Interview with Stuart Rogers, President of TerraX Minerals Inc. (TSX-V: TXR; Frankfurt: TX0; OTC Pink: TRXXF): Controls One of the Six Major High-Grade Gold Districts in Canada, Adjacent to Yellowknife

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/27/2016

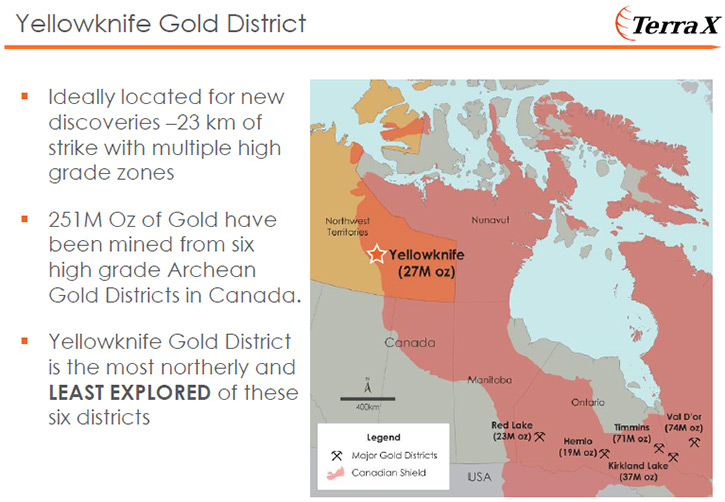

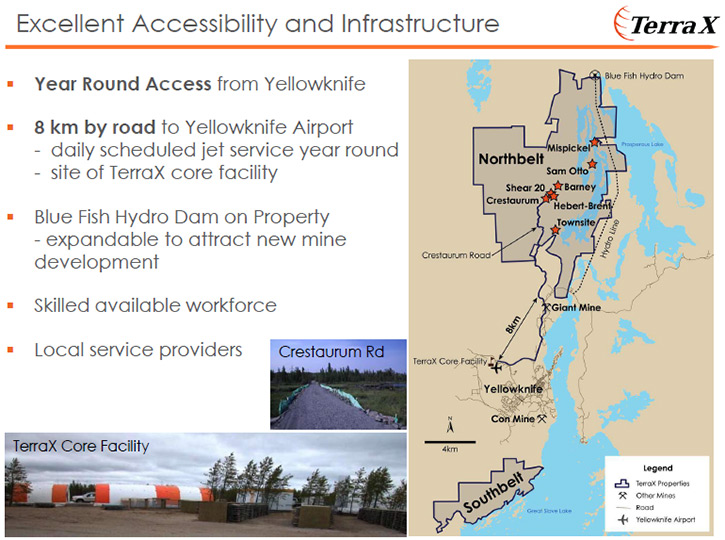

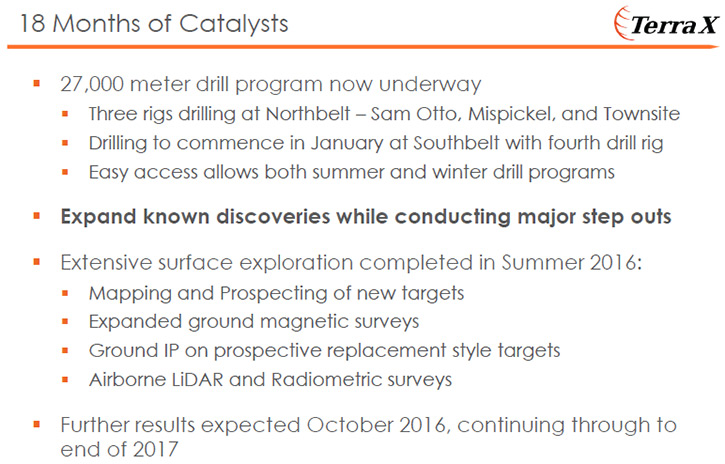

TerraX Minerals Inc. (TSX-V: TXR; Frankfurt: TX0; OTC Pink: TRXXF) is a Canadian junior mining company that controls one of the six major high-grade gold districts in Canada, immediately north and south of mining friendly Yellowknife, the capital of the Northwest Territories. Their flagship Yellowknife City Gold Project, which encompasses 129 sq. km of contiguous land, is all-season road accessible and very close to vital infrastructure, including transportation, service providers, hydro-electric power and skilled tradespeople. We learned from Stuart Rogers, President of TerraX Mineral, this is the least explored of the major gold camps because, up until recently, you couldn't drive there all-year-round. Now with highway access and daily scheduled jet service to the rest of Canada, the access is quite easy. This also allows them to work all-year- round, so they have just completed their summer exploration campaign and will be back drilling in January. The company strategy has been to identify the areas, on their vast property, where they can build a maximum high-grade resource in the least amount of time and/or cost. According to Mr. Rogers, results to date indicate that the project has multimillion ounce potential.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Stuart Rogers, who is president of TerraX Mineral Inc. Could you tell me a little bit about your properties, and what differentiates your company from many other mining companies?

Mr. Stuart Rogers: I think what really makes this project unique is that we have, over the last 3.5 years, assembled a district. It has historically been one of the highest grade gold districts in Canada, with a total production from the two mines immediately adjacent to our properties of 14 million ounces with an average grade of 16 grams a ton. It's the same type of geology as the Timmins or Kirkland Lake camps. This is the least explored of the major gold camps because of its remote location. Up until 2012, you couldn't drive there year-round. Now with highway access and daily scheduled jet service the access is quite easy.

We have 129 square kilometers, 23 kilometers of strike. We own this 100%. This is a unique situation. I think this is what really differentiates us from other companies in that we are a junior company controlling a gold district. In many cases, major companies don't even control the whole gold district. In this case, we do.

The other thing that makes us unique is the infrastructure, which is, as one exploration company has said, basically a dream. When people think of the north, they think of camps for their employees, they think of transportation by air, they think of only working in the summer because you can't drill in the winter. In our case, we're right beside a city. We have a mining-friendly town with skilled labor. This is the support center for the diamond mines and the other mines that operate to the north. The town was founded on the two mines, Con and Giant, which closed in the early 2000s after a 60 year mine life due to the low price of gold. They would love to have mines operating again beside the city Yellowknife. That would mean the people that live there could work near where they live, as opposed to flying up north to the camps and mine sites and all that’s involved in that.

In our case, because we're beside a city, we don't require camps. We hire drillers. They live in Yellowknife. They come to work. They go home. They sleep in their own beds. We don't have to house them, we don't have to feed them. We don't have to support them with helicopters unless we elect to because it's more efficient in some case, and because we're right beside an airport as well. Helicopters aren't the same expense that you would have in remote locations.

What makes us unique there is not only having control of a high-grade gold camp, but being beside a city. We have full infrastructure, full support, which makes exploration easy to accomplish and relatively inexpensive. It also allows us to work all year around. We've just completed a summer phase of our drill program and we'll be back drilling again in January.

Dr. Allen Alper: That's sounds great. Could you tell me a bit about your resources and your plans for 2016 - 2017?

Mr. Stuart Rogers: Our strategy is to illustrate the endowment of this project. The project was identified by our Chief Executive Officer and the Chairman, Joe Campbell, with whom I've worked since founding this company in 2007. He identified this opportunity beside Yellowknife. It had been unidentified for a number of reasons.

His success in the late 2000s was discovering Meliadine and introducing it to Agnico Eagle. That's a major project over in Nunavut. Actually, quite a remote project, but with the same geology that we have here. That project was acquired by Agnico Eagle in 2010 for roughly $700 million, a combination of cash and shares. Since then, it's been a very successful project for them. They expanded the resource from the 3.3 million ounces that was indicated at the time they acquired it to over 10 million ounces in all the various categories. Joe Campbell has experience with this type of project.

When Agnico became interested in Meliadine, they did it based upon an endowment report that Joe prepared for them. A resource had been defined in one area, but Joe had identified other areas where you could quickly build resources as well. That's what interested Agnico, the fact that it had potential to be a multimillion ounce camp. That's the same strategy we're trying to follow here with TerraX.

Yellowknife City Gold is more than just a project, it is a district, so to some degree it's daunting. You almost don't know where to start. We have multiple gold showing on the property, but the work that we've been doing over the last few years has allowed us to identify the areas where we think we can build a maximum resource, the highest grade resource in the least amount of time and the least amount of cost. Our strategy now is to do a combination of definition and expansion on existing resources, but also find new zones that we can develop as well so we can prove the multimillion ounce potential of this project.

Dr. Allen Alper: It sounds excellent. Could you tell me a little bit more about your background, the team, and the board?

Mr. Stuart Rogers: I've been involved in the public market since 1990 in Vancouver. I've been involved in financing a number of companies, actually in technology originally, and then in the mineral exploration area, for which Vancouver is well known and has developed a successful track record.

My role in the company has been to help raise the money to advance the project, which is a little easier now because the metals market, and particularly the gold market, has improved dramatically, but it was pretty difficult over the last few years. In our case, we were successful in raising money and maintaining a fair, reasonable valuation for the company in spite of the challenging environment for exploration companies.

I guess the key to this project and what we're doing now is Joe Campbell, and his success as I mentioned. He worked for a major company, WMC of Australia. He was responsible for the discovery of Meliadine, the development of that project and the introduction to Agnico Eagle. He has a consulting company, GeoVector, and he has a group of individuals that are his partners in that firm and have worked with him at WMC and other projects. Allen Sexton, our project manager in Yellowknife, was the Site Manager for the Meliadine gold project in Nunavut over a seven year period from discovery through to pre-feasibility, working with Joe Campbell on the day-to-day management during the development of that project.

Tom Setterfield, another director, is an experienced geologist and a partner in GeoVector as well. He has 36 years’ experience in the industry and is expert in a number of deposit types, WMS, IMCG, and obviously gold in the Americas. Paul Reynolds is another geologist who's on our board and one of founders as well. Just last year, Elif Lévesque joined our board and she is the CFO of Osisko Gold Royalties, having worked with them during the period when they developed the Malartic mine as Osisko Mining. She brings experience as far as capital and fundraising, and is Osisko’s nominee to our Board of Directors. Osisko was an early supporter of this project, an early investor, and acquired their 11% interest in TerraX by investing cash in our private placement financings.

Dr. Allen Alper: That sounds great! It sounds like you have a very strong chairman and a very strong board, and you have an excellent background too.

Mr. Stuart Rogers: Thank you.

Dr. Allen Alper: Excellent team as well! Could you tell me a little bit more about your finances and your Share or Capital Structure?

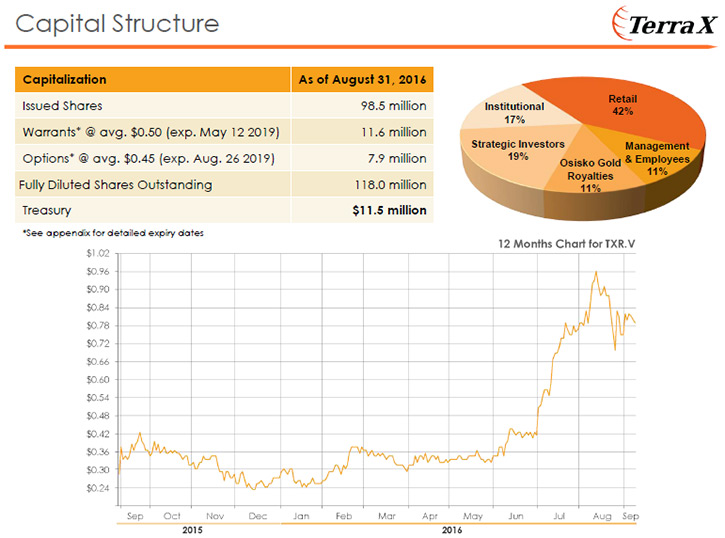

Mr. Stuart Rogers: I'm glad you asked. Right now, we have about 99 million shares issued and outstanding, fully diluted is 118 million. Our stock has been trading quite well recently. It's had good volume and there are a number of warrants that are being exercised around the 50 cent range, so that's provided more funding for the company.

In 2016 we raised about $10.5 million for exploration, with a combination of flow-through and hard dollar financing. We have just completed a 10,000-meter drill program which is almost paid for. The drill stopped turning about a week ago. We still have some more work to do, but at this point, we have completed that program and substantially paid all the expenses involved, such as the drilling contractor. We have about $9.9 million in cash in the bank to carry on with exploration. That will cover us all the way through our winter program and our summer program next year.

Because of the infrastructure and the location, for our all-in drilling cost, which includes the geologists, assays, and support, everything you need to actually get a meter of core assayed, we're looking at the $225 to $250 per meter range. I am providing a range now as not all of the bills are in, but that's historically what our costs have been during programs we've done over the last few years.

We're well financed to do the drilling that we have planned over the next year. We have designed a 27,000-meter drill program of which we've already completed 10,000 meters.

Dr. Allen Alper: That sounds great! It sounds like you have a great area. You have the money to explore it, and you have backing. It sounds like you have a lot of good things going for you.

Mr. Stuart Rogers: More importantly, we have high-grade gold.

Dr. Allen Alper: Very, very good!

Mr. Stuart Rogers: We almost forgot about that. All of those other things aren't that important, unless you actually have gold on the property.

Dr. Allen Alper: That's excellent! There's nothing like having high-grade gold!

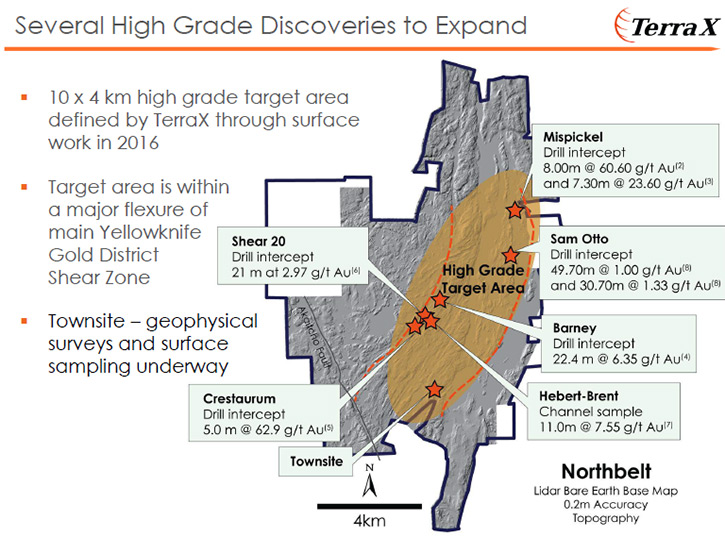

Mr. Stuart Rogers: Exactly. Some of the results really have demonstrated our potential to the market. That is why we're trading so well now, our new discovery at Mispickel. One of the myths of an area, located right beside a city, is that people think, "Well, all the gold's been found." That hasn't been the case. This area we drilled, we sampled a trench on surface that returned six meters of 7.3 grams Au. We decided to test it in the winter of 2016 and we just put four holes into the structure. All four holes had gold, with intervals such as 8.6 meters of 13 grams a tonne. Below that there was 7.3 meters of 23.6 grams a tonne. That was pretty exciting. When we were doing our winter program that was the first area we drilled. We got these results before we finished and wrapped up so we came back, drilled it again, and we got another intercept 40 meters below that of 8 meters of 60 gram a tonne.

We're showing some wide zones of mineralization. Actually with the main zones of high-grade gold that we're hitting within the wide zones of pervasive low-grade mineralization, a large mineralizing system is indicated. From the drilling that we've done this summer, we've only received and announced four holes from the 36 that we just finished. Again, good high-grade gold intercepts from the drilling. More importantly, we're finding these pervasive zones of gold mineralization, low-grade mineralization, and it's taking a while to assay everything because we're assaying all the core, not just the higher grade main zones. The low-grade mineralization obviously is something that can help the economics down the road because this all comes to surface.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Stuart Rogers: I think it's the overall potential. We have huge potential in this area. Experienced geologists know the camp. It's one of the recognized major gold camps in Canada alongside Kirkland Lake, Timmins and Val-d'Or. Yellowknife is in the geology textbooks right up there with these camps and it has produced among the highest average grades of gold of any mines in Canada. We're on the right geology. The structures are known to be on our property. We have sampled those structures and know that we have huge potential here.

On the other side, we've eliminated a lot of the risk. A lot of the risk is out of the equation in this project because we are in a politically safe jurisdiction. We're in Canada. We are in a mining-friendly jurisdiction. Yellowknife is a mining city. It supports mining in the north. The territories support mining. You have the mining support, the support from the communities, as well as the native communities in the area that work in the industry and want to see a mine. That's a major risk most companies are concerned about. One of the risks in exploration is not finding enough gold or the economics, but the other thing is not being in a position to be able to develop the mine.

This is a low-risk project, given our jurisdiction, given the geology, given the infrastructure that's available to us to develop the project, and given the grades that we have, which will take the risk out of this project should the price of gold fluctuate, which it is known to do. High-grade gives you a lot of flexibility as far as the economics.

Right now, we have shown that we keep identifying and discovering new areas of gold mineralization to develop. I think people are starting to really get the message that this is a major district. I think that's the potential that we have in this project. It's something that we could take and we could develop on our own, as we have people such as Joe Campbell and his team that have done this before. I think this is the type of project that could be a key asset for any company and for us, since it's ours at this point.

Dr. Allen Alper: Sounds like excellent reasons investors might consider looking at your company.

Mr. Stuart Rogers: We have a good shareholder base. They've been supportive. We've done a lot of good work in a difficult market. You'll find we're also frugal with money that's raised that goes into the ground. It's been noted by many people that we aren't a company that has built up a massive overhead. You really get a lot of work done for the money that's invested in this company. Management are also major shareholders in the company. We've invested a lot over the last four years. We have a major stake in this and our reward is making this a successful project. Our interests are aligned with those of the shareholders, which I think is very important as well.

Dr. Allen Alper: That's excellent! That's really important! Shows you and your management team are committed to the success of the company. That's great!

Mr. Stuart Rogers: That we are!

http://www.terraxminerals.com/

1066 West Hastings Street, 23rd Floor

Vancouver, B.C.

V6E 3X2

Tel: 604.689.1749

Fax: 604.648.8665

Samuel Vella

Manager of Corporate Communications

Toll-free: 1.800.481.1876

|

|