program, which we hope to have done before the end of the winter. One thing with winter drilling is we do use the lakes as ice roads and it is weather dependent. We expect to have a sufficient ice thickness until about the middle of April. We think we have a good chance of getting the major portion of this 17,000 meter drill program, if not the whole thing, done by the middle of April. We should continue to have a steady flow of news after that.

It’s an aggressive program, with 4 drills turning. Because we're beside a city, we're not looking at flying people in, we don't need camps. Our all-in drill cost for our programs is a third of what you'd normally expect in the area. We budgeted around $250 a meter, so 17,000 meters at $250 Canadian a meter is roughly $4.3 million. As such, we are fully-funded to complete this drilling and then be ready to do more drilling after the snow melts and we can get back into summer conditions.

Dr. Allen Alper: That's great. It's going to be an exciting year for you.

Mr. Stuart Rogers: It is, we have a lot going on.

Dr. Allen Alper: Obtaining excellent information and data and releasing important news releases all through this, will be VERY interesting for everyone.

Mr. Stuart Rogers: Yes.

Dr. Allen Alper: Could you tell me a bit more about yourself, and your team, and the board, etc.

Mr. Stuart Rogers: Joe Campbell is a very experienced individual in the mining field, his expertise is in economic geology. He was responsible for discovering Meliadine, he introduced it to Agnico Eagle, he did the endowment study and the pre-feasibility level reports that they used in their review process and relied on to make the decision to acquire the property. His consulting company, GeoVector, does mine development plans and resource estimates.

We've really looked at this from the point of view of the economics. Obviously we're interested in discovering gold, but we're very concerned about the economics. So all the work is being done towards building the models, moving things forward to advance this project. We started the baseline environmental work two years ago. All the right work is being done to take this to development and move it forward. Joe has a number of individuals on his team who worked with him at Meliadine. Brent McAllister, our drill supervisor, was working at Meliadine and has been with us since our first drill program 3 years ago. Obviously, with 4 drills going, we now keep him pretty busy. Al Sexton, our VP of Exploration was Joe’s “second-in-command” at Meliadine, and we have a group of geologists that have worked with Joe and Al over the years on this project, as well. So we have a very experienced team.

I've been involved in the public market since 1990, financing resource projects. My role with the company is to raise the money and make sure that we're properly funded to do the work that needs to be done. Joe makes sure that the proper work gets done to advance the project, the work the majors would want to see done on the project, should they even consider wanting to get involved in this.

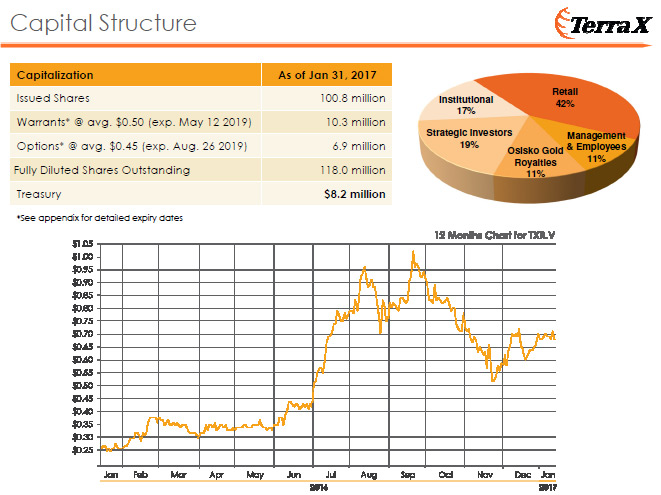

One of our directors is Elif Levesque, who is the CFO of Osisko Gold Royalties. They were one of the early investors in the Company, through Virginia Mining originally and then Osisko following their merger in early 2015. Osisko now owns about 11% of our shares and that was through investing in the company in the early stage, to help fund exploration.

Dr. Allen Alper: That's a very, very strong experienced board.

Mr. Stuart Rogers: Thank you.

Dr. Allen Alper: Well balanced, that's terrific! You have the geological background and knowledge and the financing so, that's very important.

Mr. Stuart Rogers: It is.

Dr. Allen Alper: It's good to be able to finance the geologists to have money to explore. That's fantastic!

Mr. Stuart Rogers: As you can see we're well funded. One thing we are proud of over the years, and others are impressed with, is the amount of money that goes into the ground from the money we raise. We've maintained low overheads over the years and that's been the focus. Management themselves are also major shareholders. Including the directors, plus the people we have in the field that work for us, we're probably over 11% interest in the company as well. That's an additional reason it's very important to us to make sure as much money goes in the ground, as possible, to create value. Because our goals are aligned with the shareholders in that respect as well. Though the first three quarters of last year, I calculated that 84% of the cash spent during that period went into the ground on this project.

Dr. Allen Alper: Well that's excellent. Could you elaborate a little bit more on your capital and share structure?

Mr. Stuart Rogers: Yes, the share structure right now is just about 101 million shares. We have options that average around 45 cents a share. We just had a number of 50 cents options exercised that were to expire the end of February. So those have been exercised, and have added another half a million to the treasury. Our fully diluted is 118 million, but if the other 17 million shares come in that adds another roughly $8 to 9 million to the treasury.

Dr. Allen Alper: Well that's great. I think it's very important that the management is invested in the company.

Mr. Stuart Rogers: Oh absolutely.

Dr. Allen Alper: A significant ownership means you believe in the company, and also you're going to make it work, so that's great.

Mr. Stuart Rogers: Also, because we're shareholders, we tend to try to minimize dilution. When we need to raise money we try to raise just enough money to cover our immediate needs and not raise too much money and overly dilute. We do have confidence we'll be able to advance this project and raise more money when needed.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Stuart Rogers: One big reason is the location, the jurisdiction we're in. We are in a mining community, it supports mining, it is used to mining. The past producing mines are right in the city of Yellowknife, so I think the political risk, the community risk that people are concerned about has been taken away. We employ the people from the native communities in the area, we work with them, engage them. We've really developed a relationship with the local community over the last 4 years and we get tremendous local support.

We have a district that encompasses, a number of deposits that you'll see on our website, in our presentations. Any junior company would be thrilled if they had just one of these deposits, and we have multiple targets on this project. So this is a district. This is something a major company would like to have, because it's an area where we're working and developing resources, but there's also plenty of exploration potential down the road to expand this project.

Also, last but certainly not least, we have high grade gold. You can see from the results that we've reported that we have a significant number of high grade gold intercepts. The majority of the mineralization outcrops at surface. We've identified wide zones of high grade mineralization in trenches at surface and have been able to follow it down to depth with drilling. At our new discovery last year at Mispickel, one of the intercepts on the X-section was 8 meters at 60.6 grams a ton. We are talking high grade gold. And we have a management team that has done it before. So, to summarize, it’s the location, the quality of the project, the potential for high grade gold, and management that's done this before.

Dr. Allen Alper: Well that's really great. It's excellent to have a district in the right place, high grade gold, an excellent team, and great infrastructure, so you have a lot of things going for the company. It's fantastic!

Mr. Stuart Rogers: Thanks Allen. I think the other thing people can take comfort in is we've been working on this for over 4 years now and expanding the project. People can see the project just keeps getting better. We plan to continue that trend. I think we're in the right place at the right time. We now have this good gold market to help us along and we're fully funded to capitalize on the opportunity at this point.

Dr. Allen Alper: That's really great. Is there anything you'd like to add?

Mr. Stuart Rogers: No I think we pretty much covered it. It's very easy and simple to understand, a quality project. Expect to see a lot of news, with more drills turning. We expect to have good strong news flow and we hope to have some of our first results out by early March.

http://www.terraxminerals.com/

1605 - 777 Dunsmuir Street

Vancouver, B.C. V7Y 1K4

Tel: 604.689.1749

Fax: 604.648.8665

Samuel Vella

Manager of Corporate Communications

Toll-free: 1.800.481.1876

|

|