Interview with Ann Wilkinson, Vice President, Investor Relations for TMAC Resources Inc. (TSX: TMR): Building Canada's Next Major Gold Mining District in the Hope Bay Greenstone Belt

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/3/2017

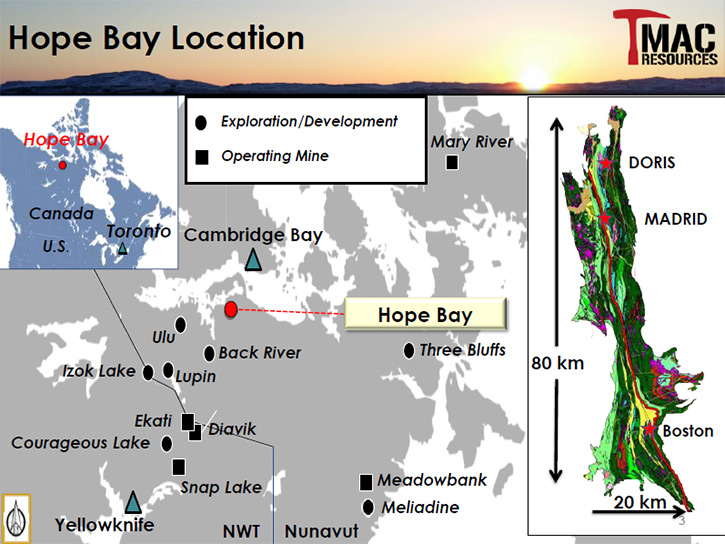

TMAC Resources Inc. (TSX: TMR) is a Canadian mineral exploration and development company focused on advancing the Hope Bay Greenstone Belt, an eighty kilometre by twenty kilometre property with significant upside resource potential in the Kitikmeot region of Nunavut. Founded by the Executive Chairman Terry MacGibbon and led by a highly experienced management team, the company is committed to building Canada's next major gold mining district. With the processing plant starting commissioning and ore being mined and stockpiled in anticipation of commissioning, they plan to reach commercial production in the first quarter of 2017.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Ann Wilkinson, who is Vice President, Investor Relations for TMAC Resources Inc. Could you tell us what differentiates your company from other companies, and all about building your mine and your properties?

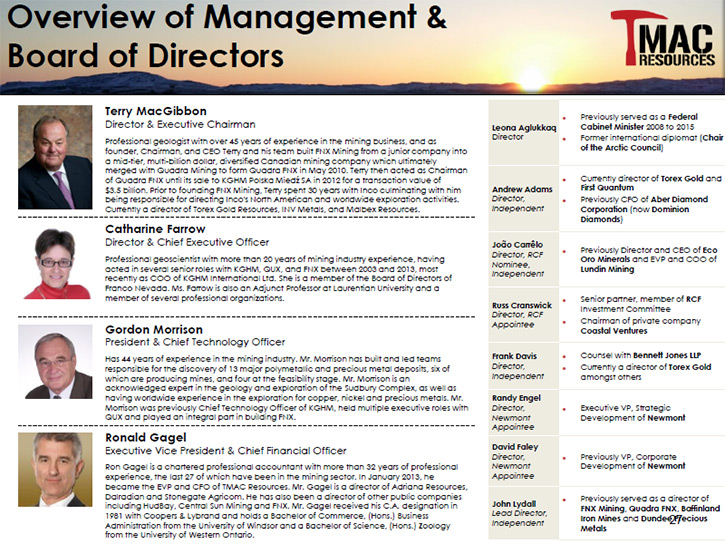

Ann Wilkinson: TMAC Resources is a fairly young company. It was founded by our Executive Chairman, Terry MacGibbon. Terry has a history of identifying non-core assets of which major mining companies are looking to divest, acquiring those assets and building a public company around them. Historically, he acquired non-core assets from Inco and built FNX from a $10 million company into half of a $3.5 billion company.

It became apparent in the fall of 2012 that Newmont was interested in divesting themselves of the Hope Bay Project. A little bit of context is always important. Hope Bay had been identified by the Canadian Geological Survey and surveys that were done of northern Canada. Subsequently, from the early '90s until the late '90s, BHP was on the ground and invested about CAD$100 million dollars exploring the project. In the late ’90’s, BHP exited the global gold space, focussing its operations on bulk commodities like iron ore and coal, and the Hope Bay Project was acquired by a company, which subsequently became Miramar. Miramar put about CAD$150 million into the property between the late '90s and 2007 at which point in time Newmont bought Miramar and invested approximately CAD$850 million into the project.

In the fall of 2012, gold prices had fallen precipitously from September of 2011 when gold prices had been close to US$1900/oz. Newmont reviewed its global stable of assets, to determine in which they were going to reinvest and of which they were going to divest themselves. They choose to divest themselves of Hope Bay; largely because at the time, it didn't look like it was capable of producing 500,000 ounces a year, which is one criterion that Newmont regularly sets for the mines that it includes in its asset base.

Additionally, at the time, there was not a 20-year mine life identified for the asset. Terry created TMAC Resources for the sole purpose of acquiring the asset. He sought out the people who had run FNX with him and, as he likes to say, "Put the band back together." Dr. Catharine Farrow is our Chief Executive Officer. Gord Morrison, arguably one of the best exploration geologists on our lovely little blue-green planet, is our President and Chief Technology Officer. Ron Gagel is our Executive VP and Chief Financial Officer and a lady named Julia Micks is our Executive Vice President Human Resources.

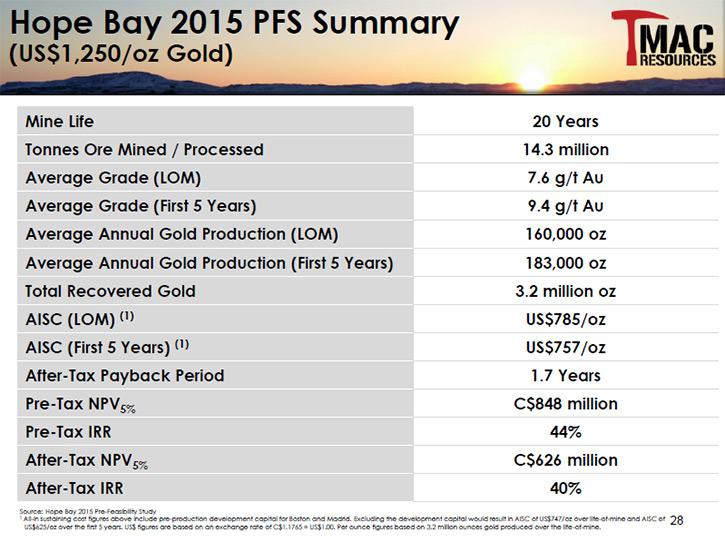

Those five created TMAC and started it in the spring of 2013. 2013 and 2014 saw the expenditure of just under $80 million in exploration to identify additional reserves and resources at Hope Bay. They put together a Pre-Feasibility Study on the three deposits that had been identified at Hope Bay being: Doris in the north, Madrid, about 8 km south of that, and Boston in the south of the 80 km long by 20 km wide Archean greenstone belt. The Pre-Feasibility Study showed an internal rate of return in excess of 40% and a payback of 1.7 years with an additional investment of just over $300 million.

On September 30th, we had spent about $294 million of the $334 million left to spend to bring the project into production. We just took delivery of the processing plant that was fabricated in Australia. It is currently being assembled inside the building that was erected for the purpose of keeping that out of the weather. We should be commissioning the processing plant late in December this year. The plan is to hit commercial production early next year.

Dr. Allen Alper: Sounds great! Once it goes into production, what do you anticipate the rate of production will be and for how many years?

Ann Wilkinson: It has a 20-year mine life. Over the first 5 years, the Pre-Feasibility Study calls for an average annual production of 185,000 ounces. The first year our Pre-Feasibility Study calls for about 136,000 ounces. Year 2 is about 218,000 ounces and then it tails off just slightly, to just between 185,000 and 195,000 ounces.

The issue that's important to remember is the Pre-Feasibility Study did not include any of the recently identified mineral inventory below a geological feature called a Diabase Dyke.

Historically BHP, Miramar and Newmont were looking for an open-pit opportunity in the high Arctic. The issue with Archean Greenstone belts is they tend to go quite deep. If you're thinking about an Archean Greenstone Belt, you should be thinking about northern Ontario, Red Lake, Timmins, Kirkland Lake, mines like the Macassa Mine, which is quite deep now. Typically in Archean Greenstone Belts, these things go on for generations and can produce tens of millions of ounces of gold.

Dr. Allen Alper: That's amazing! Sounds like a great opportunity. A great project you have there and you'll be into production first quarter of 2017?

Ann Wilkinson: That's correct. One of the highly unusual things about TMAC is we've had full mining shifts since October 2015. In fact, our first mining was in March of 2015. Prior to starting the commissioning of our processing plant, we expect to have just over 110,000 tons of material sitting on the ore pad and it should contain about 55,000 to 60,000 ounces of gold, which is pretty unusual for an underground mining operation.

Typically, when a processing plant starts up in an underground mining circumstance, the mill will, what they refer to as, pull hard on the mine. In mining terms, they call it a hungry mill. The very neat thing is, quite unusually, we will have all of this material waiting on the ore pad for the commissioning of the mine.

We've actually segregated our material that we're mining currently. We have a stock pile. The bulk of the stock pile is made up of what we consider our run of mine material, with grades between 7 grams per tonne and 23 grams per tonne (between a quarter of an ounce and three quarters of an ounce of gold per tonne). Then we have a high-grade stock pile, a smaller stock pile that contains greater than 23 grams per tonne. We have incremental ore, which falls below our cutoff grade, which is 4 grams per tonne. This lower grade material, between 2 1/2 and 4 grams of gold per tonne, will be used for commissioning, together with our commissioning ore, which is between 4 and 7 grams per tonne). We’ll use that ore until the processing plant is running smoothly.

Typically, processing plants, as you start them up, don’t work as efficiently until things settle down. You don't want to inadvertently send gold right through the system because the processing plant isn't working as efficiently as you'd like. So that's why you use lower grade material at the beginning.

Dr. Allen Alper: It sounds like you have an excellent plan and an excellent property. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Ann Wilkinson: Well, Hope Bay is an Archean greenstone belt, TMAC has a 100% interest in all of it. We look at the Hope Bay property as being a similar investment to Timmins, or Kirkland Lake, or Red Lake 100 years ago. The typical scenario 100 years ago in northern Ontario was that somebody was blasting overburden in order to put in a roadbed or train tracks and exposed a mineral deposit that in certain circumstances is still being exploited today. Archean Greenstone Belts, by their very nature, tend to go on for a long period of time.

Given Hope Bay's location in Western Nunavut, it is one of those properties that hasn't been exploited before because it was in the high arctic and infrastructurally challenged. That's no longer the case. We're on Arctic tide water and we can get all of our materials in and out during the sea lift. So we think this is like controlling a very large Archean greenstone belt 100 years ago when these deposits were just starting to be extracted.

Dr. Allen Alper: Wow! That sounds amazing!

Ann Wilkinson: We truly believe that we are building Canada's next gold mining district.

Dr. Allen Alper: That's excellent!

http://www.tmacresources.com/

Toronto Corporate Office

95 Wellington Street West

Suite 1010

P.O. Box 44

Toronto, Ontario, M5J 2N7

Phone: 416-628-0216

Investor Relations

info@tmacresources.com

|

|