Interview with Mark McCauley, CEO of Melior Resources Inc. (TSXV: MLR): Owner and Operator of a Past-Producing Ilmenite and Apatite Mine Strategically Located at Monto in Queensland, Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/31/2016

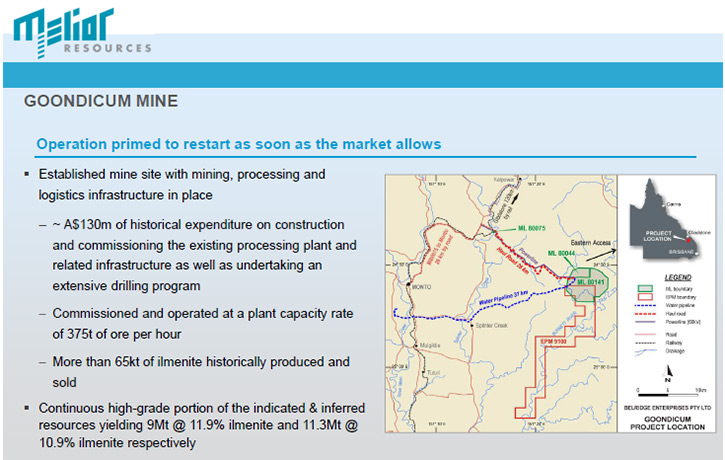

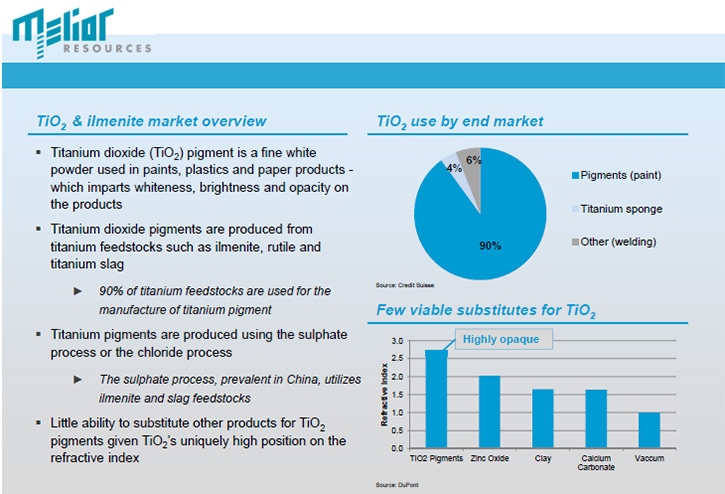

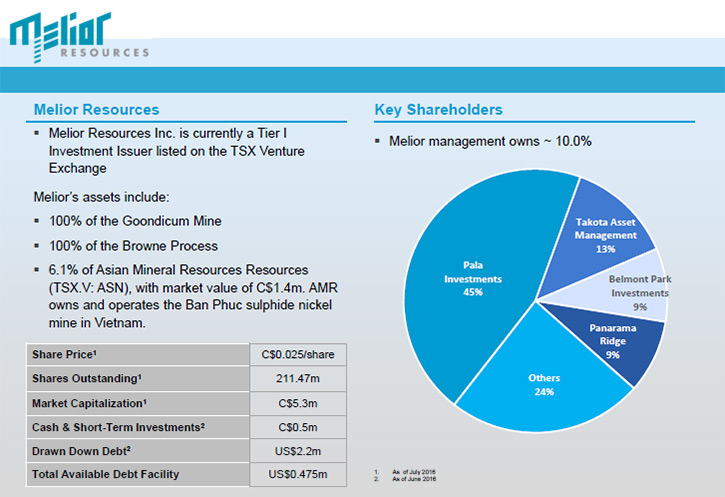

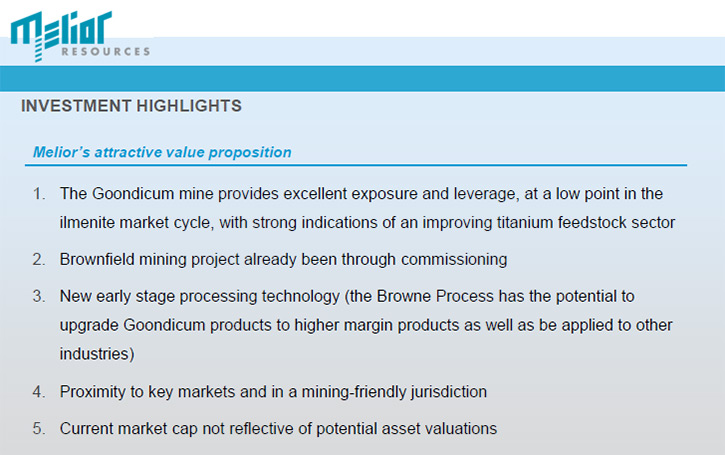

Melior Resources Inc. (TSXV: MLR) is the owner and operator of the Goondicum Mine, a past-producing ilmenite and apatite mine strategically located at Monto in Queensland, Australia. The project has excellent infrastructure, including power, water, access, and processing facilities on the site. It is a very low-capital project to get back into operation at a rate of around 170,000 tons per annum of ilmenite. We learned from Mark McCauley, CEO of Melior Resources, they have ilmenite that is used specifically for pigment manufacture via the sulphate process. Melior exports its ilmenite, primarily, to China, Japan, and Korea. Melior also produces apatite, used to manufacture slow-release organic fertilizers. Near term plans include finding a partner with expertise in either operations and/or marketing, and may be an end user or existing ilmenite producer. That will improve the ownership team, add to their capability and allow Melior to fund its share of the restart as soon as the markets allows.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mark McCauley, CEO of Melior Resources. Could you tell me a little bit about your company? I know you have ilmenite and apatite properties, and you're right near the coast.

Mr. Mark McCauley: The differentiator with our company is that the Goondicum mine has historically had over $100 million spent on it. It has excellent infrastructure, including power, water, access, and processing facilities on the site. It is a very low-capital project to get back into operation at a rate of around 170,000 tons per annum of ilmenite. From that point of view, it's probably the lowest capital cost per ton of production project around, and is sitting there ready to go.

Dr. Allen Alper: That's excellent! What are your plans to bring it into production?

Mr. Mark McCauley: At the moment, as soon as we get our short-term funding sorted out, which we anticipate will happen in the next few weeks, given the up-kick in the ilmenite market and the titanium feedstock market generally, we really want to be in a position to take advantage of that if it improves further next year. We will actively seek an equity partner for our project. That partner ideally will have expertise in either operations and/or marketing, and may be an end user or existing ilmenite producer. That will improve the ownership team, add to their capability and allow Melior to fund its share of the restart as soon as the markets allow. That's what we will be doing in the next 3 to 6 months. We think that will be a very positive process and give the project a real kick along.

Dr. Allen Alper: That sounds like a good plan. Could you tell our readers a bit about the uses for ilmenite and apatite?

Mr. Mark McCauley: Ilmenite is a titanium feedstock. Our ilmenite is a sulphate ilmenite that is used specifically for pigment manufacture via the sulphate process. We export our ilmenite to China, Japan, and Korea primarily, although there are other users in Europe and Asia. Our ilmenite is quite clean. It has very low lead, cadmium, chrome and other impurities. It's very reactive, so end users seem to like it in their process.

We also produce apatite, which is a phosphate rock. It's a refractory-type phosphate rock, which is quite unreactive, and is an ideal feedstock for slow-release organic fertilizers. We've had good discussions with a local manufacturer of organic fertilizers, who thinks our product is ideal for their process and has taken all the apatite produced from Goondicum to date. They're very confident and very enthusiastic about expanding their market, and we're very happy to provide the product for them to do that.

Dr. Allen Alper: That sounds very good! Could you tell us a little bit about your background, your team and your board?

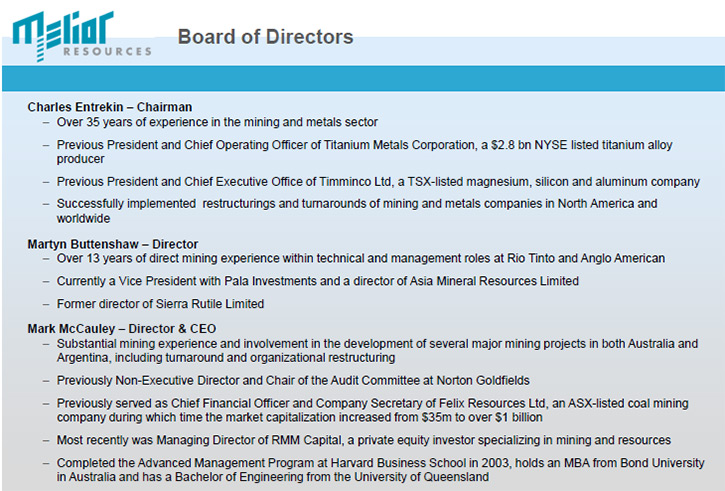

Mr. Mark McCauley: I'm actually a mining engineer from way back. I've spent a lot of time in the Australian and global mining industry in a lot of different commodities, including coal, gold, and more recently titanium feedstocks. I have been involved in all aspects of the operations, from the technical side to the financial side. I was CFO for a large listed coal company, on the ASX in Australia, for 3 years. We took that from a market capitalization of around $35 million to over $1 billion in the course of a couple of years with some smart M&A and internal project development.

I've also been involved in the private equity investment side, so looking at projects from an investor's point of view, which gives you an appreciation of what it takes to appeal to investors and to satisfy their requirements. We have a small board, which is appropriate for our stage of the project, including Chairman Chuck Entrekin, who has a long history in the titanium industry, and Martyn Buttenshaw, who's associated with the Pala Group, world-renowned resource investors. They add a lot of firepower and capability to our team. We have an office in Toronto and in Brisbane with small teams in both places.

Dr. Allen Alper: That sounds great! Could you tell me a bit about the extent of the resources?

Mr. Mark McCauley: We've just put out an updated NI 43-101 resource report that covers both the granted mining lease and the surrounding mining lease application, which was submitted previously. We have around 47 million tons of indicated resources and around 43 million tonnes of inferred resources on the property within both those tenements, and are currently finalizing a preliminary economic assessment to add to that NI 43-101 report. That should be due out in the next 2 months.

Dr. Allen Alper: Okay, sounds good. Could you tell me a little bit about your share and capital structure?

Mr. Mark McCauley: Our share structure is made up of several major shareholders, including Pala Investments, who have 45% of the company, and with 3 other large investors making up about 40%, and the remaining 15% is mainly small retail shareholders based in North America. We have about 450 shareholders in total. We currently have a debt facility through Pala Investments which totals around $3 million U.S., and discussions with them and others about re-financing or extending that facility in the short term.

Dr. Allen Alper: That sounds good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Mark McCauley: It offers great leverage and exposure to the titanium feedstock industry, which has, in the last 12 months, been through the worst period for probably over a decade. Now there are upturns starting to appear in that industry. This is a great way to get exposure to a recovery in pigment and titanium feedstocks, with one of the lowest capital costs per ton of production project, which has all its approvals in place ready to restart. This is a very good opportunity, we think, to get exposure and leverage to that industry.

Dr. Allen Alper: Is there anything else you would like to add, Mark?

Mr. Mark McCauley: In addition to the Goondicum project, we're also in the very early and exciting stages of testing some process technologies that we have previously flagged to the market. Over the next 6 months, we anticipate putting some effort and resources into furthering that. That could be very exciting for us, along with the project at the Goondicum mine that's ready and willing to be restarted. Also I think our plans to bring in a partner for that, will make for a very exciting 12 months for Melior Resources.

Dr. Allen Alper: That does sound very promising and interesting. Tell me, what is unique about some of that processing technology?

Mr. Mark McCauley: What we're looking at, Allen, is upgrading Goondicum ilmenite, not just Goondicum ilmenite but any source of ilmenite, from a relatively low TiO2 concentration to a much higher TiO2 concentration. We're looking at doing that through a process which requires much lower temperatures than conventional slagging. We're early stage, but the work done to date is quite intriguing. We will focus on that in the coming months and see where that leads us. At the moment, at a bench top level, we seem to be able to get results that no one else has been able to achieve with respect to upgrading ilmenite to a higher concentration at relatively low temperatures.

Dr. Allen Alper: That sounds very promising!

http://www.meliorresources.com/

120 Adelaide Street West, Suite 2500

Toronto, Ontario

M5H 1T1

Canada

|

|