Claude Lemasson, President and CEO of Eastmain Resources (TSX:ER): Aggressive Gold Exploration in James Bay, Quebec (PDAC Booth # 3100B)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/18/2017

Claude Lemasson, President and CEO of Eastmain Resources, tells us about their aggressive exploration strategy for gold exploration in James Bay, Quebec. They have 11 properties and are steadily advancing 3 active projects. With a strong treasury, a great land position and mining friendly jurisdiction, Eastmain is positioned to complete its 75,000 meters company-wide 2016-1Q2017 exploration program, setting the building blocks in place to complete both a mineral resource update followed by a Preliminary Economic Assessment in Q4 2017 at the Clearwater Project. Mr. Lemasson sees a strong upside potential for gold in 2017 and the market contraction has left Eastmain in a solid position, with a better leverage on the price of gold as a strong junior mining company.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Claude Lemasson, who is President and CEO of Eastmain Resources. Could you refresh the memory of our readers and tell them what differentiates Eastmain Resources from other companies, the resources you have in Quebec, and what's happening?

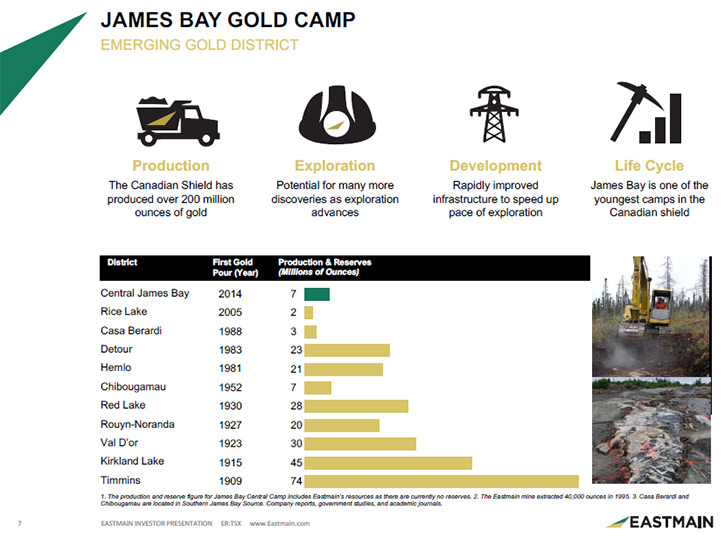

Mr. Claude Lemasson: Yes, absolutely. Thank you for having us. Eastmain Resources is an aggressive junior exploration company that operates mainly in the James Bay area of Quebec. The James Bay area is a very large area, in the central part of the province of Quebec in Canada. It has great infrastructure, roads, and airstrips. It also has hydropower from the Quebec government, through Hydro-Québec, the same company that provides power to many of the states in the Northeastern states, including New York State. We operate as an exploration company looking mainly for precious metals, particularly focused on gold. We have 11 properties in total in the area, so we're very specific to the James Bay area.

Within those 11 properties, we have three active projects that we are advancing at a fairly steady pace through extensive exploration, including drilling activities on all three. We have those three projects at three different stages. What makes us a little different is that we have a great land position in a great jurisdiction, and we are very well financed and very active moving forward on those three key projects, all of them with great potential for growth and increasing gold resources.

Dr. Allen Alper: Could you elaborate on the three projects, what results you've been obtaining, and what your plans are for each project?

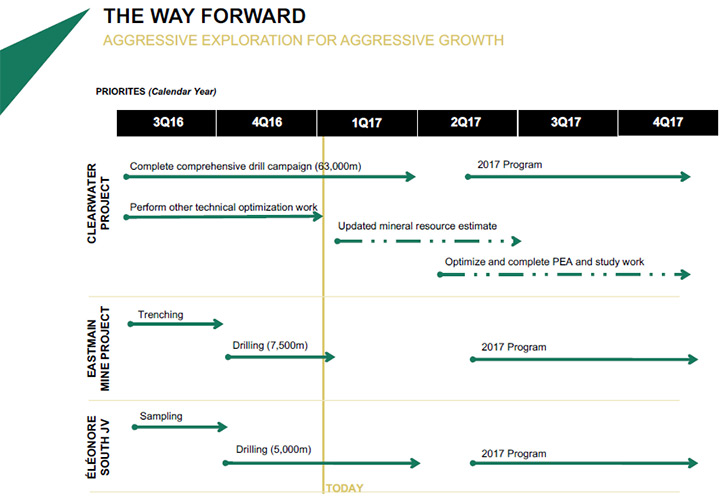

Mr. Claude Lemasson: Absolutely. The anchor project is called Clearwater. It has a known deposit, called the Eau Claire deposit, within the Clearwater property. At the Eau Claire deposit, we have just under a million ounces of measured and indicated resources, in and around 4 grams per ton grade. We also have inferred resources at over 600,000 ounces at also just under 4 grams per ton. We have a very active drilling program on the project. We initiated that program back in August last year, and will go on until roughly the end of March 2017 to complete the 63,000 meter program. We're well on our way and issuing results on a regular basis. That will continue for the next three months.

That will be followed by a new resource estimate that we will do in the second quarter of 2017. We will follow that with a preliminary economic assessment later in 2017, for that particular resource. We have been very active and have had some excellent results. We're confirming a lot of the mineralization, as we expected. We're also slightly expanding the mineralization within the deposit itself. We're doing some exploration nearby, which is related to the same deposit, in the hope of extending further mineralization near surface, particularly to the east of that deposit. That's our anchor project, where a lot of our energy is concentrated.

We do have two other projects that are fairly important. The second one is called the Eastmain Mine Project. The Eastmain Mine is a past producer. It produced in the mid-90s, over 40,000 ounces of gold, at over 10 grams, in a shallow underground setup. We are currently revisiting the known historical resource that is around 256,000 ounces, at about 10 grams. We're revisiting that as well as exploring to the northwest of that resource, within about two miles. We have four key targets, on which we have been actively drilling and issuing results, as well as trenching on those targets, exposing the ground and the rock. We have identified some very high-grade mineralization, not only of significant high-grade gold, but also silver and copper. Some great results have come out of that. We recently announced a discovery and we have more results coming out in the first quarter of 2017 on that particular property.

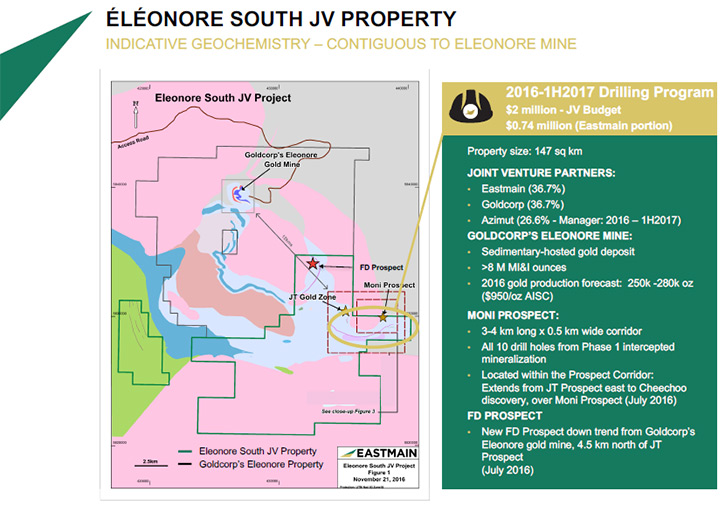

The third one is the Eleonore South Joint Venture property, about 25 miles north/northwest of the Clearwater project, our anchor project. That's near the Eleonore Mine which is one of the anchor mines for Goldcorp, one of the largest gold mining companies in the world. They have a large producing mine at Eleonore, and the Joint Venture property is literally within 8 miles. We are focusing on a new potential discovery in the area. We initiated a program as Phase 1 in late 2016. We've drilled 10 holes in this prospective corridor, and we've hit mineralization in every hole. That is fairly significant for us, and we will initiate our Phase 2 in the next three months. In Phase 2, we'll do another set of 12 holes. We'll try to define this new potential discovery better and the mineralization we have there. Those are the three key projects that we're focusing on right now.

Dr. Allen Alper: Excellent projects! The Eleonore South, that's a joint venture, Claude?

Mr. Claude Lemasson: That is correct, yes. The Eleonore South is a three-way joint venture with Goldcorp and Azimut. Our portion of the joint venture is 36.7%. Goldcorp, who owns the Eleonore Mine nearby, also has a 36.7% portion and the third partner is a smaller company out of Montreal called Azimut. Azimut has 26.6% of that joint venture.

Dr. Allen Alper: That's very good. Could you tell me a little bit about your background and your team?

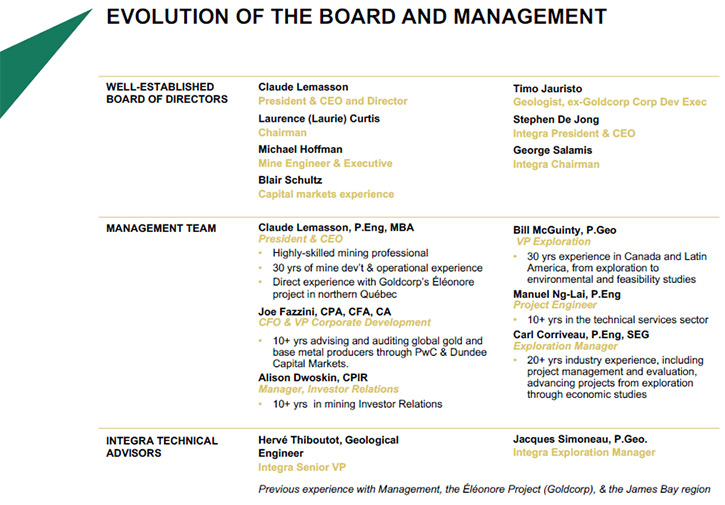

Mr. Claude Lemasson: Yes, absolutely. I became an independent director of the company, about a year and three months ago, back in November 2015. At the time, I became a director because of my experience generally in mining and in mining and exploration projects and moving them through the different stages from exploration right into production. I also have experience in Northern Quebec. We had some changes within the company back in March and April 2016. Through those changes, we essentially put together a new board of directors and a brand new management team. I took over at that time, as President and CEO of the company.

From there, I built a brand new team, bringing in some highly qualified people with very good experience in the mining sector, including Joe Fazzini as a CFO and VP Corporate Development. We also have Alison Dwoskin, Investor Relations Manager and Bill McGuinty as VP Exploration. We brought in a project engineer, Manuel Ng Lai, a key person who does a lot of our internal work in our modeling and what we call the block modeling, dealing with the drill data and looking at it from a 3D perspective. We are fully staffed in Quebec as well, on all our different sites. We have senior exploration managers and geologists on every site, with all the support staff and the drilling contractors.

As far as my background, I've been in the mining business for 30 years. I'm an engineer by profession, became an executive over the years. I was an executive with Goldcorp from essentially 1999 to 2009. I was the project manager who built the Red Lake Mine for Goldcorp, which became their main asset as a company. That's what propelled them from a junior to becoming a major. I also became the general manager of the mine at Goldcorp, in Red Lake, from 2000 to 2006, then general manager of projects for Goldcorp for North America. Our anchor project at the time was the future Eleonore Mine in Northern Quebec. I was actually responsible for that project in its first three years of existence.

Then I moved on to be President and COO of Guyana Goldfields. We had a multi-million ounce mine in Guyana, South America that I moved through from advanced exploration right up to feasibly study, over about three years. That mine is now a producer and doing very well for Guyana Goldfields. That's been a lot of my experience. I've sat on a couple mining company boards in the past and am still an independent director of another successful gold junior company called Premier Gold. I’m knowledgeable and well-connected in the industry, with a wide spectrum of experience, from advanced exploration, right through building and operating mines.

Dr. Allen Alper: Excellent background! Very impressive! Eastmain is very lucky to have you as their leader.

Mr. Claude Lemasson: Well, thank you very much.

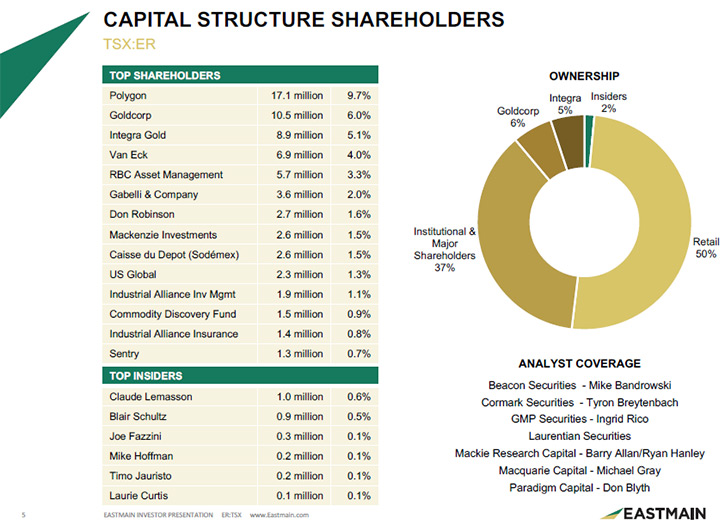

Dr. Allen Alper: Could you tell me a little bit more about your capital structure? I know you have some impressive investors, too.

Mr. Claude Lemasson: Absolutely. Other than building the senior executive management team, one of the first things we did when I took over, back in late April, was to start looking at our treasury, the money we had and the programs we wanted to execute on. We took a two-fold approach. First, we wanted to improve our capital structure from a shareholder basis. Very important, because we wanted to get the story out that this is a renewed company, with some very strong assets, a new vision, a new approach, and a very, very clear plan to execute moving forward.

We were able to do that, and we were able to go out there and meet with many different investors, retail as well as institutional. Many of them have become shareholders, including major shareholders. We have a very strong slate of major shareholders, particularly in the last nine to ten months. We have Polygon out of London, which is a major shareholder, a big mining investment fund, 9.7%. We also have two gold mining companies that are the second and third major shareholders. Goldcorp, a 6% shareholder, and Integra, a junior company that's been very successful in Quebec, at 5.1%.

From there, we got many other well-known funds, I'll name a few, going from 4% ownership down to around 1%. VanEck out of New York. RBC, that's Royal Bank Capital Asset Management, out of Toronto. Gabelli and Company, out of New York. Mackenzie Investments out of Toronto. Caisse du Depot (Sodémex Fund), which is out of Quebec, a major investment group that invests particularly in Quebec assets. US Global, from Texas, is a major shareholder as well, and various others. Very strong shareholder base. We're pleased with that. I think they've been pleased to join our company, become shareholders and see what we can do.

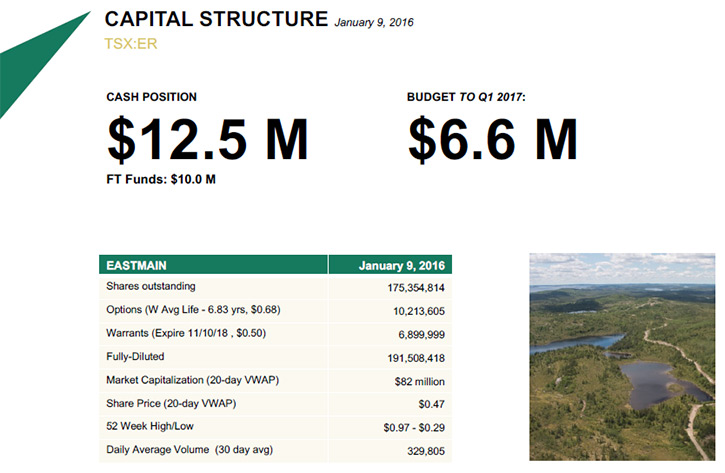

Second we wanted to build our treasury. We went out and completed financings in the early days, in April, May and June of last year. We raised quite a bit of money, over 22 million dollars. We now have a cash position in the bank of 12.5 million. A portion of that, about 10 million, is flow-through funds, so those funds are dedicated to exploration. Our budget until approximately May is around 6 million. We're well-funded, we can continue executing on our plan, and we're pleased we're able to show good results to the market through many press releases to come in the next three to four months.

Dr. Allen Alper: That's very impressive. You're in a great position to be well-funded and to be able to use those funds for exploration. Could you tell me a bit more about what your plans are for 2017?

Mr. Claude Lemasson: Sure. We look at 2017 in really two phases. There's the current phase, the next four to five months. That phase is really the extension of 2016. We're continuing to drill on the various projects, continuing to issue results and assess them. Around April or May, where we are going to regroup, review all of the results, and come to a decision point to better define the rest of our 2017 program, phase 2 for 2017. Which will start in or around June. That phase will be very intensive, probably even more intensive than the work that we did in late 2016. Now that we're well set up and not in transition anymore from the previous management, we're going to go very aggressively from June on. We will be drilling extensively on all three projects, June 2017 to end of 2017.

The plan will be defined based on success and what we've seen on all three projects. We will be able to move each project forward in an even more aggressive way. Clearwater is the anchor asset. Not only are we going to drill some more in 2017, but we're also doing a resource estimate, which is going to be due in mid-2017. We're going to follow with a preliminary economic assessment. All this happens in parallel with the ongoing drilling at the site. That's our plan right now, and it will be better defined in the next few months. We have a very clear path to growing the resources within our company.

Dr. Allen Alper: It sounds like 2017 will be a very exciting year for Eastmain Resources.

Mr. Claude Lemasson: Yes, we believe it will be.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Claude Lemasson: The first reason is the gold market in general. The gold market has seen a positive return in 2016. We saw an upswing in early 2016, particularly in the first half. We did see an adjustment in the second half, but already in early 2017 we're seeing positive signs of the upward trend of the gold price continuing. We see that as a positive now, and over the longer term. Medium to long-term, we see gold continuing to trend upwardly. From that basis, it’s an interesting market to be in for investment.

Second of all, because the gold market was so tough in the last five years, many, many companies have not invested in exploration. Exploration is really the R&D of mining. If you don't do your R&D, if you don't do your exploration work, you are not building up resources for the future. What that means is that we're seeing depleting resources moving forward. There are mid-tier and major mining companies, in gold particularly, producing currently at a certain rate, but not able to sustain that rate over the long term because they have not replaced their resources. That makes the discovery of new resources even more in demand. There is really a high demand for high-quality, higher grade gold projects.

As a junior exploration company, we have the potential to develop those kinds of projects. That makes us very attractive. Our value is particularly emphasized because of that fact. Because there's a scarcity of good gold projects out there, or good gold discoveries, anybody who has something important or significant in their hands, who has great assets like we do, becomes much, much more attractive. That's certainly another angle that makes it very interesting for investors to look at and think of the medium to long-term and say, "Where is this going? Where are we going to be sitting in six months, a year, or two years, or even five? What does this mean?" We're really seeing all of these trends being positive trends for us and for the industry in general, particularly for our company because we are so well positioned within that cycle.

Dr. Allen Alper: That sounds excellent! Very good! Strong reasons why high-net-worth investors should consider investing in your company. It makes me happy that I'm an investor in your company.

Mr. Claude Lemasson: Great. We appreciate that.

Dr. Allen Alper: Is there anything else you'd like to add, Claude?

Mr. Claude Lemasson: Any investor out there, who is looking for a good, solid investment, has to look at the gold market at large, the trends within gold mining, and quality, quality of the assets, resources, ounces in the ground, grade. Also, investors have to look at the experience and the quality of the management team and what they are doing. Are they a solid executive and management team? Is there a solid board behind them? Do they have a very clear vision, strategy, and an execution plan? Are they showing that they can execute on that plan?

We put all those elements together back mid-last-year. And now we have a clear vision, clear strategy, clear plan of execution, and we're executing on that plan exactly as we said, delivering positive results. These are all factors that I think are very important to look at when you're looking at investing in mining, and particularly in gold mining. I think if your readers/investors look very closely at Eastmain, they will realize it’s a unique company, with all these key elements for success.

Dr. Allen Alper: That sounds great. Excellent!

http://www.eastmain.com/

2400 – 120 Adelaide Street West

Toronto, ON

M5H 1T1

Tel: 647-347-3735

Alison Dwoskin

Manager, Investor Relations

dwoskin@eastmain.com

Tel: 647-347-3735

Cell: 647-233-4348

Disclosure: The Alper family owns stock in Eastmain.

|

|