Interview with Ian Ball, CEO and President of Abitibi Royalties (TSX-V: RZZ): Primary Project, 3% Net Smelter Royalty on Odyssey North at the Canadian Malartic Mine Operated by Agnico Eagle and Yamana Gold

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/7/2016

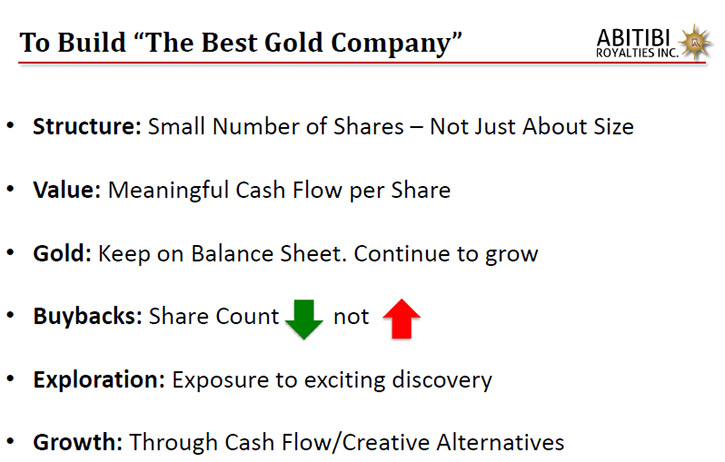

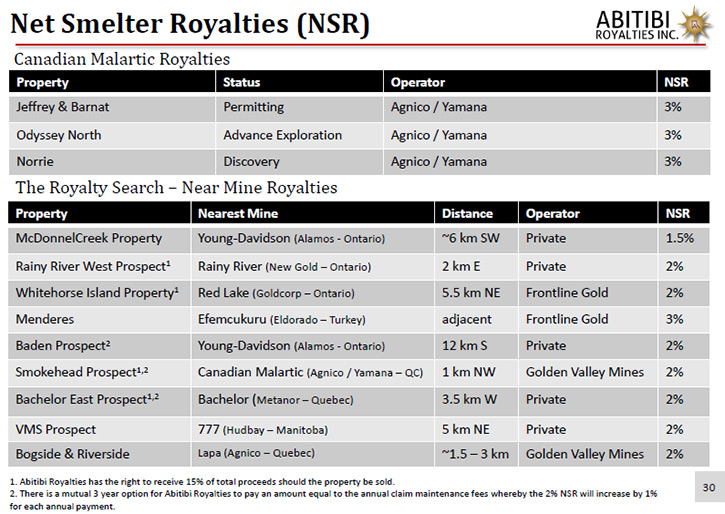

Abitibi Royalties (TSX-V: RZZ) is an up and coming royalty company in the junior mining sector with an objective to build the best gold company, based on share price performance We learned from Ian Ball, CEO and President of Abitibi Royalties, that their primary project is a 3% net smelter royalty on a new discovery called Odyssey North at the Canadian Malartic mine in Canada operated by Agnico Eagle and Yamana Gold. Abitibi has a number of other royalties at Canadian Malartic, one of which, Jeffrey-Barnat 3%NSR, which is in the permitting phase for production. Once permitted, it will have a big impact on the company's cash flow. According to Mr. Ball, Abitibi is one of the very few companies that continue to buy back their shares while generating positive cash flow.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Ian Ball, CEO and president of Abitibi Royals Inc. Could you tell me a bit about your company; what it does, what's unique about it, and what differentiates it from other companies?

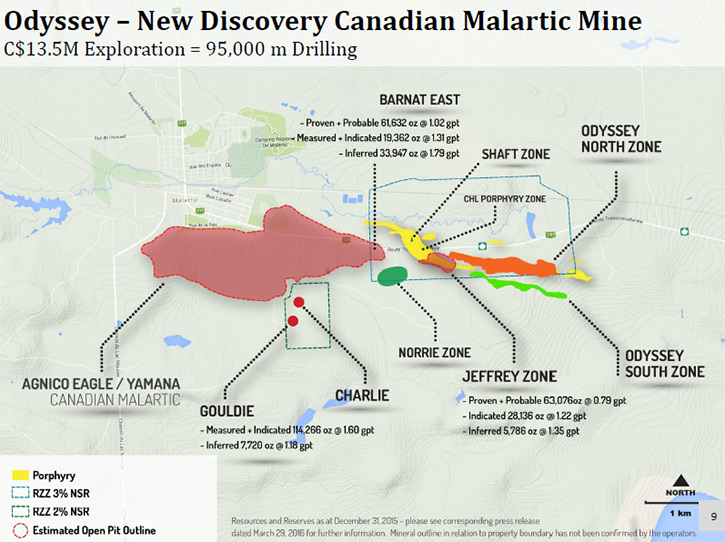

Mr. Ian Ball: I'd be happy to. As the name implies, we are a royalty company, we're the smallest royalty company within the sector. Our primary royalty is a 3% net smelter royalty on a new discovery called Odyssey North at the Canadian Malartic mine in Canada. Canadian Malartic is the largest producing gold mine in Canada and it's operated by Agnico Eagle and Yamana Gold. This year the mine owners had budgeted Cdn$13,500,000 on the project for 95,000 meters of drilling, which was recently increased further. If it's not the largest, it's certainly one of the largest drill programs in the country with nine drills operating and we're the direct beneficiary of this as we're entitled to 3% of any revenue that's generated from that discovery and it's only a kilometer and a half away from a 55,000 tonne per day operating mill. We think we're in a pretty good position.

Dr. Allen Alper: How do you see that project developing?

Mr. Ian Ball: The discovery was made initially in 2014. Then there was a lawsuit between ourselves and the mine operators, which resulted in a considerable delay of exploration, but that was settled. Last year they had initially budgeted Cdn$3,500,000 for exploration and that was increased to Cdn$5,000,000. This year's budget was initially Cdn$8,000,000, it was increased to Cdn$13,500,000 and was just recently increased again. We are expecting an initial resource to be coming on the project by the end of February 2017. Then the mine operators have spoken about moving into prefeasibility in order to move it towards production.

Dr. Allen Alper: That sounds good. Could you tell me a bit about your other assets?

Mr. Ian Ball: Very important! We have a number of royalties at Canadian Malartic in addition to the one that covers Odyssey North. We have royalties on what's called the Jeffrey deposit and the eastern portion of the Barnat zone. Both of these, right now, are in the permitting phase for production. According to the mine operators, we expect those permits to be approved late this year or early next year. That could increase our cash flow from Cdn$2,000,000 to Cdn$2,500,000 to approximately Cdn$3,00,000 in 2017 and then to just over Cdn$4,000,000 per year in 2018.

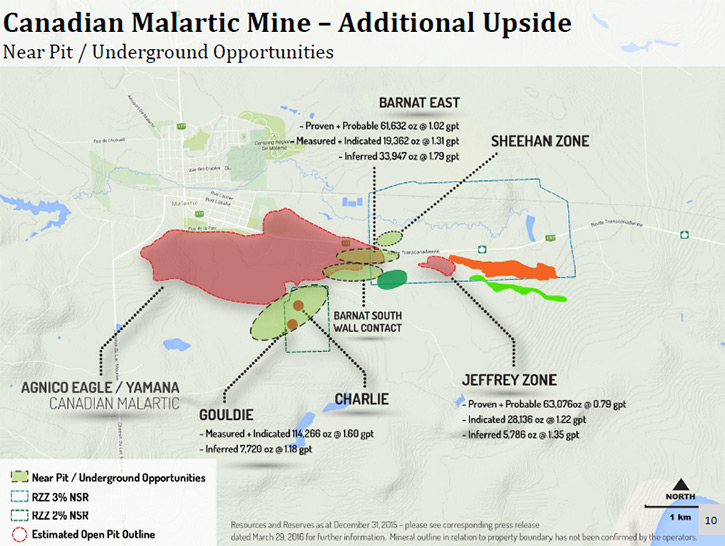

Those numbers still exclude Odyssey North, as there's been no cash flow attributable to that project yet. We also have royalties on a couple of other zones where the operators of the mine are drilling. One is called the Charlie zone, another the Gouldie zone. On those, they're looking for bulk tonnage underground targets. A third zone called Sheehan is a part of the open pit, which they're looking to extend to the northeast.

As of right now, we estimate approximately Cdn$18,000,000 is being spent on drilling, where we have royalties at Canadian Malartic. We also have another royalty on a project in Turkey. It's a 3% royalty as well. It joins one of El Dorado's main operating mines. El Dorado has drilled right up to the property boundary. Where we have our royalty is on a company property called Frontline Gold and they are expecting to start drilling there soon. The drilling will be relatively close to where El Dorado has recently had some success.

Right now we have approximately another ten royalties on properties that are all near existing mines, so we're looking to continue to build that portfolio through our cash flow.

Dr. Allen Alper: That sounds excellent. Great progress has been made since I spoke to you last.

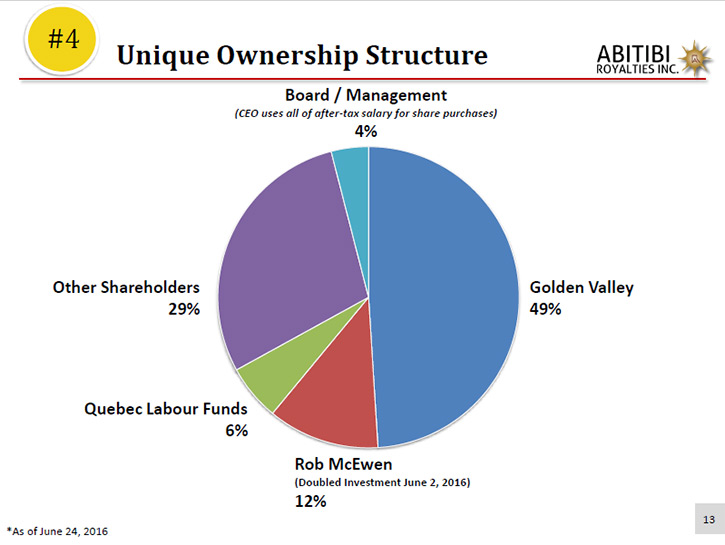

Mr. Ian Ball: What makes us unique? A couple of things. One, we continue to buy back our shares. We are one of the few, if not the only mining company right now in the precious metals sector that continues to buy back its shares; versus issue shares, which seems to be the norm in the industry. Also, our second largest shareholder, Rob McEwan, doubled his investment this past summer. He initially invested Cdn$2,000,000 and this summer he put another Cdn$2,300,000 into the company to bring his ownership to over 12%.

Dr. Allen Alper: I have great admiration and respect for Rob and his decisions and knowledge. It's great to have that support. Of course, you also had his mentorship.

Mr. Ian Ball: It's been excellent to have Rob's endorsement, both financially and otherwise.

Dr. Allen Alper: Could you tell me a bit about your background and your team abroad?

Mr. Ian Ball: I would be happy to. Originally, I started my career at Goldcorp in 2004. I then moved on to what became McEwen Mining in 2005, and there held various roles starting as VP of Mexico, then Senior Vice President and then President of McEwen Mining. I headed up the mines in terms of construction, as well as overseeing the production, looking at exploration and then leading the teams doing the feasibility studies. For the last six years, I was predominately focused on operations. In 2014 I joined Abitibi Royalties as President and in 2015 as CEO. In terms of some of the other people involved with the company, our Chairman is Glenn Mullin, he was the former CEO of Canadian Royalties, which discovered what is now a producing nickel mine up in the Raglan district of Quebec. He is also the Chairman and CEO of Golden Alley Mines, which is our largest shareholder. He was the founder of Abitibi Royalties.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Ian Ball: Not every mining stock is right for every investor. If somebody is looking for exposure to the precious metals sector and they're looking for a company that has exposure to an exciting discovery, ours happens to be the largest gold mine in Canada. We're not going to have to issue any shares and dilute the stock. We’re going to do the opposite, buy back shares and we're generating positive cash flow. That's going to be increasing. Abitibi is a company you should take a look at. It's certainly a company though, that is geared towards a long-term investor. We have a very small number of shares outstanding, 11.3 million, and there are probably only 2,000,000 shares in the public float. It’s not a company that you can easily buy and sell, traditionally if you're going to buy, you should be looking to buy for the longer term. We do have a long-term view because we're not being pressed to issue shares every six months like your normal junior mining company. We tend to take a longer-term view of situations.

Dr. Allen Alper: Is there anything you would like to add?

Mr. Ian Ball: I would. You've talked about Rob being a mentor and one of the things that Rob always emphasizes is trying to align yourself with shareholders. I don't have the financial capacities of Rob, to be able to go in and buy 25% of a company. But, for the past 2-1/2 years since joining the company, I have taken my after-tax portion of salary every week and reinvested it back into the company, through open market purchases. I'm buying on the same terms every week as shareholders are. I'm not getting any free cash out of this per se, because it's all going back into the purchase of shares. I have been doing that for 2-1/2 years and plan to continue to do that into the foreseeable future. I think that is somewhat unique within the mining sector. We've been buying royalties right now in these early stage projects. We have 13 now and we're hoping to build a portfolio between 20 and 25. Essentially we're buying them out of cash flow so there's no dilution. We look at them as a bit of a lottery ticket. It's filling our pipeline of growth and maybe one or two of them, out of the eventual 25 to 30, will be successful. The first of these projects are starting to be drilled in the coming months.

Dr. Allen Alper: That sounds excellent!

http://www.abitibiroyalties.com/

2864, chemin Sullivan

Val-d’Or, Québec

J9P 0B9

Tel: 1-888-392-3857

E-mail: info@abitibiroyalties.com

|

|