Interview with Blair Way CEO Leading Edge Materials (TSX.V: LEM | OTCQB: LEMIF): Focused on Supply of Critical Materials to High Growth Markets

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/23/2017

CEO Blair Way talks to us about Leading Edge Materials (TSX.V: LEM | OTCQB: LEMIF) a supplier of high purity graphite to the lithium ion

battery market space. They have a fully permitted production facility and recently extended their exploitation license an additional 25 years.

Blair is confident that Leading Edge Materials gives investors ground level leverage into the expanding green energy consumer electronics,

automotive, and transportation industries.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Blair Way, who is President and CEO of Leading

Edge Materials. Could you tell me the focus of the company, your objectives, and where you're going?

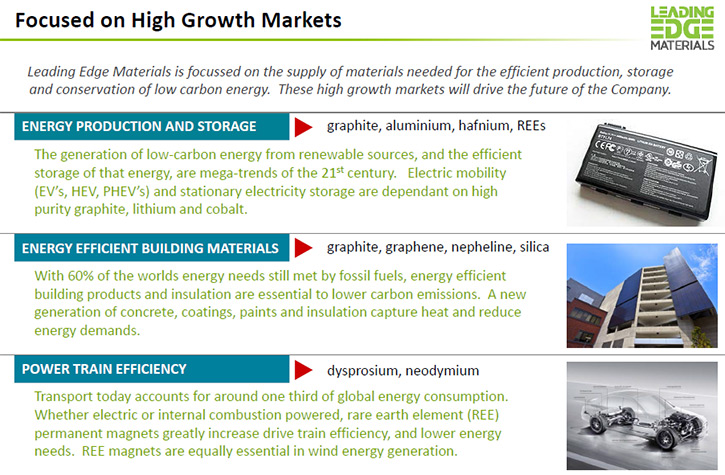

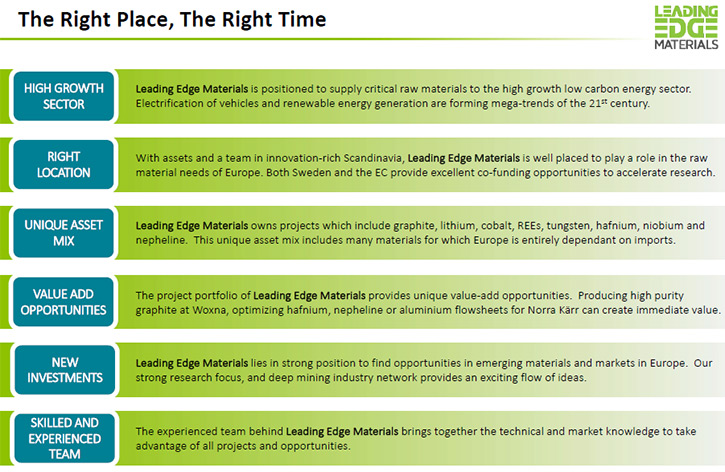

Mr. Blair Way: Certainly the big picture for Leading Edge Materials is that we're focused on supply of the critical materials, needed

for the energy storage market, for the production of energy storage and conservation of low carbon energy. It's these markets that will drive

our company. Primarily we're focused on graphite. We have a graphite production facility focused on the supply of high purity graphite for the

lithium ion battery market space, a high growth sector. There's big uptake in the usage of lithium ion batteries for both stationary and

nonstationary storage such as mobility both for consumer electronics, automotive, and transportation.

Dr. Allen Alper: That's excellent! Could you tell us the current status of your graphite project?

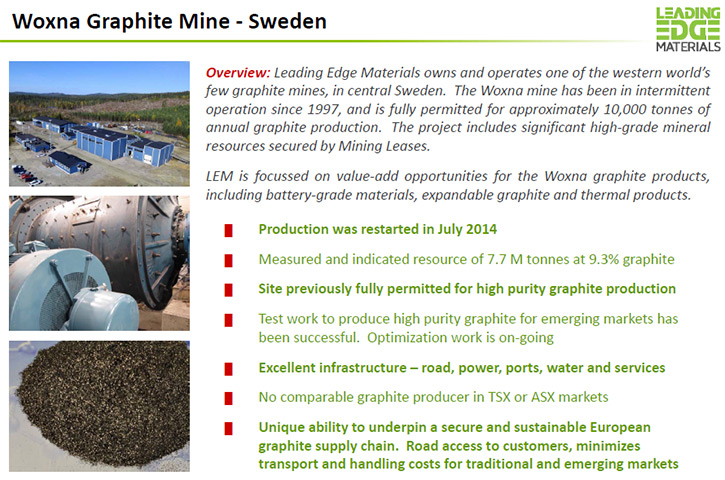

Mr. Blair Way: We're a production facility. We're permitted. In the last week we press released that we've had our exploitation

license extended by a further 25 years so that gives us that security on the ground as far as our operations. We're already a permitted and

producing facility, but we're currently not producing graphite because the market for refractory grade material is not that great and the

market for the lithium ion batteries is still a growth and early stage market. We won't start the plant back up again until we can identify

a significant or substantial supply demand for our product.

What we are able to do is produce sufficient test material in order to qualify our materials with the various potential customers.

Many of these potential customers are at the planning stage for consuming larger quantities of material, but they're not actually consuming

those quantities yet. An example of that, which everyone's heard of, is the Tesla Giga-plant but there are many other plants being planned

around the world. Even though the Tesla Giga-plant is the most advanced, currently all the raw materials are sourced and coming from China.

Dr. Allen Alper: Could you tell me a little bit with what's happening with the lithium project?

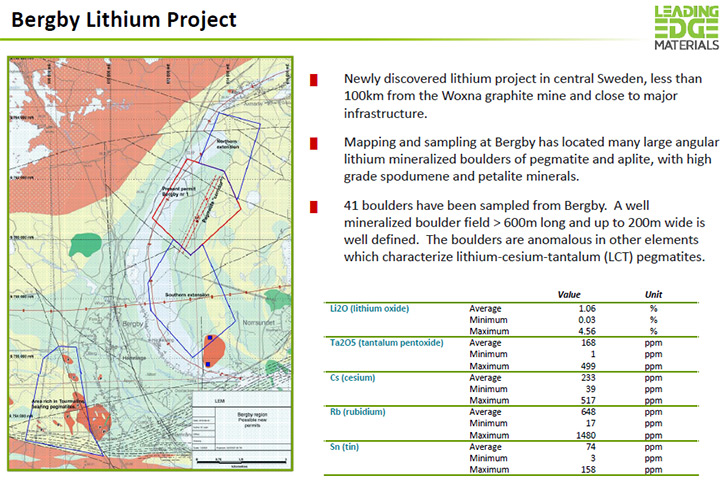

Mr. Blair Way: In addition to our graphite, we're looking at all the critical materials for the energy storage market and certainly

lithium is one of them. Our geologists in Scandinavia have been scouring the country side looking for prospects and we've identified the

Bergby project. We just recently press released that we've submitted a drill plan.

It's a conservative drill plan to de-risk the project to better understand its potential. All indicators are good. We identified

boulders initially and then we found some out-crops that have very promising results. A small drill program is a natural step in order to

continue to de-risk the project and better understand what we have, but certainly we're very positive about what we've seen so far.

Dr. Allen Alper: All that sounds good. I noticed in your press release it said the lithium oxide was averaging 1.71%. Is that

spodumene?

Mr. Blair Way: Yes it appears to be. This is still early stage, where we've identified boulders and also some out-croppings. The

drilling will give us a better clarity of mineral analysis on what we have. We're quite happy with what we're seeing to date, but in this

NI43101 world we live in, we have to be very conservative in what we can say until we actually have something tangible in our hands.

Dr. Allen Alper: What are your plans for the lithium project in 2017?

Mr. Blair Way: Accorded to our current plan, reported in our press release, we submitted an application for a permit to be able to

drill up to 40 holes in the lithium Bergby project. We anticipate that happening in the next quarter or two of 2017. Those results will then

drive the next steps.

Dr. Allen Alper: Sounds very good. Could you update our readers on the Rare Earth project?

Mr. Blair Way: Norra Karr is certainly one of the more well-understood and desirable rare earth projects out there. We've undertaken

the work up until the pre-feasibility study. Currently, we're looking at all the various options that are available to us, but we see this as

a very, very viable and valuable asset, which is why we acquired it through the acquisition transaction in August. This is more of a mid to

long term plan, in order to be in a very good position, to be able to accommodate the needs of the future. We feel it’s inevitable that the

industry will begin to feel the rare Earth elements supply challenges.

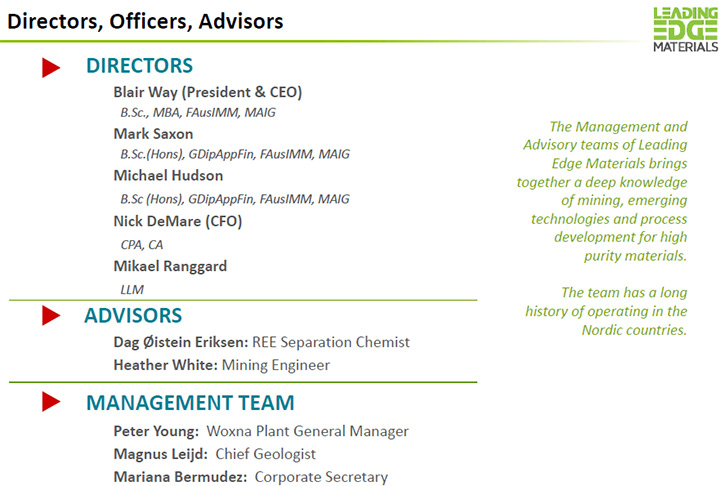

Dr. Allen Alper: That sounds excellent! Could you update our readers on your background, your board, and your team?

Mr. Blair Way: Sure, my background is as a project developer. I spent the majority of my career taking a project from the exploration

team, who've generally done the discovery and some of the early stage study works such as PEA's and PFS's. I generally get involved at the

feasibility study level, then implementation, the actual start of the actual work on the ground. That involves both the detail design and

procurement leading to construction on site into commissioning and operation. That's been the majority of my career. In the last few years,

I've been working with junior resource companies in order to be able to provide that expertise at an earlier stage, even in some cases, PEA,

in order to be able to ensure that we have a much more viable, sensible approach to implementing these projects, once we've identified a

workable discovery.

Our team has a strong geological, exploration background and executive management skills, honed in various resource companies along

with first class financial and CFO capabilities. Our Board has a wide spectrum of all the skill sets we require in order to lead our company

to complete our plans successfully. As a team, we work together very closely. We're constantly speaking and working together to ensure that we

stay focused managing our resources, human and financial as effectively as possible to efficiently facilitate the accomplishment of our goals.

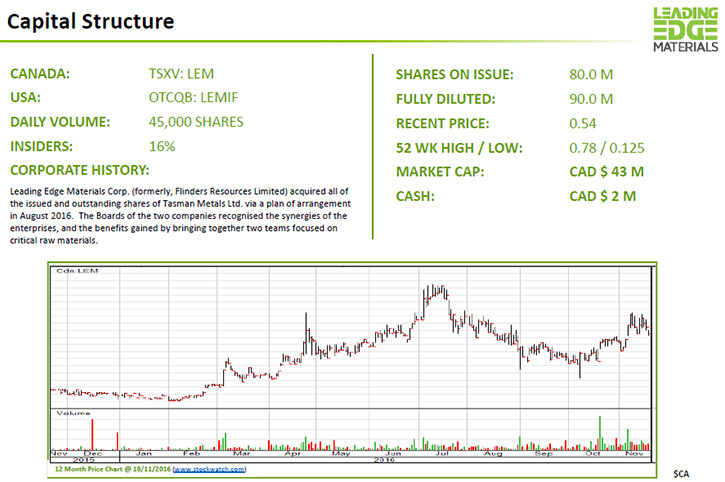

Dr. Allen Alper: That sounds very good. Could you tell us a bit about your stock, where it's listed, its symbol and a bit about your

share and capital structure?

Mr. Blair Way: Sure. We're a TSXV listed company, and we're under the ticker code LEM. We also trade in the OTCQB under LEMIF.

Insiders have about 16% ownership so we've got some skin in the game! As for shares on issue, we have 80 million shares and 90 million fully

diluted.

Recent share price has been hovering around 50 cents, although I've seen in the last couple of days we've had a bit of interest.

That's expected with the start of the new year and people realizing just what sort of activities we have underway. I think the 52 week high

has been 78 cents, so our market cap is sitting around 45 million dollars.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in

your company?

Mr. Blair Way: The main reason, and why we're so bullish on our company and our strategy, is there's so much news out there and

people are seeing it all around them, about how the energy market is growing. There's a demand for energy, there's a demand for renewable and

more green energy. In addition there's strong growth in transportation, so we have a significant amount of vehicles and other means of

transportation coming online. The expectation is that more and more is going to be through electrification.

In order for that electrification to occur, we need batteries. To enable transportation or even stationary energy storage, we need

batteries to cut down demand on the grid, by being able to store green energy. Our company is poised right at the start, targeting the leading

edge of this change in the market.

For investors who want to gain access to this energy source change, the energy storage market is going to be a significant part of it.

That's what we're targeting, that's why we think investors should and will be interested in our company.

Dr. Allen Alper: Sounds like very strong reasons to consider investing in your company. Blair, is there anything else that you would

like to add?

Mr. Blair Way: I think we've covered the key factors. We believe we're on the leading edge of this disruption in the energy sector

and we believe we've targeted the right materials in order to be in a position to benefit both as a company and for our investors to benefit

from it as well. We're very excited about the future of the company, and about the future of the energy market.

It's a really interesting sector to be in because it's no longer just about the resources in the ground, it's

about working with numerous end users and the demands and requirements that they have. It’s much more technical and challenging. It's more

than just being a miner. Being part of the process is exceptionally interesting and also very exciting.

Dr. Allen Alper: That's great, your company is especially well named, Leading Edge Materials, for a growing, emerging energy source.

Mr. Blair Way: Absolutely, it's an exciting time for us.

http://leadingedgematerials.com/

Leading Edge Materials Corp

Suite 1305, 1090 West Georgia Street

Vancouver, BC Canada V6E 3V7

Phone: +1 604 685 9316

Investor Relations:

Phone: +1 604 699 0202

|

|