Interview with Will Ansley, President, and CEO of Satori Resources Inc. (TSXV:BUD}: Past-Producing High-Grade Tartan Lake Gold Mine Project Located in the Prolific Flin Flon Mining District, in Manitoba, Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/12/2017

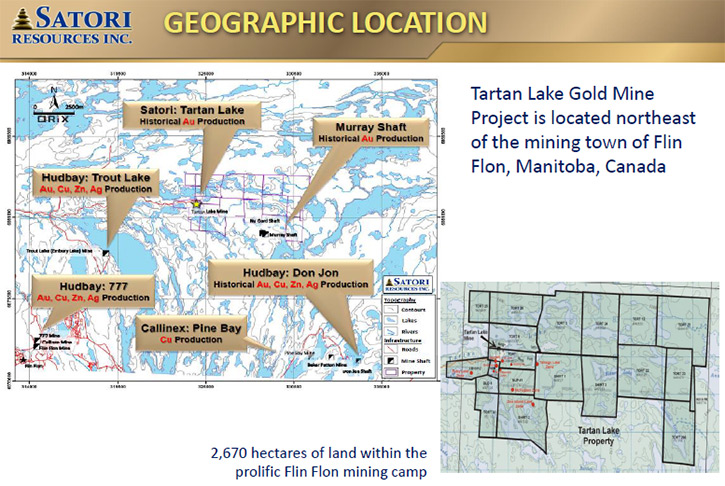

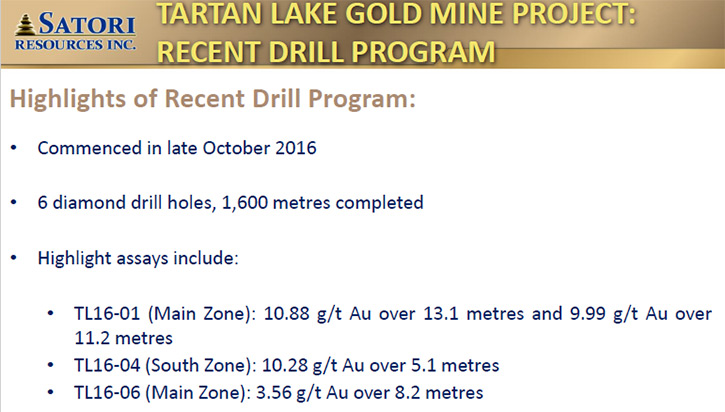

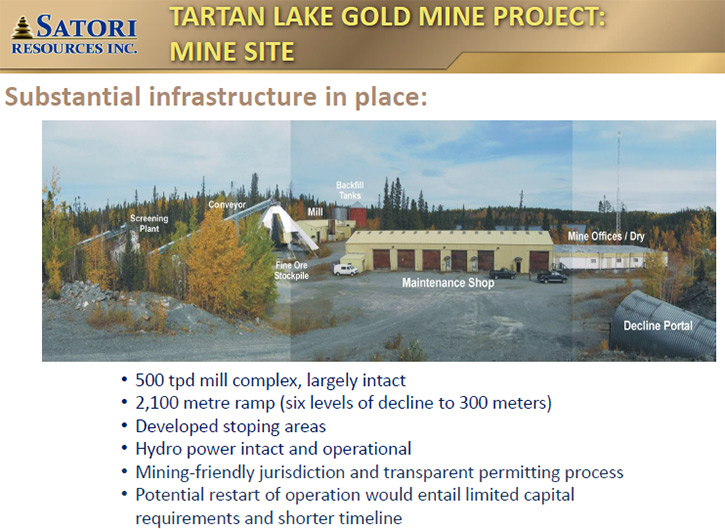

Satori Resources Inc. (TSXV:BUD) is exploring and developing their wholly-owned past-producing high-grade Tartan Lake Gold Mine Project, located in the prolific Flin Flon mining district, in Manitoba, Canada. The project has a substantial infrastructure, including a largely intact 450 tonne per day gold concentrator and a decline ramp, providing access to developed gold mineralization to a vertical depth of 320 metres. We learned from Will Ansley, President and CEO of Satori Resources, that their recent drilling program was a success with results like 10.80 grams over 13 meters. The company is encouraged by these results and has plans for further drilling and updating the existing resource and completing the PEA. According to Mr. Ansley, Manitoba is one of the best places in the world to build a mine.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Will Ansley, President and CEO of Satori Resources. Could you tell me what differentiates your gold exploration company from other companies?

Will Ansley: Our project’s key strategic advantages include being located within a few kilometers from a terrific mining camp, the presence of existing infrastructure such as roads, hydro connected to the grid, a mill, permitted tailings and underground development, completed down to 320 metres below the surface. In fact, the decline ramp goes down to within 15 to 20 meters of hole TL16-01 which intersected 10.88 grams per tonne gold over 13 metres. And lastly, we have high grades - The mine was in production for two years from 1987 to 1989 and produced 48,000 ounces of gold at approximately 6 grams per tonne. We believe all these factors combined have strategic value and make the Tartan Lake Gold Mine Project a compelling asset.

Dr. Allen Alper: Well that's great. I know you've had some recent drill results that were outstanding.

Will Ansley: Yes we recently completed a small drill program consisting of six holes and we had quite a bit of success from that program with results in the Main zone consisting of 10.88 grams per tonne of gold over 13 metres, 9.99 g/t Au over 11 metres and 3.56 g/t Au over 8 metres. In the parallel South Zone we drilled 10.56 g/t Au over 5 metres. With grades and widths like these, it won’t take a lot more of these types of drill results to materially move Satori forward.

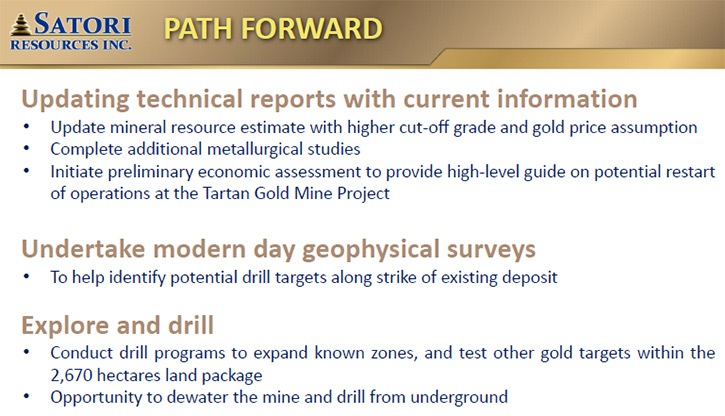

Dr. Allen Alper: That's great. Could you tell me a little bit more about your plans going forward?

Will Ansley: Well, Satori is currently a very small company that we believe is incredibly undervalued. There is definitely a compelling investment opportunity here. The drill rig remains onsite, shut down for the holidays, and in the New Year we would like to follow up on these high-grade, and wide, intercepts. Just to give you a sense of the importance of these widths, while the mine did operate in 1987-1989 the average mining width was 2.5 metres.

Also, there has been no modern day geophysical work performed on the property and we are planning on completing a ground IP survey in H1 2017 which will provide us with regional drill targets outside of the traditional mine area. We consider this asset a very strong exploration candidate for discovering new zones and expanding existing zones both on strike and at depth.

Our initial 2017 drill plan will likely employ the same methodology that we used in this last campaign, which is basically to put some holes into the zones to confirm our existing resource model, and also to expand on these zones. The Main Zone is steep dipping and somewhat predictable, we've been pretty successful at tracing and expanding the mineralization.

Dr. Allen Alper: That sounds excellent. Very good results! Such high grade for a rather large deposit! That's excellent. That's very encouraging.

Will Ansley: Yes I agree, of particular interest is our success in the South zone, which was never really the focus of the company that operated the mine from 1987-89. The South zone is a parallel zone located just south of the Main zone. Wisely, when the mine was developed by the previous operator they situated the ramp right in between the Main zone and the South zone so the infrastructure is strategically located and can provide mining access to both zones, which can help with mine sequencing, access and even ventilation. We recently had a really good drill result in the South zone, 5 meters of 10.8 gpt gold including 2 meters at 24.4 gpt Au located approximately 125 metres below surface and there is a historic hole in the same area, but approximately 200 metres deeper that intersected 5 gpt Au over 8 metres. Some pretty good grades and widths over there as well, so we'd like to follow up. Expanding the South zone would really move things along for us.

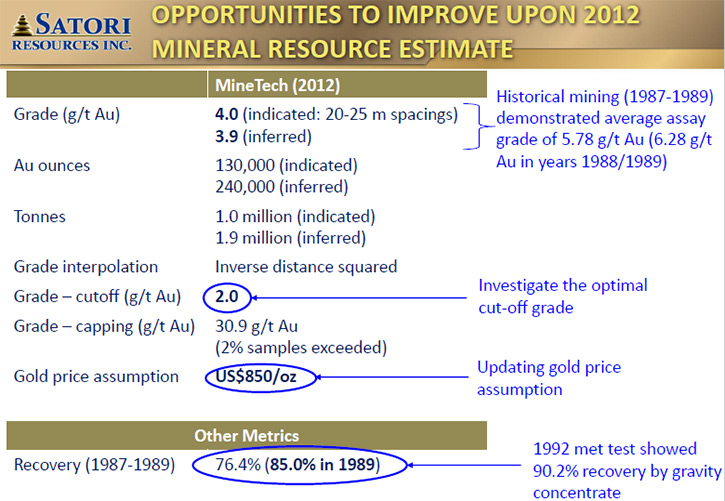

The other initiatives that we would like to complete include updating the company’s existing resource. There is a 43-101 resource on the property, but it was prepared using a lower gold price, US$850 an ounce, and a relatively low cut off grade. Satori would like to focus on a higher grade and cut-off scenario, more in-line with 6 grams per tonne, which was approximately the grade mined from 1987-1989.

In addition to completing and updated the resource, we need to have some engineering completed to determine how much it would cost to de-water and refurb the mill, which could allow us to do some mining while we continue to drill it from underground. To have underground access would allow us to lower our drilling costs significantly and increase our accuracy.

Dr. Allen Alper: That's very good. Could you tell me a bit about yourself, your team, and your board?

Will Ansley: Sure, let's start with the board. Bruce Reid is our Executive Chairman, who brought me into Satori to help move it forward. Many would recognize Bruce from Carlisle Gold where he was the President and CEO. Carlisle Gold was a Manitoba success story (with the Lynn Lake project) and was acquired by Alamos Gold in January 2016. Bruce brings his valuable experience from that endeavor over to Satori.

In terms of my background I am a Chartered Professional Accountant and have over a dozen years of experience in mining. I was part of a team that placed six mines into production over an eight year time period in both Sudbury and Timmins, Ontario. FNX Mining was in Sudbury, where we placed some nickel-copper-pgm mines into production. In Timmins, Ontario, with Lake Shore Gold, we developed three gold mines. I have a solid understanding of geology, engineering, and can work well with the technical team. I have a lot of experience with mining costs, equipment utilization, and productivity rates. I think my operational experience was something that was viewed favorably by Bruce Reid, our Executive Chairman, and the other members of the board.

We also have Jennifer Boyle on the board, who is a former securities lawyer with a great deal of experience in the mining industry including being Chief Executive Officer of St. Eugene Mining before, a company bought by Claude Resources Inc., and she was a founding director and Executive Vice President of Canadian Royalties Inc.

Other board members include Jim Fairbairn, a Chartered Accountant who has over 15 years of experience including being the former CFO at CGX Mining and numerous other board seats. Rick Henderson brings operational experience as former mine manager for approximately 27 years, and Shanda Kilborn who helps us with investor relations and corporate secretarial matters.

Dr. Allen Alper: It sounds like you have a very strong board and you have a great background too. Could you tell me a little bit about your stock? Where it's listed and your share and capital structure?

Will Ansley: Absolutely. Our shares are listed on the TSX Venture exchange and trade under the ticker “BUD”, which is kind of odd given the name of the company is Satori. Apparently the ticker is appealing to some of the marijuana companies and they have been attempting to buy it from us. At any rate, we have approximately 25 million shares outstanding on a fully diluted basis and at current pricing our market capitalization is less than $4 million, which I believe everyone will agree is undervalued.

Insiders own approximately 23% of the company, and we have been buying in the market.

Dr. Allen Alper: That sounds very good, it's very, very tight. That'll give people opportunity as you go forward exploring and drilling. How about your funding?

Will Ansley: We have just under half a million dollars in the bank and have just completed a drill program. We will need to raise some money, probably a little bit of flow through and a little bit of hard dollars in the New Year to complete our 2017 exploration plans.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Will Ansley: We are located in one of the best geopolitical locations in the world, extremely safe, extremely expedient, in terms of permitting. There is skilled labor and parts located a few kilometres from our project therefore we will not be required to build a camp for our workers. The power costs in Manitoba are one of the cheapest in the entire world. We have high grade gold, and lastly but most importantly, we have a lot infrastructure already in place. At current prices, if you were to redevelop the existing infrastructure you would likely be spending somewhere around $50-75 million. All those factors provide the company with a terrific head start in terms of creating a valuable project.

Dr. Allen Alper: Well that sounds excellent. Is there anything else that you'd like to add, Will?

Will Ansley: At the highest level, our operational footprint will support a 450 to 500 tonne per day operation and at 6 grams we could conceivable produce about 30,000 ounces of gold a year. The market capitalization of companies with similar sized operations, located in Canada, is approximately $275 million. That is our prize, our end goal, and given that our current market capitalization is less than $4 million there is a compelling investment opportunity here. We are going to work very hard by exploring and de-risking the project, so that our shareholders can benefit from getting to that end goal, that prize.

Dr. Allen Alper: That sounds very good.

http://www.satoriresources.ca

401 Bay Street, Suite 2702

P.O. Box 86

Toronto, Ontario M5H 2Y4, Canada

Investor Inquiries:

Will Ansley, President and CEO

Wansley@satoriresources.ca

|

|