Interview with Mr. Rob McEwen, Chairman & Chief Owner of McEwen Mining Inc. (MUX, TSX: MUX): Growing Gold and Silver Producer in the Americas

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/1/2016

Rob McEwen is the founder and former Chairman and CEO of GoldCorp Inc., one of the

largest gold producers in the world. McEwen Mining Inc. (MUX, TSX: MUX) is a growing gold

and silver producer in the Americas with two gold and silver mines in Mexico and Argentina

and two new mines planned in Nevada and Mexico. In addition, it has a large copper deposit

in Argentina. We learned from Mr. McEwen, Chairman & Chief Owner of McEwen Mining, that the

company just had another good quarter. Their treasury is strong, they have no debt, they

haven't sold any metal streams or royalties and they are actively exploring in Nevada,

Mexico and Argentina. Near term plans include using innovation and today's technology to

improve their operations, to reduce the capex further and increase productivity. According

to Mr. McEwen, one of the areas where they are different from others is their large insider

ownership.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News,

interviewing Rob McEwen who is chairman and founder of McEwen Mining. Could you tell me

what's happening with McEwen mining?

Mr. Rob McEwen: We had another good quarter. For the three and nine months that

ended September 30, 2016, the Company reported net income of $4.2 million or $0.01 per share

and $25.5 million or $0.09 per share, respectively. Earnings from mining operations were

$18.9 million and $57.7 million over the same periods. Net income for the three months ended

September 30, 2015 was $2.6 million or $0.01 per share. Our treasury is strong. We don't

have any debt. We haven't sold any metal streams or royalties. Actually bought back a

royalty. We're exploring on our properties with a budget of 12 million dollars this year.

The objective is to extend the lives of our mines and development projects through this

exploration effort.

Dr. Allen Alper: That sounds great. Could you tell me a bit more about your new

president and his background, and about your team?

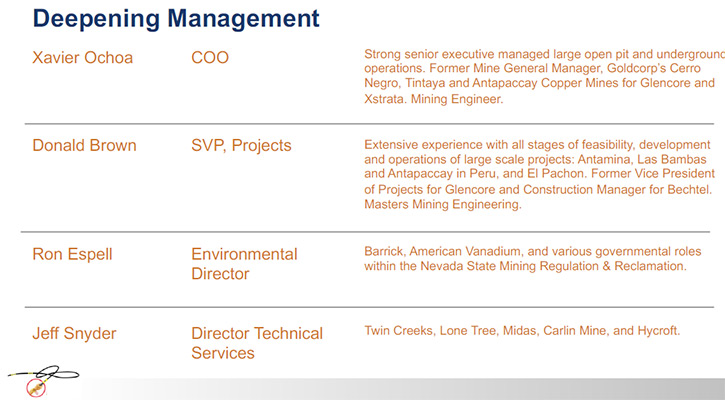

Mr. Rob McEwen: Sure. Our new president’s name is Xavier Ochoa. He has about 25

years’ experience. Before joining us he has worked with some of the biggest names in mining:

Xstrata, Glencore, Barrick and Goldcorp. He held senior executive levels with those

companies. He was responsible for both underground and open pit mines. I think it's a very

good fit, his skills to our needs. Donald Brown, who joined as Senior Vice President,

Projects, has worked for Xstrata, Glencore, and Bechtel Engineering. He built a number of

their large mines and also troubleshot when properties were in trouble. We have two projects

to develop, our Gold Bar and our El Gallo silver mine.

Dr. Allen Alper: That sounds very good. Could you tell me what differentiates McEwen

Mining from other mining companies?

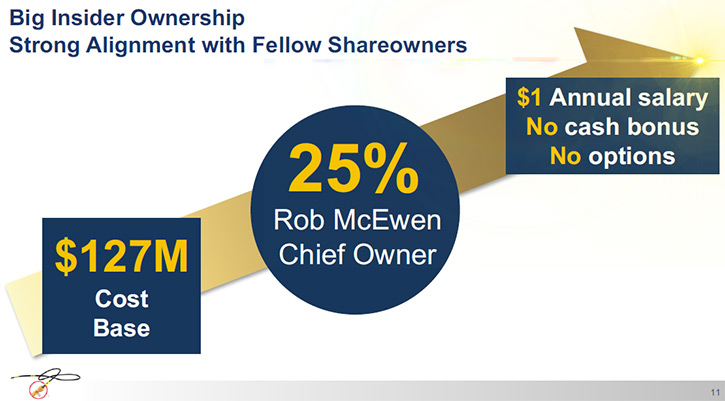

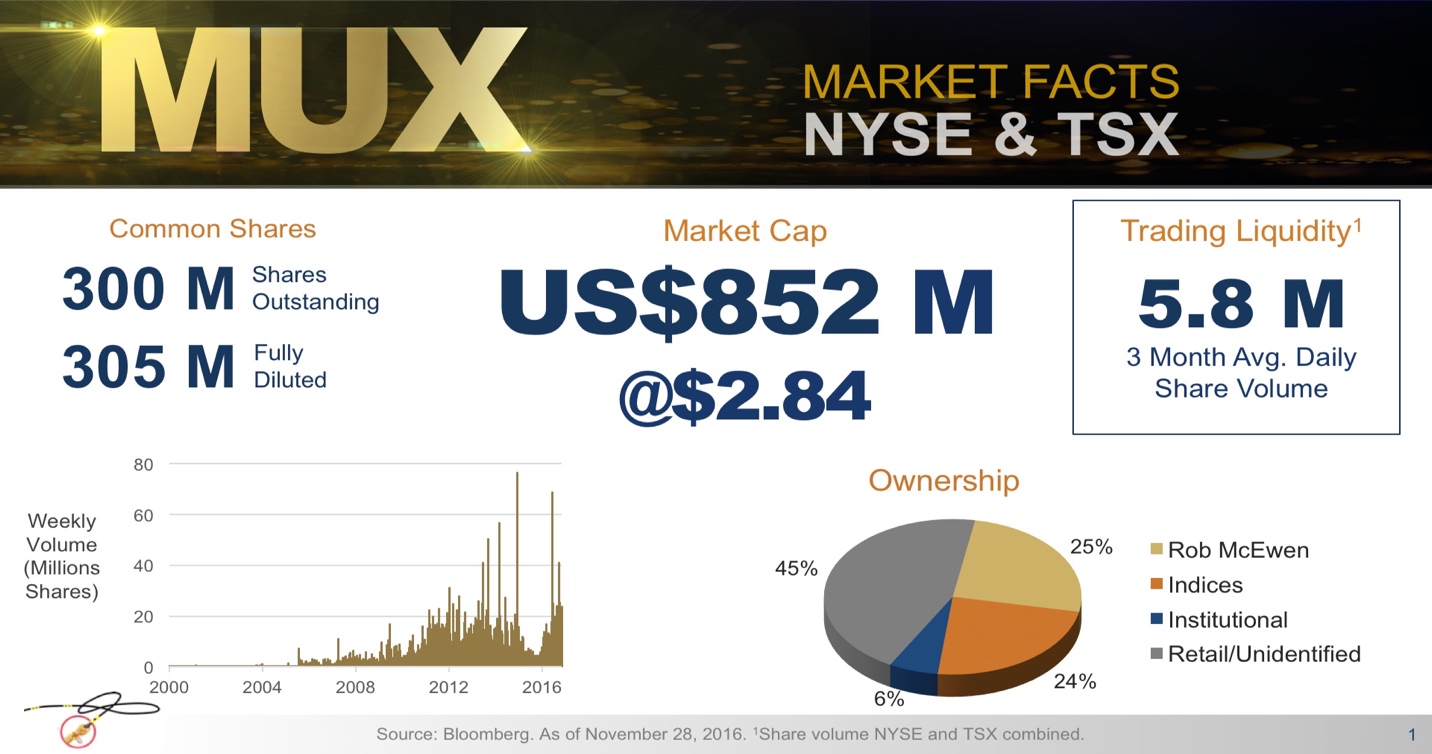

Mr. Rob McEwen: There are a couple of areas where we are different from others. One

is our large insider ownership. I own 25% of the company and my cost base is at 127 million

dollars. I take a $1.00 a year salary. I do not have any stock options. I will make money

the same way as all my fellow share owners do and that is through a higher share price. As I

said, we don't have any debt. Our treasury has been growing due to improving operations and

not from external sources of financing such as selling royalties, metal streams or by

hedging our future production. At the end of 2014 we had 15 million in cash and today we

have cash and liquid assets that total $70 million.

Dr. Allen Alper: That's great. Could you tell me what your plans are going forward

for the remainder of 2016 and 2017?

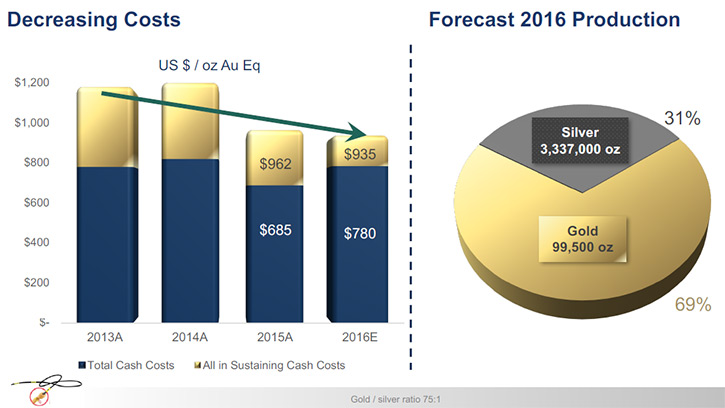

Mr. Rob McEwen: More exploration and productivity improvements. Reviewing our

development projects, Gold Bar and El Gallo silver, to see how we can reduce the capex and

opex.

Dr. Allen Alper: That sounds good. Could you tell me a little bit more about your

reserves and resources?

Mr. Rob McEwen: Reserves in Argentina are five years and resources are approximately

five more years. In Mexico, we currently have a short mine life of two years. We believe

that our exploration program will be able to extend it. El Gallo has historically been a

short life asset but our exploration has kept replacing the resources. Gold Bar has a seven

year life and there's good exploration potential around it. We also purchased a property

next door to it that should add a year or two to our production life once the mine is up and

running.

Our permitting at our Gold Bar property has been delayed. Now, it looks like it'll

be the third quarter of next year when we'll get our permit to start construction. In

January we start drilling on our Los Azules property in Argentina. It's a very large

resource. If you put it on a gold equivalent basis it would be the equivalent of about 35

million ounces of gold, just to give you a sense of scale on that project.

Dr. Allen Alper: Yes. That is certainly a big project. Could you tell me a bit about

your capital structure?

Mr. Rob McEwen: We have 300 million shares outstanding. We did have an exchangeable

share that was redeemed in early October, so today there are only common shares listed on

both the New York and Toronto stock exchanges under the symbol MUX. Our average volume over

the last three months is five million shares a day. The majority of that trading occurs on

our New York listing.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors

should consider investing in McEwen Mining?

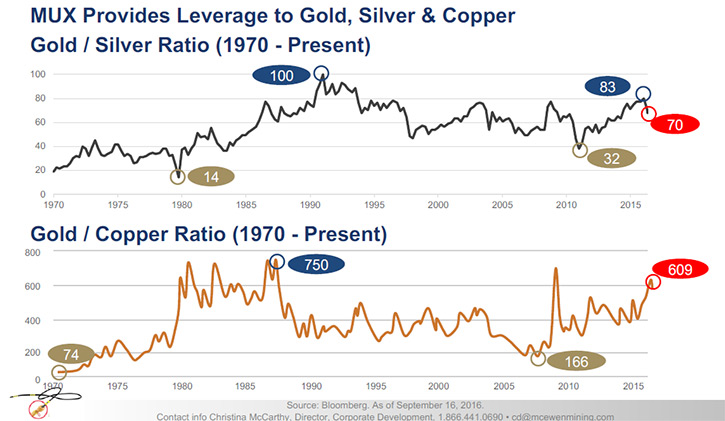

Mr. Rob McEwen: There are a couple of reasons. One, we offer leverage to gold,

silver, and copper. We have no debt. We have a high beta. It’s 2.7 times the price of

gold, one of the highest in the market.

We haven’t mortgaged the future by selling metal streams or royalties and we haven’t

hedged our production. We're big believers that the price of gold and silver are going

higher, and that our share owners want exposure to the higher prices of the precious metals.

Dr. Allen Alper: That's very good.

Mr. Rob McEwen: Large insider ownership is always something I'm looking for whenever

I'm evaluating a possible investment. I always ask how much management has invested.

Dr. Allen Alper: That's very good. That's excellent! Could you tell me a little bit

about your thoughts on what's happening with gold, silver, and copper, and the factors

influencing those markets?

Mr. Rob McEwen: Certainly. The market has been very preoccupied with the election.

The focus on the election seems to have missed the point that the monetary base has been

expanded dramatically. The low interest rates are hurting large portions of the population

and forcing people to make riskier and riskier investments in the equity market or in the

real estate market. They're taking on more debt. The economy isn't growing as fast as the

politicians would expect us to believe.

Economic history is an indicator. Whenever we've seen situations, where the

monetary base has expanded rapidly and governments and individuals have incurred debt at

ever increasing levels, the outcome is not a good one unless you have investments in hard

assets.

Dr. Allen Alper: What about silver versus gold as an investment?

Mr. Rob McEwen: Silver has large industrial applications that has an influence on

the price. The exchange ratio with gold over the past 8 years has ranged from 100 to 1 to

less than 30 to 1. It's currently around 65 to 1. Historically the average exchange ratio is

50 to 60 to one. Right now I'd favor silver outperforming gold. That's why right now 31% of

our production is from silver and within three years it will be 41%.

Dr. Allen Alper: That sounds very promising and the right thing to do. What about

copper? What are your thoughts on copper?

Mr. Rob McEwen: The copper price has been recovering. It's moved up strongly since

the summer. When you look at all the renewable energy devices and electric vehicles, they

are very big copper users. Copper has an interesting future ahead. I think it'll strengthen

over time.

Dr. Allen Alper: That sounds very good. Could you tell me how it is operating in the

US, Mexico, and Argentina?

Mr. Rob McEwen: In terms of getting a permit, the US is slower than in Mexico. In

Mexico they have some defined timeframes in which the regulators have to make decisions.

That's not true in the US. Argentina, has a new political party running the country and a

new President. For the three, four years prior to that it was a very difficult environment.

It's still challenging today because inflation is running at between 26 and 30% a year. They

have moved a considerable distance in improving the circumstances in the country for

investors, particularly foreign investors. They've addressed the exchange rate and devalued

their currency.

They've taken off the export taxes on mineral exports. This has a big bearing, not

only on our expenses, but also on the process we were going to use at Los Azules. Case in

point, we think there are over a billion dollars in saving in capex on our Los Azules

project as a result the changes the government has made.

Dr. Allen Alper: That's excellent! That's amazing!

Mr. Rob McEwen: I'd say, we're cautiously optimistic that Argentina will stay on the

current course. We're very supportive of all the government initiatives that are being

taken. Mexico has some civil issues it needs to address. There's an element of lawlessness

down there that is unfortunate. In Nevada, we hope President Elect Trump will speed up the

permitting process on Gold Bar and our other projects.

Dr. Allen Alper: I'm very impressed with your company, what you're doing, how you're

moving along, and the excellent year you've had. It's great!

Mr. Rob McEwen: Thank you. Thank you. It's been a good year and we hope next year is

even better.

Dr. Allen Alper: Very good.

http://www.mcewenmining.com/

150 King Street West

Suite 2800

Toronto, Ontario. Canada

M5H 1J9

E-mail: info@mcewenmining.com

Tel: 647-258-0395

Fax: 647-258-0408

Toll Free: 1-866-441-0690

Facebook: facebook.com/McEwenRob

Twitter: twitter.com/McEwenMining

Disclosure: The Alper family owns McEwen Mining stock.

|

|