Interview with Richard Clark, CEO of Orca Gold (TSX-V: ORG): Highly Prospective and Underexplored Gold Project in Northern Sudan

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/7/2016

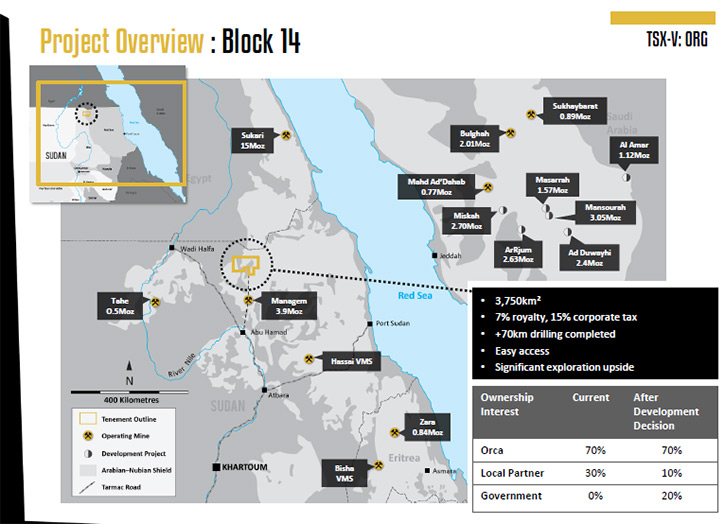

Orca Gold Inc. (TSX-V: ORG) is a Canadian resource company, focused on exploration and

development opportunities in Africa. It is currently focused on its 70%-owned, highly

prospective and underexplored Block 14 project in northern Sudan, near the border with

Egypt. We learned from Richard Clark, CEO of Orca Gold, that Block 14 is one of the top four

undeveloped African gold projects and looks to be materially economic at an $1100 gold price

for resources and a $1200 gold price for economics. The Company has an experienced board of

directors and management team and a strong balance sheet, with a treasury of over $12

million in September, 2016. According to Mr. Clark, Block 14 is a discovery in an area of

the world that is significantly endowed with gold, and the upside potential here is

huge.

Block 14 Drill Program

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News,

interviewing Richard Clark, who is CEO of Orca Gold, Inc. Rick, could you tell me a little

bit about what differentiates your company from other junior mining companies?

Richard Clark: A couple of reasons: The first reason is that we actually have a

gold project that looks to be materially economic at an $1100 gold price for resources and a

$1200 gold price for economics. It's a sizeable resource, and it stacks up to be 1 of

probably the top 3 or 4 undeveloped gold projects in Africa.

Number 2 is the management team that is running Orca. The management team is the

ex-management team of Red Back Mining. You may recall Red Back was very successful in

developing projects in Africa, and developing itself corporately from a small junior into a

significant intermediate gold producer. Eventually, the company was sold to Kinross back in

2010. That management team is back together, and we're looking to have a similar type

business plan to Red Back. It would be fantastic if we could duplicate our previous success,

but that's unlikely, these things only seem to happen once in a lifetime. However, that

doesn't mean we can’t build a very significant company in Orca, with the foundation asset we

have.

Dr. Allen Alper: That sounds great. Sounds fantastic! Could you tell me a bit more

about your property, location in northern Sudan, and why that area is so interesting?

Richard Clark: That's a really good question. Today, if you look at exploration

projects around the world, there are hardly any new ones because money hasn't been spent on

them for the last 4 or 5 years. There are no significant new discoveries. Most exploration

and near-term development projects are projects that have been around for a long time and

keep waiting for the next cycle or a different gold price.

We are going to parts of the world where there are opportunities to find significant

projects, particularly gold. I think we are pretty unique in doing this. After selling Red

Back, we as a team looked around and said, "Where do we think we could go in Africa, to

potentially find another major gold project, where people haven't really looked yet?" We

came up with the Arabian Nubian Shield.

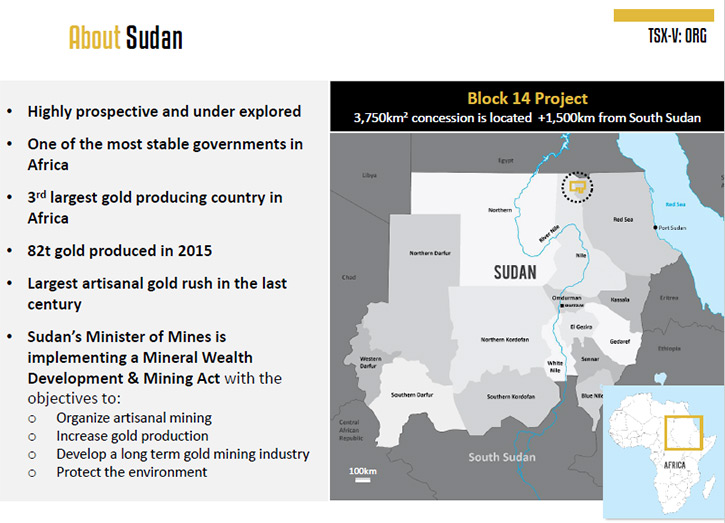

The Arabian Nubian Shield extends from Saudi Arabia, Sudan, down into Eritrea,

Ethiopia. We really liked the prospects of Sudan because historically it's pretty well

documented that Sudan was the primary source of gold for the Egyptian empire.

We also make our own assessment of political risk. We have been in Sudan for 5 years

now. We have found it to be one of the easiest countries in Africa where we have worked as a

group.

The thing that excites us so much about Sudan is that it is the third-largest gold producer

in Africa today, and has a good chance of being the second-largest gold producer in 2017,

and yet Sudan has no commercial gold mines. Sudan is experiencing the biggest gold rush in

history. There are approximately 1.5 million Sudanese artisanal miners in Sudan producing

gold with picks and shovels.

I exaggerate a bit there. They have taken artisanal mining to new heights. When you

drive to our project, for 60 kilometres, all you can see is excavators working in small pits

and miners everywhere. In the first half of 2016, Sudan officially produced about 45 tonnes

of gold. They're on track to produce a similar number for the last half of the year, which

will make them solidly the third-largest producer in Africa, with no commercial gold mines.

What's exciting is we're the most advanced project now in Sudan, and we're looking to fast-

track our project into commercial production. That's the future of gold mining in Sudan. For

artisanal mining, they'll eventually pick away at everything at surface and exhaust what's

easy in terms of oxides. For a sustainable industry in Sudan, they're going to need real

commercial mines, and we're in the vanguard of that.

Dr. Allen Alper: That sounds great! That's really exciting! Could you tell me a

little bit more about your background, your team and board?

Richard Clark: Absolutely. My background originally is in exploration geology, but

very early on I decided that I needed to do something a little different. I became a lawyer

and practiced resource law here in Vancouver for a number of years. In 1993, I left the

practice of law and joined a client of mine, and started running gold mining companies. I've

been doing that ever since.

I joined the Lundin group of companies about 16 years ago. We embarked on a gold production

initiative. It was the first one the group had really done, and certainly the first one in

Africa for us. We created Red Back, and I ran Red Back for almost 10 years. We took that

company from a market cap of about 40 million and sold it for 9 billion in 2010.

After that, I've been dabbling in different things. Orca is a company Lukas Lundin

and I started privately 5 years ago. Gradually as we had success, we brought the rest of the

Red Back team into Orca in order to turn it into a real company. Up until this year I've

been the Chairman of Orca, effectively unpaid. I was not prepared to come into the company

until we were confident we had a project we could build. We produced the PEA this July, and

that was extremely positive. That inspired me to say, "Okay, let's put the Red Back

management team back together and use Orca as our vehicle to build another African gold

mining company."

Dr. Allen Alper: That sounds great!

Richard Clark: Simon Jackson, my number 2 at Red Back, who was Vice President of

Corporate Development, is now the Chairman of Orca. Simon is the CEO of Beadell Resources

based out of Perth, with a mine operating in Brazil. Again, lots of experience on the board

from that front.

Management wise, Hugh Stuart is the President. Hugh was the Vice President of Exploration at

Red Back. Hugh was pretty much responsible for the gold discoveries in Red Back, and also

Orca’s discovery in Sudan.

Kevin Ross, Chief Operating Officer, was my Chief Operating Officer at Red Back.

Jeff Yip is our CFO. Jeff joined the Lundin group of companies in 2012, and he's now come

into his own as the CFO of Orca.

We have a strong consulting team doing our PFS, which is being led by Lycopodium,

our main engineers when we ran Red Back. Also Knight Piesold Pty Ltd., which is doing all

the tailings work, worked for us at Red Back. This isn't our first rodeo. We've worked in

the desert before. We've worked with all these guys, all these consultants. We know what it

takes to build a mine. We know how to do it on time and on budget, and that's what we're

going to do.

Dr. Allen Alper: You have a very impressive background. Your team is a great team,

and you have a very strong board. That sounds great!

Richard Clark: Thank you. We're happy.

Dr. Allen Alper: Could you tell me a bit more about your finances and share

structure, capital structure? I know recently there was a change in investment. Maybe you

could talk about that a little bit.

Richard Clark: With Ross Beaty?

Dr. Allen Alper: Yes.

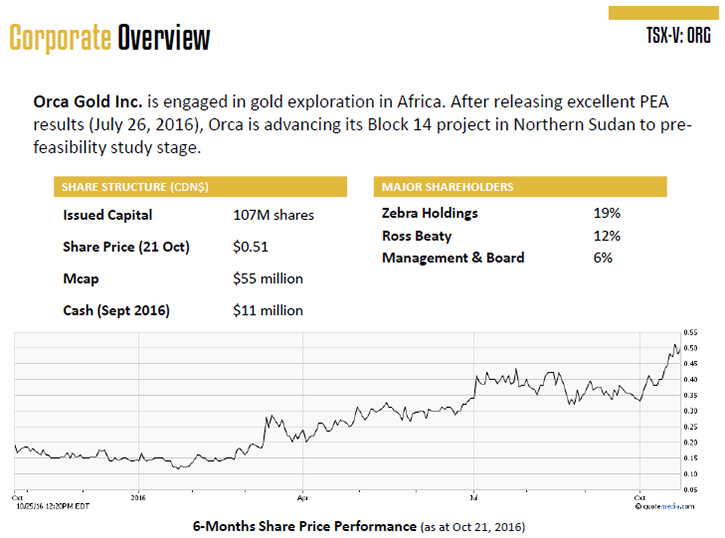

Richard Clark: Why don't I start with that? Orca was originally a company called

Canaco. Canaco had a prospect in Tanzania that didn't turn out as expected. During the last

boom cycle, Canaco was able to raise a lot of money for that project. At the end of the day,

they ended up with an uneconomic project, but lots of cash in the bank. A very good friend

of mine, who was a director of Canaco, came to me and said, "Are you guys interested in a

cash shell?"

We had our own company that had the Sudanese assets in it. We did a deal with Canaco

whereby we merged our 2 companies and we kept $60 million of cash, and spun out the Canaco

assets plus about $20 million of cash to the former management. Once we did that, we changed

the name to Orca Gold. We have never done a financing since that deal, and we have been

spending that $60 million Canadian on advancing our Block 14.

At the moment, as we sit here today, we have $11 million Canadian in the bank. We've

just announced a $2 million private placement, which is strategic and will give us $13

million going into the end of the year.

The reason I started with that is, one of the things we inherited with Canaco was a

Chinese SOE shareholder by the name of Sinotec. Sinotec is based in Beijing. They have been

very good shareholders, very supportive, but their mandate really is high-grade, narrow,

underground-type operations. The scale of what we've done and discovered in Sudan is not in

their business plan, namely a big, open-pit type of operation. I've been talking to them

for quite a while, over a year, about placing their share position strategically for Orca

going forward. They agreed to that subject to pricing.

A close, long-time friend of mine, Ross Beaty, came to me and said that he was very

interested in investing in various gold juniors, positioning himself in gold early. He is a

gold bull going into the next cycle, and he and I have never actually worked together, even

though we've been friends. We were keen to do that. I was able to broker a deal between Ross

and the Chinese, and Ross now owns a little over 12% of Orca.

On the share structure, it's a very closely held company. The largest shareholder is

Zebra Holdings. The next largest shareholder is Ross Beaty. Then we come down to management

at 6%. That includes about 3% owned by me. What it doesn’t include is another 5% or so owned

by my ex-wife. She and I are very good friends and close. She's a strong supporter of what

we're doing in Orca, as well. That being said, obviously I can't add her into the management

side.

When we funded our private company originally, we brought in some very close friends in

terms of their personal accounts, guys that are CEOs of big companies that you would know,

fund managers that you would know. When you add all that up, it's effectively almost 50% of

the company is closely held.

Dr. Allen Alper: That's amazing! It shows that you all have great confidence in what

you're doing.

Richard Clark: We all write checks.

Dr. Allen Alper: That's excellent! It'll really mean a lot to you if your company is

successful. That's excellent!

Richard Clark: One of the things Adolf Lundin told me many years ago is that the

only way to make money in this business is to write checks and invest in yourself. I took

that to heart many years ago, and that has worked out extremely well for me, my family and

friends.

Dr. Allen Alper: That's great! I've interviewed Rob McEwen many times. He owns 25% of

McEwen Mining. He doesn't get a pay check. He's going to earn money through the growth of

his company. It sounds like you and your team are doing the same.

Richard Clark: Exactly.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors

should consider investing in your company?

Richard Clark: We've touched on a number of them: the quality of the project; the

management team; and that it's effectively virgin territory. This is a discovery from

nothing in an area of the world that is hugely endowed with gold, and there's no modern

activity. I think Orca’s opportunity in discovering more is huge. I think we're only

scratching the surface.

In terms of developing this project, you can look at small junior companies with

market caps under $100 million, and think, "How can you possibly fund your project?" But,

we're in a unique position. The good news and bad news of our story is that we're in Sudan.

The bad news is that it has an unfair perception in terms of the media and the world.

The good news is that Sudan is rapidly improving its image, and particularly with

its Muslim neighbors. We're seeing a lot of interest from sovereign funds and Arab investors

to go into Sudan and help Sudan grow as a nation. The Arab world loves gold. We present an

opportunity to that market to invest in a company that is building a gold business in Sudan,

and we're the first ones. We're in a unique position to tap into that source of financing,

as opposed to pretty much any of our peers.

This is a project that is also unique in that its capital requirement, the capital

to build it, is under $150 million. When we come out with the PFS at the end of Q1, you're

going to see very different numbers, a different production profile, but the capital is

still going to be very low. At $150 million, it is a number that is definitely achievable

for a company like Orca to finance and build. That's very different from a lot of our peers.

I think you've hit upon it, Allen, we all invest in our companies. We make money

when our investors make money, and we look for an exit strategy. We're not here for a

legacy. We are a group that looks for opportunities. We don't fall in love with our

projects. Everything's for sale at the right price, and that's how we've made our investors’

money. I think we're pretty good business people.

At the same time, we just aren't going to sit on one asset. Over the next months, you'll

start hearing that Orca's going to be growing into different areas in Africa. We're using

this project in Sudan as the foundation to build Orca into an African gold developer-

producer. That's why I'd buy us.

Dr. Allen Alper: That sounds very good. Sounds like excellent reasons to look closely

at your company. Is there anything else you'd like to add, Rick?

Richard Clark: I think the only thing in closing is a little bit about Sudan. Sudan

has sanctions against it, primarily by the U.S. and there are lesser sanctions from the UN.

I think people have to recognize that Orca is a Canadian company. Canada does not actually

have its own sanctions against Sudan, although we follow the principal ones of the UN to not

make any weapon-type investments in Sudan.

The reason for the sanctions is something that happened 20 years ago, primarily

targeted at the government of President Bashir. President Bashir is getting older. It's

unlikely he'll stand in the next election. People need to understand Sudan is one of the

largest or strongest allies of the U.S. or the Western powers in that part of the world.

It is a very moderate Muslim society. It's anti-Al Qaeda, it's anti-ISIS, and it has

the army to back that position up. We're now seeing Sudan, for example, send troops to

assist Saudi Arabia in Yemen. I just heard, when I was in Sudan that there had recently been

cooperation with the Israelis in northern Sudan against Hamas. Sudan is doing the right

things in the world, and I think we're going to see a softening of the political rhetoric. I

think we're going to see an opening of Sudan for foreign investment on a commercial basis.

In a meeting in Sudan a few weeks ago, the Canadian ambassador told me Canada's policy vis-

a-vis Sudan is one of investment. Things are changing. I think in a couple of years, Sudan

is going to be a real target for mining companies as these barriers come down. The unique

position Orca has is that we are there first.

Dr. Allen Alper: That sounds excellent!

http://www.orcagold.com/

Elina Chow

Investor Relations

416.645.0935 x 226

info@orcagold.com

|

|