Interview with Graham Harris, Chairman of Millennial Lithium Corp. (ML: TSX.V; A3N2: GR: Frankfurt; MLNLF: OTCQB): Focused on Quality Lithium Assets in the "Lithium Triangle" of Argentina

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/23/2017

Millennial Lithium Corp. (ML: TSX.V; A3N2: GR: Frankfurt; MLNLF: OTCQB) is an exploration and development company focused on quality lithium

assets in Argentina. The company's flagship project is a 100% owned Pastos Grandes project located in the "Lithium Triangle". We learned from

Graham Harris, who is chairman of Millennial Lithium, that they recently completing a $3 million drill program and are fully committed to driving

Pastos Grandes to production. The company is looking forward to delivering good results over the next coming weeks and taking the project through

to PEA by the end of 2017. According to Mr. Harris, there's a massive demand for lithium ion storage in batteries coming. They are hoping to be

part of that solution in terms of providing lithium to the market over the next five to 10 years.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Graham Harris, who is chairman of Millennial

Lithium Corp. Could you tell me about your company, what distinguishes it, differentiates it from other companies? I know you're in a great

location, one of low costs in a huge lithium area, in the lithium triangle of Argentina. Tell our readers more about your company.

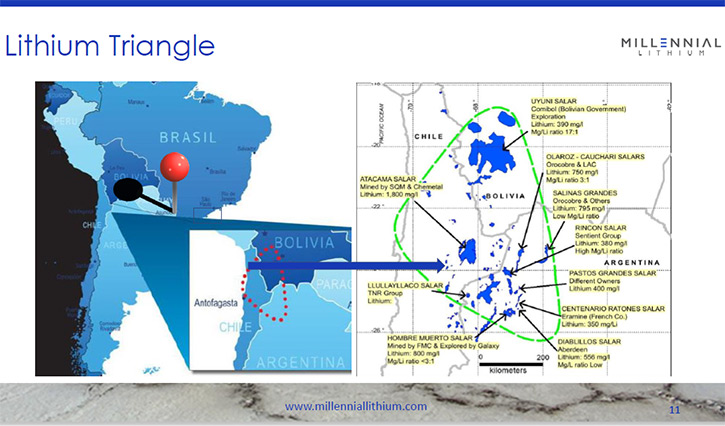

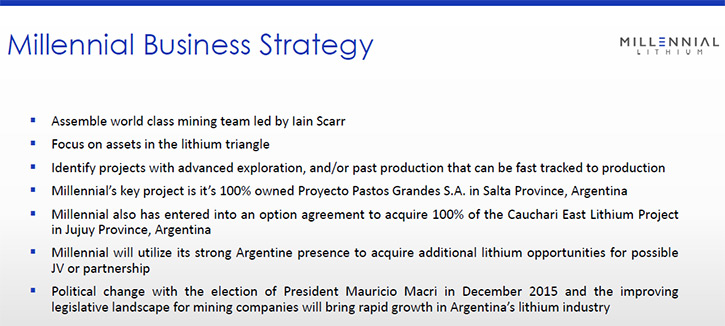

Mr. Graham Harris: Sure, Dr. Alper, as you pointed out, if you're going to be in the lithium development space, you really want to

be in the brines. They're the lowest-cost producers versus the hard rocks. Of course, we have people talking about the clays and everything else,

but those are much higher cost producers. If you want to be a low-cost producer, you want to be in the brines, and if you want to be in the

brines, you should be in Argentina. In the Golden Triangle down in South America, you have Chile, Argentina and Bolivia. You can't do business in

Bolivia. In Chile, they consider lithium a strategic metal, therefore any deal needs to involve the government which makes it take longer and it

is a little more difficult to do business there.

That leaves Argentina. Since the government changed, a year and a bit ago, Argentina is open for business again. I was there in 2007-8

working with another company drilling a gold project. The results weren’t there for us to continue, but witnessing the transformation in

Argentina in the last year and a half, I realized that it was time to go back and work in Argentina. Argentina is open for business again, which

makes it a little easier for resource companies. You want to operate in a politically safe environment, and the Province of Salta in Argentina is

certainly the best place to be. Having said that, we're an exploration and development play.

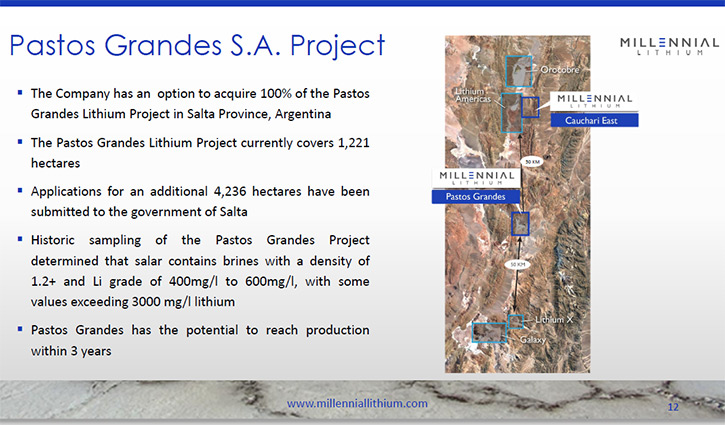

Our main asset is called Pastos Grandes, which is in the middle of the Puna, which is the high, arid desert region in Salta Province. Nearby, we

have LIX and Galaxy approximately 50 miles to the south. We have Orocobre just to our north, so we're certainly in elephant country. We're in the

right place, I think we're there at the right time, and we have the right people. By right people, we're very fortunate that we attracted a

gentleman named Iain Scarr to come and join our exploration and development team. Iain Scarr did the feasibility at Galaxy and recently he was at

Enirgi working on the feasibility at Rincon.

We were very fortunate last spring to have gotten Iain to join our company. Iain looked at our asset and wanted to be involved with it. We're

very lucky because Iain is Salta based, so not only do we get Iain, but we get a complete team of locals, all the way from drillers to geologists

to logistics people who are all based in Salta. This has made our job a lot easier, and it's allowed us to advance Pastos Grandes at a fairly

significant rate in relation to our peers. That’s solely because all of our people have experience operating in the lithium space in Salta.

Dr. Allen Alper: That's great. Could you elaborate a bit more on your background and the rest of your team and board?

Mr. Graham Harris: Here in Vancouver, my background was originally as a managing director in the early days at Yorkton and

Canaccord. I've been on the other side of the business now for about 15 years. I've developed a number of assets through public companies. My

partner, with whom I work closely, is Andrew Bowering. Recently, about five years ago, we founded Capex Iron Ore. We did a big development on an

iron ore play in Quebec. We took that right to pre-feasibility. Unfortunately, iron ore prices collapsed, but we developed and advanced the

mineral asset. That's our modus operandi. We try to find good projects and develop them with good people, using the public markets to fund them

and hopefully, at the end of the day, you either sell them or drive them right through to production.

At this point in time, apart from at Pastos Grandes, we've also added a number of projects into Millennial. We're developing a pipeline

of projects, but our main focus is Pastos Grandes and we are fully committed to driving Pastos Grandes to production. We were just recently

completing a $3 million drill program. Previously Pastos Grandes had about $5 million spent on it by a French company, Ermine, so there is ample

data available. By the end of the current drill campaign, scheduled to be completed by the end of this month, we should be able to come with some

pretty good results that will allow us to go back to the market and talk about taking Pastos Grandes through to PEA by the end of 2017.

We have good connections in the financial markets. We have a lot of people following us, including a very big following in Europe, mainly because

one of the biggest shareholders in Millennial Lithium is a Swiss-based resource fund that specializes in lithium companies, and they give us a

lot of breadth in the European market. To date, all the investors have done quite well in the story and we look forward to delivering good

results over the next coming weeks and advancing Pastos Grandes over the next term.

Dr. Allen Alper: That sounds great. You're definitely in the right place and you have a very strong team. That's excellent.

Mr. Graham Harris: On the technical side, we also have a gentleman named Vijay Mehta, who's on our advisory board, and Ben

Binninger, both of whom have been involved in the lithium space for some time. When you Google anything about lithium, the names that will pop up

are Iain Scarr and Vijay Mehta. You'll see that they've been involved with our project from inception. We're very strong technically, in terms of

our project, and management-wise, we're very strong in terms of financing capabilities. I know we have the right team in place. At this point we

have a good project, good people, and as long as this lithium market holds, which it looks like it will for quite some time, then hopefully we'll

keep driving the project forward.

Dr. Allen Alper: That's excellent. We have done many articles on lithium companies and are doing many more. Could you remind our readers

and investors why lithium is so important, what's happening with the market now and in the future, and why it's a very important investment to

consider.

Mr. Graham Harris: Sure, Dr. Alper. Over the last 10 years, everybody's probably heard about lithium ion. Now we are finally

reaching the stage of commercialization in the lithium ion battery space and basically the prevailing battery technology now is lithium ion.

There will be no other battery technology in the near future that's going to replace it. As industry has focused on the lithium ion battery,

there have been great leaps made in the battery technology space. Just look at your Tesla cars, your electric cars. They used to have an 80 mile

range, now they can go 800 miles. There's been a lot of advancement in the storage space, and that's been key, because as people can store more

energy, you'll have better uses for it.

The storage technology utilizes lithium. Looking out, it's not just your electric vehicles; Tesla bought Solar City, not because they

want to put a solar panel on a car, but because they want to store the solar energy from the solar panels on the roofs into the battery packs-

the Tesla battery packs that are going to be in your house. I think people are underestimating greatly the need in the near future for battery

and lithium ion demand and we certainly see that in our space, because everybody's heard of Tesla, but there are 30 Tesla size companies in

China, that people have never heard of, that are developing batteries and battery technology for electric vehicles and energy storage.

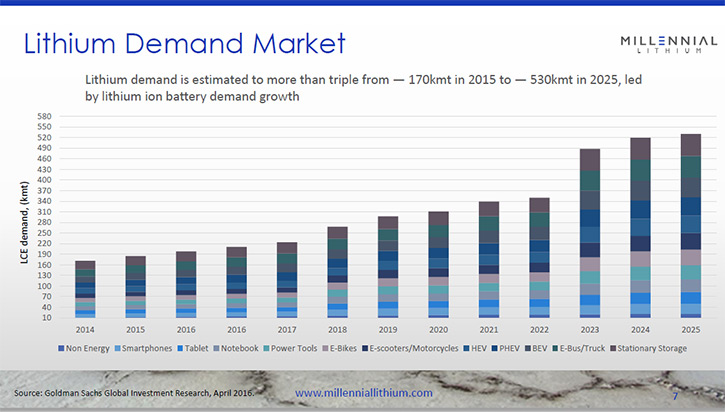

In the next 10 to 15 years demand growth is forecasted to grow from about 190,000 tons a year in 2016 to over half a million tons by 2024 and

double again by 2030. There's a massive demand for lithium ion storage in batteries coming and we're hoping to be part of that solution in terms

of providing lithium to the market over the next five to 10 years.

Dr. Allen Alper: That sounds like it's an exciting time, right in the forefront, in the right spot with a great team. That all sounds

great. Could you tell me a bit about where your shares are listed and about your capital and share structure?

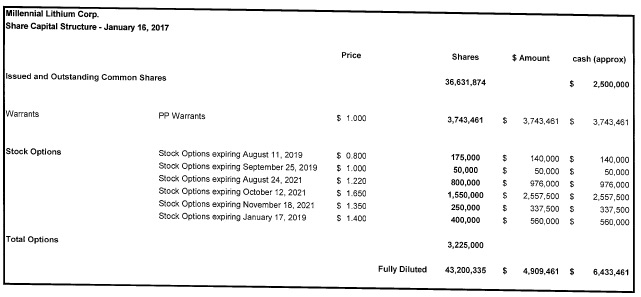

Mr. Graham Harris: We have around 40million shares fully diluted right now. Our last financing, done at 65 cents, just came due, so

there's no more cheap stock that's coming due to the markets. The stock is currently about 1.40 Canadian. We're listed on the TSX Venture

Exchange. We're also listed on the Frankfort, and we're also listed on the OTCQX market down in the states. There's ample liquidity in the stock,

we trade probably half a million shares a day on average, so there's good liquidity for the investors. We're just seeing the market absorb the

last financing round, so we're hoping that the stock will rebound back to the $2 level where it was earlier.

In terms of our market cap at around $50 million, we're slightly below some of our peers in the area, but they're a little more advanced.

What we're expecting is that as we release our data over the next few weeks and months, people will realize that our asset is just as significant

as those that are better known in the area and will probably move up the market capitalization as we release more results.

Dr. Allen Alper: Could you elaborate a little bit on what the plans for the company are for 2017?

Mr. Graham Harris: 2017, certainly. We're just wrapping up our recent drilling campaign and what I would imagine is that those

results will justify us moving ahead, committing more money, so we'll probably look to raise another $10 million or so and drive Pastos Grandes

through to PEA. We're hoping to have a resource and PEA by the third quarter of 2017. We also have another project called Cauchari East that we'd

like to do some initial drilling on. That should be quite exciting because Cauchari East sits right next to Lithium Americas. They just announced

a big $280 million financing with a big Chinese company, so that project is going to be developed and we have a very good project right next door

to it. So in 2017 we look forward to advancing Pastos Grandes with more drilling and engineering to take it to PEA and starting to advance some

of our other projects in the pipeline.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Graham Harris: If you want to be in the lithium space, there's only a handful of companies that have really good projects. As

usual, what will happen in these types of markets, is they will attract a lot of other promoters who come in with projects claiming that they've

got a great asset .They don't really spend a lot of money in the project, it's more about promotion. We're not about promotion; we're about

driving and developing the assets. We're one of the few people in Argentina actually working in the ground and drilling with the money we raise.

You'll see a lot of people down there trying to acquire ground and create a story, but nobody's working the ground.

The thing that separates us apart from a lot of the peers in the intermediate space is that we are fast tracking to production. We

committed over $5 million last year into the project. We expect to put at least double that into the project this year. As far as people wanting

to invest in a company, you want to be invested in a company that's investing in the project. Our goal is to have Pastos Grandes, in production

in three years and generating cash flow. You want to be generating cash flow, so if and when the lithium prices pull back a bit, you're ahead of

the game, and you've started cash flow. That's the key driving factor for us. We have the technical team there who are capable of developing the

asset and they can ensure that the project is on track.

Dr. Allen Alper: Excellent! You really have a very fast track schedule and program being laid out, very smart. Is there anything else

you'd like to add, Graham?

Mr. Graham Harris: I appreciate the opportunity of being interviewed by you, Dr. Alper. I do think it's a good time to look at

Millennial Lithium Corp., not only because we're advancing the project, but because of it, our stock is poised to break out of its recent

consolidation pattern. All the cheaper financing stock has finally been absorbed, so now we can start moving forward and bring on more investors

and focus on getting the price back up. As we advance the project, there's going to be a big milestone coming when we announce a resource and

take this thing to PEA. I expect a reevaluation of Millennial, probably more towards the higher valuations that are given to companies likes LIX.

That's probably the best comparable out there. So, I think there's a good catalyst that's going to move the stock forward in the near future.

People are going to start to figure it out pretty quickly.

Dr. Allen Alper: By the way, we're PDAC Media Partners, so I'll be looking forward to dropping by and talking with you and Pete Atkins, in

March, at PDAC in Toronto.

Mr. Graham Harris: We should have Iain Scarr there as he is scheduled to be coming up from Argentina. We're at the Cambridge Show

this week and then Iain and I are going through Toronto, New York, and London. It's always a pleasure to have him come and talk to the analysts,

who like to dig a little deeper into the story as the technical side starts to unfold. We welcome all your readers/investors to come on by and

say hi.

Dr. Allen Alper: Thank you. That's great.

http://www.millenniallithium.com/

1177 West Hastings Street

Suite. 2000

Vancouver, BC Canada

V6E 2K3

Tel: (604) 662-8184

Fax: (604) 602-1606

E-Mail: info@millenniallithium.com

|

|