Interview of Mr. Rick Howes, President and CEO of Dundee Precious Metals Inc. (TSX: DPM): Multi-National Gold Mining Firm, with Precious Metals Assets, as well as Exploration, Mining, Development, and Processing of Precious Metals

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/3/2017

Dr. Allen Alper, Editor-in-chief of Metals News, interviewed Mr. Rick Howes, President and CEO of Dundee Precious Metals Inc. (TSX: DPM). Mr. Howes shared his views and insights about the mining sector in general, and the Company’s operations in particular. He told us about the growth prospects in the mining industry and the various projects and properties currently held by Dundee Precious Metals Inc. as well as a summary of its strengths that will allow it to thrive in the growing precious metal market.

Company Background

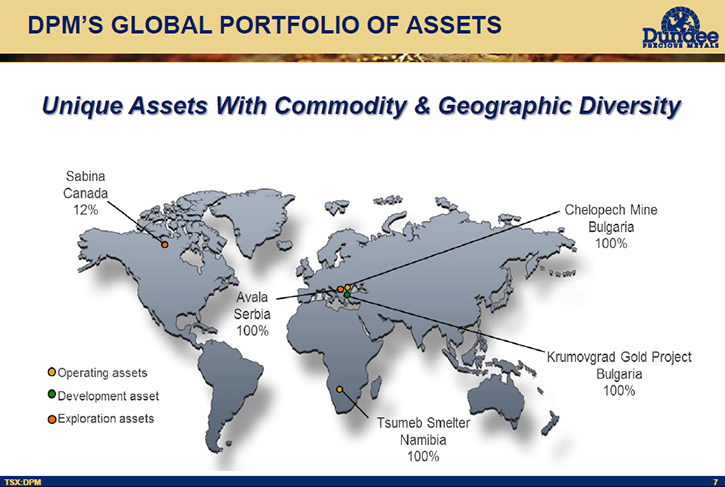

Dundee Precious Metals Inc. (“DPM”) is a multi-national gold mining firm whose operations include precious metals assets, as well as exploration, mining, development, and processing of precious metals. The Company’s operating properties include the Chelopech mine and the Tsumeb Smelter. The former is a copper concentrate property containing gold and silver situated in Sofia, Bulgaria, while the latter is a copper concentrate processing facility situated in Namibia. In addition, the Company has interests in a number of gold exploration and developing facilities located in Serbia, Bulgaria, and northern Canada, which includes the Krumovgrad gold project and their 10.7% interest in Sabina Gold & Silver Corp.

Mr. Rick Howes is the President and CEO of DPM. He has over 34 years’ experience in the mining industry. He has been closely associated with a number of world-class mining projects, such as Inco’s North Mine, which had won the Ryan Award in 2006 for being the safest mine in Canada. Mr. Howes joined DPM as General Manager and Executive Director of Chelopech Mining EAD (now Dundee Precious Metals Chelopech EAD) in early 2009, was appointed Executive V.P. and COO of the Company in November 2010 and assumed the role of President and CEO in April 2013. Before joining the Company, Mr. Howes had served in different mining projects in various operating and technical capacities for major mining companies such as Vale Inco, Cominco, and Xstrata (formerly Falconbridge). He is a graduate of Queen’s University where he earned a B.Sc. in Mining Engineering.

Jonathan Goodman is the Executive Chairman of DPM, and has served as a director since 1993. Mr. Goodman served as the President and CEO of the Company from 1995 to 2013. Mr. Goodman has over 25 years’ experience in the investment and resource industry, and has worked as a senior analyst, geologist, senior executive, and portfolio manager.

Interview with Rick Howes

Talking about the performance of the gold mining industry in the first half of 2016, Mr. Howe said that it’s astonishing how the industry has turned from an unloved and unwanted sector to a star performer. He stated that the year-to-date price of gold has increased by over 25% just behind silver and zinc, while the GDX gold index has appreciated by 110%.

During the interview, he said that a number of factors have contributed to the spectacular performance of gold. However, the industry cannot afford to take this for granted and must focus on improving productivity creating sustainable value in our businesses.

Mr. Howes was excited to point out that DPM was able to make great progress by implementing a number of different strategies such as strengthening the balance sheet, optimizing operation efficiency, and executing organic growth strategies.

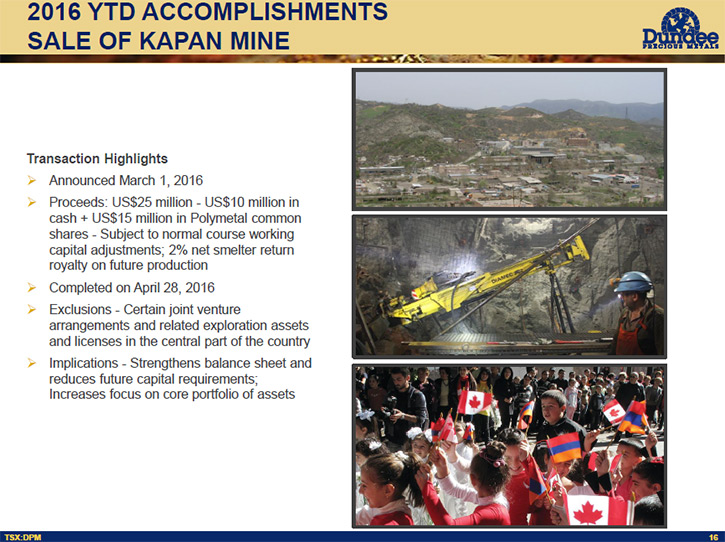

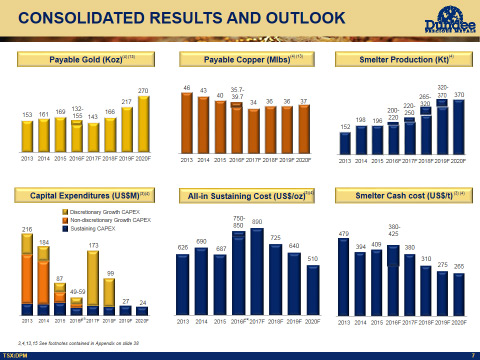

He said the Company had performed exceptionally well during the second quarter of this year tracking well against production and cost targets for 2016. He further explained the Company had extracted nearly 39,000 ounces of gold and about 10 million pounds of copper during Q2 2016. This excludes precious metals extracted from Kapan Mine production that was sold to Polymetal International plc in April.

Gold production guidance of the Company had increased by about 10% to accommodate the solid performance at the Chelopech mine during the first half of the year while the all-in-sustaining cost of gold was $580 per ounce, well below the gold production guidance. This was achieved despite the significant effect of a lower copper by-product credit.

Due to the solid production performance, Mr. Howes said he was glad that the Company balance sheet is in good shape with $184 million of available liquidity, consisting of $160 million in undrawn revolving credit facility and $24 million in cash.

Mr. Howes said Company debt declined significantly and now stands at $149 million, remaining fully compliant with bank covenants. The balance sheet of the Company had been strengthened further by proceeds that were received from the sale of the Kapan mine as well as the bought deal equity financing that was completed in July.

Later Mr. Howes talked about the Company’s various operations and properties. Talking about Chelopech, he told me the mine continues to perform really well and has increased production by 10% as compared to the previous year. That said, the production of gold and silver had decreased by about the same percentage as compared to the previous quarter due to lower grade copper and gold extracted from the mine. During the second half of this year, gold production from the Chelopech mine is expected to be lower than the first half due to lower grade zones in the mining sequence.

Mr. Howes stated that in their regional exploration program around Chelopech, a new target area known as SE Breccia Pipe Zone was identified. This is located southeast of the existing mining blocks and is approximately 700 meters long and 150 meters wide. Surface and underground drilling for testing the site will commence in September 2016.

Talking about the Tsumeb smelter, Mr. Howes explained that 44,545 tonnes of complex concentrate smelted in the second quarter was in line with expectations. The annual maintenance shutdown commenced on June 18, 2016 and the smelter returned to operation on July 16, 2016. He said that complex concentrate smelted during the first six months of 2016 of 101,967 tonnes was 5% higher than the corresponding period in 2015 due primarily to increased availability of the Ausmelt furnace and the timing of the annual maintenance shutdown.

Reduced oxygen supply from one of the two oxygen plants constrained smelter throughput in May. These problems were addressed during the maintenance shutdown in June and the oxygen supply is back to full capacity. The acid plant commenced commercial production in the fourth quarter of 2015 and operated, as planned, in the first half of 2016 producing 92,314 tons of acid.

The operation of the new copper converters stabilized during the second quarter of 2016, contributing to a decrease in the secondary materials that accumulated during the construction and commissioning of the acid plant and converters, as well as reduced variability in estimated deductions for metals exposure. Secondary material levels are expected to continue to decline in the second half of 2016 and 2017, resulting in reduced variability and deductions for metals exposure and stockpile interest.

Unfortunately, shortly after completing the annual furnace rebricking a country wide power outage occurred in Namibia on July 22, 2016. During the power outage, back-up systems for power and cooling water did not operate as expected which caused a cooling water leak in the furnace roof to enter the Ausmelt furnace, compromising the integrity of the refractory lining. No one was injured in the incident. Repairs to the roof and furnace rebricking took three weeks, resulting in a reduction in annual throughput of approximately 20,000 tonnes.

Complex concentrate smelted in 2016 is now expected to range between 200,000 and 220,000 tonnes. Most of the repair costs will be covered by insurance. A full investigation of the incident was carried out and addressed all measures required to prevent any reoccurrence.

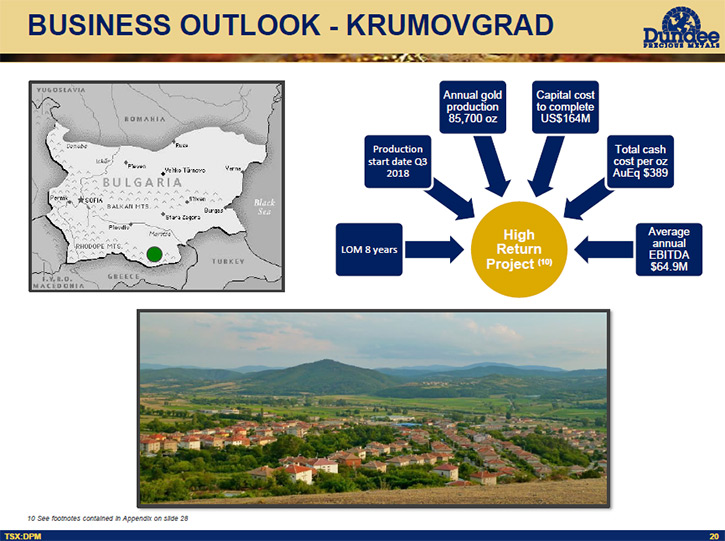

About the Krumovgrad gold project, Mr. Howes said that permitting progress is continuing according to plan. He said that land use re-designation was received in February this year, and that the land purchase was completed in May. All documents for the final construction permit were submitted in June and the permit itself was issued in early August. He further stated that financing of the plan remains on track and it is expected that the Company will gain board approval for full project release in the fourth quarter. This would result in construction beginning by the end of the year, as planned, with production expected to commence in the second half of 2018.

Mr. Howes said that a full technical review had been completed at the 100% owned Avala exploration projects in Serbia. He stated that the TImok sediment hosted gold project activities are focused on examining targets situated close to Inferred and Indicated Resources. The Company is also continuing to analyze and develop targets on licenses over the Lece Volcanic Complex in the southern part of Serbia.

In conclusion, Mr. Howes said he was excited about commencement of the long awaited low cost open pit gold project in Krumovgrad. This project will considerably increase growth and earnings of the Company in the near future.

http://www.dundeeprecious.com/

1 Adelaide Street East

Suite 500, P.O. Box 195

Toronto, Ontario, Canada, M5C 2V9

Main Line: (416) 365-5191

Fax: (416) 365-9080

Email: info@dundeeprecious.com

|

|