Interview with Jim Gowans, CEO of Arizona Mining (TSX: AZ): Developing the Taylor Deposit into a World-Class Lead-Zinc-Silver Deposit

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/25/2017

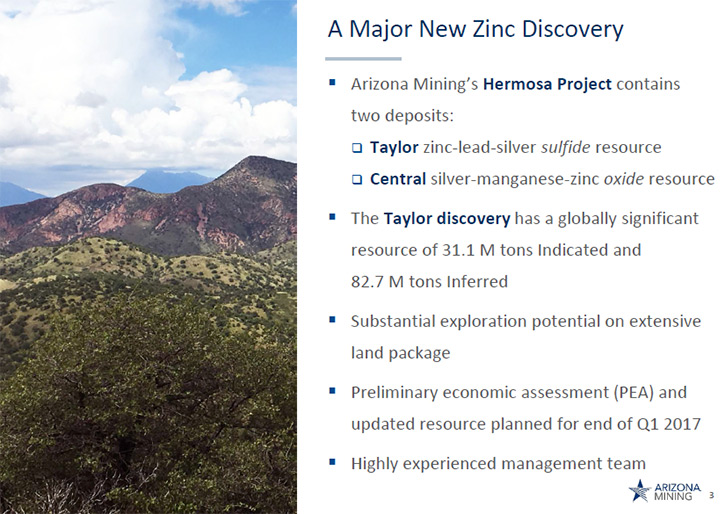

Jim Gowans CEO of Arizona Mining (TSX: AZ) tells us they are developing the Taylor deposit into a world-class lead-

zinc-silver deposit. With good drill results continuing to be reported and the orebody shaping up, the goal is to

complete the Preliminary Economic Assessment by the end of Q1 2017. They plan on completing a feasibility study in Q4 of

this year. This should revalue Arizona Mining.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Jim Gowans CEO of Arizona

Mining. You are getting great results. You had great results before, but now your results are even fantastic.

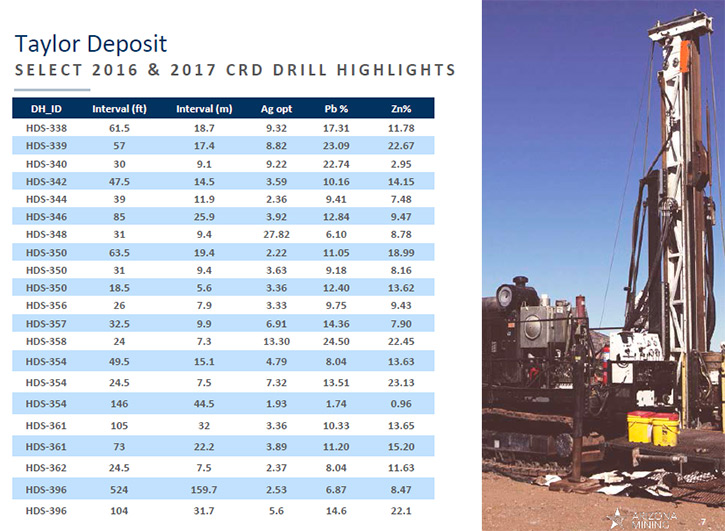

Jim Gowans: We're continuing to get good results. It's very clear from our extension of drilling on the

Trench property (acquired from Asarco in January, 2016) that the geology there is a bit more complicated than we

initially anticipated, but we do get great stuff over there, but the core of the ore body is under what we call the Alta

block. The extensions to the northeast and southwest are on our claims and on the BLM land. Yeah, it's a wonderful ore

body, shaping up to be a wonderful ore body in size and grade, and has some lovely features like a boatload of silver in

it, too.

Dr. Allen Alper: Jim, could you tell me what differentiates your mining company from others?

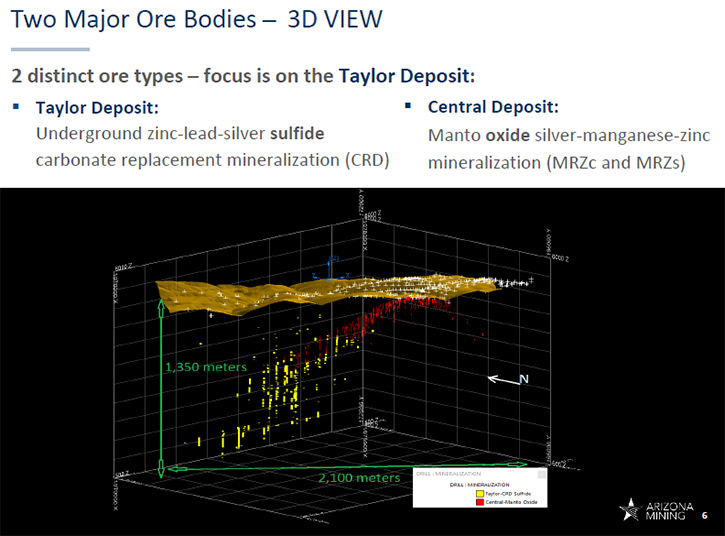

Jim Gowans: What intrigued me, convincing me to join Arizona Mining a year ago, instead of retiring, was

looking at the ore body, and seeing the potential for the Taylor deposit specifically. We have two deposits, but I was

more focused in on the Taylor deposit. It looked like it had the potential to shape up in terms of size and grade to be a

world-class ore body. That's what intrigued me, the opportunity to build one more mine, my lucky seventh mine.

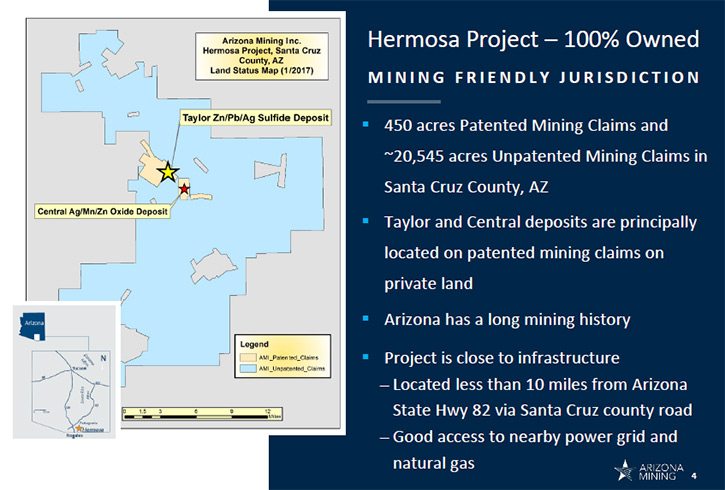

What I think is unique about Arizona Mining is that we're in a great mining environment in southern Arizona.

There are lots of mines in the area. It has quite a history, locally, in the region. The claim blocks that we have down

there have two significant deposits, quite different in terms of the chemistry and the geology and metallurgy, but

nevertheless two significant deposits, which I think is quite amazing.

When you look at this area that's been gone over for a long time, to find an exciting new ore body on an historic

property is amazing. It is all because Don Taylor, our COO and head of exploration, had the insight to read the geology

correctly and go down into the Paleozoic formations, searching for the CRD deposits when he saw some of the signs.

Dr. Allen Alper: That's great. Could you describe the body a bit more? I know it's a lead, zinc, silver.

Jim Gowans: Yes. The lead and zinc are about equal, which is very similar to where I grew up in Kimberley,

British Columbia, with the Sullivan Mine. The lead and zinc there were about the same, a 50-50 ratio as opposed to Pine

Point or Polaris or Red Dog or some of the other lead-zinc deposits, with which I've been involved, that had different

ratios of lead to zinc. Nevertheless, it's lead, zinc, and significant amounts of silver.

Dr. Allen Alper: It's a very high grade, and a very large deposit. Is that correct?

Jim Gowans: Yeah. It's very large and very high grade. Probably never get to the grade of Red Dog. You only

get one opportunity in a lifetime to build the richest silver or zinc mine in the world, but this is definitely

significant in terms of the overall grade. Our resource is currently coming in around about 11% combined ore-zinc

equivalent, so it's pretty significant.

Dr. Allen Alper: That's great!

Jim Gowans: Large size, over 100 million tons and counting.

Dr. Allen Alper: That's excellent. Could you tell me a little bit more about the plans for 2017?

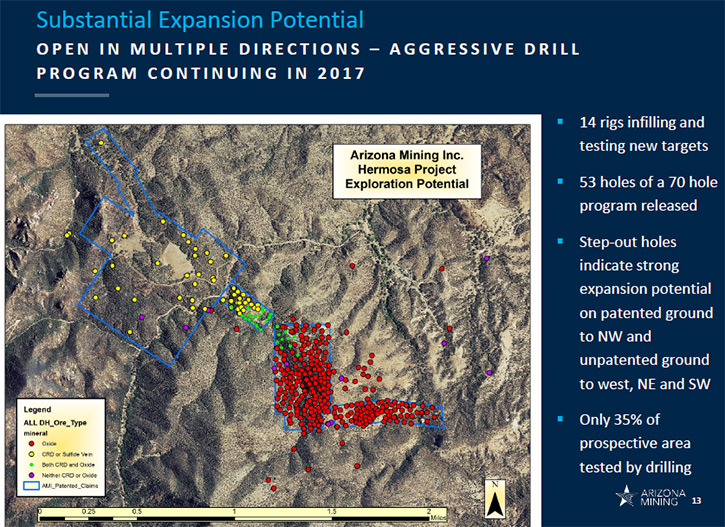

Jim Gowans: Yes, I can. 2017 is a crossroads year for Arizona Mining. We have several activities or

priorities on our schedule. First off, we're currently executing a twofold exploration program, a drilling program, to do

two things: to do infill drilling on the main part of the deposit to get our percentage of indicated resource up to a

higher percent. It's currently sitting around about 30% of the total resource. We'd like to move that up in terms of

percentage in preparation for developing the PEA or preliminary economic assessment by the end of Q1. That's our targeted

time frame.

The exploration program's second goal is to actually step out on the claim blocks that we have and go after some

other targets, to determine the extensions or if there are any possible extensions of the Taylor deposit. That'll be

primarily done in Q1. We'll also do a resource update towards the end of Q1. We currently have all our engineering

consulting companies focused in on developing the PEA by the end of Q1.

Dr. Allen Alper: That's very good. I noticed you have funding offers and also offtake offers. Could you elaborate

on some of that?

Jim Gowans: Sure. We’re in the process of doing a PEA, of course with concentrate production, so we have

engineering companies designing the mine and resource. It'll be a shaft-based mining development or a shaft/ramp. We have

metallurgical research being done at SGS Lakefield, as part of the background for the PEA. We have the various other

supporting engineering companies doing hydrogeology for our permitting, the geotechnical for supporting the mine design,

and the like.

Part of the PEA is to reach out to traders and smelters using a consultant by the name of Andy Falls to do

marketing for the lead and zinc concentrates. That's part of the process. The preliminary test work that we've done so

far demonstrates that we get a fairly clean and high grade concentrate.

Both zinc and lead concentrates are fairly good grade. We have some manganese in the zinc concentrate, which is a

solid solution of sphalerite. It's offset with ultra-low iron and cadmium content and we get anywhere from about 100 to

150 grams per ton of silver in the zinc concentrate, and in the lead concentrate it's very high. It's probably in excess

of 750 to 800 grams per ton of silver in the lead concentrate.

We've been going out to traders like Ocean Partners and Orion Resources to look at the marketability of our

concentrates. It was in that process that you saw that we got the quotations back.

Dr. Allen Alper: That sounds excellent. I know you have an excellent background, but tell me a bit more about

yourself, your board and team.

Jim Gowans: I've been around the mining industry for over 40 years. I've primarily been involved with major

mining companies. First, for almost 20 years, I was at Cominco/Teck-Cominco. When I first graduated, I spent a bit of

time with them and was involved with some of their mines, a gold mine in the Northwest Territories, the Sullivan Mine at

Kimberley, and then I was involved in the feasibility study and design and building and startup of two of their zinc

mines, zinc-lead mines, the Polaris Mine up in the High Arctic, the world's most northerly-based metal mine, and of

course Red Dog, the world's biggest, richest zinc mine. I also ran a potash mine in Saskatchewan. That was part of the

other side of their business, which was the chemicals and fertilizers, which they eventually spun off as Agrium.

Dr. Allen Alper: That's great.

Jim Gowans: Then I moved to Placer Dome and was involved in various positions there. I was involved in their

projects team, building two gold mines, the Cortez Mine in Nevada and Musselwhite Mine in northwestern Ontario.

Then I did a little bit of consulting and moved to Inco, to run their big nickel laterite operations, their

mining and smelting operations in Indonesia for a little over four years, stepping up production and setting records in

production down there.

Then before I came back, I was recruited by DeBeers to build and operate their first two diamond mines in Canada,

the Snap Lake and Victor Mines. I also completed the feasibility for their third mine, Gahcho Kué, a joint venture with

Mountain Province, which is now currently being commissioned and starting up. I moved to Africa to take over their

operations, first as the COO for DeBeers and then moving into Botswana to run their joint venture with the Botswana

government, to operate the two biggest diamond mines in the world.

I was coming back to retire when I was asked to be the COO of Barrick, which I did for two years. Then I was

retiring until I was presented this opportunity to be involved with Arizona Mining. My retirement from Barrick lasted

about three hours.

Dr. Allen Alper: That's fantastic!

Jim Gowans: My friends and colleagues call me a mining junkie. I've been in mining for over 40 years. I love

the challenge of new projects, finding and solving the issues and problems they have, and developing and building them

and adding value for the shareholders.

Dr. Allen Alper: That's excellent.

Jim Gowans: It's been the big hook of my career.

Dr. Allen Alper: It looks like you are in the right spot right now.

Jim Gowans: Yeah. Looking at the Arizona Mining, one of the things that intrigued me, and gave me so much

impetus to join the organization, is that Arizona Mining is a rather unusual junior mining company. It has a very well-

grounded and experienced team. Our executive chairman, Richard Warke, has been involved in very successful junior mining

ventures, Ventana Gold, Rosemont, and others over his career, and is very good at developing the financing to support a

junior industry.

Our head of exploration, Don Taylor, for whom we named the deposit, because of his brilliant insights, looked at

the Central Deposit and figured out that we probably had a sulfide CRD deposit downdip. He was a Vice President of BHP

for North America. He was also an executive with Doe Run, so he has quite a pedigree on base metals and lead-zinc in

particular. He's worked all around the world, so he has lots of experience on developing ore bodies.

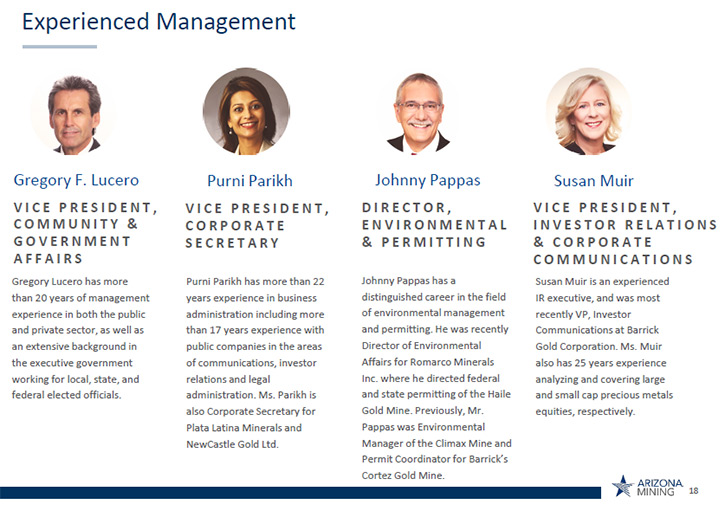

Johnny Pappas has lots of extensive experience in doing permitting with Barrick and then with Romarco. He's

basically permitted the last mine developed in the United States, the Haile project in the Carolinas. We brought him on

to develop the permitting and implementation of the permitting strategy for Arizona Mining.

Then we have our government relations person in Arizona, Greg Lucero, who is deputy mayor of Nogales. He's involved in

the board of trade in the local county, so very well known, very well connected, and very well respected in the region

for working on the government relations side.

When you look at that, and you look at Susan Muir, who's our VP of Investor Relations who spent nearly 10 years

at Barrick in IR, we've pulled together a very experienced team.

Dr. Allen Alper: That's great. That sounds like you have a great team and a great property. Could you tell me a

little bit about your capital structure, where the stock is listed, and something about your finances?

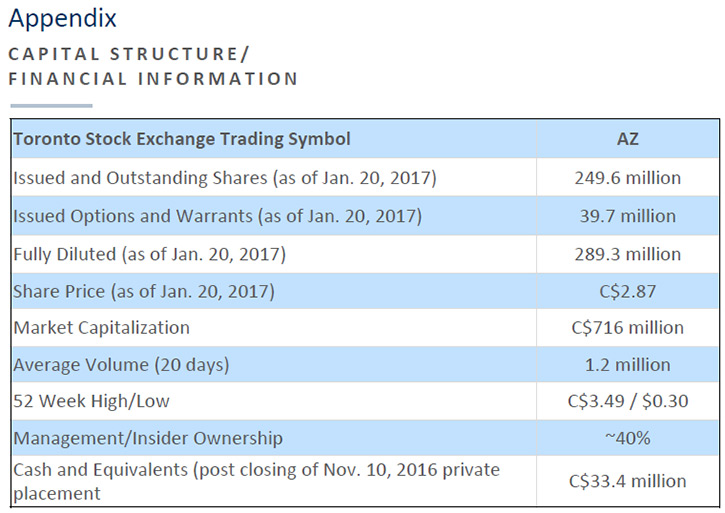

Jim Gowans: We've done three fundings over the last year to be able to accelerate the exploration. Our market

cap is something north of $600 million. The insider ownership is about 40%; Richard Warke, our chairman, has the vast

majority of that, but the others, also significant ownership in terms of the senior management and the board. It's around

about 40% ownership of the company.

Dr. Allen Alper: The management team really believes in and has invested in the company.

Jim Gowans: We have a huge investment in the company, and obviously a great belief in the company and the

deposit and what we can do with it.

Dr. Allen Alper: That's great.

Jim Gowans: We’ve put our money where our mouth is.

Dr. Allen Alper: That's excellent. That gives other investors confidence. What are the primary reasons our high-

net-worth readers/investors should consider investing in your company?

Jim Gowans: I think the reason why you'd invest in Arizona Mining is because it's sitting on two deposits,

one that's developing into a world-class lead-zinc-silver deposit. Also, what's unique about Arizona Mining is we have

about 450 acres of patented claims, which allows us to drill very fast because we don't need a lot of permits to do it.

It should help facilitate the permitting process as we start to work toward a feasibility study.

We're actually pushing to do a feasibility study delivered by the end of this coming year.

Dr. Allen Alper: That's excellent. That's very fast. Your company is moving very fast.

Jim Gowans: It's moving very fast. We have people we know can do it. We're obviously not blind to the

challenges to do that in that kind of a time schedule, but so far we've been able to deliver on the commitments that

we've made.

Dr. Allen Alper: That's excellent. Is there anything, Jim, you would like to add?

Jim Gowans: I just think that it's a very exciting deposit, nice, clean concentrates with the exception of a

bit of manganese. The manganese may be a bit high, but it's offset by extremely low iron and cadmium and of course the

lack of other deleterious materials and the zinc content is also very high grade.

The lead concentrates are quite high grade concentrates and very clean, and they have a lot of silver, so they

are a great concentrate that a lot of smelters and refineries would like to use.

It's a great company. It's developing fast. The zinc market is showing so much strength right now, and looks like

it'll have some legs in terms of premium prices for zinc. Not a lot of new zinc has been found over the last 10 years or

so, so I think that's a big opportunity.

Dr. Allen Alper: That's excellent.

https://www.arizonamining.com/

#555-999 Canada Place

Vancouver, BC V6C 3E1

Tel: 604.687.1717

Fax: 604.687.1715

Email: info@arizonamining.com

|

|