Interview with Rick Van Nieuwenhuyse, President and CEO of Trilogy Metals: High Grade, 8 Billion Pounds of copper, 2 Billion pounds of Zinc and over 1 Million Ounces of Gold Equivalent

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/21/2016

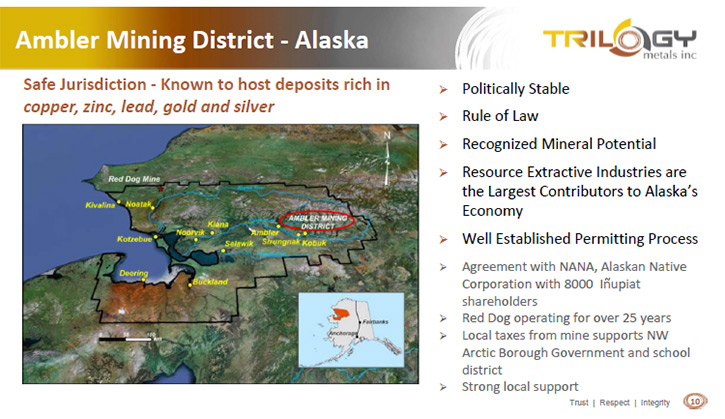

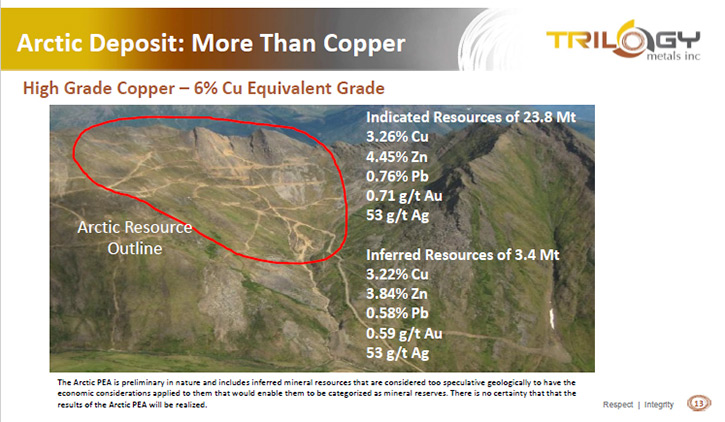

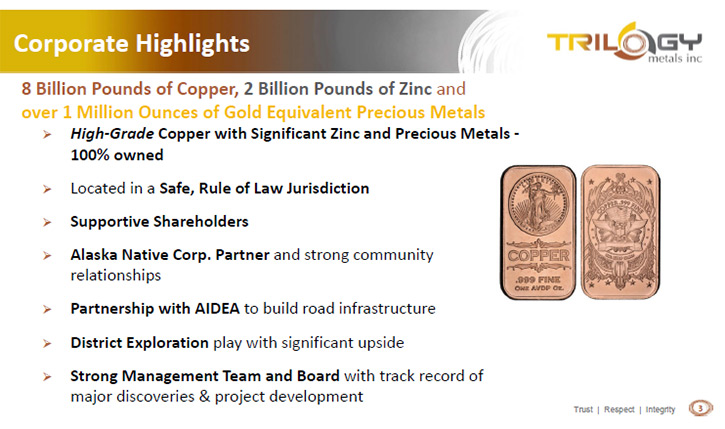

Trilogy Metals Inc. (TSX, NYSE-MKT: TMQ), formerly NovaCopper Inc., is a metals exploration company focused on their 100% owned, low capex/opex Upper Kobuk Mineral Projects (UKMP) located in Ambler mining district in northwestern Alaska, home to some of the world's richest known copper-dominant polymetallic deposits. Together the two projects - Arctic and Bornite - hold 8 billion pounds of copper, 2 billion pounds of zinc and over 1 million ounces of gold equivalent precious metals. According to Rick Van Nieuwenhuyse, President and CEO of Trilogy Metals, they are literally 10 times the grade of most of the other copper deposits being mined around the world. We learned from Mr. Nieuwenhuyse that the company is trading at far less than a tenth of their net asset value, so he thinks this is a good time to invest.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Rick Van Nieuwenhuyse, who's President and CEO of Trilogy Metals Incorporated. Rick, could you tell me what differentiates your company from other copper and base metals companies?

Rick Van Nieuwenhuyse: It's really the size and the quality of the copper endowment that we have, along with a substantial amount of zinc and precious metals, hence the name Trilogy. That's why we decided to change our name from NovaCopper to Trilogy to highlight some of these other metals, but our Arctic deposit is also a very high grade, and at 6% copper equivalent, so that's made up of 3.5% copper and 4.5% zinc plus significant precious metals. It's so much higher grade than the average copper deposit out there in the world, which is somewhere between 0.3% and 0.6% copper in an open pit scenario. Our copper is also open pittable at Arctic. We're not talking about an underground mine. This will be an open pit mine. We're literally 10 times the grade of most of the other copper deposits being mined around the world.

Dr. Allen Alper: That's fantastic. That's really great. Could you tell me how you're progressing?

Rick Van Nieuwenhuyse: We've been working on a pre-feasibility level study this year. We've completed a whole series of drill tests to complete pit slope stability studies. We have metallurgical studies ongoing, hydrology, and waste rock characterization. The resource is very well-defined, so with these engineering related studies we can eventually produce a pre-feasibility level study that can lead us to start permitting the project and, subject to completing a feasibility, arrange financing. That's the work that's going on now.

Dr. Allen Alper: Can you tell me when you foresee getting your feasibility study, preparing for production, and finally reaching production?

Rick Van Nieuwenhuyse: It's all the studies that I just mentioned. Essentially, we're wrapping up. The metallurgical study, should be wrapped up by the first quarter of next year. We'll be receiving the report on our pit slope stability studies later this month. Waste rock characterization will be ongoing through the early part of next year. The important part is getting all the drill results and getting all the field data to be able to complete these studies.

Essentially, all of that work was completed this past summer season. Now it's just really working with the information, with the engineers and hydrologists and the metallurgists, to put together a more formal document on what the recoveries are going to look like for copper, lead, zinc, gold, and silver, what pit slope angles, inter-ramp angles we should be using in our mining design, and on the waste rock and hydrology so we can properly design the facility. It's a relatively low area of risk. Lastly the waste rock characterization work that's ongoing so we know what the character of all the waste rock material is, in addition to what the ore material is. Of course, the majority of our studies are on the ore, but we also have to study the waste rock that'll be left behind, as well.

All those are ongoing, and we'd expect to be working on a pre-feasibility study next year unless we get back to drilling at Bornite, which is our second target here, which is also a very substantial target. It's about 20 miles away from Arctic, so literally right next door and lots of potential synergy between the two projects. With an improving copper market here recently, we're thinking about getting back to exploring and seeing how large we can get Bornite to be. Again, it's already quite substantial, we want to see if we can make it larger still.

Dr. Allen Alper: That sounds exciting. Could you tell me a little bit about your team? I know it's an award-winning team, recognized team.

Rick Van Nieuwenhuyse: Yeah, we've been working together quite a while. Joe Piekenbrock and I went to graduate school together at the University of Arizona, and we've worked on and off together for a good part of our careers. We were rewarded for our efforts at Donlin, the Donlin gold discovery in Alaska, which is a 40 million ounce gold deposit. We made the discovery while working at NovaGold, a company I started nearly 20 years ago. More recently, we were recognized for the success we've had in the discovery of the Bornite project, which is now in Trilogy Metals and formerly NovaCopper.

The other area in which we've been recognized by our industry peers is our success working with Alaska Native Corporations and Canadian First Nations. We've received several awards recognizing the good work that our team has done in working with local communities, including local engagement, local hire, safety and training - all those things that really go to being a good corporate citizen and responsibly developing a mining project in a remote location that is acceptable to the local community. It's a great team. We've worked together quite a long time, and we know each other's strengths and weaknesses. It's a small team. There are only six or seven of us, but we've managed to cover a lot of ground.

Dr. Allen Alper: That's excellent. Could you tell me a bit about your working relationship with the Native groups and also the government?

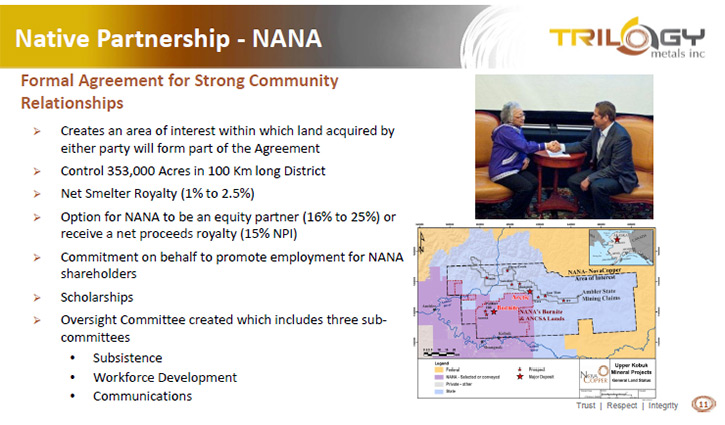

Rick Van Nieuwenhuyse: Certainly. We're in a partnership with NANA. NANA, the acronym is used to describe Northwest Arctic Native Associations. They just really go by NANA now. They have about 8000 Iñupiat shareholders. Most of them live in the region, in northwestern Alaska. There are 12 villages in that part of Alaska. There are only about 5000 people that live out in the region. The rest of the shareholders live in Anchorage, Fairbanks, or some of the other communities throughout Alaska. The Alaska Native Corporations were created under the Alaskan Native Claims Settlement Act back in 1971, and it deeded them title to traditional lands and allowed them to select lands for long-term economic development.

In NANA’s case, one of their selections covered the Red Dog deposit, which has become the Red Dog Mine, the largest zinc mine in the world, operated by Teck. It's been in operation for 25 years. NANA also selected some of the land in the Bornite area adjacent to our Arctic deposit. They understand mining. They've been literally mining Red Dog for 25 years. They selected the lands around Bornite specifically for mineral development, and that's why we formed the partnership with them, so we had the mineral rights to, not only Arctic, but also to Bornite. Combined, that represents the huge metal endowment that I referred to earlier - over 8 billion pounds of copper, two billion pounds of zinc, plus several million ounces of gold equivalent (gold silver).

We have a very strong working relationship with NANA. They are involved. We meet on a quarterly basis and update them on developments with the project and also developments with regards to the road that AIDEA is currently permitting.

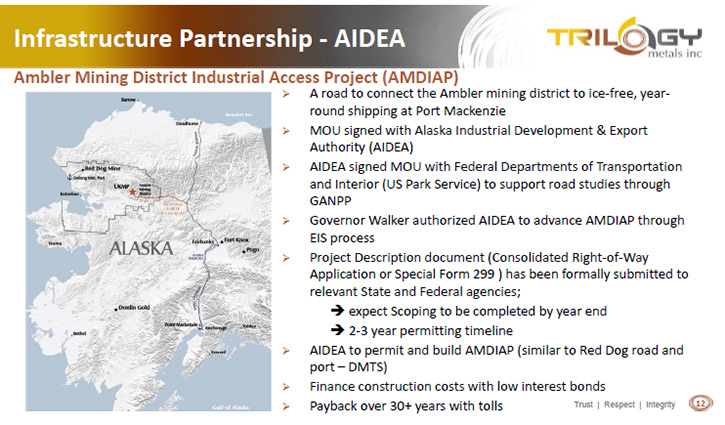

That really leads me to the second half of your question about working with the State of Alaska. AIDEA - stands for the Alaska Industrial Development Export Authority. It is a state owned organization whose responsibility is to assist in building infrastructure in rural Alaska. It is essentially a state-owned development bank. Their job is to build infrastructure and to find ways to help support building infrastructure in the state. They built the road that supports the Red Dog Mine in the late 80s, and that's been a very, very successful project. The state has made money, significant dollars. I think about $23 million goes into the state treasury every year as a result of the tolls that are paid on the Red Dog road and port. The state owns the road and port through AIDEA and charges the Red Dog mine a toll to use the road and port.

The same concept is what AIDEA wants to do with the Ambler access road, which is a road that would connect the Ambler mining district to the Dalton Highway. It's about 200 miles long. AIDEA is in the formal permitting process of that road as we speak. We're hopeful, with a change in federal administration, the process might go a little quicker than it might have a few years ago, under an Obama administration. We'll see how that works out. President-elect Trump has still to take office, but he's certainly anticipated to make some significant changes in leadership at a number of the federal postings, so it'll be interesting to see how permitting mines and permitting roads and permitting infrastructure might change under his administration.

Dr. Allen Alper: That sounds like you have a good relationship and the possibility of the political environment improving for mining.

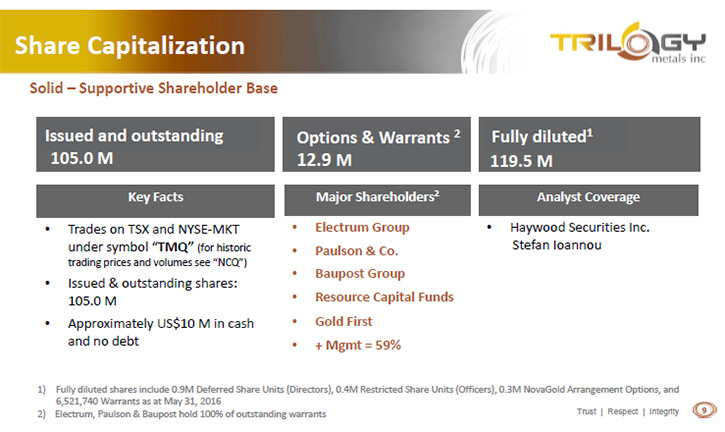

Could you tell me a little bit about your share structure?

Rick Van Nieuwenhuyse: Absolutely. We have just over 100 million shares outstanding. We have five large shareholders, including the management. The Electrum Group, Paulson, Baupost, Resource Capital, and Gold First, plus management, all own about 60% of the company, so we have a very strong shareholder base. It's a blue chip shareholder base with very well-established institutions that have a long-term view of resource development. They understand that developing a mining district takes time, and they've been very supportive when it comes to writing checks to support the company. Management owns a significant number of shares in the company as well, so we're well-incentivized and aligned with shareholder interests.

Dr. Allen Alper: That sounds great. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Rick Van Nieuwenhuyse: I think the quality of the assets and the scale of the endowment are good reasons. Why invest now, given that it's still exploration and there's still risk involved in advancing the project? Because, as an investor you want to be able to acquire assets at a relatively low percentage of their net asset value. That's essentially what you're getting with our story. We're trading at far less than a tenth of our net asset value for Arctic alone – not including any value for Bornite, which is larger than Arctic. So that's a pretty good proposition for an investor.

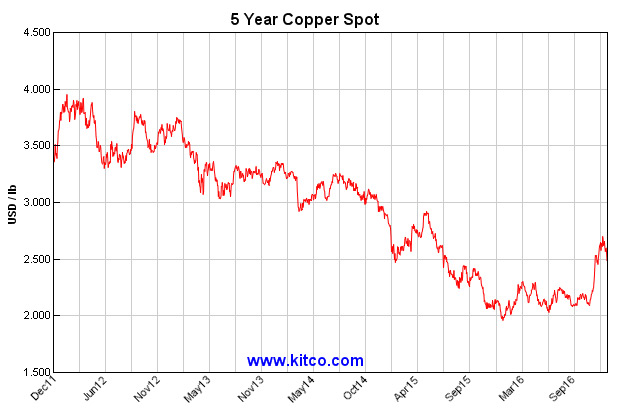

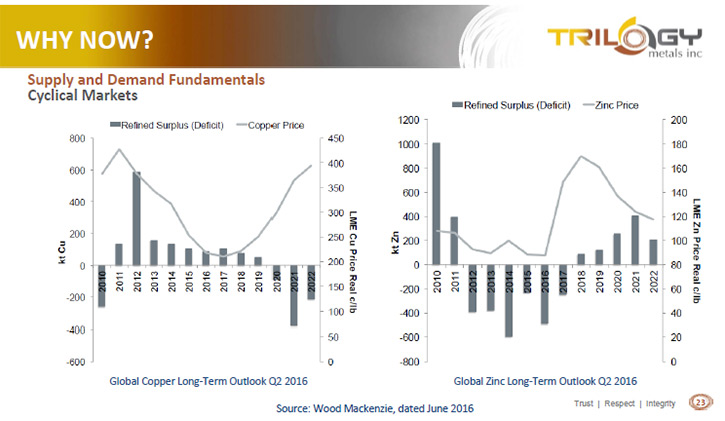

Look at the dynamics of what's going on in the copper space. Copper's been sluggish at $2 to $2.10. For the last three or four years, it's been on a heavy downward cycle. It's been lackluster over the last couple of years. However, recently we’ve seen renewed interest and bid up towards the $2.50, $2.70 range. Perhaps somewhat speculative, but it's an indication that it doesn't take a lot of speculation to move the copper price up significantly. Just a month or so since the Trump election, you've seen copper go from the $2 level, $2.10, up to $2.70. That's a pretty significant move in a short period of time for a metal.

It's good timing, I think. When you look at the supply and demand statistics for copper, 2017, 2018, things are starting to look pretty thin. You're not seeing a lot of new investment in building copper mines when copper's at $2, so that eventually catches up with the market, and then suddenly you're in deficit, and the only way to entice more copper production and more copper investment is for the copper price to go up. I think both those reasons, fundamentally good quality assets, high quality assets in a safe jurisdiction, and a good time in the copper market cycle to be investing in copper, because you're buying at a relatively low value and you'll be able to ride this up to when copper is back in a bull market.

Dr. Allen Alper: Could you mention a few words on what's driving the copper market and why copper usage is growing?

Rick Van Nieuwenhuyse: Yes – one of my favorite topics! The copper market in general is very different from the gold market. It's very much a supply and demand story. When copper was $4 plus, there was an over-building of capacity. So you had too much copper on the market, an oversupply situation. Inventories build up, and prices went down. A lot of what's happening right now is that inventory is diminished. You're starting to see speculation that there's not going to be enough copper.

On the back of that, of course, you have the Trump election and his references to building out more infrastructure in the U.S., which will require copper. I think an interesting dynamic is that the world continuously requires more and more energy – particularly as the develop world advances. Regardless of whether it's coal-based or natural gas-based or alternative energy-based, all of those require copper to produce the energy, to transport the energy, and to use it, wherever it's being used, whether it's in the microwave or turning on lights or plugging in your computer. Every step requires copper.

And Green energy requires more copper. For example, there's a new offshore wind energy facility in Rhode Island. That requires 10 times as much copper to produce that energy and to connect it into the grid than, say, a coal-fired power plant would. As the world turns to more and more green energy, as China addresses their huge pollution issues, as they turn towards wind and solar power generation, and they've made huge commitments to generate a significant amount of power with wind and solar, all that requires more copper. We're all for green energy and high tech solutions. Hybrid cars require more copper than the standard combustion engine. Electric cars require yet more copper. As the world develops more and more high tech, you're going to see more and more consumption of copper.

I was laughing at people referring to the cloud and storing data on the cloud. The cloud's not a cloud. It's a bunch of computer servers. It's a bunch of memory, and all of that requires a lot of copper and a lot of other metals, but foremost a lot of copper, not only to energize that storage capacity, but to maintain it. Copper is historically referred to as the red metal, but I like to jokingly refer to it as the green metal, because of the whole green revolution. If you want cleaner energy and cleaner cars, and more high-tech, all that's going to require more copper. For those reasons, we’re very bullish that copper really is the green metal of the future.

Dr. Allen Alper: That sounds great. Is there anything else you'd like to add, Rick?

Rick Van Nieuwenhuyse: No, I think we've covered a good cross-section. We're very excited about our project. We're seeing very concrete steps taken on permitting the Ambler access road. That's of course a huge step. This mine, the Arctic deposit, would have been developed years and years ago if there had been a road connecting the project to a year-round port, so the work effort that we've put behind working with AIDEA and with NANA and the state of Alaska on getting the road to a permitting decision by the federal government is very, very significant. I think the Trump administration's emphasis on clearing up red tape and getting projects permitted that have been on standby for some time is very, very exciting for us.

Dr. Allen Alper: That sounds correct. I think there'll be more emphasis on mining with the Trump administration.

https://trilogymetals.com/

Head Office

1950 - 777 Dunsmuir Street

Vancouver British Columbia

Canada V7Y 1K4

Phone: 604-638-8088

Fax: 604-638-0644

Email: info@trilogymetals.com

|

|