Interview with Peter Steenkamp, CEO of Harmony Gold (JSE: HAR, NYSE: HMY): Million-Ounce Producer of Gold in South Africa with over 100 Million Ounces of Gold Reserve

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/11/2016

Harmony Gold Mining Company Limited (“Harmony”)(JSE: HAR, NYSE: HMY) is a million-ounce producer of gold in South Africa, with exploration tenements in Papua New Guinea, focused on developing the Golpu JV property in New Guinea. According to Peter Steenkamp, CEO of Harmony, the company is well positioned, and has restructured itself to benefit from higher gold prices. With over 100 million ounces of gold reserves, Harmony provides great leverage on the gold market.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Peter Steenkamp, CEO of Harmony.

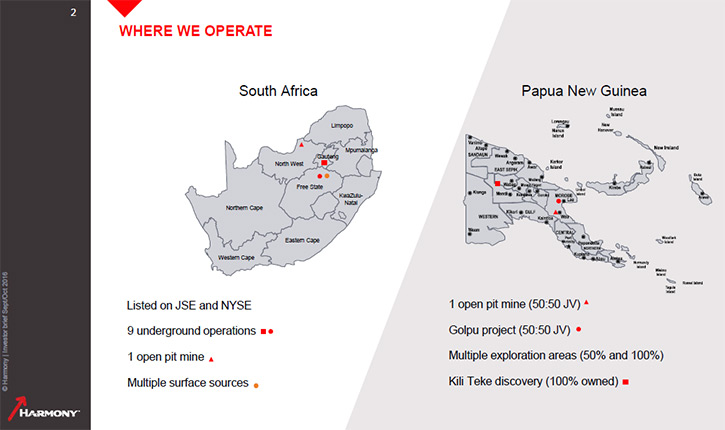

Peter Steenkamp: Harmony is a company that operates in South Africa and Papua New Guinea. We produce more than one million ounces of gold per year. Most of our operations are in South Africa.

Dr. Allen Alper: Very good. Could you tell us more about your operations in South Africa and also in Papua New Guinea?

Peter Steenkamp: We operate 9 underground gold mines, predominantly in the Free State Province of South Africa. We have an open-cast mine in the North West Province, and a few operations on surface and surface resource treatment facilities.

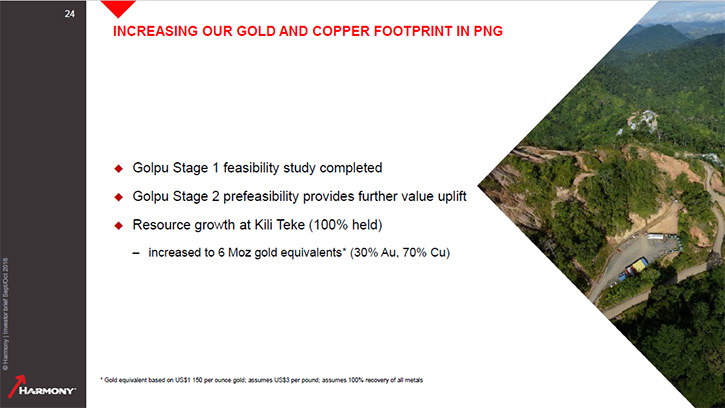

In Papua New Guinea we have a mine called Hidden Valley, an open-cast mine, which we used to own fifty-fifty with a JV with Newcrest. We now bought the full 100% of that asset. We have a gold-copper project called Wafi Golpu, which is also in the Morobe province, a fifty-fifty JV with Newcrest Mining Limited. In addition, we have a Kili Teke prospect that we own 100% in Papua New Guinea.

Dr. Allen Alper: That sounds very good. Could you tell me more about your deposits and your operations?

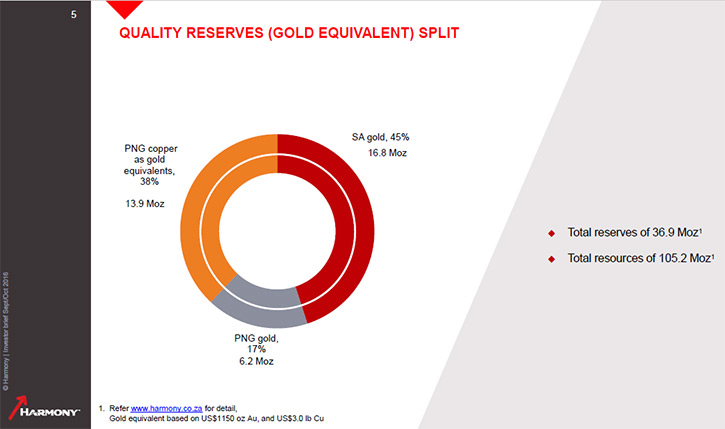

Peter Steenkamp: Yes, we have quite a big reserve and resource base. Harmony has total reserves of 37 million ounces, but there are still over 100 million ounces in resources. 45% of that is in South Africa and the rest is in PNG. In PNG we have a split of about 30% gold and 70% copper. We're a predominantly underground gold miner in South Africa, with 9 operations. We have a recovered grade of about 5 grams a ton from the underground operations. We are a company that is going to be there for the long term. 26% of our production has a life of about 5 years, and the rest of our production is longer than 5 years, up to 20 to 25 years.

Dr. Allen Alper: That sounds excellent. Could you tell me a bit about your operating results and your costs and revenues?

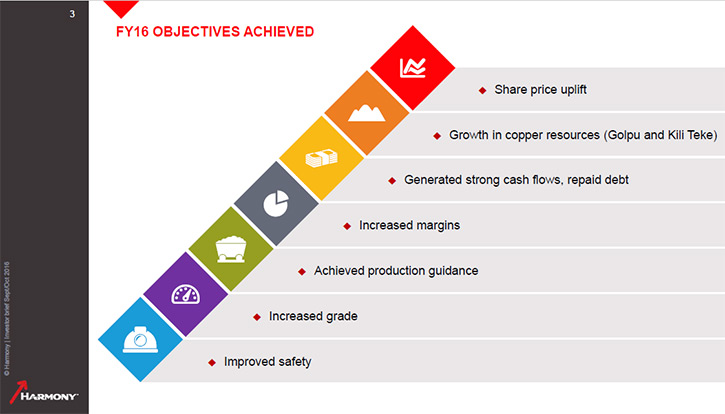

Peter Steenkamp: We've achieved most of the objectives we set for ourselves last year. First of all we have improved safety, we have increased our grade for 4 years in a row, and we’ve increased our margins dramatically. Our dollar per ounce costs were 19% lower than the previous year; that's really on the back of the exchange rate of the South African Rand, it obviously depreciated over that time. In Rand terms, we had a 3% increase in costs, so we have a very, very good margin. Last year, our 2016 financial year, we had a cost of 978 dollars per ounce. So that is the company’s cost and the capital cost. We had a very good margin. We will be debt free by the end of the year. We had about 192 million Rands of debt about 2 years ago, and a year and a half ago, and we will be debt free by the end of this calendar year.

Dr. Allen Alper: That sounds excellent! Very good! Tell us a bit more about your plans going forward?

Peter Steenkamp: Obviously the biggest opportunity we have in Harmony is building the Golpu project, of which we own 50%. The other 50% belongs to Newcrest. We would like to build that. To do that we are busy beefing ourselves up in terms of our production performance, so we have enough capital available to build it and Harmony is repaying its debt. We're doing that to increase our margins. We have a whole program of operational excellence that we're driving. We have created cash certainties with selective hedging, but also paying back our debt. We have very strong control of capital allocation, making sure we get the right return for whatever capital we allocate. So, yes, the company's in a good space at the moment, it is generating a lot of cash, and also paying dividends.

Dr. Allen Alper: That's great! Could you tell us a bit about yourself, your team and the board?

Peter Steenkamp: My mining career started 37 years ago. I've been involved in gold mining most of my life. I've also been involved in platinum and coal mining. Most recently, I was the managing director of Sasol Coal, which is the second biggest coal producing company in South Africa.

Our chairman is Patrice Motsepe, a well-known South African entrepreneur. He's been involved in gold mining since 1997. He's a non-executive chairman of Harmony, but he's also the executive chairman of African Rainbow Minerals, a well-known mining company in South Africa.

My Chief Financial Officer is Frank Abbott, he's been around for many years. He's been a financial director of Harmony and also of ARM for a long time. He's been back at Harmony now for about the last 8 years. A very well experienced person!

Then we have another executive director, Mashego Mashego, looking after many of our stakeholder relationships; a well-connected person in South Africa.

We have two Chief Operating Officers; one looking after strategy and strategic safety issues, Phillip Tobias; a well-known and experienced mining engineer. Our other Chief Operating Officer is Beyers Nel, newly appointed in the position, very energetic young man with excellent experience in gold mining. He's been a gold miner since he started his mining career after university.

So we have a very strong team. In south-east Asia we have Johannes van Heerden, an experienced person looking after the south-east Asia team. He's been with Papua New Guinea and South-east Asia now for 12 years. His right-hand financial man has also been around for 10 years or more in the South-east Asian environment; well experienced with a good track record of building our plant in South-east Asia.

Dr. Allen Alper: That sounds like a very strong team and board. Could you tell us about your capital and share structure?

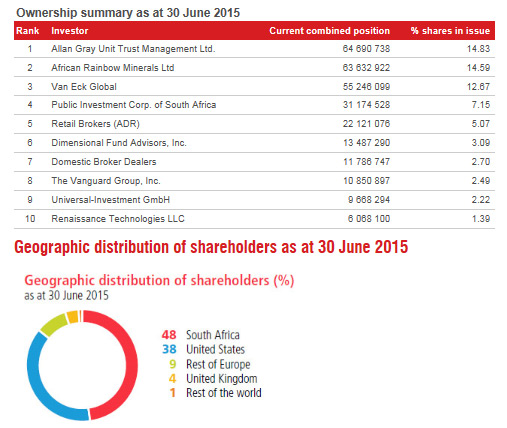

Peter Steenkamp: Our major shareholder is African Rainbow Minerals, which is our Black Economic Empowerment shareholder in South Africa. It is the major Black Economic Empowerment partner held by our non-executive chairman, so they are the biggest shareholder in Harmony. Then we have many other shareholders. About 65% of our shares are held by our top 10 shareholders. We have Van Eck Global, Allan Gray, the Public Investment Corporation of South Africa, and quite a few other companies, investing in our organization. We have very stable shareholders, who have been with us for a long time. Except for the 15% that's held by ARM, which they're now selling, all of our shares are trading very well, with the free float on both the Johannesburg Stock Exchange and also the New York ADRs.

We've spent a lot of capital in South Africa to build some of our projects, but that is behind us. Our South African capital is about 150 million US dollars. We have Golpu that will start in 2019.The Golpu project will cost 2,6 billion rand, our part of it will be 50% of that, or 30%, 35%, it depends on what stake the government will take in Wafi-Golpu.

Dr. Allen Alper: Sounds good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Peter Steenkamp: First of all, we've been around for a very, very long time. We have very big resources and reserves available to us. We've been delivering good results over the last few years. We have a fantastic, one of the best prospecting projects available for us in Wafi-Golpu; there are not many gold companies that have a project like that in the pipeline. We are positioning ourselves to build that project and to deliver on that project. We have increasing grades, many companies don't have that, our grades are increasing all the time and will continue to increase over the next 3, 4 years. So as a company we're in a very good space at the moment.

Dr. Allen Alper: That sounds great. Is there anything else you'd like to add?

Peter Steenkamp: Dr. Alper, thank you very much. The company is well positioned, and has restructured itself for the last couple of years to benefit from higher gold prices, which it has shown to do through higher rand per kilogram prices during the year, with having increased our cash position and having increased our cash per share from about 39 US cents per share to about 73 US cents per share. Thank you very much for allowing us this opportunity. I enjoyed talking with you.

https://www.harmony.co.za/

South Africa (Registered office)

Tel: +27 11 411 2000

Fax: +27 11 692 3879

E-mail: corporate@harmony.co.za

P.O. Box 2

Randfontein

1760

South Africa

|

|