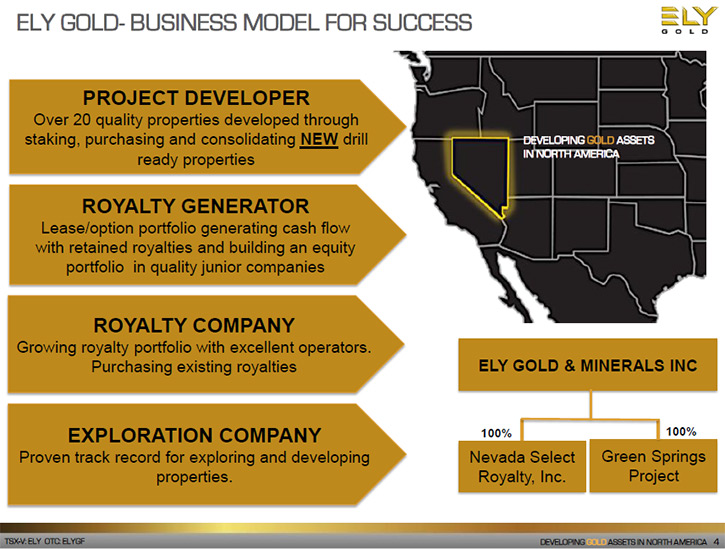

Trey Wasser, President, CEO and Director of Ely Gold and Minerals, Ltd. (TSX-V: ELY, OTC: ELYGF): Gold Project Developer, Royalty Generator, Royalty Company and Exploration Company in North America.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/7/2016

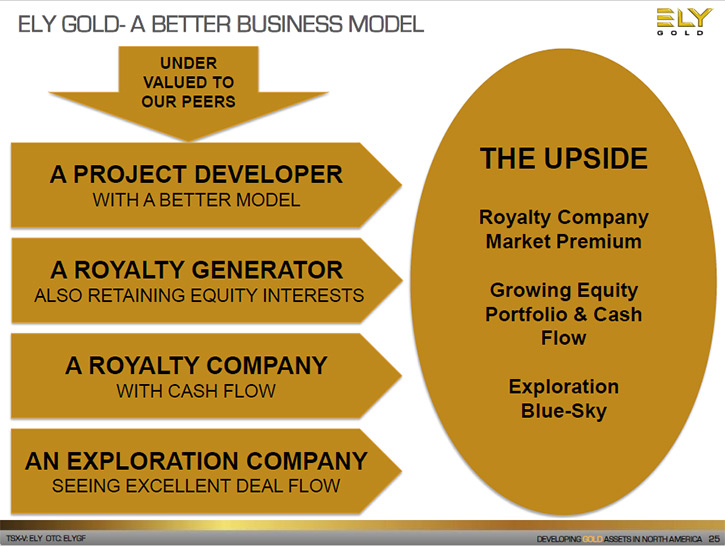

Trey Wasser, President, CEO and Director of Ely Gold and Minerals, Ltd. (TSX-V: ELY, OTC: ELYGF), discusses Ely as a project developer and a royalty generator. Ely’s model is to option out the property 100%, to a company who is responsible for development, and Ely keeps a royalty. Ely also has a blue sky exploration potential. They have cash flow from the project generation that they can use to explore key properties. If you are interested in gold, Ely provides great leverage on the gold market.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Trey Wasser, who is President and CEO and Director of Ely Gold and Minerals, Inc. Trey, could you tell me a bit about your focus and what differentiates your company from other junior mining companies.

Mr. Trey Wasser: We have a history going back to about 2010, late 2009 when I was first involved in the business with the company. We developed the Mount Hamilton project with a partner. We sold that last year, at a bad time in the market. We were able to get quite a bit of cash for a small company. We deployed part of that cash by buying a portfolio of primarily gold properties, most of the projects being in Nevada.

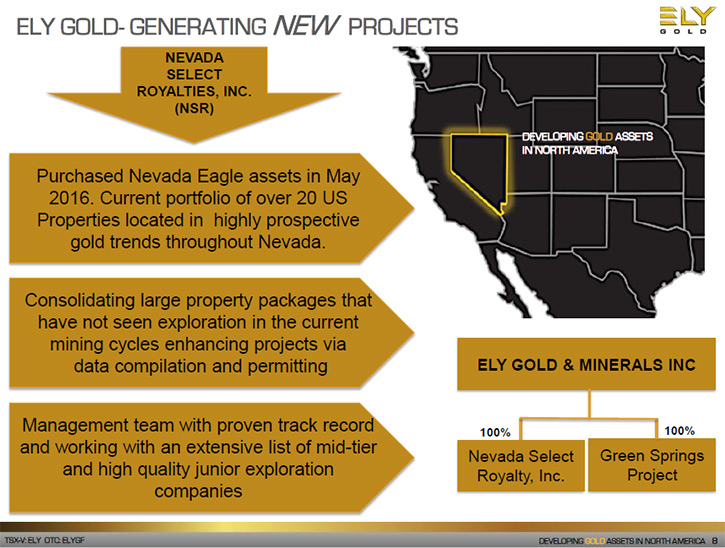

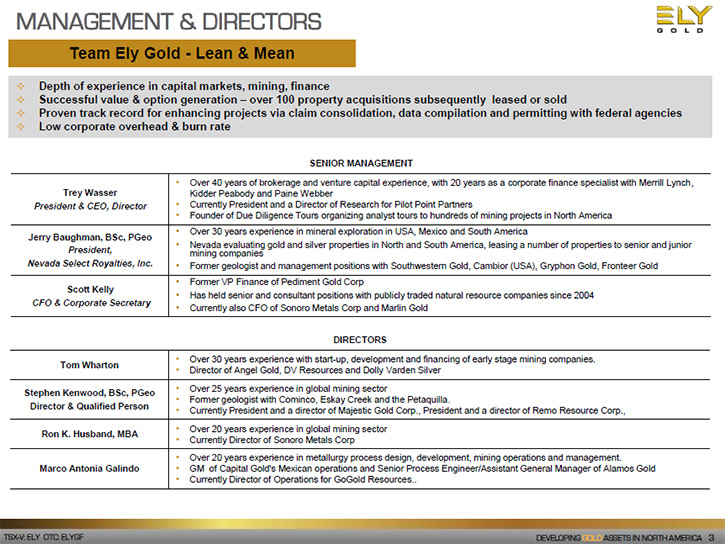

We purchased the assets from Jerry Baughman and we formed a new company called Nevada Select Royalties, Inc. Nevada Select is our 100% owned subsidiary of Ely Gold and Minerals, Inc. Jerry is now president of that company. Jerry has a long history of staking and optioning properties in Nevada and the Western United States for over 35 years. He develops most of the projects through staking so they are royalty free. We then option them out, keeping a royalty.

We purchased 27 properties from Jerry. We closed on that transaction in April of this year. We've since sold a couple, we've traded a couple and we've eliminated a few. Right now we're at about 20 properties. But that number is a fluid number. We're also out staking new properties. It's kind of a moving target. On the 20 properties, we've adopted Jerry's business model for finding partners for these as lease properties. We do not do joint ventures, so we like to think of ourselves as a project developer and a royalty generator.

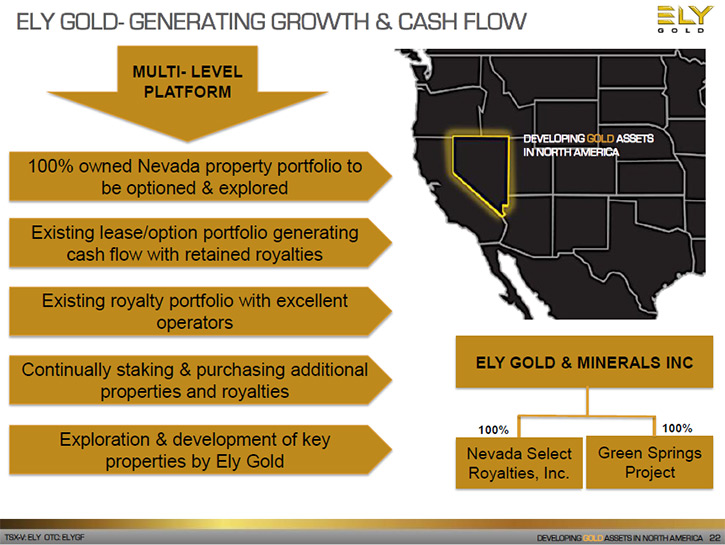

We option our properties out 100%. We keep back a royalty interest on the property. Unlike the joint venture model which most of the project generators use, we generate cash through the option payments and then advance royalty payments. The option payments are staged generally over three to four years and they escalate. With most of the buyers of our properties, we don't even require work commitments, because we feel a well-financed junior or mid-tier producer is going to do the work. At this time, there is a true renaissance of companies looking for projects in Nevada.

The option payments escalate. They start smaller and get bigger with a balloon at the end of three or four years. Like a joint venture, the company has a chance to go in and do the work and decide if they want to move forward with the project. But unlike a joint venture, if the project is dropped by the company, we get it back 100%. Of course, if we feel like it's been drilled off and maybe it's just not as good a property as we thought, then we'll drop it ourselves.

With this model, we don't have the work of managing joint ventures or being involved in renegotiating deals. Our deals are pretty much structured from the beginning and they stand on their own. I guess that's what differentiates us. If you look at the comparisons of our company in our presentation on the website, we compare ourselves to some other project generators. Companies like Millrock Resources or Strategic Metals, those are the types of companies that we think are a good comparison to us.

When we do these transactions with a mid-tier producer, we like to take equity positions in the companies. On top of that, we always hold back one of our properties to do some exploration work. We have the cash flow for exploration money and this gives our shareholders the blue sky of also having an exploration subsidiary.

Dr. Allen Alper: That sounds like a very good model. You differentiated yourself well from others. Could you tell me your plans going forward the rest of this year, next year?

Mr. Trey Wasser: We're trying to do as many deals with these properties as we can. Coming together with Jerry has benefited both of us. He has the skill to find these properties. He has a larger database and has experience staking. We have a lot more experience consolidating projects, doing deals, selling properties and exploring. We feel the best unexplored properties in Nevada are ones that have had claims issues and haven't been promoted and have not seen a drill rig in this cycle.

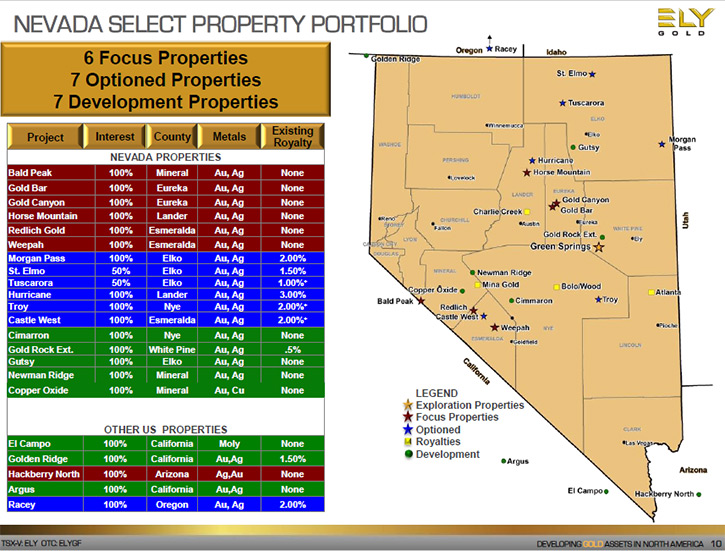

Breaking down our 20 properties, we have six we call focus properties. These are properties we've staked. We'll then go in and acquire patented claims that may have been fragmented, solve some problems, other problems with claim issues and pull these projects back together for the first time. Of our six focus properties, five have historic resources on them, well in fact all six have historic resources on them and five on them have not seen a drill rig since the 1990's.

That's mainly because these properties have been fragmented and the claims may have been owned by several different owners within the claim block. We have been able to go in and consolidate these claims, put the project back together, acquire data and get the project drill ready. In the end, what we offer our shareholders, our investors in Ely Gold is a play on the gold price in the gold market.

What we offer as a project developer, is a large portfolio of high quality projects in Nevada. We have six focus properties that are ready and being shown, the data rooms are put together. We have seven option properties, already under option. We have six deeded royalties in the portfolio. We also have six of what we call development properties. These are properties that we're still in the process of consolidating the claims. Again, for our shareholders, we offer a large property portfolio, we offer a royalty portfolio, we offer an equity portfolio of mid-tier companies and the blue sky of an exploration project. That adds up to excellent leverage to the price of gold.

Dr. Allen Alper: Awesome! Excellent!

Mr. Trey Wasser: For the rest of this year, we expect to see three or four more deals to option properties out. We're currently talking to over a dozen companies. We have term sheets out on several of the projects and they're in the due diligence process. We hope to see those, turn into purchase agreements. We are continually looking to add to the property portfolio. We just staked eight additional properties that we cannot quite talk about yet but we're very excited about.

We just returned as you know from the Precious Metals Summit where we presented and had meetings back to back the entire time. We had over 30 meetings. Two thirds of them were with companies, mostly majors and mid-tiers, that are looking for properties in Nevada. There's just a resurgence in Nevada of companies looking for a good safe jurisdiction, where there continues to be new large discoveries. We're very excited to have so much interest in Ely Gold not only from the shareholders' standpoint but from companies prospectively looking for properties in Nevada.

Dr. Allen Alper: That sounds excellent. Could you tell me a little bit more about your own background, Trey?

Mr. Trey Wasser: I spent 22 years on Wall Street, most of that time with a firm called Kidder Peabody. But I started with Merrill Lynch. After Kidder Peabody, I was with Paine Webber for a bit. I did some trading, some investment banking and was a broker. I had a diverse background on Wall Street in all different aspects of corporate finance. Today, that background really helps me in trying to solve problems and execute the transactions.

Dr. Allen Alper: That's excellent! You and Jerry complement each other very well to make a very strong team. Could you elaborate a little bit more on Jerry's background?

Mr. Trey Wasser: Jerry has been a land man or geologist. He has a geology background and he's been doing this for 35 years. He developed a portfolio of 54 properties. In 2008, he sold that portfolio to Griffin Gold who then sold it to Frontier, which was taken over by Newmont. Many of the properties Jerry developed are now in Newmont's portfolio. A few of them were spun off to create Pilot Gold, which was spun off from Frontier when Newmont purchased them. Jerry worked for a while with Pilot Gold to help them evaluate the projects. Then in 2013, Jerry went back out on his own and started staking properties again. We purchased the projects he staked in 2014 and 2015. Jerry has probably originated somewhere between 75 and 100 projects in Nevada in his career.

Dr. Allen Alper: Awesome! Excellent! That's really great. It's great the two of you teamed up together.

Mr. Trey Wasser: We're actually having some fun in this market. Glad to see the market improve. We're especially glad to see this resurgence and huge interest in gold mining in Nevada.

Dr. Allen Alper: That's excellent! Could you tell me a little bit about your share structure?

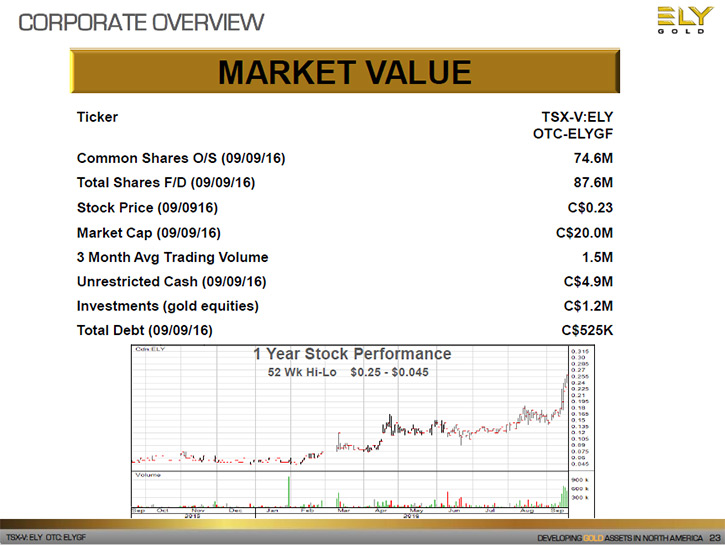

Mr. Trey Wasser: Well, we currently have just 74.6 million shares outstanding. That includes a 10 million unit placement that we announced and we haven't quite closed. We'll close it this week. That's the current share structure. We have, with the warrants from this new structure, about 87 million shares outstanding, fully diluted. With the offering proceeds, we'll have around $4.5 million in cash and about a $1 million worth of securities from companies like Solitario, who was our partner in Mount Hamilton. Also from Gold Resources Corporation with whom we did a transaction in August, on one of our properties. We have very little debt. When we purchased Jerry's company, part of that was in a note for about a half a million dollars.

We're in very good shape. Together with the transactions we've completed this year and the current option portfolio on which we receive payments, we should cash flow somewhere between 1.5 to $2 million this year; that is gross cash flow from the proceeds from transactions and option payments.

Dr. Allen Alper: That's really good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Trey Wasser: If somebody is looking for leverage to the gold price, we think we offer it in four different ways. We have an excellent portfolio of Nevada properties, which just became more valuable with the gold price. We have an excellent team in Jerry and myself, and we're adding to our team. We should have news on an addition of some more technical expertise sometime this week. On top of the portfolio, we also have the royalty portfolio, which is significant in and of itself and it's growing.

We actually did a transaction and purchased four royalties earlier this year. We're always looking to either generate the royalties organically through our option agreements or to purchase royalties outright. Royalty companies tend to have a higher valuation than straight equity companies. We're a cash flowing company so we'll not see the dilution that you'd see in other companies. We also have the blue sky of an exploration project. Currently our exploration project is a property called Green Springs. We think we offer quite a good leverage to the gold price for high-net-worth investors. We have a rather unique business model that is being embraced by the mid-tier and senior companies that are looking at our projects.

Dr. Allen Alper: That's great. That sounds very good and very promising. Is there anything else you'd like to add, Trey?

Mr. Trey Wasser: Encourage your readers to go to the website. We're continually trying to enhance that with more information on our projects. The presentation there has a very good comparison to some of the other project generator companies. We think the stock is undervalued and represents a very good value.

Dr. Allen Alper: That sounds excellent!

https://elygoldinc.com/

459 - 409 Granville Street,

Vancouver, British Columbia

V6C 1T2

Tel: 1-604-488-1104

Fax: 1-604-488-1105

info@elygoldinc.com

|

|