Interview with John Kontak, President, West Red Lake Gold Mines Inc. (CSE: RLG; FWB: HYK; OTCQB: RLGMF) Focused on High Grade Gold in Canada’s Prolific Red Lake District

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/1/2017

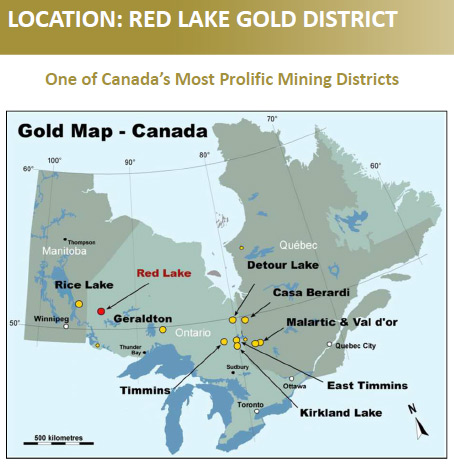

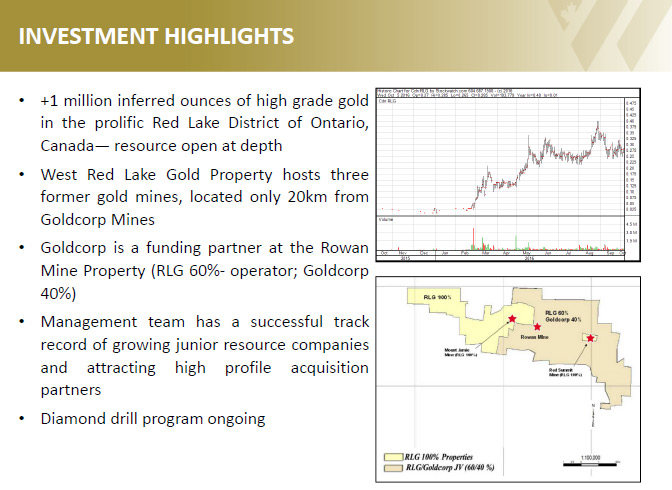

West Red Lake Gold Mines Inc. (CSE: RLG; FWB: HYK; OTCQB: RLGMF) is focused on gold exploration and development in the

prolific Red Lake Gold District of Northwestern Ontario, Canada. We learned from John Kontak, President of West Red Lake

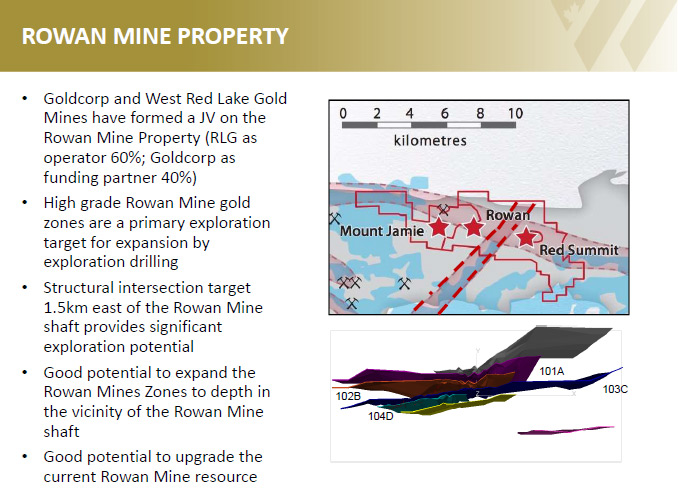

Gold that the company has a 3100 hectare property in three parcels: two parcels are 100% owned by West Red Lake, the Mt.

Jamie parcel and the Red Summit parcel, with former mines on each property; and the high grade Rowan Mine property is a

60% joint venture with Goldcorp. The company's main focus has been on the Rowan Mine property, where they are the

operator. Currently, the company is in the middle of a two or three year exploration program at Rowan Mine, with the gold

of expanding the Rowan gold deposit to something around two million ounces. And there is also a second exploration target

where two regional gold bearing structures intersect on the Rowan Mine property. According to Mr. Kontak, who believes in

gold as an asset class, the company is closely held with major share positions held by management and a few institutional

investors.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing John Kontak, President of

West Red Lake Gold. Could you update our readers on what's happening with West Red Lake Gold Mines, John?

John Kontak: We have the West Red Lake Project property in Red Lake, Ontario, where we're in a joint venture

with Goldcorp. Goldcorp, of course, was founded in Red Lake, Ontario. We have a 3100 hectare property. It's actually in

three parcels. Two parcels we own 100%, the Mt. Jamie parcel and the Red Summit parcel, both have former mines on the

property, but our two main drill targets during the course of 2016 and for 2017 are on the Rowan Mine property portion

of our 3100 hectare property. That's a joint venture with Goldcorp, where we're 60% owner and operator and Goldcorp is

40%.

Just speaking briefly of the regional geology, our property is about 20 kilometers west of the major Goldcorp complex in

Red Lake, where they have the Red Lake Mine, the Campbell Mine, and the Cochenour Mine. The Red Lake Gold District has

produced about 30 million ounces of gold and about 18 million ounces have been produced by Goldcorp. Our property has

about 12 kilometers of strike length on the Pipestone Bay St. Paul Deformation Zone, which is a major east-west trending

geological structure in the Red Lake Gold District, a world-class gold district known for its high-grade ore.

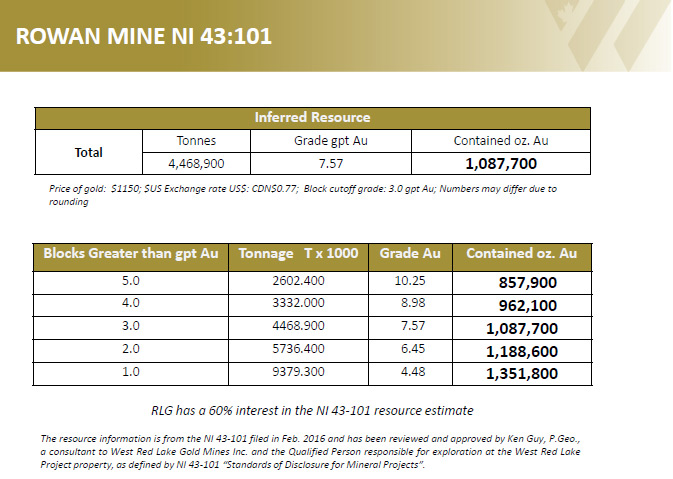

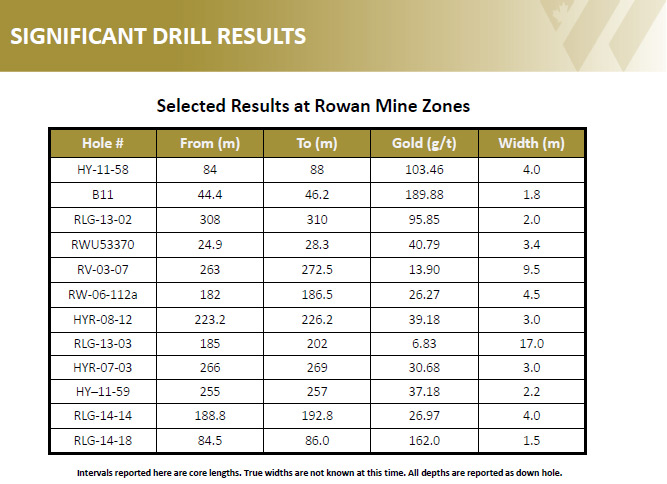

We have two main drill targets that are both on the Pipestone Bay St. Paul Deformation Zone. One is the Rowan

Mine deposit, where we released a NI 43-101 compliant Technical Report in February of 2016 which included an inferred

resource estimate of 1,087,000 ounces grading 7.57 grams of gold per tonne, within 500 meters of surface, so a classic,

near surface, narrow vein gold deposit.

The second drill target is where the Pipestone Bay St. Paul Deformation Zone is intersected by the Golden Arm

Structure, a second regional gold bearing structure. Such geological intersections can host major gold deposits.

John Kontak: What we're doing both in terms of the drill results in the second half of 2016 and as we plan for

the work programs for 2017, we're going to explore to greater depth below the inferred resource area at the Rowan Mine

deposit. We're going to work our way down to about 1000 meters during the course of the next number of years. We're

working a two or three year program with the goal to double the size of the gold deposit.

The grade tends to perhaps increase as you go to depth in Red Lake, and so maintaining the high grade resource in

terms of grams per tonne as we grow the size of the deposit. With improving gold sentiment and deposit values

beginning in early 2016 all the macro pieces appear to be in place looking out over the next few years. As we get more

value per ounce in the ground in Red Lake, as the gold sentiment improves, and we grow the size of our deposit, we think

we can do good things for our shareholders by drilling out the Rowan mine deposit over the next few years. Our September

news release and our December news release reported on the two 2016 drill programs.

At the same time, what you'll see in those news releases is that about a kilometer to the east of the Rowan mine

deposit you have the intersection of two regional gold-bearing structures. The Pipestone Bay St. Paul Deformation Zone

east-west trending geological structure is intersected by the Golden Arm Structure and adjacent NT Zone coming from the

southwest and trending to the northeast. When you get the intersection of two major regional gold-bearing structures you

have the potential to find a large deposit. Goldcorp, our 40% funding partner, understands this because just 20

kilometers to the east is where two gold bearing structures intersect, that took Goldcorp from a company that was tens

of millions of dollars in market cap and changed them into a multi-billion dollar company.

Long story short, Al, is that we have a relatively straight forward exploration play as we drill the Rowan Mine deposit.

Ken Guy, our exploration manager, has been with Tom and me for previous projects exploring and developing gold deposits

in that Archean Greenstone geology in Ontario. He's very familiar with that, and we think we will bring value to our

shareholders and move the company forward in value as we drill out the deposit over the next number of years and ride an

improving gold sentiment. And we also provide our shareholders with more of a blue sky play at the Structural

Intersection where you could find a significant Red Lake style gold deposit.

What we do is de-risk the gold project for the mining industry. As well as conducting drill programs, we're

starting the permitting and baseline studies, water samples, etc., as we prepare to sell these assets to gold producers

and allow all our shareholders get a win.

Dr. Allen Alper: That sounds excellent. It sounds like you're in a great place, discovering excellent gold

resources, and you're next to a great neighbor there, and you're getting great support from Goldcorp, so that sounds

excellent.

John Kontak: We've winterized the exploration camp, and the drill remains on the property. We intend to be

drilling in the first quarter of 2017 and continue to drill more or less on a quarterly basis and keep providing the

drill results to the market. To some extent, it's a very simple game. We're drilling the Rowan Mine deposit, going to

depth, and working to expand the resource estimate. We're getting about $30 an ounce in the ground right now in Red

Lake. In a good gold market you can see multiples of that. Then there is the blue sky potential of the Structural

Intersection.

People that follow gold as an asset class are looking for gold to form a higher bottom, and then move forward in the

course of 2017 and form a higher high. We think that we're going to be in a positive gold sentiment for an extended

period of time, and we're going to de-risk this asset and make it valuable to industry players that are using up their

assets every day as they mine for gold.

Expressed in Canadian dollar terms, the price of gold is quite strong. Canadian miners sell it in U.S. dollars,

but for Canadian gold miners, they're getting something around $1400 an ounce Canadian dollars right now, and they're

producing gold for under $1000 an ounce and brings value to what we're doing in terms of de-risking an asset and showing

how this could be an economic underground gold mine right there in Red Lake, with all the labor, power, roads, mills

with capacity.

Tom and I and Ken Guy and others, we've done this before. I’m directing my comments toward the Rowan Mine

deposit. When it comes to the Structural Intersection, we're developing a whole technical team, Al, because as you know

when you get regional gold-bearing structures intersecting, you get the folding and fracturing of the rock which can

create larger more valuable gold zones. That's what happened with Goldcorp a few kilometers to the east.

Dr. Allen Alper: That sounds excellent. John, could you tell me a bit more about your background and Tom's

background, and your team and your board?

John Kontak: Yes. I think an important thing is that Tom and I have worked on prior Ontario gold exploration

and development companies along with Ken Guy, our exploration manager. We believe, as a management team, that in the

junior gold sector a lot of the value is created during the exploration and development stage. Gold producers know this.

Juniors like ourselves, with proven track records, are the best people to be managing these work programs and allocating

the dollars and identifying the targets. That's what we do.

We have three former mines on the property, so we're looking for gold where gold was found before, but also we

know how to drill out a deposit and have it recognized by first the street, in the capital markets basis, but then

ultimately to sell the asset within the industry to a gold producer as a way to create the most value for shareholders.

I'm a lawyer by training, so I take care of a lot of the administration of the company. Tom's from a fourth-generation

Canadian mining family here in Toronto, so he takes care of a lot of the capital markets and strategy type questions.

John Heslop, for example, the former president of PDAC, is on our board of directors. He joined us at the AGM in June.

He's a senior diplomat in the Canadian mining community, so John's very helpful. He's also a professional geologist who

has put mines in to production.

We're starting to look at the development studies. We're going to work away at this. We have a number of

institutional investors and shareholders who've been with us before. People that have stayed with us over the bear

market, and now, are people who understand that we're on a two or three year timeline here, in which we can take this

company that's worth $20 million today and potentially turn it into something that's worth hundreds of millions of

dollars by drilling the Rowan deposit, and if then we find the blue sky success at the Structural Intersection. It

could be a story that's much more. Our investors and our shareholders, by and large, understand this and have made money

before with us. They're working on these time frames. That's what we're looking to do, and we think that the gold market

and the gold sentiment will support us through that time frame.

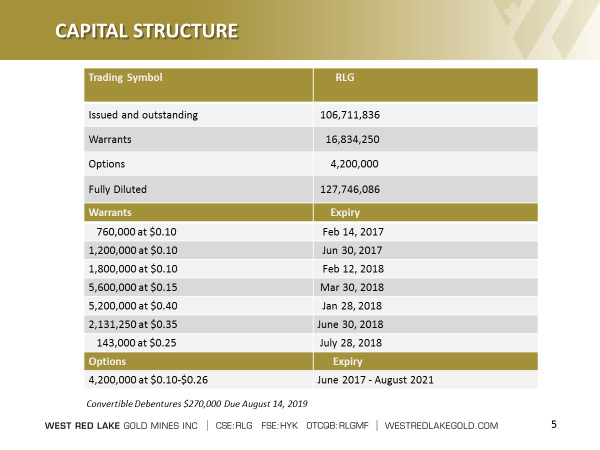

Dr. Allen Alper: That sounds excellent. Could you tell me a bit more about your share and capital structure and

where the stocks are listed?

John Kontak: We are RLG on the Canadian Securities Exchange here in Toronto. We're RLGMF on the OTCQB in the

US, and we're on the Frankfurt Stock Exchange in Germany. We understand that in all three of those places, you have to

support your listing. A significant portion of our stock is closely held by institutional shareholders as well as

management and a few other key shareholders.

So we have a closely held stock with just over 106 million shares outstanding. and we have a float in Toronto

and New York and in Frankfurt. We're actively supporting those listings. In Canada, we've traveled to Vancouver and

Calgary and Winnipeg a couple times this year. Tom was speaking in Montreal and Atlanta recently. I was in Florida and

made two trips to the German-speaking world in the Fall of 2016 including Zurich, Frankfurt, and Munich.

At a certain level, Al, it's quite simple. You drill out the property, and you get out and tell people the story.

Those are the two things we do, and what we have been doing, and what we're going to do during the course of 2017. We're

going to drill quarterly, and news release the drill results quarterly in the course of 2017, and we'll be traveling. We

already have our first quarter travel plans in place, so we'll be out telling the story during the course of 2017. We're

planning for a gold sentiment that supports all that as the year moves along.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should

consider investing in your company?

John Kontak: I would say two things. One is just gold as an asset class, including gold equities. As I say,

we've been traveling a fair amount recently, but we've been going to places that understand gold as an asset class,

Zurich, Munich, Frankfurt, West Palm, Boca, San Francisco gold show, Toronto, Vancouver, even in Calgary. I've been to

Calgary a couple times this year, and as IAs and others move out of oil and gas as an asset class, one of the places they

find attractive is precious metals including gold. As sovereign debt increases, negative real interest rates in various

places, loose monetary policies etc, we think this will lead to an extended positive sentiment for gold and gold

equities.

The other answer I would give to a wealthy individual, for example, is that we as exploration and development

people think a lot of the value is created during the exploration and development stage. We have a track record. The

three things that I have told people, who've asked these questions at luncheons and different places recently, is that

not all boats have risen with the tide as the gold sentiment improved in 2016, but I think those companies that did rise

with the tide had three things, one of which is that they had proven management teams. They were following a template

which allowed them to move quickly and get everything going again once the gold sentiment improved, say in the first

quarter of 2016.

Another thing I think is very important is high grade deposits. The gold producers are going to be looking for

high grade as they look for assets to purchase. The third thing is people are looking for good jurisdictions. I guess

when things get roaring, as they did in prior bull markets, people have been going to central Africa and Latin America

and chasing maybe low grade deposits, etc. But as it gets going here, we have a proven management team, we're in the high

grade gold capital of Canada, and we're right here in Ontario that understands mining, and we have all the infrastructure

in place, etc. Those are just briefly the things I would list.

Dr. Allen Alper: I think those are excellent reasons for our high-net-worth readers/investors to consider

investing in West Red Lake Gold.

http://www.westredlakegold.com/

West Red Lake Gold Mines Inc.

82 Richmond Street East, Suite 200

Toronto, ON M5C 1P1

CANADA

Office: 416-203-9181 x 4600

Email: investors@westredlakegold.com

|

|