Interview with Mark Smith, President and CEO of Largo Resources Ltd. (TSX: LGO) (OTCQB: LGORF): Largo Owns and Operates the World's Richest Vanadium Mine and the Highest-Grade Vanadium Project

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/31/2016

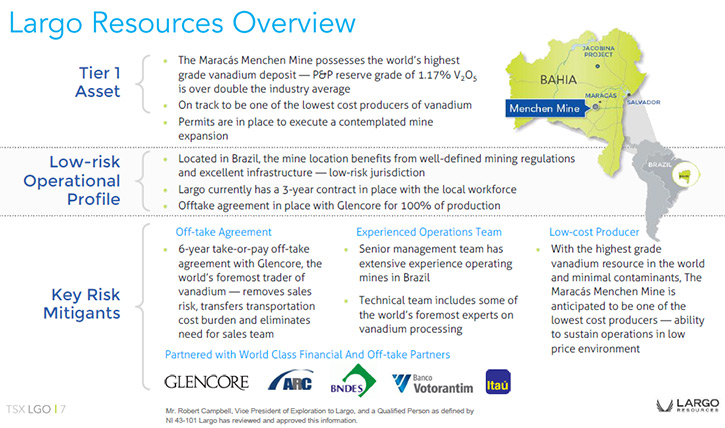

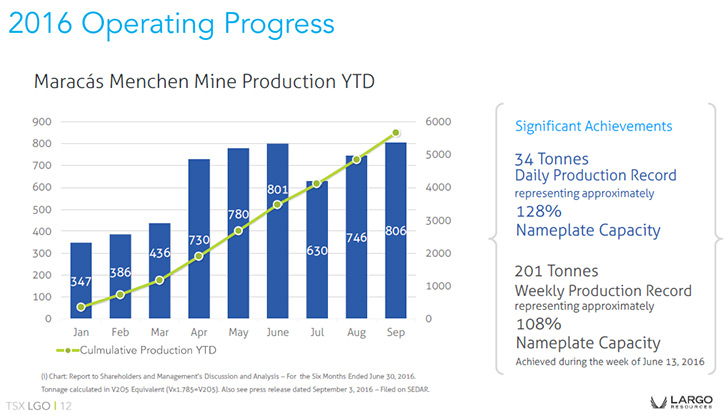

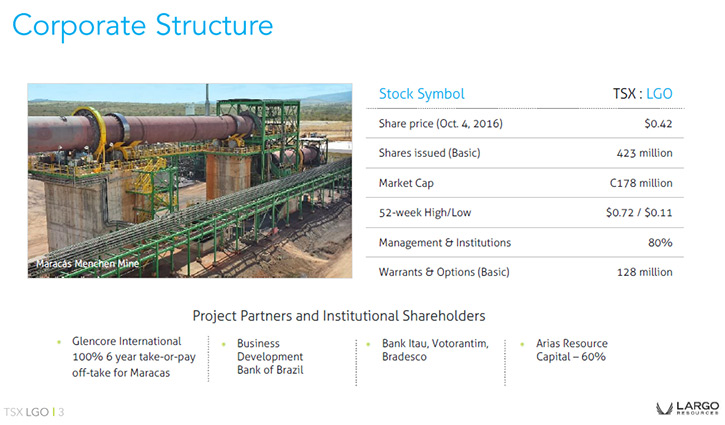

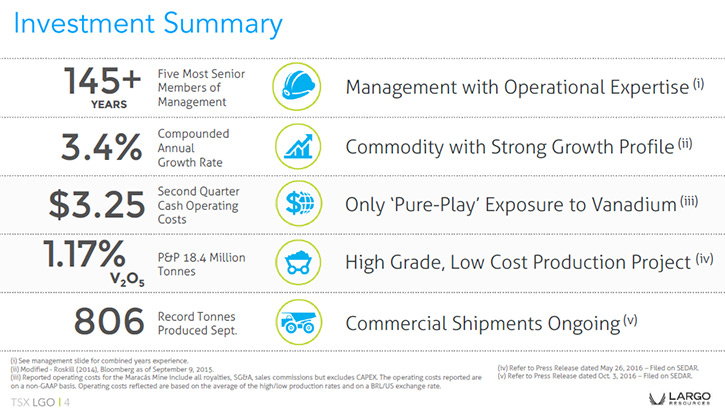

Largo Resources Ltd.(TSX: LGO) (OTCQB: LGORF) is a growing strategic mineral company and the only pure-play producer of Vanadium, focused on the production of vanadium pentoxide at its wholly-owned Vanadio de Maracás Menchen Mine, located in Bahia State, Brazil. The Maracás Menchen Mine is the world's richest vanadium mine and the highest grade vanadium project in the world. We learned from Mark Smith, President and CEO of Largo Resources, that this September the mine reached record production of 806 tons, and the company plans to achieve 5% to 10% above nameplate capacity, which is 800 tons per month, with little or no capital investment. According to Mr. Smith their Brazilian team is excellent and the quality of the product they are producing is one of the best in the world right now.

View of the AMV Precipitation system

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mark Smith, President and CEO of Largo Resources. You're having a fantastic year this year, hitting all kinds of production rates. Could you bring our audience up to date on what's happening with Largo, why the company is unique?

Mark Smith: Thank you, Allen, for interviewing us today. We very much appreciate your continuing interest in us. As you know, we published a press release recently that indicated record production for the month of September. We actually hit 806 tons. It is my firm belief that our company can probably achieve 5% to 10% above nameplate capacity, which is 800 tons per month, with little or no capital investment. I'm actually at the mine, in Brazil, during this interview. We're working on our plans to make that happen, as we speak.

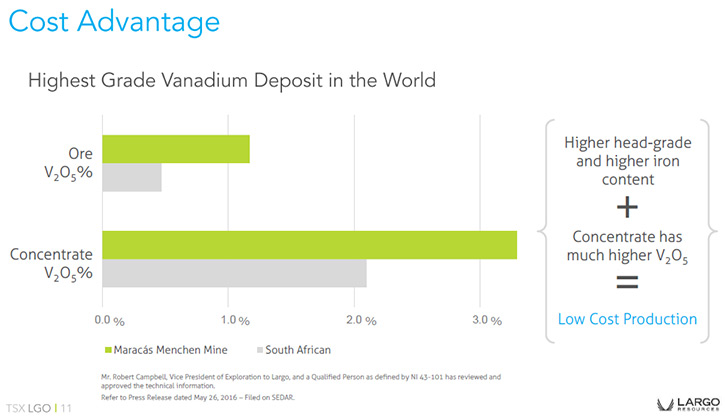

The Largo resource is absolutely world-class in nature. That’s the reason why all this can happen; why this is such a special project. It's big. It's very rich. We're 2 to 3 times richer than the next best primary vanadium mine in the world today. The high ore grade flows through everything we do. We end up with higher quality concentrate. We end up with very good recoveries in our processing system. The quality of the product we're producing is probably one of the best in the world right now. That really opens up some new doors in terms of where our material can be used and the margins that we can expect.

There is a lot of excitement here at the mine and a great group of people making it all happen. You can have the best ore body in the world, and the best processing systems in the world, but it takes really good people to make those things successful. I could not be more proud of the 99.9% Brazilian team we have running this facility. They are some of the best that I've had the opportunity to work with.

Dr. Allen Alper: Sounds excellent! Could you tell me a bit more about your plans going forward in 2016 and 2017?

Mark Smith: Our plans are very straightforward. We want to to continue to excel on the operational front. We want to focus on getting this extra 5% to 10% production out of this plant with little or no capital, and we want to continue to lower our unit operating costs. We reported our average unit operating costs for the second quarter of this year at $3.25 a pound on a V2O5 basis. If it's not the best in the world, in terms of low-cost production, it has to be in the top 2 or 3. We're going to continue to focus on getting more out of this plant and at a lower unit cost.

Moving forward throughout the rest of 2016 and 2017, we want to get our high-quality product into the higher-end applications, where we can get higher prices for our material, hence higher margins. We might be able to fill the vacuum left in the high-quality vanadium production area, with the exit of Vanchem.

We think Largo can fill that void very easily with our high quality. Increasing sales prices and decreasing unit production costs is so important. Every time we can lower our unit operating costs by 25 cents or increase our average sales price by 25 cents, that's $5 million to the bottom line of Largo. Our people are laser-focused on reducing those unit costs and making sure the quality of our material exceeds customer expectations, so we can get into these high-end applications with higher margins.

Dr. Allen Alper: That's excellent. Could you elaborate a bit on what some of those high-quality applications are?

Mark Smith: We are focused on 3 exciting areas for high-end applications. One is the aerospace alloying business. Aluminum is alloyed with vanadium and ultimately with titanium. There is no replacement for it in the aerospace industry. It goes into the construction of the jet engines. That's about 4.5% of the total world market for vanadium today.

The next application for vanadium is in the chemical industry. Vanadium is a very important component in the matrix of catalysts that are used in the refining industry and the sulfuric acid production industry, in particular. Customers require very high quality material in these very precise catalyst applications. Those catalyst manufacturers are willing to pay higher prices for high-quality material, much higher than the published prices for typical spec material.

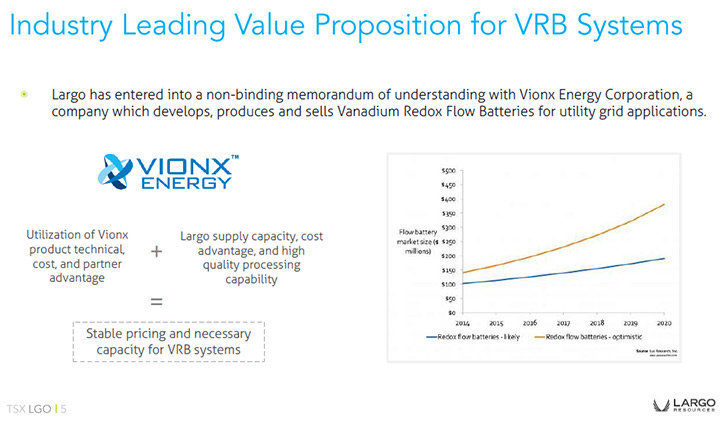

The third area, the vanadium redox battery industry is exciting and it should push demand for vanadium. The applications of VRBs, the vanadium redox batteries, are really starting to accelerate and are forecast to continue based on a couple of very sound fundamentals.

The utility companies are asked to continue to generate more and more renewable energy, typically in the form of solar or wind. They have to couple those with batteries. Coupling those renewable energy sources with things like vanadium redox batteries, allows a utility company to utilize those storage devices and then claim the renewable energy sources as base load pieces of their infrastructure.

The vanadium redox battery is extremely well-known and the technology is very sound. It's been around for over 20 years, and it has an unbelievable capability of absorbing energy and, maybe more importantly for you and me, Al, discharging energy. When you and I turn on the light switch in our house, we don't have to sit and wait for the power to come in from the battery. That power comes in immediately from a vanadium redox battery, and we see our lights go on right away. It's very good for the end-user, the ultimate customer, very good for the utility company, and obviously very good for the vanadium industry as the demand for these materials accelerates.

Dr. Allen Alper: That sounds excellent. That's really great. Could you tell me a little bit more about your background, your team, and your board? I know you have a fantastic background, but could you elaborate on that?

Mark Smith: I would love to. I have 35 years of experience in the resource business, I've loved every single opportunity in terms of working with different companies and learning about different metals, different metallurgies, and different financing mechanisms. I've been an executive for over 16 years and I’ve enjoyed every minute of it. I'm also a registered professional engineer, and a lawyer. Those two skill sets have definitely helped me in my career as an executive. Many things cross over into both of these areas significantly every day. So I’m very happy with the education that I chose as I pursued my career.

The board of directors for Largo is a group of individuals that is extremely strong. We have very strong accounting and audit committee skills. We have very strong financing skills. We have very strong technical skills on the board, at both an exploration level and a production level. The board of directors has been an unbelievable resource for me. They give me extra help where the company needs to look at things differently or use somebody's experience to make sure we're not trying to reinvent the wheel. They're extremely helpful and very competent. I appreciate the privilege of working with such a fine group of people. They care about this business very deeply.

It is an honor to work with and for the management team here at Maracas and at our corporate level. Our CFO is one of the best CFOs, with whom I've had the opportunity to work. His name is Ernest Cleave. I'm very proud of the management at the mine. It’s a Brazilian operation being run by Brazilians. They want this project to be successful, not only for themselves but for their country, and you see that in their everyday work. I really respect the effort, the hard work and determination, the entire team puts in every day, and it shows in the results, which are excellent.

Dr. Allen Alper: That's excellent. Could you tell me a little bit about your share and capital structure?

Mark Smith: We have about 420 million shares outstanding on an undiluted basis. The diluted basis is higher, but a lot of the warrants associated with that diluted basis, are either not in the money or they have a long term left on them. Our largest shareholder is Arias Resource Capital. They own just under 60% of the company. About 5 to 6 shareholders in total make up about 80% of our shareholding. It's a very stable situation and the top 6 or so shareholders continue to participate in various fundraising efforts because they really believe in and support the company. They demonstrate it every time the company needs to add more cash to its treasury. They have been with us throughout the entire cycle, both the positive side and the negative side.

Dr. Allen Alper: Excellent! It's very good to have strong support from an experienced team and loyal stockholders, who will back you in good times and bad. It says a lot for you, your project, your resource, your team and the high quality of your entire operation and company. No one gives that kind of loyalty otherwise. That's great!

Mark Smith: Absolutely, it's a good thing to have.

Dr. Allen Alper: I know there are some market predictions that vanadium prices will increase and vanadium pricing is very important. What are your thoughts and what are the market experts saying about the vanadium market going up?

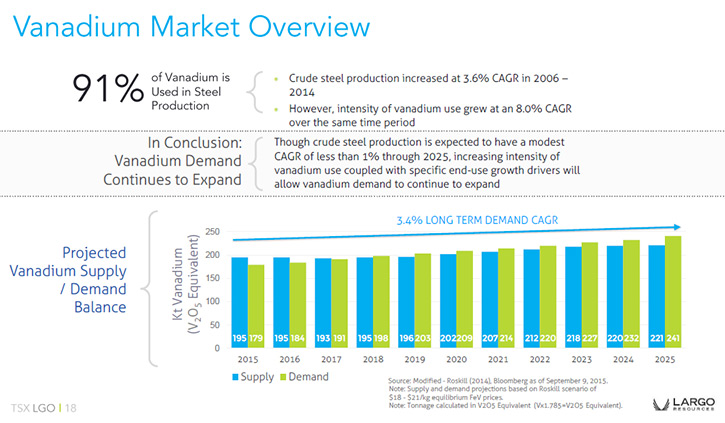

Mark Smith: I try to read every one of those forecasts, because I want to be as factually prepared as possible in terms of forming our own conclusions. During the global economic downturn, several vanadium mining companies shut down. Several businesses went into liquidation bankruptcy. So the supply side of the equation has been dramatically impacted. We anticipate that upwards of 12% to 15% of the total supply side has been taken off the market.

Demand is growing a bit due in part to a recovering steel industry and new applications. But even if it remained status quo, that's fine, because we are now in a deficit situation where demand is greater than supply. We also monitor the inventory levels for vanadium, which we believe are very low across the entire world right now. We think the equation is set up very well for favorable pricing going forward. As a low-cost producer, with the highest ore grade in the world, we are very much looking forward to this turnaround.

We're feeling it already. Prices have already gone up about 60% since December of last year. Even with that 60% increase, we're not quite up to some of the 30-year and 10-year average figures, so there's still room for more recovery to occur. Again, we think supply, demand, and inventory fundamentals are all pointing in a positive direction in terms of price increases.

Dr. Allen Alper: That sounds very promising. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mark Smith: That's a great question, Al. Sometimes it's not an easy question to answer when you're a company like Largo. Largo is a pure play vanadium company. That's what we do. We do vanadium. I think personally that given where the market is today, and the ultimate price increases that are occurring right now, it's an outstanding opportunity to come in and invest in a pure play vanadium company. I personally have continued to invest in the company with my own money. I believe in where we're going, how we're doing it, and I'm very confident we're going to get there. I think it's an excellent time to take a hard look at investing in a pure play vanadium company, and Largo is the only company in the world that can say that. I think it's a great time to look at Largo, and a great price point to come in.

Dr. Allen Alper: That sounds excellent. Very strong reasons to take a close look at Largo! Is there anything else you'd like to add, Mark?

Mark Smith: Just another big thank you, Al, for your continuing interest in Largo. We are exceptionally proud of what we're doing, how we're doing it, and where we're going as a company. I can't thank our people in the company enough. They're so dedicated and passionate about success, it just adds extra confidence, from my perspective, watching everything our team is doing in the company.

Dr. Allen Alper: Thank you, Mark, for taking the time to fill our readers/investors in on what's happening with Largo and the great results you're achieving this year.

Disclosure: The Alper family is invested in Largo stock.

http://www.largoresources.com

55 University Ave., Suite 1101

Toronto, Ontario, Canada M5J 2H7

416-861-9797

|

|