Interview with Leigh Curyer, CEO of NexGen Energy Ltd. (TSX: NXE, OTCQX: NXGEF): Flagship Arrow Mega-Deposit in the Athabasca Basin, Saskatchewan, Canada, Has Unique Technical Advantages over the Existing Producing Uranium Mines

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/7/2016

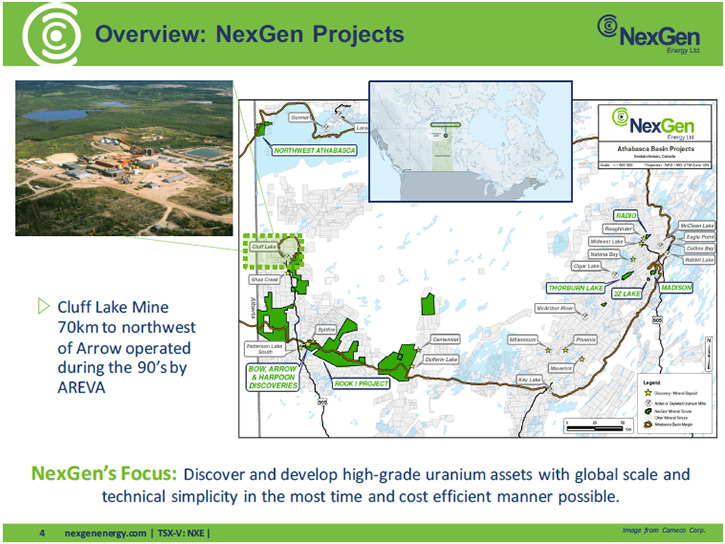

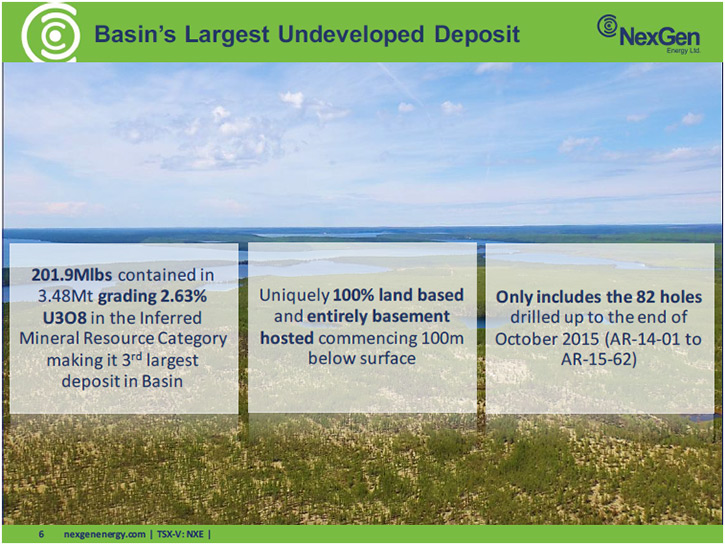

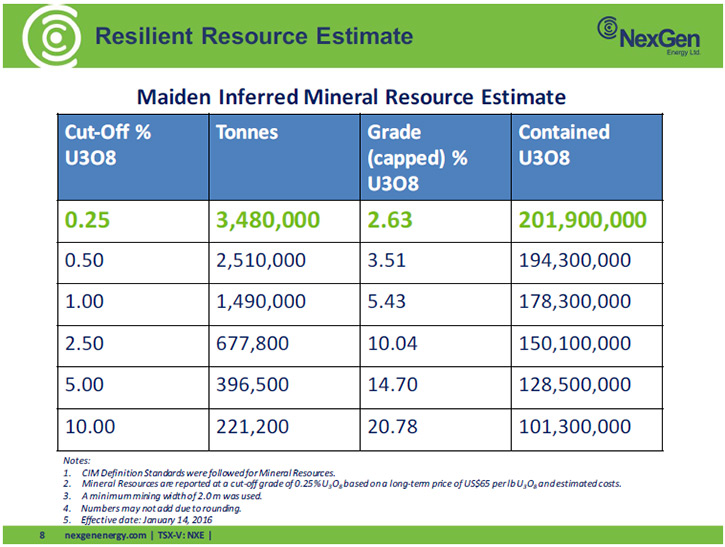

NexGen Energy Ltd. (TSX: NXE, OTCQX: NXGEF) is a British Columbia corporation with a portfolio of highly prospective uranium exploration assets in the Athabasca Basin, Saskatchewan, Canada. We learned from Leigh Curyer, CEO of NexGen Energy, that their flagship project, the Arrow Deposit, is exhibiting some very clear unique technical advantages over the existing producing uranium mines, particularly for the mega-deposits in Canada: it is 100% on land while other deposits are under lakes; it is 100% contained in the competent basement rock, so it will not require sophisticated freezing technology in order to develop and operate the mine, or during the reclamation process. With the Arrow Deposit's maiden Inferred mineral resource estimate of 201.9 M lbs. U3O8 contained in 3.48 M tonnes grading 2.63% U3O8, it is showing a likely production profile which could make it the largest producing mine on a per-pound basis globally.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Leigh Curyer, who is CEO of NexGen Energy Ltd. Could you tell me, what differentiates your uranium company from others?

Mr. Leigh Curyer: There are 2 aspects that are real differentiators with respect to NexGen in the uranium space. Firstly, the project, which we are developing, is exhibiting characteristics very unique in the uranium space, particularly for the mega-deposits in Canada. It's 100% land-based, whereas all the other operating ones are currently under lakes or have surface water to deal with. Also, Arrow is contained 100% in the competent basement rock, so it will not require sophisticated freezing technology in order to develop the mine, operate the mine, or during the reclamation process. It's exhibiting some very clear technical advantages over the existing producing mines, and yet it's showing a likely production profile which could make it the largest producing mine on a per-pound basis globally when it goes into production.

The other aspect that differentiates NexGen is that the management and board of NexGen is qualified from exploration right through to production. We cover the disciplines right along that development cycle from exploration, development of the resource, running of the engineering studies, the permitting process, the mine financing and during production; that's very unique for a company in our position. We're now in exploration and development, and we know where we're going. We are not under pressure to bring in a major partner because we have the skills required to bring this project through to a significant uranium supplier globally. Uniquely, for us, we know where we're going, and we have a very exciting asset to take us there.

Dr. Allen Alper: That's excellent. Could you tell us more about the Arrow deposit, the resource, etc.?

Mr. Leigh Curyer: We released our maiden resource estimate in early March 2016, which outlined an inferred resource of 201.9 million pounds at an average grade of 2.63%. Within that resource, we have a very high-grade sub-core of 120.5 million pounds at 13.3%. That in itself is the largest maiden resource ever recorded in the Basin to my knowledge.

It only took just shy of 60,000 metres and approximately C$26 million to get us to that maiden resource estimate which, on a per-pound discovered basis, represents just 13 cents, which ranks it on top of the charts in terms of deposits discovered in excess of 100 million pounds.

What's unique is even though it's very large, we hit it in nearly 100% of the holes drilled which is unprecedented given the fact that these types of deposits are typically quite discrete. The fact we are hitting with nearly 100% of holes drilled at Arrow makes the case that this system is massive.

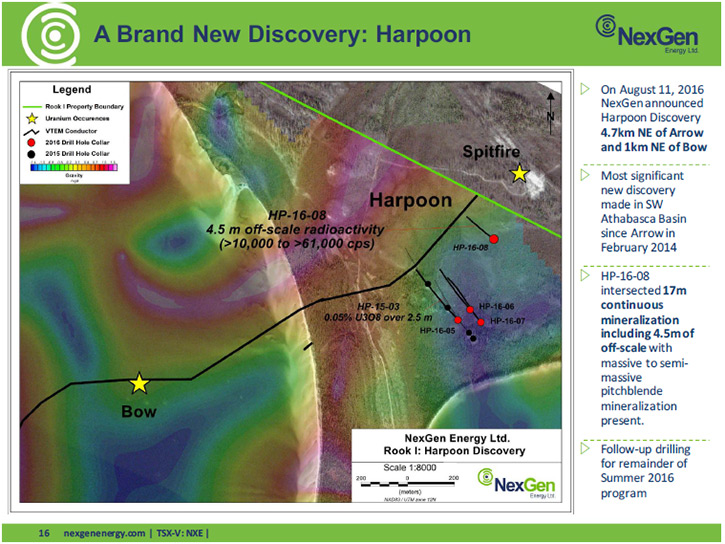

We still are just scratching the surface at Arrow, and we've subsequently made another discovery 4.7 kilometres along trend to the northeast, called Harpoon, which speaks to the potential for multiple Arrow-type deposits to be located along the Patterson Corridor which we are targeting. Today, I just can't tell you what we think the ultimate size of this is, because we have a lot more drilling to do. Suffice to say, we're onto an incredibly large mineralized system at the Rook 1 project, which hosts Arrow, Harpoon, Bow, Cannon and potential many others.

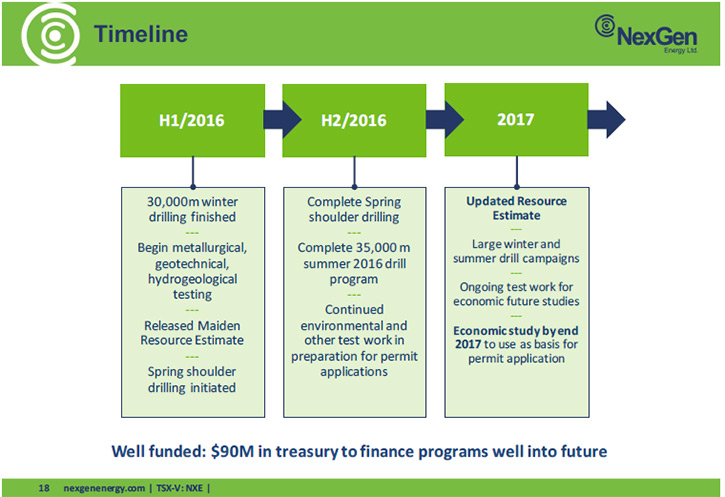

Dr. Allen Alper: That's outstanding! That's really great! Could you tell me a bit more about your plans for the year?

Mr. Leigh Curyer: In June, we completed a US$60 million financing package with CEF Holdings. which is 50% owned by Li Ka-shing, China's wealthiest invidividual and 50% by CIBC bank. We're well-financed well into the future to continue drilling the deposit, running the required engineering studies such as metallurgy, site characterization, hydrology as well as the environmental baseline monitoring. With the updated resource estimate and these studies combined, we plan to publish a pre-feasibility study before the end of 2017. The pre-feasibility studiy is a very important document, because it starts to quantify the economic parameters of the project and it is the document which we will use to support our permit application.

Dr. Allen Alper: That sounds excellent! Sounds like you have a huge deposit in the right place, and you have strong financial support. Excellent!

Mr. Leigh Curyer: Yes. We feel we have the strongest shareholder registry of any company in the uranium sector and with CEF we're now clearly demonstrating we have the financial backing of a group with capacity to potentially commit development capital and construction capital to get Arrow into production.

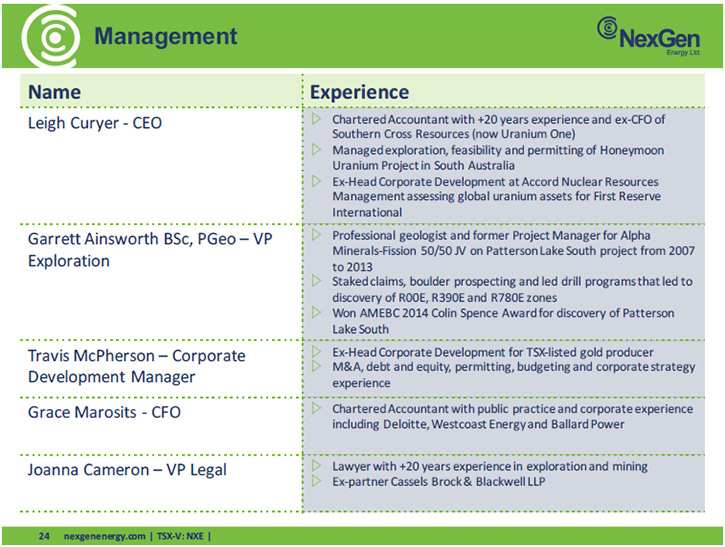

Dr. Allen Alper: That's excellent. Could you tell me a bit more, Leigh, about your own background, your team's background, and the board?

Mr. Leigh Curyer: Sure. I'm a chartered accountant by background and I started in the resources sector in 2002 as a chief financial officer for a small uranium company called Southern Cross Resources which had a development project in South Australia which was part-way through permitting and feasibility. I oversaw the balance of the development studies and permitting successfully. We then did a number of joint ventures and smaller transactions, and then a larger deal with Aflease to form Uranium One, which went on to become the second-largest uranium producer worldwide.

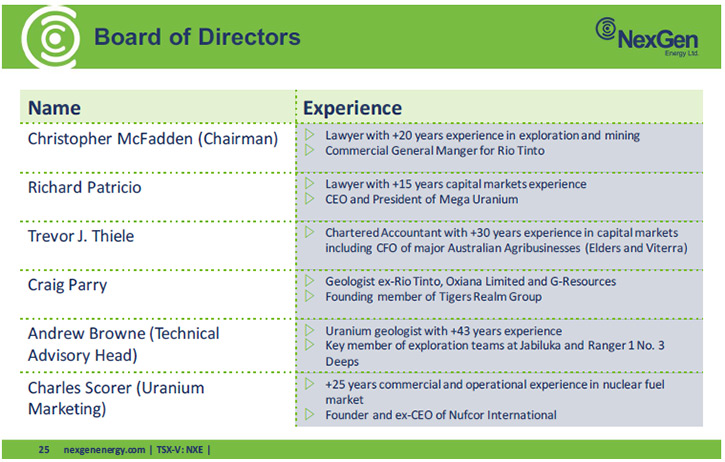

After that, I went into private equity with First Reserve International based in London, UK, where I looked at every uranium project right around the globe from a technical, financial, and sovereign risk perspective. Then, following Fukushima and after 3-years with First Reserve I incorporated NexGen with the current chairman, Chris McFadden, who was running Rio Tinto’s uranium division at the time, with the focus of acquiring exploration ground in the Basin. We got together and incorporated NexGen and acquired the properties that you now see in our portfolio. It was then 2014, that we made the discovery at Arrow.

Also on the board is Craig Perry, an ex-uranium geologist from Rio Tinto, as well. Trevor Thiele, who's the head of our audit committee. He's also a CA, with many years’ experience with public and private companies in Australia. Also, Richard Patricio, who's a well-known director in the Canadian resources sector and has a legal background, as well.

In terms of management, we have Garrett Ainsworth as our VPX. His involvement in the western part of the basin, where Arrow was discovered, is very well-known. A winner of the Colin Spencer Award for his work in discovering the Patterson Lake South project, now called Triple R. We also have Travis McPherson, who's our corporate development manager. He has many year’s investment banking and corporate development experience in the resources sector, as well. We have a very well-rounded board and executive team covering all the disciplines you require to take a project from discovery right through into production.

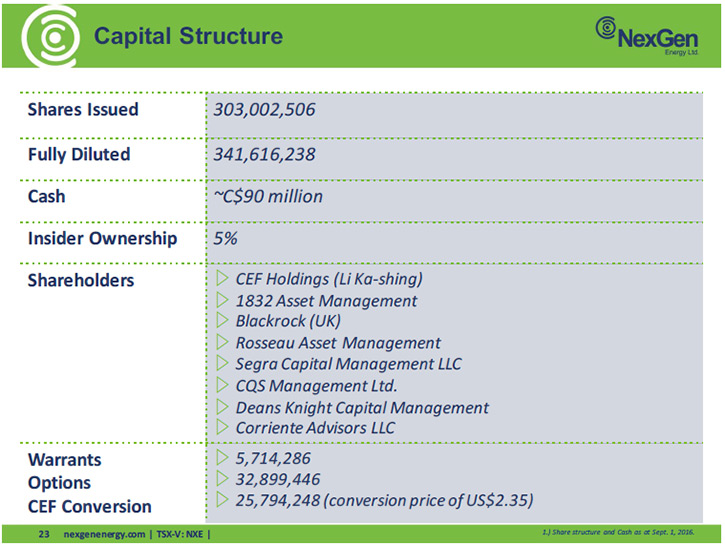

Dr. Allen Alper: That does sound like a very strong, well-balanced, experienced team and board. That's excellent! Could you tell me a bit more about your share and capital structure?

Mr. Leigh Curyer: Sure. We have 303 million shares currently issued, another 60 million in warrants, options and the CEF convertible debenture. The CEF debenture is convertible at a conversion of C$3.05. We have approximately C$85 million currently in the treasury. When you look at the share structure, about 5 phone calls account for about 45% of the issued capital. It's a very tightly held shareholder base, largely institutional and sophisticated with funds that are very familiar with the resources sector.

Dr. Allen Alper: That's excellent!

Mr. Leigh Curyer: The list of shareholders is very impressive when you look at their track record of investment. It should tell people that when experts are investing like this, it's a really good aspect of due diligence that's already been done for them.

Dr. Allen Alper: That's great! Could you mention a few of them?

Mr. Leigh Curyer: Yeah, there's Warren Irwin from the Rosseau Asset Management, 1832 Asset Management both in Toronto, and then also CEF Holdings. We also have Mega Uranium as a shareholder as well as Blackrock, CQS, Deans Knight and Segra Capital.

Dr. Allen Alper: Excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

The company's Arrow deposit is one of the best mineral discoveries of the decade, regardless of commodity. Arrow is big, it is high grade, it is mineable, and it is in a good jurisdiction. Arrow will become a mine one day.

NexGen's outperformance over the last year despite uranium's continuing deep bear market proves these points.

Mr. Leigh Curyer: There's no doubt it has the profile of becoming the world's largest-producing uranium mine which has always been a goal of the Board and management. Arrow is one of the best mineral discoveries in recent history, regardless of the commodity you are talking about and its technical characteristics mean it is also likely to be one of the most prolific. The grades and tonnages we are talking about at Arrow are unlike anything else in the world with the exception of Cigar Lake and McArthur River. Unlike those two mines, however, Arrow has no water issues to deal with in terms of surface water or ground water which requires sophisticated and expensive freezing technologies. We won’t need that at Arrow given it is basement-hosted and land-based. We look forward to publishing the maiden pre-feasibility study next year as we believe it will surprise the market in terms of this projects ability to perform in any pricing environment.

When you consider the fundamentals for nuclear, particularly post-2020, are so compelling, it's not really about the spot price today for uranium as to why investors should invest. It's about what the spot price is going to be post-2020 when we're getting into production and, unanimously, the uranium price is projected to be significantly higher than what it is today. The good thing about us is, even if the price stayed where it is today, we'd be one of the most profitable mines in the world at that time. It's a very strong project economically. It only looks to be getting better. When the project does get into production, the fundamentals should be even that much stronger for the project. As you know, a lot of these things play out a lot earlier. The investment normally starts to move prior to the actual commodity price rising.

Dr. Allen Alper: That sounds excellent. Very strong, excellent reasons why our readers and investors should consider investing in NexGen. Is there anything else you'd like to add, Leigh?

Mr. Leigh Curyer: I would like readers to note that, even though we have a very significant resource, it's still very early days. We're still just really scratching the surface with respect to what this resource is ultimately going to be and we haven’t been able to showcase yet what this project will look like in terms of its ability to generate cashflow yet, but that will come with the pre-feasibility study next year. The fundamentals for clean energy are very real. There has to be significant reductions in carbon emissions in order for the world to survive really. The only basis for that is for nuclear energy to play an important role in that future energy mix, and we are very well-positioned, still a little bit unknown, but we are incredibly well-positioned to meet that very exciting fundamental demand in the very near future.

Dr. Allen Alper: That sounds excellent. I enjoyed talking with you, Leigh.

http://www.nexgenenergy.ca/

NexGen Energy Ltd.

3150 - 1021 West Hastings Street

Vancouver, BC V6E 0C3

Tel: 604.428.4112

Fax: 604.259.0321

Investor Relations

Travis McPherson

604 -816-2686

tmcpherson@nexgenenergy.ca

|

|