Interview with Carl Hansen, President and CEO of Atacama Pacific Gold Corporation (TSXV: ATM): Cerro Maricunga Oxide Gold Deposit, One of the Largest Undeveloped Oxide Gold Deposits in the World Strategically Located in the Maricunga Mineral Belt in Chile

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/30/2016

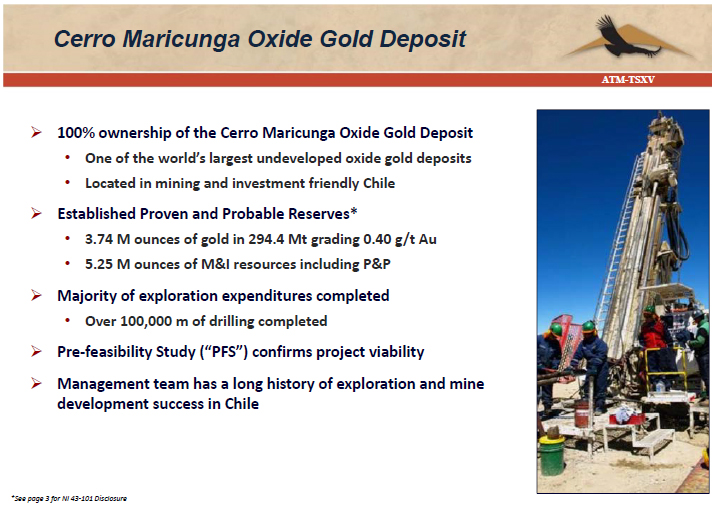

Atacama Pacific Gold Corporation (TSXV: ATM) is a precious metals exploration and

development company focused on advancing its 100% owned, low-risk and development-ready

Cerro Maricunga Oxide Gold Deposit, one of the largest undeveloped oxide gold deposits in

the world, strategically located in the Maricunga Mineral Belt in Chile. We learned from

Carl Hansen, President and CEO of Atacama Pacific Gold, that the deposit is their own

discovery, it contains high- purity gold, and is located near existing mines in a developed

mining camp, with good road access. Near term plans include an updated PFS, which should

commence next month, followed by a feasibility study and later, ultimately taking the

project to production either by themselves or with a JV partner. According to Mr. Hansen,

the company is very tightly held. Management and friends and family own about a third of the

company, so they are dedicated to maximizing the shareholder value.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News,

interviewing Carl Hansen, President and CEO of Atacama Pacific Gold Corporation. I know a

lot of exciting things have been going on for your company. Could you tell me a little bit

about what's happening in Chile with your gold properties? I know you have an unusual gold

property that is an oxide property, and in the industry, oxide is queen. Could you tell me a

bit about what differentiates your company and deposit from other gold companies?

Carl Hansen: Most certainly, and thanks for the opportunity. We've been very

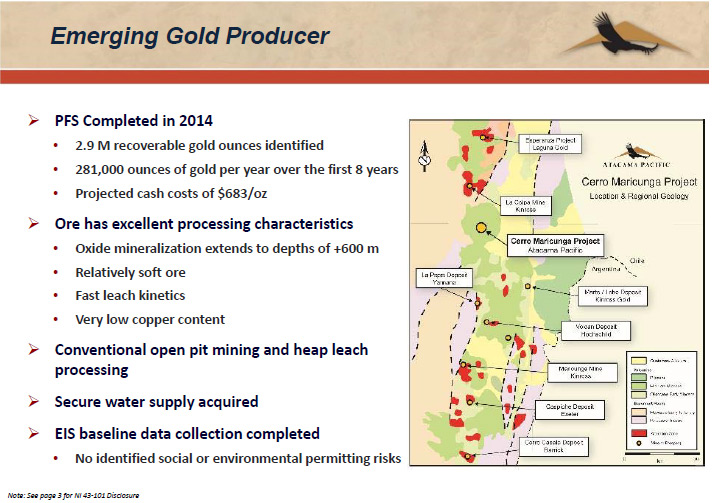

fortunate to have discovered a very large oxide gold deposit in Chile, within the Maricunga

Mineral Belt, very close to some existing gold mines, such as La Coipa, Lobo-Marte, and

Maricunga Mine.

Cerro Maricunga deposit was a grassroots discovery made by our group back in 2007. We went

public four years later, after we had done a fair bit of exploration work (mapping,

trenching and drilling) outlining the Property’s potential. It's an unusually deposit for

the area in that the oxides extend to extraordinary depths, in excess of 600 meters below

surface.

Further, the iron mineral at Cerro Maricunga, which is typically pyrite or

pyrrhotite at many deposits, is magnetite. The mineralization at Cerro Maricunga was very

likely deposited in an oxidizing environment, resulting in the formation of magnetite. In

addition to being oxidized, with a very deep weathering profile, there were likely only rare

sulfides in the deposit during deposition. The benefit being, from a processing standpoint,

the planned leach pads will not be acid generating.

We are a pure gold project with very little copper or silver in the ore. In fact,

unlike other Maricunga Belt deposits, which are copper bearing, Cerro Maricunga has only

0.002% of leachable copper. It's a clean, gold-dominated deposit. The gold grains

themselves are very fine in size and have an average purity of approximately 97%, resulting

in fast leach kinetics.

Dr. Allen Alper: Could you tell me about your plans going forward with your project?

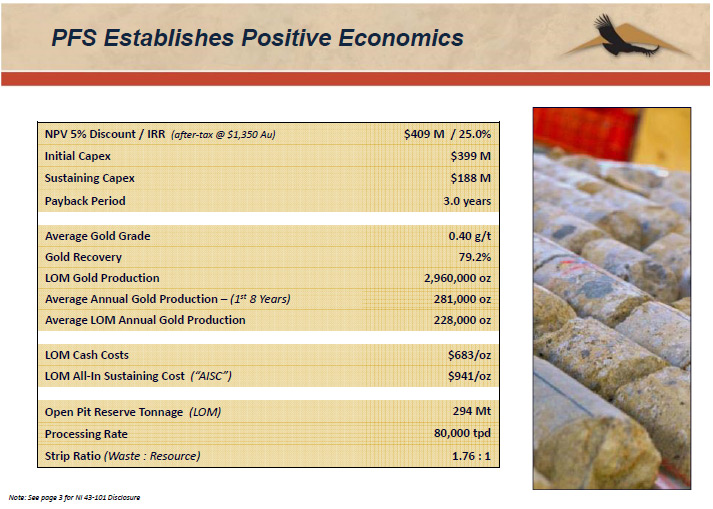

Carl Hansen: We finished our PFS back in 2014. At the time we were using a $1,350

gold price and while gold has rebounded slightly, we’re not yet back to those prices. But

on the other side, you have to consider that many of the majority of the input costs have

fallen tremendously since 2014. Oil is down significantly: we were using about $100-barrel

oil in the PFS. Electricity in Chile is down by about 40%. Lime and cyanide prices are

down as well. One of the few items to increase has been the US dollar which works in our

favour as well. At today's prices, we're probably as competitive as we were at $1,350 but

to establish that, we're preparing to commence a feasibility study.

We're currently raising funds in order to commence the feasibility study which we plan to

start in the early New Year. The feasibility will take about 12 months to complete and will

involve looking at some new development options, such as primary crush versus a three-stage

crush that we considered in the PFS. Our focus is on reducing the upfront capital

expenditures.

Dr. Allen Alper: Based on your feasibility studies, do you plan, at some point, to

take it to production or look for a partner?

Carl Hansen: We are open to all avenues to move the project forward. We can put

it in production ourselves. Our team has a mining background, so we're more than capable,

but we're also willing to consider a sale or a joint venture. Management and “friends and

family” own about a third of the company, so we want to create value, however it be, for all

of our shareholders.

Dr. Allen Alper: That sounds good. It's good to hear that management has confidence

in the company and has a large position.

Carl Hansen: We have a large position.

Dr. Allen Alper: That sounds great. Could you tell us a bit about your background,

your team, and your board?

Carl Hansen: Yes, most certainly. I'm a geologist by training. I started with

INCO over 25 years ago where I was involved with the development of the Casa Berardi and

Snow Lake gold mines. From there, I spent 10 years at TVX Gold, initially as senior

geologist working in the Americas and Europe and then a few years in investor relations

learning the finance side. After TVX was acquired by Kinross in 2003, our group formed

Andina Minerals which was sold to Hochschild in 2012. I had stepped aside in 2009 when it

was time for the development engineers to come in. In 2011, we took Atacama Pacific public

on the TSX-Venture.

I've worked with Dr. Albrecht Schneider, the Executive Chairman of Atacama for quite

some time, initially back in the days of TVX gold. He’s one of the top geologists in Chile

and has an excellent reputation for finding mineral deposits. He’s built a first-rate team

of senior exploration and engineering professionals. Together we successfully formed Andina

Minerals and Atacama Pacific.

Tom Pladsen is our CFO. An experienced mining-industry finance professional, who

has worked with our group since the formation of Andina Minerals.

We have two finance fellows on our board, Paul Champagne, who has a background in corporate

evaluations and heads the audit committee and Robert Suttie, who has a long history as the

CFO of a number of junior companies. Currently, we're looking to bring an engineer onto the

board as we move into feasibility work.

Dr. Allen Alper: That sounds very good. It sounds like you have a very good board and

you have a very strong team, and an excellent background yourself.

Carl Hansen: A dedicated management team is important. As is having an intimate

knowledge of the country in which you work. We like Chile. We’ve been working in the country

since the 90’s. It's a place where we are very comfortable working and comfortable with the

political and economic systems. The permitting and development process is well defined by

law, so you have certainty that when you find a deposit you can move it forward.

Dr. Allen Alper: It's very good to know the area, how to get around, what to do, and

have communication with everyone.

Carl Hansen: Yes, that is key.

Dr. Allen Alper: Could you tell me a bit about your shares and where they are listed?

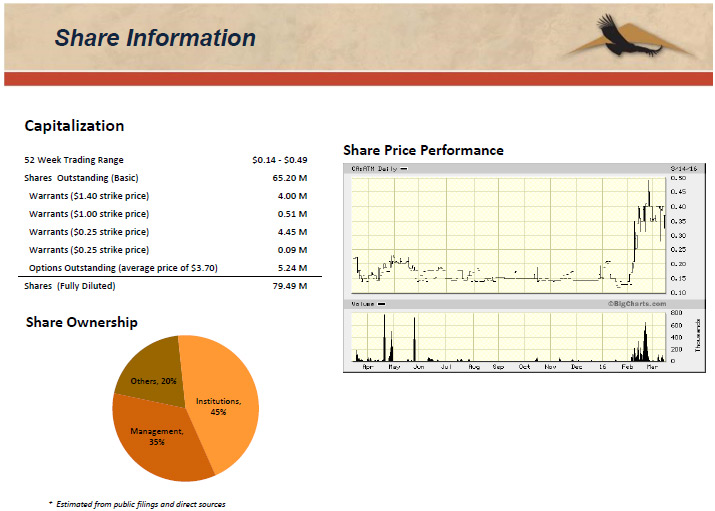

Carl Hansen: We're listed on the Toronto Venture Exchange. When the currently

announced financing is completed, there will be about 83 million shares outstanding. I had

a goal of keeping our outstanding share float under 100 million shares prior to financing

any development and so far we in good shape.

In addition to management owning about a third of the company, there are three

institutions that own approximately 40% total. That's 70% just with management and a few

institutions. Then we have a number of institutional shareholders with smaller amounts.

It's a very tightly-held stock.

Dr. Allen Alper: That sounds very good. You've done an excellent job not to let go of

your stock.

Carl Hansen: Yes. When management owns a significant stake, they tend to be more

careful.

It should always be that way.

Dr. Allen Alper: That's great! Could you summarize the primary reasons our high-net-

worth readers/investors should consider investing in your company?

Carl Hansen: Atacama Pacific owns one of the largest undeveloped oxide deposits

in the world. From a valuation standpoint, we have 3.7 million ounces of proven and

probable reserves with a market cap of around $40 million dollars, so a very low per-ounce

valuation. The deposit is located in Chile, a resource-based country, with a well-defined

permitting regime. Further, Atacama Pacific is a very tightly-held stock with a management

team that is dedicated to getting maximum value for all shareholders.

Given the size of the resource, when we're in full production, Cerro Maricunga will

produce 280,000 ounces a year for the first 8 years, at an attractive total per ounce cost.

That’s significant enough to move the needle for any company.

Dr. Allen Alper: Sounds excellent! Sounds like very strong reasons potential

investors should consider looking very closely at Atacama Pacific Gold Corporation. Is there

anything else you'd like to add, Carl?

Carl Hansen: If an investor is considering Atacama Pacific, I encourage them to

visit our website. We publish quite a bit of data from assay sections to metallurgical

results. Go through the data and make an informed decision.

Dr. Allen Alper: Okay, that sounds great!

http://www.atacamapacific.com

Atacama Pacific Gold Corporation

25 Adelaide Street East, Suite 1900

Toronto, ON

M5C 3A1

Phone: 647-560-9873

Fax: 1-844-964-7320

|

|