Interview with W. John DeCooman, Vice President of Business Development and Strategy for Silver Standard Resources Inc. (NASDAQ: SSRI, TSX: SSO): 400,000 Ounces a Year of Annual Gold Production, Operational excellence, about $233 Million Cash in the Bank

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/5/2016

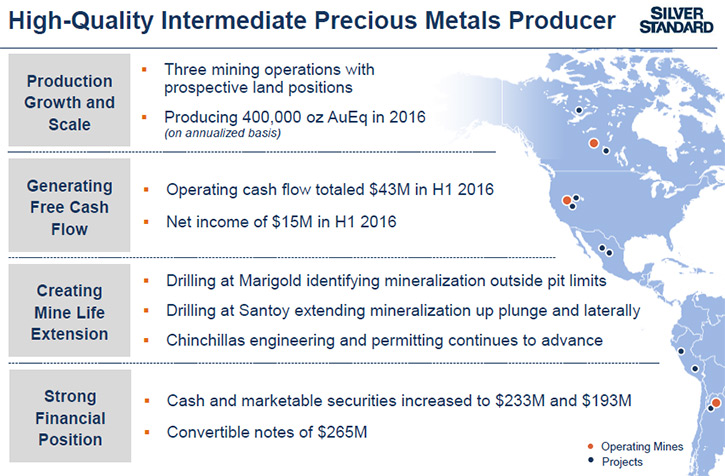

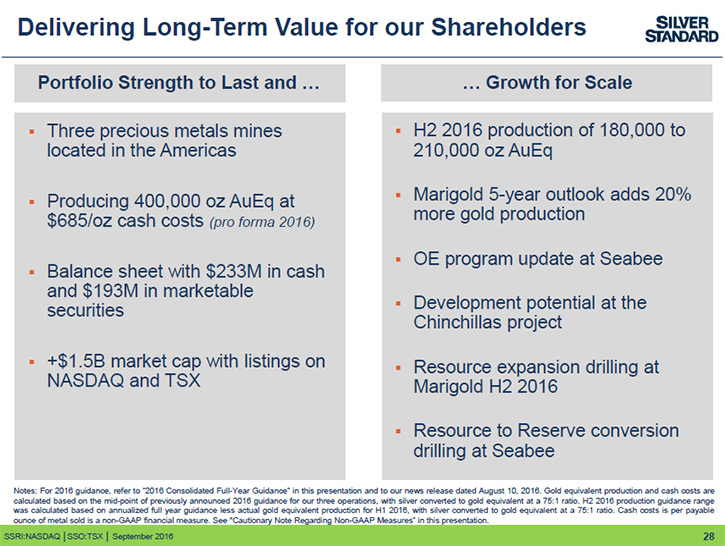

Silver Standard Resources Inc. (NASDAQ: SSRI, TSX: SSO) is a Vancouver-based mining company that owns and operates three precious metal mines: the Marigold mine in Nevada, U.S., the Seabee Gold Operation in Saskatchewan, Canada and the Pirquitas mine in Argentina. We learned from John DeCooman, Vice President of Business Development and Strategy for Silver Standard, the key driver that differentiates Silver Standard from other mining companies is a good management team that’s delivered free cash flow generation and production growth over the last 4 years, with a very solid balance sheet and a cash balance that’s continued to grow. With close to 400,000 ounces a year of annual gold production, with the management focused on operational excellence, and with about $233 million cash in the bank, Silver Standard Resources appears a very solid company positioned to grow.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing John DeCooman, Vice President of Business Development and Strategy for Silver Standard. Well, you work for a great company, and I see you have a great background. Could you tell me what differentiates Silver Standard from other mining companies?

Mr. John DeCooman: We have a good management team that’s delivered free cash flow generation and production growth over the last 4 years. We have a very solid balance sheet with a cash balance that’s continued to grow over that time period. Simultaneously, we have realized value by selling non-core projects and we have continued to invest in both our operations and our exploration portfolio for the future.

Dr. Allen Alper: Very good. Could you tell me a little bit more about your silver and gold operations?

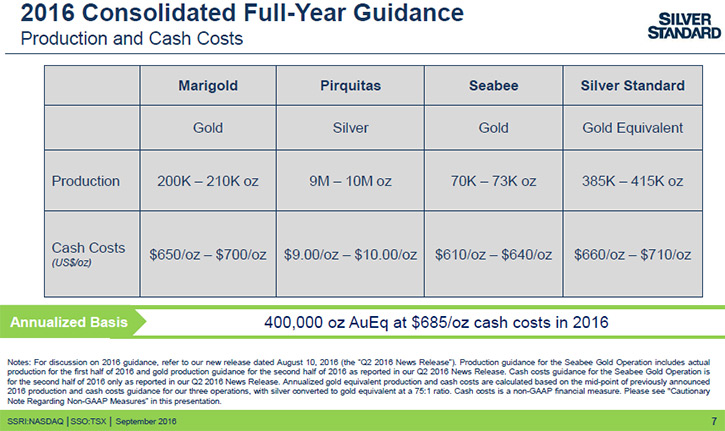

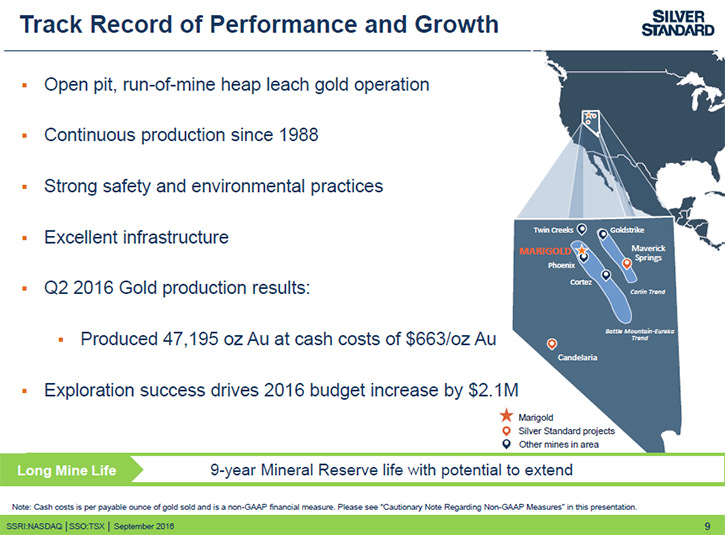

Mr. John DeCooman: Sure. Silver Standard has three precious metals mines all located in the Americas. Our largest operation, by production, is in Nevada. It’s called the Marigold mine. It’s been in operation for well over 25 years. It produces a little over 200,000 ounces of gold, at sub-$1000 all-in sustaining costs, and has been a good performer for both ourselves and prior owners. It has a $6 million exploration program for 2016 that has uncovered gold mineralization that we believe will be a continuing good story around building Mineral Resources and Reserves to maintain a solid mine life. As well, I think people are relatively comfortable with the geopolitical risk profile in Nevada around labor, inflation, things of that nature; so overall Marigold is a very important asset for us.

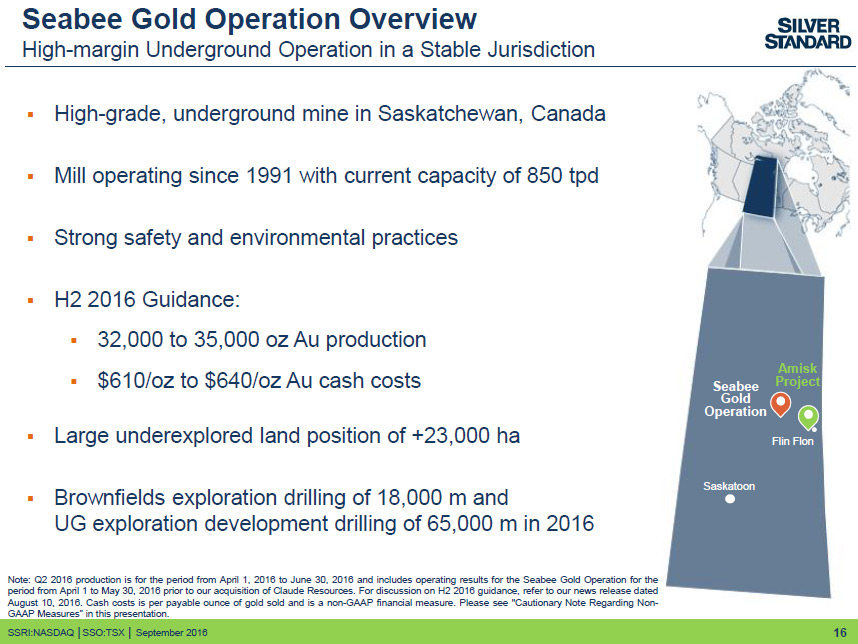

We just acquired our second gold operation, the Seabee Gold Operation, in Saskatchewan, Canada, about four months ago. It is Important to us because it provides us with a stable, lower cost profile. Seabee gives us a tremendous amount of confidence in generating free cash flow. It is an underground mine, producing around 70,000 ounces of gold per year. It is about one third of the size of our Marigold mine, from a production scale standpoint but it has lower cash costs and lower overall costs, probably sub $900-$950 per ounce, depending on where things end up this year with the Canadian dollar, so it provides a bit higher margin cushion. Historically it’s been a good performer and we think it will be a good operation for us going forward. It has good people, good political jurisdiction, and does not require a large amount of capital to move forward.

Dr. Allen Alper: Sounds excellent!

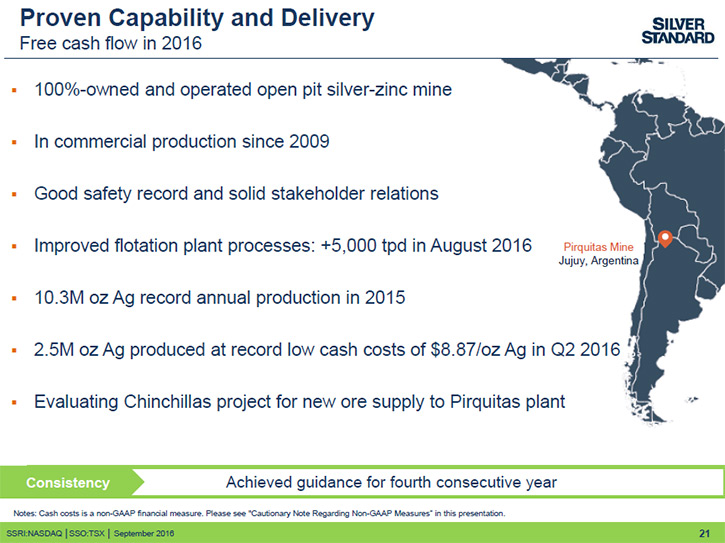

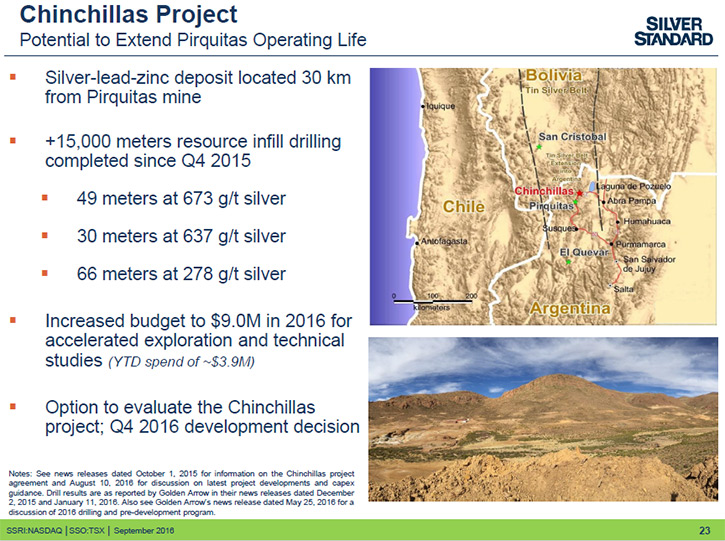

Mr. John DeCooman: Silver Standard has a third operation, the Pirquitas mine in Argentina. It’s a silver mine, exclusively silver at this point. It had produced some zinc in the past. Pirquitas has less than a year of Reserve life in the open pit and we have an option agreement for the Chinchillas project that’s within trucking distance from Pirquitas and represents the possibility of mine life extension for Pirquitas plant. The Pirquitas mine is having a very good year in 2016 as a result of higher silver prices, good silver grades, and also a very accelerated depreciation of the peso in 2016 that has given us some fairly healthy margins, but not sustainable in the long run. This underpins the importance of the Chinchillas project, whereby affording us the possibility to develop the project and use our in-house expertise to maximize shareholder value.

Dr. Allen Alper: Oh! Excellent! Could you tell me a bit more about your exploration activities?

Mr. John DeCooman: The exploration activities are primarily focused on the operations, as you can tell from our spending: about $6 million at Marigold and about $2 million at Seabee. If you consider the Chinchillas project in association with Pirquitas on the exploration side, which I think is fair, it adds another $9 million. Total exploration spent for the year is close to $17 million, attributable to brownfields exploration potential. Since I’ve been at the company, which is about seven years, we've never been in the position we’re in today, to potentially find new Resources, expand our existing Resource base, or expand our Reserve base. We are able to pursue these goals because of our growing cash balance and we've been able to systematically approach exploration at each of the operations over time.

As a result of our renewed interest in greenfield exploration, we are currently performing exploration work at a couple of properties. One of them is located in California, USA. It’s very early stage with a lot of indicators of a sediment/carbonate-hosted disseminated deposit potential like our Marigold mine. We have an option agreement to explore and acquire that project. Additionally, we’ve optioned a similar type of property package primarily to the south of our Seabee Gold Operation in Saskatchewan. Again, very greenfields orientated exploration opportunity that essentially doubles our exploration land package at Seabee. We are reinvesting capital from some of the exploration properties that we’ve sold in the recent past into what we think are higher prospectivity, higher potential properties.

Dr. Allen Alper: That sounds like an excellent approach. Could you tell me a bit about your background, the management’s background, and the board of directors?

Mr. John DeCooman: We have a very long history. Silver Standard is celebrating its 70th anniversary in December. It was founded back in 1946 as a result of the Silver Standard mine, located here in BC. The more recent history of the company involves the reinvigoration, recapitalized, and a renewed focus, strictly on silver in the mid-90s. As the company approached the mid-2000s, the management team at that time focused on Resources in the ground. They moved over strategically to an operating model as a result of an increased focus on ETFs and royalty-streaming companies.

That’s important because in the late 2000’s, it ushered in a management change. Since 2010 we’ve had a tremendous turnover in management that is more focused on operational excellence and operating skill set, as well as capital allocation and discipline. The required skillset is very different in an operating model compared to a traditional exploration company model. As a result, we have a number of professionals at the management level that have worked primarily in South America and Australia in the mining industry for larger companies. They have brought a balance of discipline and maturity in the approach to resource development, and ultimately operational excellence that you don’t always see in a billion-plus-dollar market cap company.

Our Board of Directors, who also came in the late 2000’s, and in the mid 2000-teens, has a similar background in terms of international mining expertise. Each of the directors brings a deep skillset in some capacity, whether it be international business (Gustavo Herrero from Argentina), through to accounting (Bev Park) and operations (Peter Tomsett, Mike Anglin, ex-COO of BHP’s Base Metals Group and Steve Reid, ex-COO at Goldcorp) An additional board member just joined recently as a result of the acquisition of Claude Resources and the Seabee Gold Operation, who brings very deep, long-standing expertise on the exploration side. As a team, we cover a lot of the key disciplines around exploration, development, construction, and operations, along with the accounting and legal disciplines that are required in this day and age for public companies.

Dr. Allen Alper: Sounds like you have a very strong management and board of directors. Excellent!

Mr. John DeCooman: Yes, I agree. Also, I think we have a very strong management team relative to the size of our company. We’re very fortunate.

Dr. Allen Alper: Very, very good! Could you tell me a bit about your Capital and Share Structure?

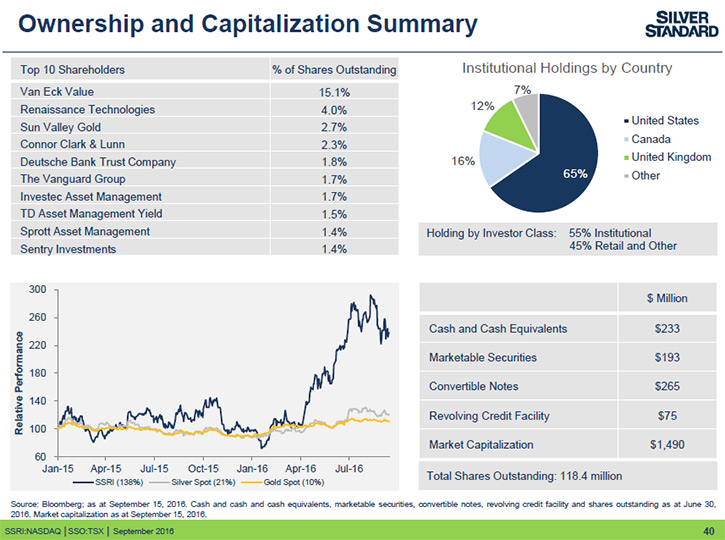

Mr. John DeCooman: Sure. Up until this year, we had not issued equity since 2010. We have about 119 million issued and outstanding shares, and almost 123 million if you consider a fully diluted basis.

Dr. Allen Alper: Where are your shares listed, and what price level are they?

Mr. John DeCooman: The shares are listed in the US with the NASDAQ. That’s where the bulk of our trading takes place on a daily basis with a stock ticker symbol SSRI. We're also traded on the TSX as SSO. When you combine that with a US share price of about $10.60 as it is today, you have somewhere in the neighborhood of about a $1.3 billion US market cap, so a reasonable size. Very good trading liquidity. We have had extraordinary success in the past, and continue to benefit from a good brand that provides a lot of trading volume on a daily basis.

We have cash in the bank as of last quarter of about $233 million. That will be increased over the course of this upcoming quarter because we have announced that we had a tax ruling here in Canada that went in our favor and we got our deposit back. You should see cash in the neighborhood of probably $250+ million for this upcoming quarter. We have a convertible note that’s outstanding. It could convert to equity at US$20 per share.

I think another important facet of our balance sheet, particularly when it comes to cash and marketable securities, is that we maintain about 17 million shares or about 9% of a gold resource company called Pretium Resources. That’s valued in the neighborhood of US$150 to US$175 million, so from a working capital standpoint we have close to $550 million of current assets, which is pretty impressive for a company of our nature.

Dr. Allen Alper: That’s amazing! That’s really outstanding! Could you summarize the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. John DeCooman: Sure. I think really it comes to two very good combinations that provide balance. Silver Standard has a balance sheet that can withstand lower metals prices, if in fact we experience more of that. Given our reasonable cost structure, strong cash balance and access to marketable securities, I think your readers/investors should feel comfortable with the stability of the company through all parts of the business cycle. On the flip-side, we provide a tremendous amount of optionality and leverage that when the metal prices do turn, you have fantastic trading liquidity both to get in and to get out, because typically buyers get in to eventually monetize and profit from their investment. They shouldn’t be fearful of being able to buy more shares or get out.

With our 400,000 ounces annual gold production profile, on a pro forma basis, we have a tremendous amount of leverage on a $100 movement in the gold price, that can be quite material to the bottom line. It can provide investors a great amount of upside movement in the share price.

Dr. Allen Alper: Ah, that’s excellent!

Mr. John DeCooman: I think with Silver Standard you get leverage along with protection to the downside, and that’s not always the case for some of these companies.

Dr. Allen Alper: Yes. That’s very, very good. Is there anything else you’d like to add, John?

Mr. John DeCooman: If people have questions or concerns about the operations, we're very open to discussions. We host internal conference calls with groups. We are available from an investor relations standpoint. We want to be interactive and transparent.

Overall, Silver Standard Resources is a solid company with a strong financial profile, free cash flow generation, assets in good jurisdictions, and experienced management team.

http://www.silverstandard.com

Silver Standard Resources Inc.

Suite 800 – 1055 Dunsmuir Street

PO Box 49088

Vancouver, BC

Canada V7X 1G4

Telephone: 1-604-689-3846

North America toll-free: 1-888-338-0046

Fax: 1-604-689-3847

|

|