Interview with Kiran Patankar, President and CEO of Geologix Exploration Inc. (TSX-V: GIX}: Advanced-Stage Tepal Copper-Gold-Silver Porphyry Project in Michoacán State, Mexico

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/22/2017

Geologix Explorations Inc. (TSX-V: GIX) is a Canadian mineral exploration company focused on acquiring, exploring, and developing promising mineral resource opportunities. The company's primary focus is its 100% owned advanced-stage Tepal Gold-Copper Porphyry Project in Michoacán State, Mexico. We learned from Kiran Patankar, President and CEO of Geologix Exploration, that the recent PEA shows an average production level of 79,000 ounces of gold over the 10-year mine life with 32 million pounds of copper, paying back capital in 2.3 years. In 2017 the company plans to continue to de-risk the project and take Tepal from the PEA stage all the way through to feasibility. According to Mr. Patankar, Geologix is blessed with a fantastic asset, talented people, a world-class board of directors and strong local partners.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Kiran Patankar, who's President and CEO of Geologix Exploration Incorporated. Recently you had some rather exciting news on your preliminary economic assessment. Could you tell our readers, first what your focus is at Geologix Exploration, what differentiates your company from others, and then elaborate on the PEA?

Mr. Kiran Patankar: Absolutely, Allen. Thank you for having me. It's a pleasure to speak with you. What we're doing at Geologix Explorations is quite exciting. Obviously you referred to our preliminary economic assessment on Tepal. I'll get into some of the details on the PEA, but first I’ll give you an overview of Geologix, I think what defines us and what differentiates us from our peers is: number one, we have fantastic assets, and number two, we have talented people. The company has been a bit quiet over the last couple of years with the decline in metals prices. That's been a conscious decision on the part of a very astute board of directors, some of whom run large mining companies, and sit on the board of directors of several others, Silver Wheaton for example, Capstone, Timmins, SilverCrest, et cetera.

I'm blessed with a world-class board. The company has an advanced project in Tepal in a great jurisdiction right on the border of Jalisco and Michoacán in Mexico, well-defined, substantial gold ounces and copper pounds in the resource endowment, advanced to the point of a pre-feasibility as recently as 2013. But ultimately the markets weren't conducive to continuing advancement of that project at the time, and the board made a prudent decision to curtail that activity. Unlike a lot of junior companies that, during the downturn depended on cash via equity to pay salaries and constantly diluted shareholders. We've kept our burn rate incredibly low while preserving a great asset and retaining key people.

I have a budget this year of about 600 grand if we don't raise any more money to advance Tepal, which is close to the minimum listing cost for a Canadian public company. I went out as soon as I jumped on board in June and raised $1.2 million Canadian, and we've spent our money judiciously. You can see the result of some of that spending on Tepal to evaluate whether or not it was a go in this market, which it clearly is. We're preserving capital. Obviously we're going to see some traction in the market on the PEA. It's still quite early, which is what's so timely about this interview.

Dr. Allen Alper: Well, great. Could you elaborate on some of your results of the Tepal PEA?

Mr. Kiran Patankar: Absolutely. I should preface with the fact that our price assumptions for the PEA reflect our canvassing of long-term analyst consensus on metals prices for gold, copper, and silver, but also are very conservative. You know, gold's above $1200/oz now, and copper's above $2.50/lb., so we're using a $1250/oz gold price and a $2.50/lb. copper price combined with an $18/oz silver price in all of these estimates, which we believe is conservative. Relative to the PFS, which had about a $350 million upfront capital cost, with a $400 million total capital cost, those are US dollars, we've brought the CapEx down significantly in this PEA design concept.

Upfront CapEx is now $214 million US with a total CapEx of right around $300 million, so substantial reduction both in terms of upfront and total capital. The return on that capital, the after tax NPV, using a 5% discount rate, is $169 million US with a 24% internal rate of return and a 2.3 year capital payback after tax. These are the kinds of numbers that are very attractive for a large gold, copper, porphyry project; you're paying back your capital rapidly. If you're paying back capital in 2.3 years after tax, under the PEA mine plan, and you have a 10-year mine life, there's potential to significantly expand that, and of course, once your capital is paid back, the rest of that's gravy.

The projected average annual production level is 79,000 ounces of gold over the 10-year mine life, with 32 million pounds of copper. Our average gold production over that first five-year period is right around 108,000 ounces, with about 37 million pounds of copper. This is a low CapEx, high margin development scenario for Tepal. If you were to have plugged in $2.50 copper and $1250 gold into the original PFS mine model, it would have returned a negative NPV. The project's a no-go, which is why the valuation of the company over the last three years traded down to a level of a nice project that’s technically solid, but needs higher metals prices, and at these prices is out-of-the-money.

I think what's important to note is with the release of this PEA, we're on track and we're demonstrating to the market that this project, which has had so much work done on it, I mean $27 million has been spent by this company to define the resource and complete a PFS. We're going to release our technical report within the next two to three weeks, ahead of schedule, so JDS did a fantastic job. We hard costed, got hard vendor quotes for the majority of the recapitalization. We evaluated trade-off studies on design and throughput. I think the results of this show that we have a project that makes money at today's metals prices with quite a bit of upside if prices were to increase from here.

Dr. Allen Alper: That's excellent! It sounds like you really used your money well to do your PEA. Could you tell me a little bit about what your plans are for 2017?

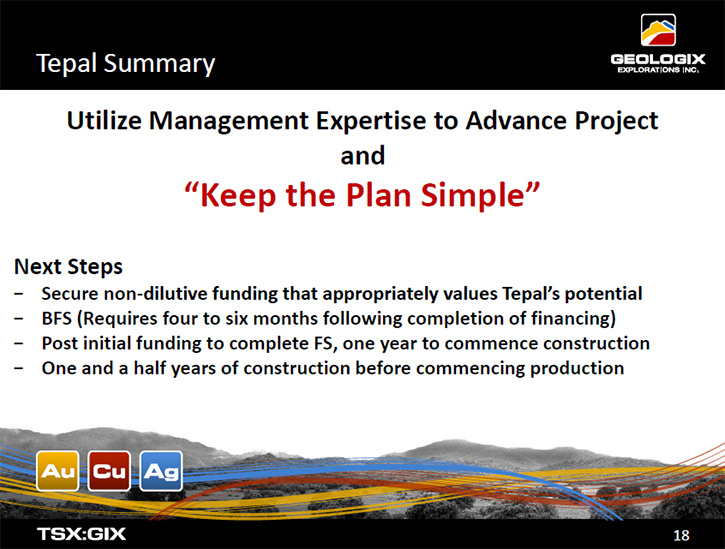

Mr. Kiran Patankar: Absolutely. 2017's going to be a very exciting year for us. Obviously it's off to a great start early in the year, and that's by design. We took six months to evaluate Tepal thoroughly in terms of whether it was a flagship project or a nice project to have on the sideline, but perhaps looking at acquiring something else. Now that we have a credible development plan for Tepal, I think the next steps are to continue to de-risk the project. I think projects like this, large gold, copper, porphyry projects with this type of production profile and these kinds of operating margins - our life of mine average cash cost plus sustaining cost is sub $400, so there's quite a bit of margin on each gold ounce that Geologix is producing. That again is net of copper and silver by-product.

I think, given the advanced stage of development and these kinds of economics, it's very much in the sweet spot. I think a lot of money has been spent on earlier stage projects, gold started to see a bit of an uptick in 2016 after a multi-year downturn and money started flowing back into the sector, but surprisingly, because there's been such chronic under-investment in development, there's been so little capital available for that, the money by and large was flowing into either production stories or early stage exploration reflecting investors' appetite for risk. The high quality development projects, which are so critical to augmenting the production profiles of smaller and mid-tier gold producers, I think Tepal very much fits that sweet spot.

I'm an ex-investment banker and have spent eight years on the investment banking side in Canada and globally as an M&A banker, so a student of markets with a lot of corporate relationships and you know as well as I that companies are being much more cautious with how they deploy capital and they're rationalizing their portfolios, many of the projects of which were acquired during much higher, much headier times in the market. They're really spending a lot of time with their teams scrutinizing projects. We obviously keep our eyes open for potentially accretive transactions on the M&A side. However this PEA was to put forward a project that we felt confident we could build ourselves if need be. I think de-risking the project, both technically and financially is the key focus for 2017.

We have a modest budget to take Tepal from the PEA stage all the way through to feasibility for a very reasonable amount of money in the $5 to $6 million US range, and I'm going to be on the road in the next month talking to investors about the project and the company. We have a great asset with a substantial metals endowment, an economic project, a good jurisdiction, ease of permitting, and available infrastructure and sustainable development. I spent a lot of time on community and stakeholder engagement on the ground in Mexico, over the six months that we were developing the PEA.

I can say with certainty that we couldn't ask for a better place to have a project. The community is very much behind what we're doing there. Our project is located primarily on private ground, so we deal with private landowners with whom we're engaging on a regular basis.

We have strong local partners. We have an excellent situation there. We have good security and port access is readily available, port capacity at Lazaro Cardenas, and Manzanillo is readily available. Obviously we'll be shipping a copper concentrate with substantial gold credits, so we need to have a port facility readily available. We're very blessed with infrastructure in terms of power and water. The focus is going to be on advancing Tepal in 2017, de-risking the project financially and technically, possibly bringing in a couple of partners at the local level and finishing some negotiations with respect to our surface rights and things like that.

Dr. Allen Alper: That sounds very good. It sounds like you have a very good plan for 2017. Could you tell me a little bit more about your background, your team, your board?

Mr. Kiran Patankar: Absolutely.

Dr. Allen Alper: I know you have an impressive background, but I'd like you to tell our readers.

Mr. Kiran Patankar: Our board made important contributions to Geologix before I even arrived on the scene. Dunham Craig, our Chairman, lived, ate, slept and breathed Tepal for the last seven, eight years of his career. He is technically incredibly strong, very solid reputation in the market. He is a director of SilverCrest. He took over as the interim CEO for SilverCrest Mines when their CEO became ill. He was part of the team that built the Santa Elena project for a far lower capital cost than anyone, including the market, anticipated. Ultimately that project and company were scooped up by First Majestic last year.

His background before that includes Wheaton River and a couple of other companies, so a very astute, very capable, very hands-on person. I couldn't ask for a better chairman. Dunham is still very much actively involved with the company, brings a ton of continuity to the project. George Brack is a friend, he's a mentor. He's our Lead Independent Director, Chairman before Dunham, investment banker, geologist, built the mining investment banking teams at Macquarie and Scotia Bank, and now sits on the board of Silver Wheaton, is the Chairman of Capstone Mining, and is on the board of Timmins Gold as well, so incredibly astute, very strong on the capital market side. Then Randy Smallwood, he is probably well known to you, CEO of Silver Wheaton.

Dr. Allen Alper: Yeah, I've interviewed Randy and did a featured article on Silver Wheaton.

Mr. Kiran Patankar: I'm blessed to have Randy, and Randy does not sit on many smaller company boards. He has a pretty full slate, but he's very actively involved with the company. I think he has stayed with this for quite some time, even during the three years of quiet activity because he's a believer in Geologix Explorations, as is the rest of the board, and the long-term potential of the Tepal project. On the accounting and corporate governance side of things, I couldn't ask for a more knowledgeable person on our board than Graham Thody. He has worked hand in glove with Dunham because they share directorships with SilverCrest, strong, strong capital markets and financial focus, and he heads up our audit committee. Very importantly about our company, is the corporate governance here is incredibly strong. Everything is passed by the board. The board gives me their full faith and confidence.

I feel very fortunate to have Dunham, George, Randy and Graham there to mentor me. I'm a young CEO. I'm 40 years old, and just to give you a brief synopsis of my background, I am an intellectually curious individual. I grew up outside of Philadelphia, Pennsylvania, and ended up in Colorado, fell in love with the geology of the Rocky Mountains, got my under-graduate degree at the Colorado School of Mines, and I graduated with a B.S. in Geological Engineering in 1999, and then proceeded to work in the industry for a couple of years. I did all the mineral exploration and petroleum exploration work as an under-grad and worked for some think tanks and government entities and whatnot. Then I ended up back on the east coast. I ran ready-mix concrete plants for a couple of years, built some very practical skills while I was managing a blue collar manufacturing business. I did a turnaround at one of the plants that I was running, learned practical skills including fixing diesel engines and welding, and running heavy equipment. I love the salt of the earth part of this business. I'm an engineer by training, so I like to get my hands dirty and roll up my sleeves. I ended up wanting to pursue my business education after that, and ended up at the Yale School of Management, where I received my MBA in 2007, and then right out of MBA in 2007 I was recruited and started working for Macquarie, on their global mining investment banking team first in Vancouver from 2007-2009, and then three years in Toronto.

Left Macquarie in 2011 as a Vice President and became Managing Director of Mackie Research Capital, which is a Canadian boutique investment bank, largely focused on the resources sector. I ran their mining investment banking team for three years from 2012 to the end of 2014, then 2015 I was recruited to run a public gold mining company, more of an exploration company, listed on the NYSE at the time, and the TSX. I was brought in as a turnaround expert. It had a very small resource, and the markets were quite poor. I completed an acquisition of a 1.2Moz gold project and oversaw a PEA, then managed a competitive M&A sale process that resulted in an announced transaction and completed $500k equity financing. Unfortunately, the acquisition transaction was never consummated and I left to pursue other opportunities.

When the Geologix opportunity came up, I evaluated it with the banker's eye that I use on every asset and every company. I respect the board, I love the characteristics of Tepal, which the board kept in good standing ready to be taken forward, and the opportunity to relaunch the company with some updated economics and a new design concept. It's a very clean company from the standpoint of balance sheet, cap structure, et cetera. I think the board brought me on due to my strong technical and financial skills. We're still in early days here, but I think things are looking up for the company.

Dr. Allen Alper: Well, that sounds like you have a very impressive background and an extremely strong board, so that's really excellent. Great team! Could you tell me a little bit about your capital structure?

Mr. Kiran Patankar: Absolutely. We've about 188 million shares outstanding right now. We have about 17 million options. A fund out of Europe, on our last financing, came up to 9.9%, so just under 10% ownership. The way the board kept this project up and unencumbered was by putting their own dough into the company and financing the company when the cost of capital was quite a bit higher. They kept Geologix up and running with their own money because they believed that much in the long-term potential of the project. Board and management, I myself own 550,000 common shares and 600,000 options with an 8-cent strike price. A significant part of my compensation is in the form of equity. I think that's going to continue as we go forward. This is how we're able to keep our burn rate as low as it is. The board receives no cash compensation. Despite being some of the most successful people in the industry, they are compensated with options and equity, and management and directors combined own right around 10% of the company with substantial skin in the game.

Geologix is a very widely held company, that remaining 70-80% is widely held. We trade about 200,000 shares a day so good liquidity, despite the fact that the company's been fairly quiet news flow-wise over the last couple of years. I think that's only going to increase as we go forward and continue to put good news out into the market. Then in terms of cash, we raised 1.2 million Canadian and we spent very judiciously on a PEA and a couple of key employees, myself and my CFO Evelyn Abbott, who's a very important part of this team. We're very glad to have her extensive knowledge of capital markets, accounting, finance and record keeping and bookkeeping. She's also our corporate secretary. We have an employee in Guadalajara, who's my right-hand man in Mexico, but right now that's it.

We brought mostly institutional money in at that level to finance the evaluation of Tepal and give us about a 12 to 18 month operating budget. We entered the year with just over half a million dollars US. We have very low G&A, and very little expense in terms of property management. Keeping the property in good standing in Mexico is fairly inexpensive. We will be out on the road. I would like to see the share price start to reflect the fundamental value of Tepal before we would pull the trigger on any type of equity deal.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Kiran Patankar: It comes down to our great asset and experienced team of people. The project is one of the larger copper, gold, porphyry projects in Mexico, a very desirable jurisdiction, with a 1.8 million ounce gold endowment and almost a billion pounds of copper in the total resource, and the economics of the PEA under the 20,000 tonne per day smaller throughput type of design concept. It's largely flying under the radar, with its valuation of 15 million bucks Canadian. Our current market cap reflects three years of near-dormancy. Considering the value of our Tepal asset and the team behind it, I think this is a screaming buy at eight cents.

We're trading at eight cents today. When I was announced as CEO, we completed a financing and the stock traded up to 14, 15 cents, with no news. We spent that money in the right place, and a lot of time in Mexico, understanding the project and development plan. So I think it is worth more today than it was when it was at 14, 15 cents on no news. I think if you start comparing it to our peer group of development-ready, advanced gold projects in the Americas and safe jurisdictions, you'll be hard-pressed to find a company that has such an attractive valuation and upside frankly.

As an investor your money's going to be well looked after. We're going to spend every dollar of it looking to increase shareholder value and we're going to do things that are accretive. I think those are the key highlights. It’s early days now. I think there's going to be a lot of news flow here in 2017 on the back of this PEA result that investors can look forward to.

Dr. Allen Alper: Those sound like very strong reasons for our investors to consider investing in your company.

I'm associated with some colleagues who represent a very large refinery. At some point, maybe after your feasibility study is done, they would be interested in your doré bars of gold and silver, and they could even help with investment to help you get there. That might be something for you to consider as you go forward.

Mr. Kiran Patankar: Thank you, I appreciate that and I would definitely be interested in talking about it. As part of that advanced work done in 2013 on the project, the company had produced, via a pilot plant, a 26% copper concentrate that was marketed to smelters. With a pre-feasibility already completed and these types of concentrate marketing studies done, permits in hand, there's a lot to build on here with this company. I would love to talk to you again once we've reached some further milestones. I would also be very appreciative of having a conversation with you about the refining side of this.

Dr. Allen Alper: It all sounds good. I’m looking forward to interviewing you again once you’ve reached some further milestones. I have a very good feeling about you, your team, your board, your 100% owned advanced-stage Tepal Gold-Copper Porphyry Project in Mexico and Geologix. I have interviewed many, many companies over the years and watched them grow and prosper. It’s a great feeling!

http://www.geologix.ca/

Geologix Explorations Inc.

570 Granville Street, Suite 501

Vancouver, BC V6C 3P1

Canada

Kiran Patankar

President, CEO & Director

Geologix Explorations Inc.

M: +1 (610) 937-8727

E: kpatankar@geologix.ca

|

|