Interview with Paul Kuhn, President of Avrupa Minerals Ltd. (TSX.V: AVU): A Prospect Generator Business Model with Projects in Portugal, Kosovo and Germany

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/22/2017

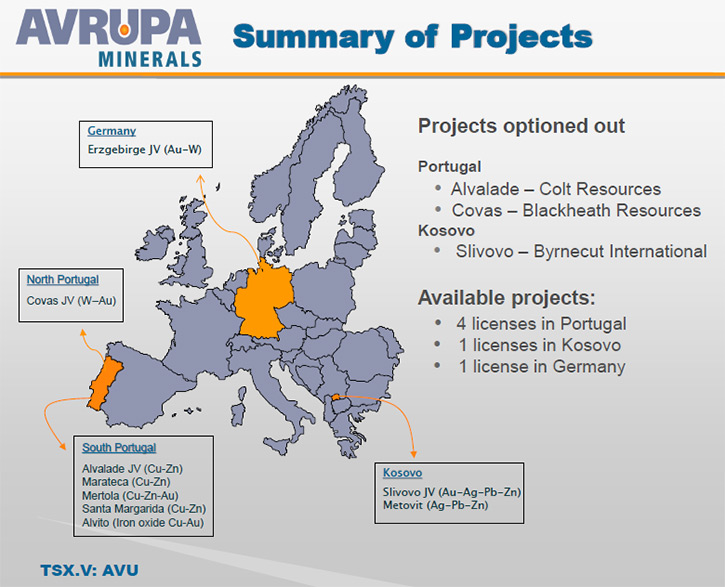

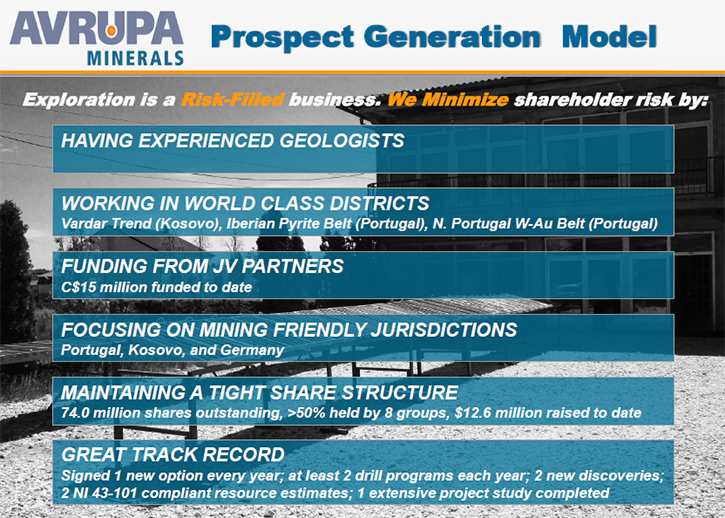

Avrupa Minerals Ltd. (TSX.V: AVU) is a growth-oriented junior exploration and development company focused on discovering valuable mineral deposits in politically stable and prospective regions of Europe. The Company currently holds six exploration licenses in Portugal, two exploration licenses in Kosovo, and one exploration license in Germany. Avrupa is using a prospect generator business model and has three joint ventures, two in Portugal and one in Kosovo. We learned from Paul Kuhn, President of Avrupa Minerals, that in 2017 they will advance programs in Portugal, where they have a JV with Colt Resources, called the Alvalade discovery, as well as three other projects that need a JV partner. According to Mr. Kuhn, Avrupa is poised to move ahead, thanks to its business model where they are largely using their JV partner's money to advance their projects.

Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Paul Kuhn, who is President of Avrupa Minerals. Could you refresh our readers on what your company is doing, where you're exploring? I know you have exploration in Portugal, in Kosovo, and Germany.

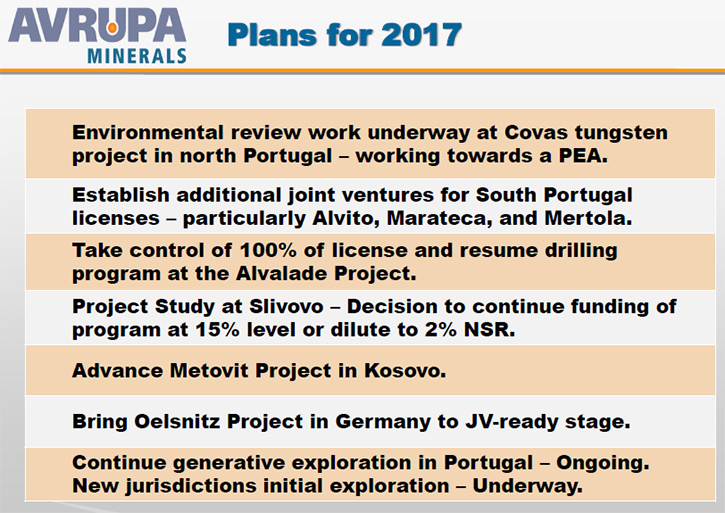

Paul Kuhn: Gladly. Avrupa is a prospect generator. We are in areas specific to Europe. We do work in Portugal, in Kosovo, to some in extent in Germany and we're looking around in other places around Europe. Our main area for the last year or so has been Kosovo with a gold project there. This year, 2017, we are expecting to get back and push our programs in Portugal. The reason for this is that our Kosovo project is now at a point where our partner is really running the show. We have just received a detailed study from them on the potential of the project. They spent 2 million Euros in 2016 and now have 85% of the project. We are now in a position on that project to make a decision as to whether we will continue funding the joint venture at a 15% level or decide to dilute down to a 2% royalty. Avrupa decided to allow the Slivovo partner to continue to fully fund the C$ 8 million exploration program for the coming field season.

The project is going to cost a lot of money this year as far as exploration goes. Our partner has proposed a C$ 8 million budget of drilling and exploration to increase the ounces in the deposit. That would cost us C$ 1.2 million for just the drilling project. If we decide not to fund our portion of the project and let them fund everything and dilute us down to the royalty, then we have that money to use elsewhere. Particularly in Kosovo where I think we can find more deposits, and elsewhere in Europe, of course. So Avrupa decided to allow the Slivovo partner to continue to fully fund the C$ 8 million exploration program for the coming field season.

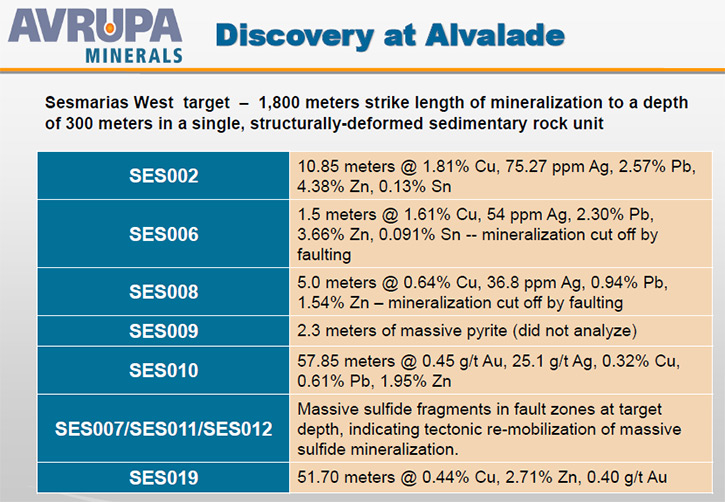

Kosovo is at a point for us where it's time to look ahead. More on that decision shortly. This is why we're going back to Portugal. We have a discovery there, at Alvalade and a partner in that project has been unable to fund since the beginning of 2016. We are now looking at ways to consolidate the Alvalade Project so we can get back to work there.

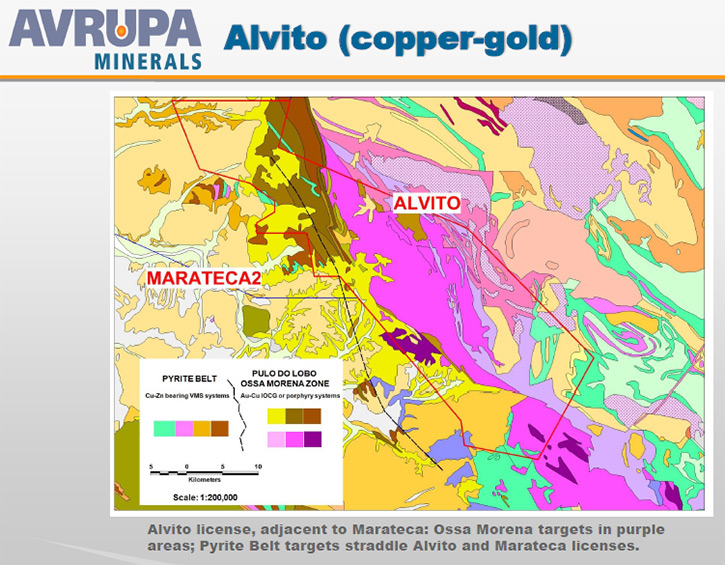

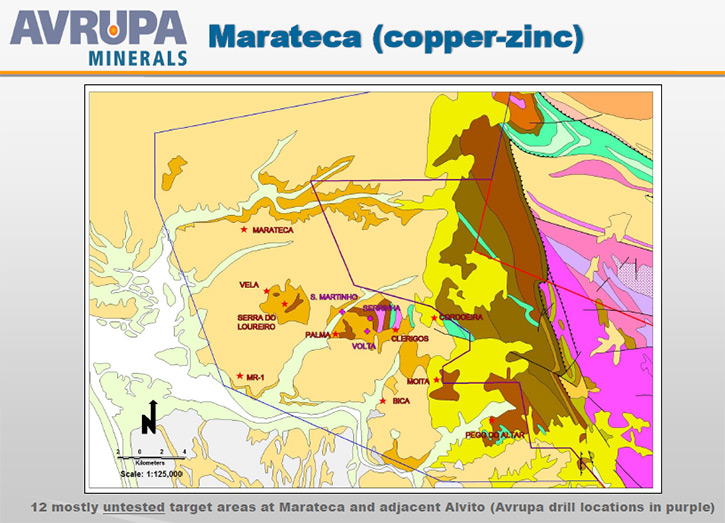

We have a pending joint venture at Alvito, a copper-gold property. I will be in Vancouver in a couple days, to discuss a potential joint venture on that one. We are going to be talking to our underlying owner of the 60% with Alvalade while we're there in Vancouver, and we're looking for joint venture partners for Mertola and Marateca. These are all copper-zinc properties that have a lot of potential drill targets. We did a little drilling at Marateca at the end of 2016, and our surface mineralization at the Pego do Altar target continues down dip. Now we're logging and sampling the core.

I expect, Al, to spend more time in 2017 in Portugal than anywhere else. We have four base metal projects that are moving ahead and we have our tungsten project up north as you know. Our partner there seems to be making noises again to have funding available for deposits. I'm in Vancouver this coming week. And, I'll certainly be talking to Blackheath concerning how the future of Covas looks.

Allen Alper: That sounds good.

Paul Kuhn: We're going to be busy Al. Portugal is going to be our main program for the next six months. We made a couple applications, there's some submittals that I have to look at. We think we're going to get Alvalade going again and advance the copper-zinc discovery, as well as aim for other targets on the license. And we think we're going to get the Alvito copper-gold project going this year.

Allen Alper: That's very good. Could you elaborate a little bit more on some of those properties, in Portugal?

Paul Kuhn: Sure. Alvalade is the property that contains the massive sulfide discovery we made back in 2013. Our partner at the time continued funding through the end of 2014 and then decided to leave Europe. Eventually Colt Resources purchased their 60% of the Alvalade project. We did some drilling in the fall of 2015, made a further massive sulfide discovery, but then Colt was not able to continue funding and the project has been dormant in 2016. That's the Alvalade project.

Alvito is an iron oxide copper-gold target. We've discovered mineralization in 2013, 2014, early 2015. Then we had Lowell Copper as a partner there for a few months in 2015, and spent 137,000 Euros on the project, but then they closed shop and went in different directions. We've been inching the property forward during 2015 and 2016 and now we have an interested party in the project. We'd like to see it move ahead pretty quickly as well. Again, it's a copper-gold property, I'll emphasize the copper right now but you can get some decent gold targets there.

Then we have Mertola and Marateca, both again Iberian Pyrite Belt copper-zinc properties, and we've developed drill targets at both properties. One at Marateca is called Pego do Altar, and we discovered an outcrop of gossan there. This fall we drilled a couple of shallow scout holes, down dip on the target area and found mineralization in the rocks at 25/ 50 meters down to about 100 meters down from the surface. This indicated that the mineralization in the gossan target continues down dip. It’s hard to tell at this point whether the mineralization is a stockwork directly related to a massive sulfide system or a stockwork related to the re-mobilization of a massive sulfide system, but what it tells me is that either way, there is some good potential that massive sulfide mineralization could be nearby, and we'd like to get somebody in to help us move that project forward. We're logging the core now and we'll go sampling in the near future. It looks interesting. That's just one of half a dozen, or seven or eight targets on the Marateca property.

At the Mertola property, we've still done very little work. We have developed a very nice drill target at the Chança target, which other people have drilled, but we feel they missed the real target. We've done no work around the old Sao Domingos mine, which is an end-of-the-19th century through 20th century copper mine in the Pyrite Belt. It's on our license, there's one lens that we know of but these deposits in the Pyrite Belt are typically four and five lenses. We need to do some exploration work there. The old mining operations produced about 25 million tons of +1% copper and the prospect is ready for us to have at it! There are a number of other known, highly prospectable targets on the license, and much of the license is still basically un-explored.

Those are our four main projects in south Portugal. I can't say very much about Covas, Al, and I know you like that one, because of the tungsten possibilities. Actually, it's been difficult for Blackheath to fund this past year but right now they're working on a number of possibilities. We hope to hear from them in the near future about how Covas is going to move forward.

That's Portugal. We're going to be busy in Portugal this year. There's no doubt. I made two applications on Pyrite Belt land this past fall, so we'll start evaluating them in 2017, as well.

Allen Alper: That sounds very good.

Paul Kuhn: We're excited about it.

Allen Alper: That sounds like you have some very interesting prospects to pursue in Portugal.

Paul Kuhn: You keep asking me about our German project, and it's good that you do. I think this year is going to be our last opportunity to move that one forward. I've got some people that are interested in the tin possibilities. However, I'm still more interested in the gold possibilities, myself. This spring, summer, we're going to have to move that one forward. I'd like to say it'd be with a funding partner but at the moment, Avrupa will be planning to move that one forward itself in the short term.

Allen Alper: Could you tell our readers, refresh their memories on your background, and Mark Brown and the rest of your team and board?

Paul Kuhn: Sure. The technical team is based in the Lisbon area in Portugal. The financial team under Mark Brown is based in Vancouver. Mark's a Chartered Accountant. Winnie Wong, our CFO, is also in the office in Vancouver. I'm based in Lisbon. I have a very thin team at the moment because we haven't been so busy. We're in the beginning stages of expanding our geological team in Portugal and eventually in Kosovo. I'm a geologist myself, I have a Master’s degree. I've been in the business since the late 1970s. I've been involved in a number of discoveries in Turkey and now Portugal and Kosovo. Our team has been very successful. Our business is to look at old areas in new ways and use new ideas to do low-cost, early-stage exploration with the hope of advancing the properties to a point where a project can be joint-ventured to a bigger company with more money and more staying power.

That's our group right now. We have a great financial group in Canada and our technical team in Portugal and Kosovo has made two discoveries in the past couple of years and we're heading out towards a couple more, I hope.

Allen Alper: That's very good. Could you tell me a little bit about your share structure and how your stock is listed?

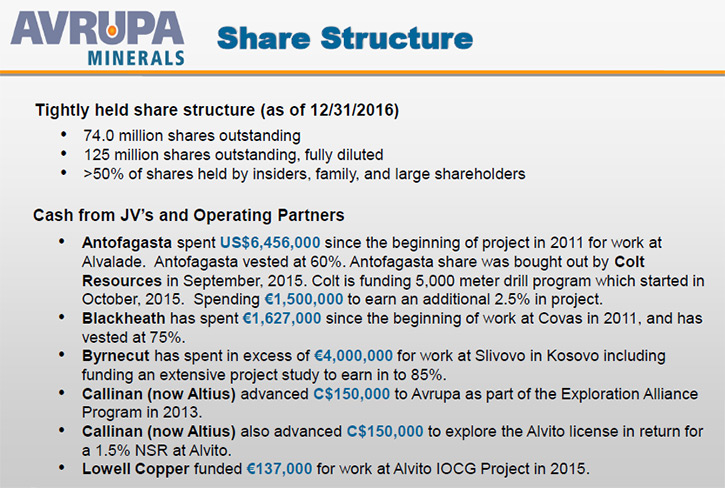

Paul Kuhn: We have 75 million shares outstanding. About 45% of those shares are held by eight entities. Another 25 or 35% of the shares are held by long-term holders, whom we know. 20 - 30% of the shares are free floating. It's good to have strong, long-term backing, but that has made our float a little bit on the thin side, which sometimes made entries and exits not as easy, at least until recently. Our share volume has gone up significantly in the last two or three months. We have $500,000 Canadian in the bank at the moment. The share price is hovering between 10 and 13 cents. We were at 12 the 18th of January. We're hanging in there pretty well. We've moved the company forward in 2016, even with diminished funding in our joint ventures in Portugal. Our study in Kosovo has indicated how to move forward on that project. That's our program right now.

Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Paul Kuhn: It's the same positive story that I've had for a while. I think we're on the verge of breaking out. The market for copper and zinc, the prices are high. They've gone higher in 2016. Lead prices are up. Tin prices are up. Gold prices have been up and down and making things a little bit difficult for the junior market. Avrupa is poised to move ahead because of its joint venture program. We spend money wisely, of course. Our joint venture partners have actually funded quite a bit of our program. For every dollar we spent from equity made funds, our partners have spent about 1.5 dollars. We're doing the project generator model properly. We're moving things forward, using our partner's money for the most part. We've also started moving some of our projects forward with our own dollars. We see the merit in doing our own work, when it is necessary and when we have a prospect that we think we can really move forward ourselves and get a better venture on it, or perhaps run it on our own if it's good enough.

Allen Alper: That sounds very good. Could you tell our readers a little bit about the partners you have?

Paul Kuhn: Okay. Blackheath Resources is our partner at Covas in north Portugal, the tungsten project. They're a company that's specifically working on tungsten projects around Portugal. Our partner at Alvalade in south Portugal is Colt Resources, but they have not been able to fund the project in 2016. We are now looking at ways to consolidate the project to the point where we get the whole thing back.

Our partner in Kosovo is Byrnecut International. They're a mining contractor based in Australia, a private company. They work around the world, certainly on five continents right now. They're well-funded. They're well known and they've been a very strong partner for us in Kosovo.

Allen Alper: That sounds very good. Is there anything else you would like to add?

Paul Kuhn: No, I think I've elaborated profusely on the good things that are happening at Avrupa. We're pushing to move ahead in 2017. We think we're going to get the Alvalade project back, we think we're going to get a joint venture at Alvito. We have two other projects in Portugal, poised for joint ventures. Kosovo, I'm looking to restart general recon in the country and go out and find a couple more gold projects.

Allen Alper: That sounds very good.

http://www.avrupaminerals.com/

410-325 Howe Street

Vancouver, BC V6C 1Z7 Canada

Phone: +1-604-687-3520

Fax: +1-888-889-4874

Email: info@avrupaminerals.com

|

|