Chris Castle, President of Chatham Rock Phosphate Ltd (CRP: NZX): Mineral Resource Development Company Holds a Mining Permit off the Coast of New Zealand with Significant Seabed Deposits of Rock Phosphate and other Potentially Valuable Minerals

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/17/2016

Chatham Rock Phosphate, Ltd (CRP: NZX) is a mineral resource development company that holds a mining permit over an area off the coast of New Zealand with significant seabed deposits of rock phosphate and other potentially valuable minerals. Very significantly, the Namibian government has just opened up phosphate mining off-shore in Namibia, where Chatham has five more prospecting license applications. We learned from Chris Castle, President of Chatham Rock Phosphate, that the offshore phosphate deposits are sitting on the surface of the sea floor and you can dredge the surface material off and then bring it to the shore. The material itself will be used for fertilizer. In New Zealand, where the economy is based on agriculture, the existence of a local source of phosphate is particularly important. The near-term plans, for the New Zealand deposit, include being fully permitted by the end of 2017 and going into production in 2020, mining 1.5 billion tons a year of rock phosphate and selling it for roughly $250 million dollars a year, making roughly $100 million dollars’ profit in round numbers. The Namibian project is at an earlier stage and will provide a broader base for the company in the 2020s.

Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Chris Castle, President of Chatham Rock Phosphate. Recently you had a great announcement about being able to mine marine phosphate rock off the coast of Namibia. Could you tell me a little bit about your company. What's happening and what your plans are?

Chris Castle: Our major project is off shore in New Zealand. We already have a mining permit there. We are expecting to get an environmental permit likely by the end of 2017. Very significantly, the Namibian government has opened up phosphate mining off shore in Namibia. We have five applications there as well. That gives a broader based company and therefore less risk in terms of business perception and we can move forward on two fronts. In terms of the permitting that has just happened in the Namibia instance, it is less likely that we will be stopped in our second attempt to get an environmental permit in New Zealand because there is no longer the first mover risk associated with the decision.

Allen Alper: That sounds very promising. Could you elaborate more on the nature of the deposit? How you will mine this? What the uses will be?

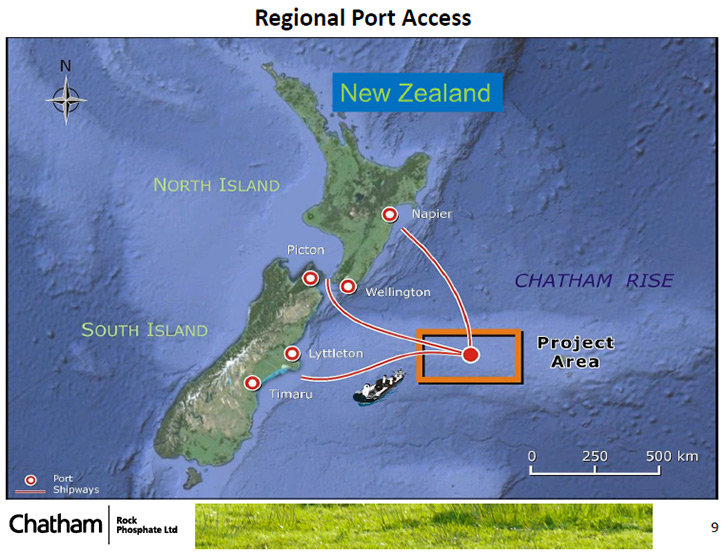

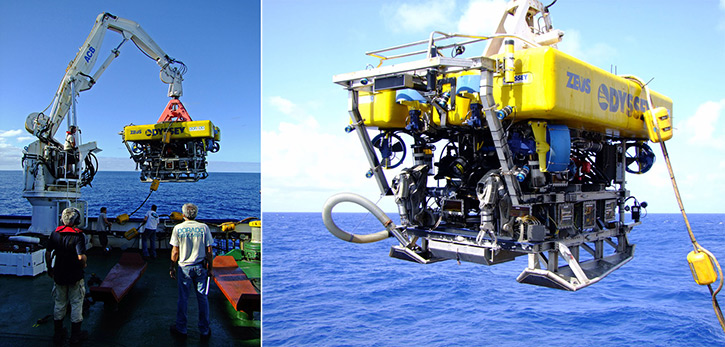

Chris Castle: These deposits are out in the ocean and are on the surfaces of the sea at depths of 300 to 400 meters. As they are located on the surface of the sea floor it is a simple process to use a dredge to recover the phosphate and then bring it to the shore. The deposits are essentially the same in both places, although the characteristics of the ore are different. In New Zealand they are bigger nodule sizes. In Namibia they are much finer.

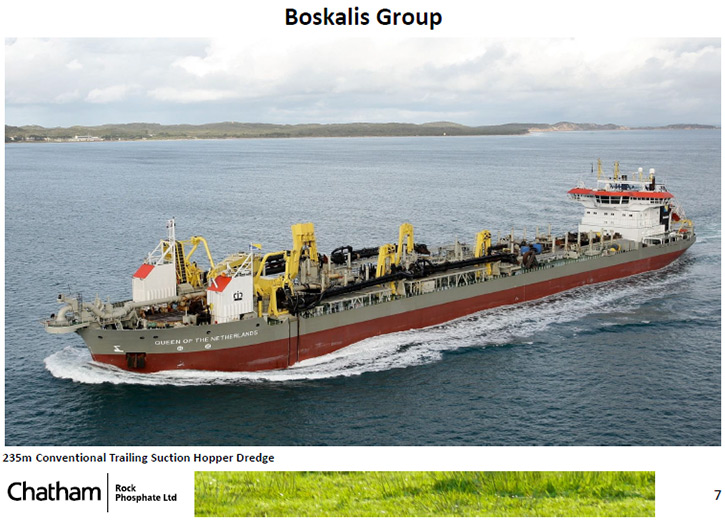

We will mine using a trailing suction hopper dredger, which is a standard dredger topper operated by the major dredging companies in the world. They have been dredging for at least a hundred years, basically for coastal protection, creating islands, airports, and so on. We will be working with one of those companies, called Boskalis Offshore. Boskalis is a Netherlands-based company that provides services relating to the construction and maintenance of maritime infrastructure on an international basis. The company has one of the world's largest dredging fleets. Interestingly it may be involved in the Namibian project recently issued an environmental permit. If so they will be developing an expertise in marine phosphate mining that will stand them in good stead.

The material itself will be used for fertilizer. There are three sorts of fertilizer that are needed on soil in order to grow plants and to ultimately feed people. These include phosphorus, which is contained in rock phosphate, potassium, contained in potash, and nitrogen, which is often applied as urea. Those three fertilizers are applied in varying mixtures depending on the soil types to help grass, crops, and trees grow and ultimately to feed people.

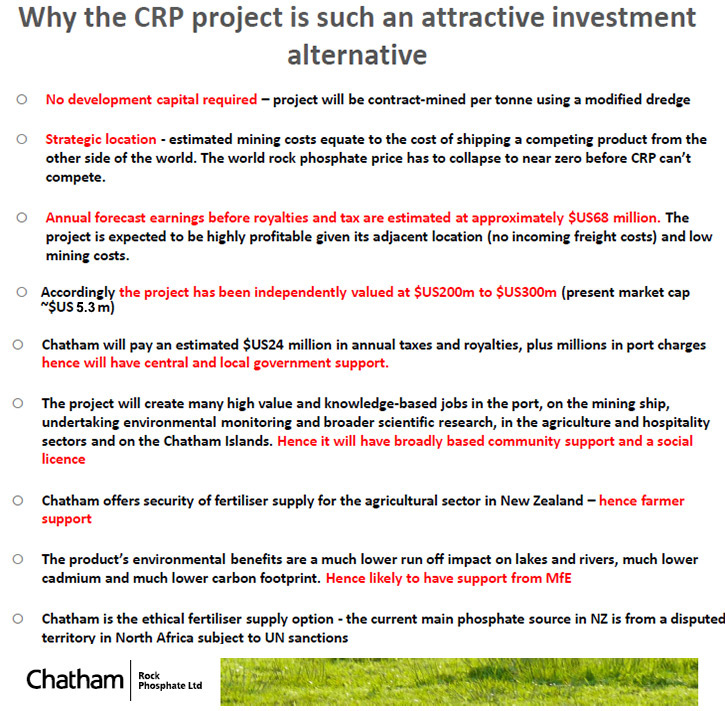

In New Zealand, this is particularly important because our whole economy is based on agriculture and so our project has a strategic value for the New Zealand agricultural sector. Although offshore, the deposit is very close to New Zealand and much closer than the major world deposits, which are predominantly located in Morocco and the Middle East. The location of any fertilizer deposit is probably as important as its existence, because it is expensive to move it. For example, we can mine rock phosphate off the sea floor of New Zealand for the cost of freighting it from the other side of the world.

Allen Alper: That sounds very good. Could you tell us your plans going forward for the next few years? Do you plan to take this to production?

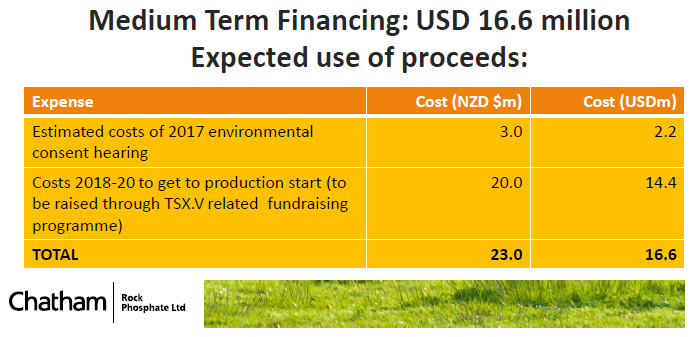

Chris Castle: In the New Zealand deposit, we plan to be fully permitted by the end of 2017 and going into production in 2020, mining one and a half million tons a year of rock phosphate and selling it for roughly $250 million dollars a year, making roughly $100 million dollars profit in round numbers. In Namibia, our applications are in a very prospective area but a lot more exploration and resource definition work is required. So we will be spending money in order to determine the size and the grade of the deposit. That work is going to start in parallel during 2018 and 2019 and the project will come in to fruition later in our cycle. We are also looking at other off-shore deposits around the world because phosphate is a strategic material. There are a number of smaller deposits that may also makes sense. Part of our business plan is to pick those up if we can. Those are our plans.

Allen Alper: That sounds very good. Can you tell us a bit about your background, the team, and the board?

Chris Castle: I originally trained as an accountant but very early on (in the mid-70s, early 80s) became involved in mineral exploration and mining. I first raised capital for mining companies in the 80s and have been pretty much committed to that full time for the last 17 years. I’ve been involved in a number of minerals and oil and gas projects in places as diverse as New Zealand, Fiji, Vietnam, Inner Mongolia, the Central African Republic for diamonds, nickel in Vietnam, this phosphate project and gold in China.

Chatham Rock Phosphate, Ltd (CRP:NZX), a mineral resource development company, is an associate company of Aorere Resources (stock market code AOR), which is focused on investing in carefully selected minerals projects, and building shareholder value as projects advance. Aorere is capitalizing on the networks developed and experience gained from establishing and managing Chatham Rock Phosphate, to develop a revised investment portfolio.

On the Chatham project, I have a group of scientists who were involved in research on the Chatham deposit back in the 80s. Three are based in New Zealand and one in Germany. They have an encyclopedic knowledge of the deposit and form part of our board and of our management team. Other board members bring marine mining, corporate finance, marketing and accounting skills to the team.

Allen Alper: That sounds very good. Can you tell me a little bit about your finances and your share and capital structure?

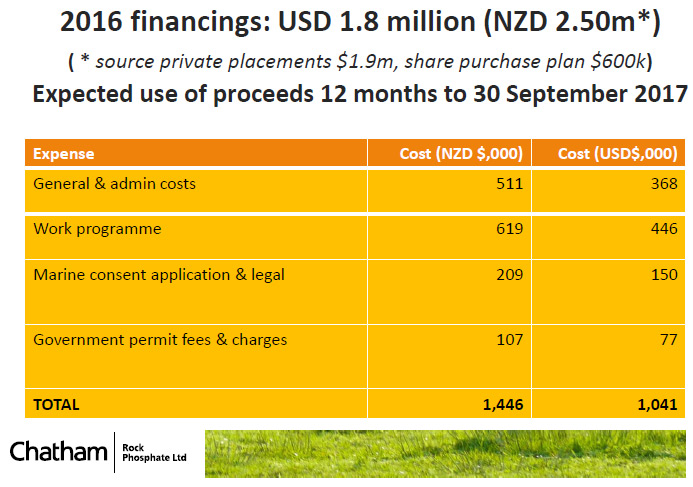

Chris Castle: Since we started the New Zealand project back in 2010. We have raised roughly $38 million New Zealand dollars, which is roughly $25 million US dollars.

We currently have over a million dollars in the bank and a steady investment flow adding cash to the Treasury every month. We are currently in the process of listing the company on the Toronto Stock Exchange by means of a reverse takeover. After the merger we will be listed on the Toronto stock exchange with about 10 million shares out trading at about a dollar. Following the listing we will be looking at perhaps raising more money for the environmental application next year. Our cornerstone shareholders are management and high-net-worth investors based in Singapore, Germany, Switzerland, The Netherlands and the USA.

Allen Alper: Right, that sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Chris Castle: The main reason is because, assuming that we succeed in getting fuIly-permitted and go into production, they should have a very high return on their investment. The market value of the company is currently USD5.3 million. The project has been valued independently by two different organizations to be about USD300 million US. As we move towards production, the value of the company should move from its present value of USD5 million dollars towards $300 million dollars. That's a roughly 60 times multiple.

This potential upside is how I have managed to raise USD27 million US over the last 3-4 years. Another important distinguishing factor is that we have no capex required to go into production – the deposit is going to be mined on a contract basis. So investors investing now are not going to be significantly diluted by future capital raisings. Those are two very good reasons why investing in Chatham Rock is, assuming that we succeed with our plans, likely to be a worthwhile investment.

Allen Alper: It sounds like a very important reason why our readers/investors should look closely at your company. Is there anything else you would like to add?

Chris Castle: If any potential investors are interested in hearing me in person or talking with me, I am always available on the phone, whatever the time zone is. I am used to that. We are based in Europe, USA and Singapore. I am available pretty much 24-7. If any of this is unclear or the shareholders would like to talk to the guy who runs the company, I am available and free, because I don't invest in any company unless I talk to the guy who runs it.

Allen Alper: That sounds great!

http://www.rockphosphate.co.nz/

Level 1, 93 The Terrace, Wellington

PO Box 231, Takaka, 7142, New Zealand

chris@crpl.co.nz

Main +64 3 525 9170

Mobile +64 21 55 81 85

|

|