Interview with Douglas R. MacQuarrie President and CEO Asante Gold Corporation: Moving the Kubi Gold Joint Venture in Ghana to Production

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/28/2017

Asante Gold Corporation (CSE: ASE/ FRANKFURT:1A9/OTC: ASGOF) President and CEO, Douglas R. MacQuarrie tells us about

his newest venture in Ghana. With 20 years of experience and 11 million ounces of gold discoveries in Ghana, Mr.

MacQuarrie’s team is confident that it has the credentials to drive Asante to success in Ghana. BXC, a wholly owned

subsidiary of Beijing Fuxing Xiaocheng Electronic Technology Stock Co. Ltd. (“BFXC”), has agreed to provide C$19.5

million in funding to earn 50% of the Kubi Gold JV and a 30% equity interest in Asante. Ghana is a stable country with a

mining-friendly government and a huge exploration potential. Asante has a low market cap and provides quite a bit of

leverage on Gold prices. If you are betting on Gold you should consider betting on Asante Gold.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Douglas R. MacQuarrie,

President and CEO of Asante Gold Corporation. Could you tell me a bit about your company and what differentiates your

company from other junior mining exploration companies?

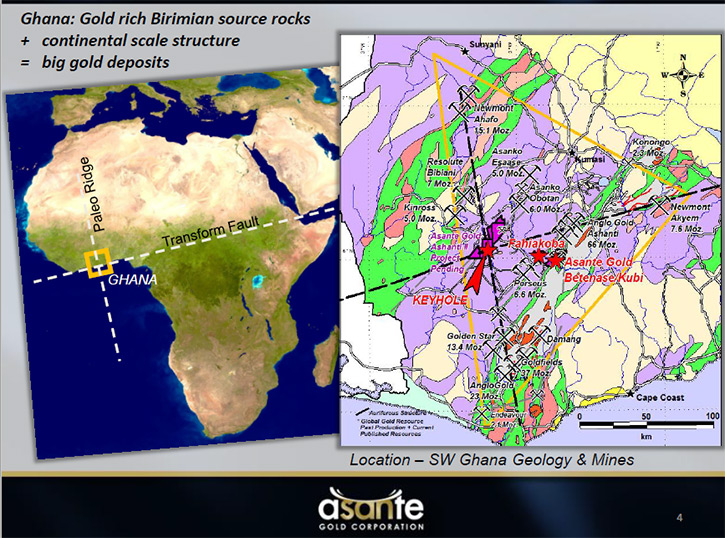

Douglas MacQuarrie: Yes, definitely, Allen. Thanks for that. Asante Gold is a fairly new company. We've only

been public for four years. We're totally focused on gold, and we're totally focused in the country of Ghana in west

Africa. Ghana's one of the major gold-producing countries in the world, 9th largest in the world and second largest in

Africa. There's not a lot of competition in Ghana as opposed to a lot of other places in the world. I think for that

reason, I've been into gold mining in Ghana for over 20 years. In that time, my team has found 11 million ounces of

resources, so Asante is our next shot at finding the next big one in Ghana.

Dr. Allen Alper: That sounds great. Could you tell me a bit more about your properties in Ghana, and how you're

progressing with exploration, and what you have found?

Douglas MacQuarrie: Right, very good. Basically, my background is in exploration geology and geophysics. I

like finding gold. Currently in Asante we have a near production property on which we've just announced a joint venture

with a Ghanaian firm controlled by a Chinese-listed company. That will be a 50-50 joint venture, and it's to develop a

500 ton per day underground mine. Basically the partner's going to put up $19.5 million Canadian to capitalize the mine

and to buy a 30% equity interest in the shares of Asante, so we'll have a very interested partner that can certainly be

there to provide additional funding. We are looking for that agreement to close 28th February 2017, and then shortly

after closing we'll start constructing the mine.

We've designed it as a 500 ton per day direct shipping gold milling operation. Even though you might think $19.5

million isn't a lot of capital for building a mine, if you don't have to build a mill complex with all the licensing and

tailings ponds and all that, it's actually sufficient capital. We believe this $19.5 million will get us to initial cash

flow around 12 to 14 months after we start work.

We also have a bunch of other exploration properties. We've optioned one project from Perseus Mining, and that one has

some initial drill discoveries on it. We plan to do more ground geophysics and a second-phase of drilling.

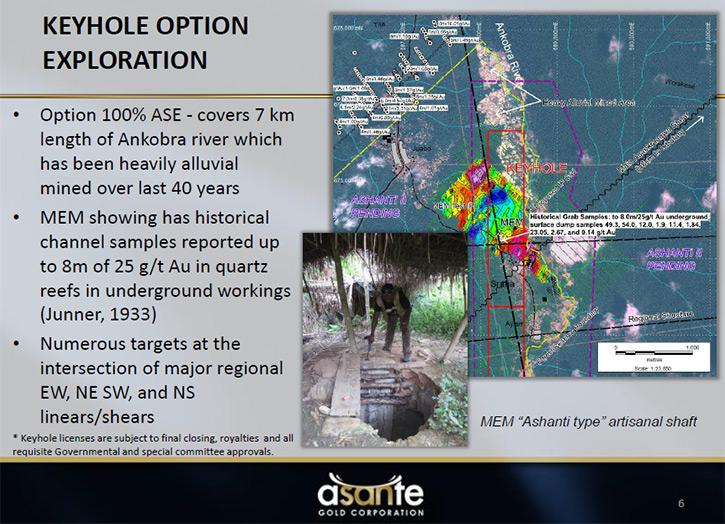

We have another project called the Keyhole that we just brought in to Asante a few months back. It's a very, very

exciting project in that major surface alluvial gold mining's been going on for 25 years. I'd say seven or eight

kilometers of the local river have been ripped up by local miners, and yet nobody's ever found a source for the gold. A

very flat area, it's all covered with transported river deposits. There is one showing, which was reported in the 1930’s

to have some pretty spectacular grades in an underground local artisanal working. We're going to be drilling that in the

next couple of months to see if we can confirm the old sampling results and extend it. We've also recently completed a

program of ground geophysics and outlined a further 5 drill targets in the area, so hopefully we can get ourselves a new

discovery there in the next few months.

Then we're also bringing in another eight concessions from one of our associate companies in Ghana. That company is the

one that provided all the projects to Asanko Gold. Asanko is now a listed company. It has a market cap of around a

$billion. I was formerly the President of the company called PMI Gold, which Asanko bought three years ago. My team put

all the producing assets into PMI, and we ended up getting the rights to eight of the exploration concessions back,

including the Kubi Gold Mining Leases. These eight concessions should come in over the next year, so basically a very

large explorative project - six are contiguous and stretch 35 km long, and the other two adjoin Kubi. They're all on

strike with major producing gold mines, and they've all had quite a few discovery drill holes already drilled on them, so

basically it's just going to be a very, very exciting year as funding comes in to drill out exploration projects and

develop our first mine.

Dr. Allen Alper: That sounds great. That's amazing. You've done that in a very tough and difficult time for the

last five years. Really Excellent!

Douglas MacQuarrie: Yes, it's been a brutal market for the juniors. Investors are risk averse. However we

would argue acquiring gold in the ground and high potential gold properties actually lowers risk!

Dr. Allen Alper: Yes, but it looks like things are picking up, and I think most gold miners are now becoming more

optimistic about what's going to happen in 2017 and beyond. What are your thoughts?

Douglas MacQuarrie: For sure, Allen. Everything has its day in the Sun. Gold certainly had its day a few

years back, reaching $1800 an ounce, and it retraced all the way down to a $1000. Now it's back up around $1200. I think

in terms of long-term charts, gold is under-valued. To me it looks like the U.S. dollar is in a bubble and overvalued.

The big board U.S. stocks appear to be at peaks, so I think it's time for a sectoral rotation. I think commodities are a

good place to be, and gold in particular as it is also money, and especially when the world reserve currency, the U.S.

dollar, is being sold and continuing to lose ground as far as its percentage of central bank reserves. The Chinese yuan

and other currencies are certainly getting a bigger and bigger piece of that pie. You put it all together with the new

presidency in the U.S.A. and the volatility that's bringing to world markets, world trade, world currency values, I think

it's going to be a very volatile and very exciting year for gold.

Dr. Allen Alper: Yes, it seems that way. Could you tell me a little bit more about your background and your team,

your board?

Douglas MacQuarrie: Right. My background is geology, geophysics. I've been doing that since I graduated from

high school. I think I've had a fair bit of luck at it. As far as my team goes, I have some investment bankers on my

board. I have a fellow named Ned Goodman, whom most of your readers should know. He funded the big Hemlo gold mine in

Ontario back in the day. He formed and grew a company called Dundee, which is now a multi-billion-dollar company. He's

basically semi- retired now, and he joined our board as chairman last year. He’s there to give us advice. He is still a

huge gold bug based on golds fundamentals, and he certainly sees Africa, and Ghana in particular as having huge

development upside. We were a perfect match for Ned to join with us as our chairman.

I also have as my Vice President the former mine manager for the large Anglo Gold Obuasi Mine, which is located

just 20 minutes away from our Kubi development. Bashir worked his way up from a student miner to operating a mine with a

thousand workers under him, so to put Kubi in production will be something that's well within his expertise.

Dr. Allen Alper: That sounds very good.

Douglas MacQuarrie: We basically have all the people we need to get going here. We're just waiting for our

funding to close. The date's the end of February and then we move!

Dr. Allen Alper: That sounds excellent. Could you tell me a bit about your capital structure or share structure,

where you're listed, etc.?

Douglas MacQuarrie: Right. We're currently listed on the Canadian Securities Exchange. That is a competitor

to the TSX Venture Exchange in Canada, the TSE, and our symbol is ASE. We're also listed in Frankfurt, and we're

contemplating doing an OTC listing here in the next couple of months to make it more available to our U.S. shareholders.

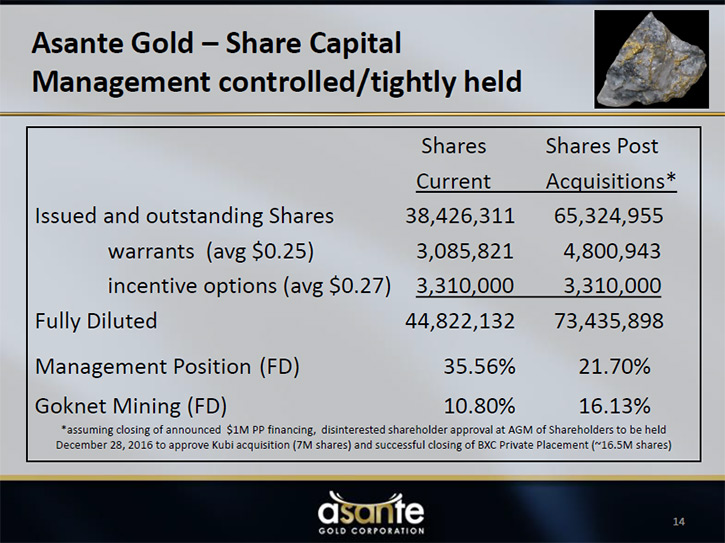

Our current capital structure is 38.4 million shares issued, and upon closing a recently announced private

placement for $1.25 million, that'll increase it by about another six million. Fully diluted, we're sitting very close to

50 million shares at the moment, very tightly held. I'd say about half is owned by management and insiders, so pretty

tight.

In the second part of our deal with our new Chinese investors, they'll be buying 30% equity in the company that

will then take it to 65 million shares issued, and fully diluted around 73 million. At that point we should be well on

the way to building our first mine and cash flow, a pretty tight share capital structure.

Dr. Allen Alper: That sounds very good. Could you tell me a bit more about your plans for 2017?

Douglas MacQuarrie: In 2017, the first thing is to close our agreement, get the funding in, and put together

all the operating committees and construction committees to get Kubi on its way to production. At the same time, we'll

have exploration going on two or three of our concessions. They all have discovery holes on them, so it's just a question

of poking some more holes around and seeing how big these things are, and then bringing in the other eight concessions.

That should all happen this year.

It's also very fortuitous that Ghana just had an election in December of last year. Ghana's on basically the same

timing schedule as the U.S.A. Their new president was just put in power I think on January the 7th. All of his new

ministers should soon be positioned and to work, including a new mines minister. This new government is very, very pro-

business, very, very pro-transparency, and very, very pro the rule of law, so this will be a great change in the

direction and fortunes of the country.

Over the last eight years, Ghana has suffered somewhat, seeing a lot of development money flow to its neighbors,

but I think with the new government in power in Ghana you're going to see a reversal of that. Ghana is very peaceful, and

I think large sums of investment funds will return to Ghana from the diaspora and along with international inward

investment boost the economy.

Dr. Allen Alper: That sounds excellent. That's very good. What are the primary reasons our high-net-worth

readers/investors should consider investing in your company?

Douglas MacQuarrie: Okay, thanks, Allen. I'm the largest shareholder in Asante, and I'll tell you the reason

I've invested. Number one, I think Ghana is a great, peaceful country. Without peace, a long-term investment like mining

is something you can't do. Ghana's a very, very peaceful country. They just had a peaceful election, and that's the fifth

one in a row, so it really is a leader in Africa.

Number two, the commodity is gold. In all honesty, I'm not really interested in the other commodities. I think

the world is going to have some very restrictive trade policies. I don't see a huge amount of GDP growth anywhere in the

world, and so gold, being the least volatile of all commodities, is the place you want to be. Nothing better than a safe

insurance policy in gold in the ground – that’s leveraged thru ownership in good gold stocks.

The third thing is, gold is money. With, beggar thy neighbor, foreign exchange policies of all governments,

Europe, China, the U.S.A., etc., everybody looking after their own interests, who can/will devalue the first and the

fastest to preserve market share and jobs? I think that's where we're going, and in that environment of depreciating

currencies, gold will be a spectacular investment.

The fourth thing, Ghana has huge exploration potential. The big mining companies, the Newmonts and Goldfields of

the world, Anglo Gold, they're all there and they all have very large plus 10 million ounce deposits. In the case of

Anglo, that's a plus 10 million ounces of plus 10 grams per ton, so they're large and they're rich. I think the best

place to find a mine is next to somebody else's mine, and so all our projects are fairly close to existing mines in

elephant country, so that reduces risk.

The fifth reason is Asante has a market cap right now of about $5 or $6 million U.S. To me, that's extremely

undervalued relative to the value of our Kubi project, which we've just joint ventured 50% of for $20 million Can. That's

$15 million U.S. for only half. That would infer the project is worth $30 million, and yet our company only has a total

market cap of five or six million. It just doesn't make sense. And that's giving us zero value for our exploration

expertise finding an awful lot of gold resources in Ghana, and zero for the exploration upside on about 10 concessions,

which we will control.

I don't believe in buying the majors. If we have a major gold run, your upside is a double. Your downside's half.

On a stock like Asante, the upside is many, many multiples and the downside is - I think we're already there in the

basement. Those would be my reasons.

Dr. Allen Alper: Sounds like very strong reasons for our high-net-worth readers/investors to consider investing in

your company. Is there anything else you'd like to add, Douglas?

Douglas MacQuarrie: No Allen. It's just been great talking to you. We've known each other a long, long time,

and I think it's going to be the year for gold. I'm absolutely comfortable with the three-year $4000 announced gold price

target some pundits are talking about. Certainly James Rickards, some of your readers will be familiar with his

prediction.

Dr. Allen Alper: Yes.

Douglas MacQuarrie: I don't have any problem with three to four thousand U.S. dollars an ounce in the next

few years. Good juniors that are sitting with gold resources in the ground, like Asante, are just going to revalue many,

many times. One needs patience. Every drill hole doesn't hit a new ore body. Sometimes it takes 10. Sometimes it takes

20, maybe 50 drill holes. It's capital-intensive and requires a bit of patience, but if a person had some long-term funds

and wanted to get a little extra leverage in the market, I think it's just the right sector.

Dr. Allen Alper: That sounds true.

http://www.asantegold.com/

Douglas MacQuarrie, President & CEO

Telephone: 1-604-558-1134

Canada/US Toll Free: 1-877-339-7525

Mobile: 1-604-710-8442

Ghana Mobile: 233 (0) 246-327-934

Fax: 1-604-558-1136

Email: Douglas@asantegold.com

SKYPE: douglas.macquarrie

|

|