Interview with Ken Brinsden, Managing Director & CEO of Pilbara Minerals Limited (ASX: PLS): Advanced-Stage Pilgangoora Lithium-Tantalum Project Located in Pilbara Region in Western Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/25/2016

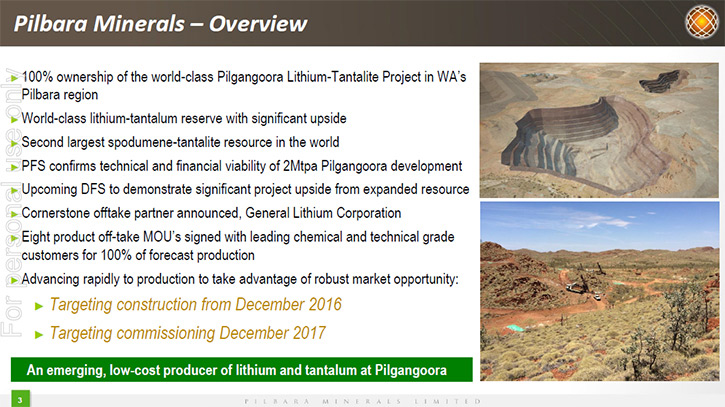

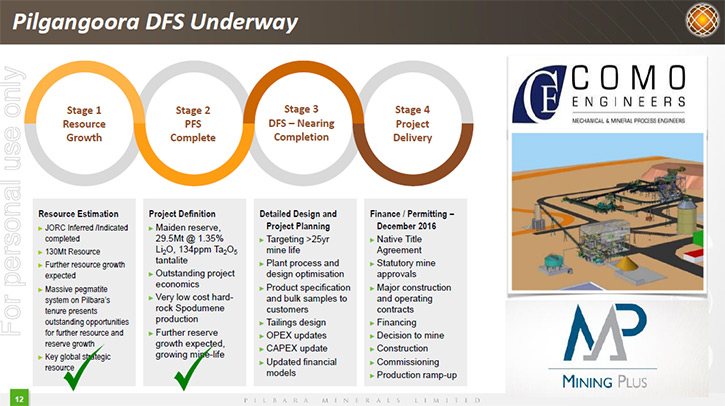

Pilbara Minerals Limited (ASX: PLS) is an emerging Australian strategic metals producer,

focused on its wholly owned advanced-stage Pilgangoora Lithium-Tantalum Project, located in

the Pilbara region of Western Australia, an historically famous mining jurisdiction with

first-class infrastructure. We learned from Ken Brinsden, Managing Director & CEO of Pilbara

Minerals, that the high-grade Pilgangoora deposit contains the world's second largest

lithium spodumene resource of approximately 130 million tonnes and has upside exploration

potential. The high grades of lithium, the credit of tantalite byproduct, the economies of

scale and the close proximity to port will make Pilgangoora one of the lowest cost hard

spodumene operations. The company is backed by institutional investors. Earlier this year

they raised $100 million to continue the development of the project, and recently they

signed an offtake agreement with General Lithium Corporation from China, inclusive of plans

for a joint venture chemical plant to convert their spodumene into lithium raw materials to

take advantage of the downstream markets. Mr. Brinsden is proud of his team, pleased with

the skills of the Pilbara Board and very excited about the quality of the project and the

speed with which it can be developed. The construction at Pilgangoora is expected to start

late this year with plant commissioning by the end of 2017.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News,

interviewing Ken Brinsden, Managing Director & CEO of Pilbara Minerals. I've been looking

over your website and I'm extremely impressed with your company. You have a great company, a

great property, and it looks like you’re the right guy to put them in production by the end

of 2017 in lithium and tantalum. Could you tell me a bit more about your company, your

resources, your plans, and what differentiates you from other lithium companies?

Mr. Ken Brinsden: Yeah, by all means, Allen. You're right. It's a really

exciting combination. The effect of significant global change and the electrification of the

transport industry, the application of the Lithium ion battery technology, and of course,

ultimately the raw materials that are required to make all that work. That's where we think

Pilbara Minerals with our Pilgangoora project has a really distinct advantage. We are very

pleased and excited about the opportunity that we have in that resource.

What really brings Pilgangoora to the fore as a key source of lithium raw materials

is firstly its location. The Pilbara in Western Australia is an amazing mining jurisdiction,

historically very famous for its massive iron ore exports, soon to be famous for its lithium

raw material exports, because of the effect of our Pilgangoora discovery. This location is

an important advantage due to the benefit of having access to absolutely first-class

infrastructure. The Pilbara as a whole has been developed as a massive mining jurisdiction,

so the infrastructure that you can access, the roads, the power distribution, the ports, are

all world-class. They are absolutely amazing facilities. We're on their doorstep.

Also, as a subset of the location, the proximity to the port itself is also really

important. You're shipping a semi-bulk material. You have to move a concentrate. Therefore,

being close to the port lowers the cost of logistics. In our case, by road, we're only

approximately 130 kilometres from the port by road, so that makes for a very low cost of

logistics. In summary, the North Pilbara is a fantastic place to be building a new mine

development.

Additionally, you have to have a high grade resource. The benefit in having a high

grade resource is in 2 parts. Firstly, the quality of the product that you can produce.

Clearly, in the world of lithium, you have to produce a product that people want to buy. If

you have a high grade, as we do at Pilgangoora, then you've got a better chance of

delivering a high specification product, and therefore maximize the price.

Second, the higher the grade, ultimately the lower the cost of recovery. You have a

lower per-unit processing cost. The combined effect of lithium grade and tantalum grade,

which is an important byproduct credit, is to in total make for a very high grade resource,

and as I said, ultimately therefore to lower your cost of production.

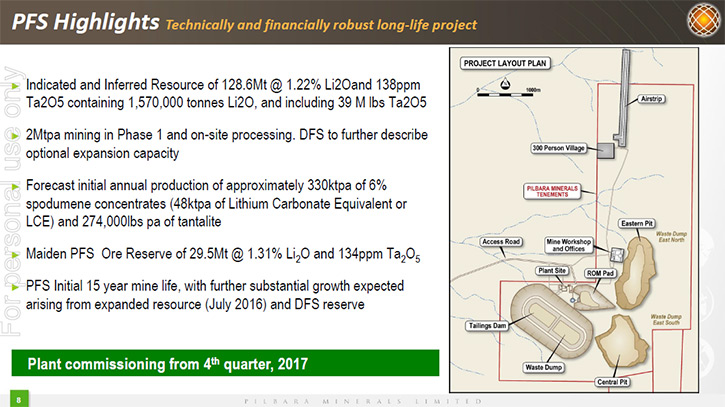

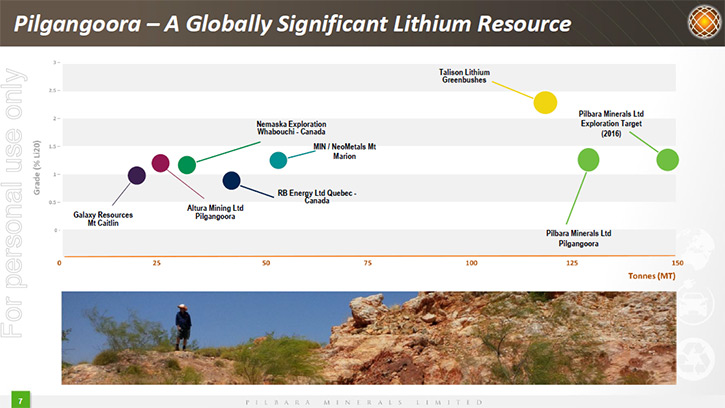

Last but not least, an opportunity for economies of scale. There is no doubt that the

Pilgangoora resource is huge. It's absolutely enormous. In fact, based on our most recent

resource update, ours is basically the largest by tonnage hard rock spodumene resource in

the world. As I said, we announced 130 million tonne resource. The most recent or closest

published number was also in western Australia, at the Greenbushes mine, where they had a

resource of 118 million tons. It's one of the big ones, and the benefit in that is that we

can generate some economies of scale when we open the mine, and we have flexibility to

continue to expand the mining operation to support what we would anticipate being a high

growth environment for lithium raw materials.

We have every chance to continue to expand our operations over time. The resource

could very well continue to grow from here, because the resource that we've described so far

is part of a very large geological system. Who's to say that the resource wouldn't continue

to grow from here, should we continue to drill the resource? In any case, it's a very large

resource already.

Some of what I've described there has already translated to a response from the market, in

investment markets in resources and the lithium space, but also a response from the buyers

of lithium raw materials. Firstly: We did a significant raising earlier in the year. The

raising was very well supported by institutional investors and our existing shareholders as

well. We raised $100 million to continue to support the development of the project,

massively over-subscribed and a key indicator of the quality of the project and the backing

of institutional investors.

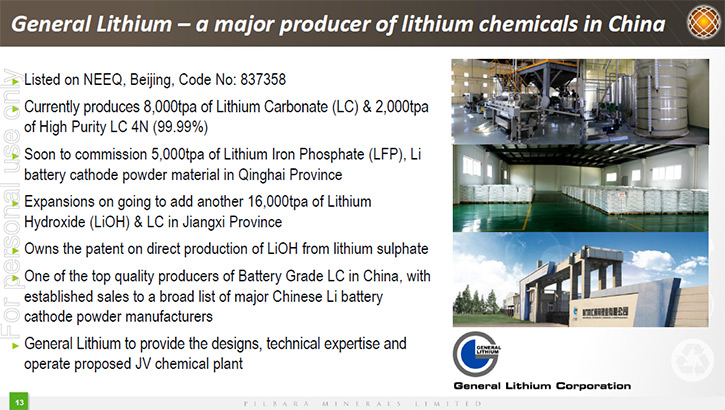

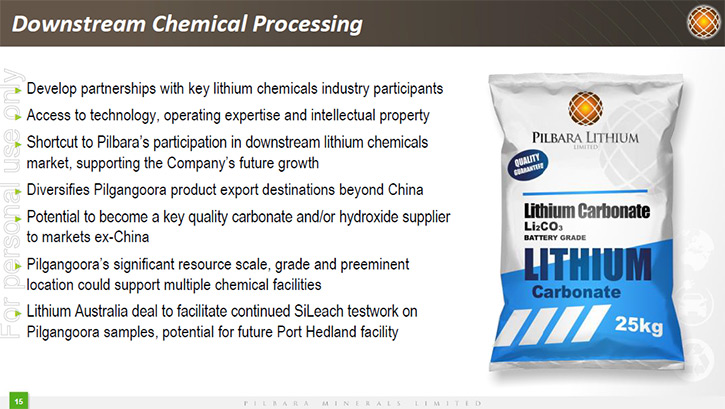

On the lithium markets themselves, we've recently signed what we think is a very

important series of deals with a key Chinese dispenser in the lithium raw materials

industry. We signed an offtake agreement with General Lithium Corporation. General Lithium

is one of the more significant players in lithium raw materials in China, and they've become

our key or cornerstone offtake partner. The effect of the agreements that we've signed with

General Lithium is, for us, to underwrite raw material supply to their existing business in

China and the expansions that are already underway, shipping 140,000 tons of spodumene

concentrate to General Lithium to support their Chinese business. In return, they will work

with Pilbara to continue to progress an initiative that would ultimately see us building a

joint venture chemical facility outside of China to convert our spodumene from the

Pilgangoora project into the lithium raw materials, but in particular lithium carbonate and

lithium hydroxide.

Both companies benefit. The benefit for Pilbara is, a bigger chance to participate

in the value-added industry, where the spodumene is being converted into lithium carbonate

and lithium hydroxide. The benefit to General Lithium is that we supply their existing and

future facilities in China. That's a big win for them, because the market is so tight for

the raw materials. That's a big help for them. Lastly, in the agreements with General

Lithium, they've also indicated, as part of the deal, as an agreed position they will make

an equity investment, albeit a relatively small one, 3% of the equity in Pilbara Minerals to

cement the partnership. That could grow to 5% of Pilbara over time. All in all, very

positive developments for the company, but important also for our future growth and broader

participation in the lithium market. We're really happy with our progress, and excited about

the potential.

Dr. Allen Alper: That sounds excellent. That's really great. Could you tell me a

little bit more about your background, the board and the management team?

Mr. Ken Brinsden: Yeah, of course. It's a fantastic project and the benefit in

that is to attract some great people. We've been continuing to build the expertise and the

experience at both our board level, for Pilbara Minerals, and also within the executive and

management teams.

I guess that starts with me. I have a lot of experience in the Pilbara. I was

involved in developing many mines out there, historically in the iron ore industry of

course, given that's what the Pilbara has been very famous for. In a nutshell, that resulted

in the development of 5 mines during the course of the last decade or so. As a result, I

have significant experience in what it takes to develop those mines and the intricacies, the

knowledge base to assist in the fastest possible progress of our Pilgangoora project. I'm a

mining engineer by training, and have spent my entire career in and around mine development,

mine management, production management, and ultimately leading organizations to continue to

grow. Hopefully, that's a big help to Pilbara.

At a board level, we're continuing to build the experience both amongst the key

board members. We've recently taken on a new chairman. His name is Tony Kiernan. Tony is a

fantastic, incredibly experienced guy. He's a lawyer by training, although he hasn't been in

private practice for quite a while now. He's been intimately involved in the mining industry

in Western Australia, including across multiple commodities, but perhaps most important of

all, he too has been involved in the development of mines in the Pilbara. He was and is

still the chairman of an iron ore company called BC Iron. They're involved in mine

developments in the Pilbara of Western Australia as well. A guy with fantastic experience

and credibility and pedigree in the mining industry in Western Australia, and we're lucky to

have him. He's a great guy.

We continue to build the parallel skills that are required at a board level. We've

recently taken on a very experienced director and Western Australian resources expert, Steve

Scudamore. Steve comes from a corporate finance background. He was the managing partner of

KPMG in Western Australia for many years. Fantastic finance background, and again, another

key addition to the board.

The founding directors of the company are geologists, and still intimately involved with the

business. Neil Biddle and John Young, both highly experienced geologists, and you would

credit them with the discovery of the Pilgangoora resource. Fantastic work and real

commitment too, because they were drilling the Pilgangoora resource when it wasn't really

that sexy to be drilling it. At that stage, when they started drilling Pilgangoora 2.5, 3

years ago, it wasn't easy. It certainly wasn't easy in the same way as we might imagine it

to be today. They had to raise money and in some circumstances use their own money to

continue to progress the project's development. To their credit, they did, and now of course

having realized the potential in the resource as a result of their good work, both in terms

of drill holes in the ground but also the technical work that's required to progress the

project, for example, metallurgical studies and petrological studies, environmental studies.

They've done a really good job in that area, and as a result we now have a very

advanced project that should continue to develop quickly, as you alluded to earlier, to the

point where we're constructing late this year and we're commissioning late next year. It's

all to look forward to, Allen.

Dr. Allen Alper: That sounds great. Your plans are to get into production by the end

of 2017, is that correct?

Mr. Ken Brinsden: Yeah, that's right. It's a fast-track development, but

through the experience of the team and the good work that had been done inside the project

up to this point in time, we're well advanced. As a result, we'd expect to have the final

environmental approvals by early next year. We'll have finished the financing of the project

at our about the same time. As a result, we'll be in construction for the major site works,

with some preliminary works commencing before the end of this year. The construction period

is approximately 12 months, maybe just a fraction less. As a result, we'll be commissioning

late in 2017. All very doable, and as I said, built on the foundations of some very good

project work. It's exciting.

Dr. Allen Alper: That's really fantastic. Could you tell me a bit about your share

and capital structure and your finances?

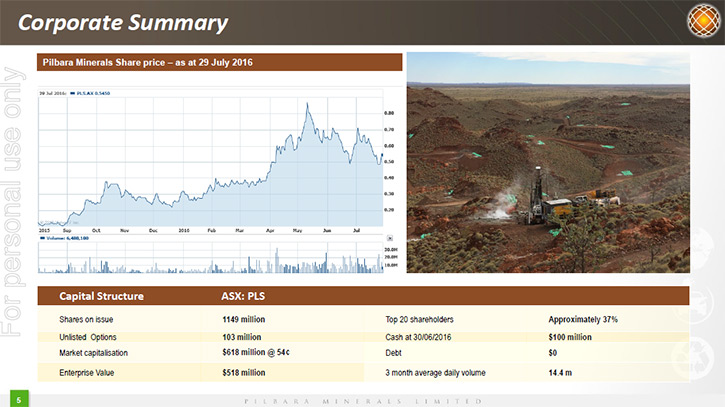

Mr. Ken Brinsden: Of course. I alluded to the very successful raising from

earlier in the year. That was conducted in April. We raised $100 million Australian. $85

million of that was from institutional markets, and the balance $15 million from existing

shareholders and through what's called a share purchase plan in Australia. As I said, the

raising was very well-supported, with both consignments being heavily over-subscribed, and

really demonstrated the appetite of the market for such a project as the one we're

developing here.

We have approximately 1.2 billion shares on issue. We had $95 million in cash in the

bank as of the end of October. Based on our recently released definitive feasibility study,

the capital estimate was approximately $215 million Australian, so we still have to finish

subsequent fundraising for the development of the project, but the customers will assist in

the financing. As I said earlier, General Lithium will assist in an equity investment in the

company. Some of the parallel offtake agreements that we're working on will see customers

continue to support the financing of the project. As a result, we'll have a relatively small

amount to finance prior to the commencement of major site works early next year. In any

case, that all looks readily doable. It is a very strong project, so we don't see that

financing as being overly challenging. We'd expect that to be well-supported by the market.

Dr. Allen Alper: Do you plan to do that all in equity, or equity and debt?

Mr. Ken Brinsden: We haven't made any commitments yet, Allen. We're basically

keeping all options open. I think it's fair to say that the debt would be readily doable for

the project, given the strength of the project, but we haven't made any commitments one way

or the other. That's to be determined, but we would expect the financing to be readily

doable through whatever means we chose to execute it.

Dr. Allen Alper: That sounds very reasonable.

Mr. Ken Brinsden: Yeah. It's not an overly complex project, Allen. It's, from

a mining point of view, actually quite simple. From a processing point of view, whilst it's

a reasonably large processing plant, it's not a complex plant. The processes used within the

plant for the concentration of the spodumene mineral and the recovery of the tantalum

concentrate are not complex processes, primarily crushing, heavy media separation, which is

widely used through the resources industry, coal handling, iron ore, mineral sands, that

sort of thing, and then recovery for the purpose of the tantalum concentrate recovery, and

then lastly oxide flotation. Really, nothing too complex, and hence the relatively modest

capital cost.

Dr. Allen Alper: You're looking at tantalite as a byproduct to the lithium product,

will that lower your overall cost?

Mr. Ken Brinsden: Yeah, that's right, Allen. Actually it's quite an important

credit. There's a bit of history behind the Pilgangoora resource. It's been long known as a

potential tantalum resource. Originally, the purchase by Pilbara Minerals was targeting the

tantalum. It was anticipated to be a large probably low-grade tantalum resource with the

possibility of a high-grade subset of those tonnes. What has actually happened is exactly

that. It is a very large low-grade tantalum resource, and it's been proven to have some

high-grade subsets involved with it, but of course what's also been discovered is this

incredible endowment of lithium. The guys consider themselves both very lucky, but as I

said, they've also done some good work to prove the potential in the resource.

Dr. Allen Alper: That's excellent. That's really great. That must make your company

very competitive compared to others as far as your costs.

Mr. Ken Brinsden: Yeah, we believe that we'll be one of if not the lowest-cost

producer for hard rock spodumene globally. The combined effect of all those things I

described earlier, that important location, Pilbara and close to the port, very high grade,

high quality product, and the economies of scale that are generated given the huge resource

that we're working on, all those things make for a very competitive cost base. That's one of

the reasons why we like the idea of being able to participate in the downstream value-add,

basically to leverage the quality of the project into a value-added product. If we're going

to be mining there for decades, we should take advantage of the ability to participate in

downstream markets.

The truth is, Allen, we're a mining company, so we wouldn't pretend, at least not in

the first instance, to be able to participate in chemical markets. We can, if we work with

the right partners, and that's why the relationship with General Lithium is such an

important one, because we're able to access their technology, their designs, their existing

operating expertise, and work with them to establish new chemical facilities. It’s a really

important relationship that we think is going to continue to support the growth of the

business.

Dr. Allen Alper: I think that's an excellent idea. I think your plan is great. Start

out with mining, and then later to get into value-added products and keep the margin

products. That sounds great. Excellent plan. Could you tell me a little bit why lithium is

so important for my readers? Something in that market? Why it's so exciting?

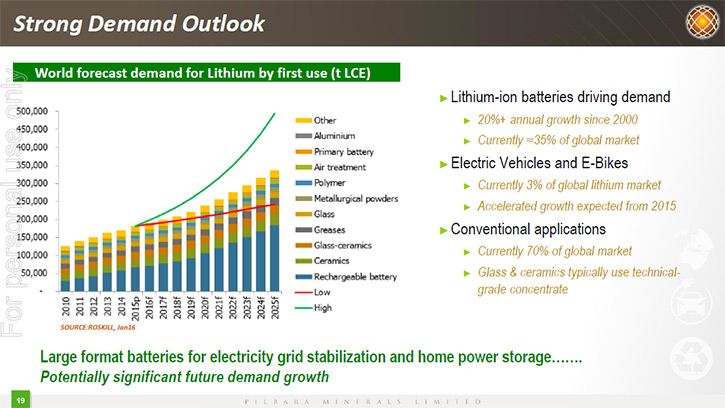

Mr. Ken Brinsden: It's really phenomenal what is unfolding and in particular

in China. I couldn't pretend to be the world's greatest expert in lithium, but what I've

learned is the world actually is going through this great period of really significant

change. It's driven by a couple of key important factors. Firstly, the economics of the

battery technology are changing so rapidly, and the commercialization of the lithium-ion

battery, and what's soon to be significant economies of scale, means that those batteries

are both light and powerful, but they're now becoming significantly cheaper. What that

technology is enabling is, because of their power and their relative power to weight, they

are ideally suited to the electrification of the transport industry. That's a phenomenon

that's now starting to absolutely take hold globally. What's going to happen, and what's

already happening, is that the electrification of the transport industry will be in total.

E-bikes, cars, buses, commercial trucks, they're all now being actively deployed. It's a

significant growth industry, and the reason it's happening is because of the pre-eminence of

the lithium-ion battery technology, and hence the pressure on the supply base to produce

more lithium raw materials. That's part 1.

Part 2 is an even stronger phenomenon over the longer term. That's the co-commitment

of battery technology, and I think in particular low-cost lithium-ion battery technology,

and support of the renewables industry and grid applications, both micro and macro grid

applications and grid stabilizations. Basically, what that means is that the world's power

distribution is rapidly changing. It's changing from one where we operate in a centralized

utility model, where a big central power station feeds a network, to one where we have

distributed power generation. Around cities, for example, like the city of Perth, there's

already huge deployment of solar throughout the network, to the point where there is

literally thousands if not tens of thousands of generating points. The co-commitment and the

parallel initiative that works really neatly with that is the application of battery

technology. What the battery technology allows is the ability to improve the efficiency of

the distributed power generation network. By that, I mean the combination of rooftop panels

in solar and battery support.

What's happening is that the speed with which the cost of that distributed power

generation network is reducing is going to indicate its much broader application. In fact,

it's already happening. In cities like Perth in Western Australia, major generating networks

in states like California in the U.S., where you're already seeing huge solar installations

on a micro scale and a macro scale, and now cheap battery technology supporting the

efficiency of those networks. That's where the really serious leverage is now starting to

emerge, putting pressure on the global supply base for lithium raw materials. Those 2

things, in total, mean there has to be a material change in the lithium raw materials supply

base, and that's why we think Pilgangoora is such an important part of this supply solution.

A really big resource to match really big growth in supply requirements for lithium raw

materials.

Dr. Allen Alper: That sounds fantastic. That's really great. You're in a great

position, an exciting time, and you have the great experience to do a great job. You are

putting an excellent team in place, too. It looks like you have everything going for you.

Could you mention the primary reasons our high-net-worth readers/investors should invest in

your company?

Mr. Ken Brinsden: Yeah. When you think about resources investment, it almost

doesn't matter which commodity you're looking at. What you're looking for is the high grade,

low cost, low risk development opportunities. If you have those 3 criteria, you are a

resource company that's going to be amongst the survivors in an industry, where you do

ultimately end up with cyclical pricing outcomes.

We have, in Pilbara Minerals, the premiere lithium development for those criteria

globally. We have fantastic location. As I said, the Pilbara, you almost cannot get a better

location globally to be developing a mine. We have the benefit of very high grade,

especially once you include the combined effect of the tantalum concentrate production as a

byproduct. We have a relatively low risk development, in the sense that we have a good

location, low environmental impact, and low capital cost. For all those reasons, we think

Pilbara Minerals and our position in the global lithium scene is genuinely world-class. When

we talk to investors, including in the U.S., the investors agree. They look at our project

and they're like, "Where did you guys come from? It's an amazing discovery." I hope that

your readers can appreciate just how significant the resource we have is.

Dr. Allen Alper: That's fantastic. That's really amazing. Is there anything else

you'd like to add, Ken?

Mr. Ken Brinsden: No Allen, you had a series of good questions. Our recently

released definitive feasibility study continued to demonstrate all those key things I've

described, the scale of the resource, its competitive cost base, and its high quality

production. Furthermore, we have demonstrated the scaleability of the project with the

release of the 4Mtpa processing capacity pre feasibility study. Both projects present

outstanding project economics and we are looking forward to getting the project underway.

It’s a very busy, but very exciting time for the company.

Dr. Allen Alper: That sounds excellent.

http://www.pilbaraminerals.com.au/

Pilbara Minerals Limited

130 Stirling Highway,

North Fremantle WA 6159

Phone: +61 8 9336 6267

Fax: +61 8 9433 5121

|

|