Building a World Class Lithium Producer: Interview with Brian Paes-Braga, founder and CEO of Lithium X Energy Corp. (TSX.V: LiX, OTCQB: LIXXF)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/23/2016

Brian Paes-Braga, founder and CEO of Lithium X Energy Corp. (TSX.V: LiX, OTCQB: LIXXF) tells us how he has positioned Lithium X to be a world class Lithium producer. With projects in North America and Argentina, Lithium X just announced an over two million ton of around 500 ppm LCE resource in Argentina. Mr. Paes-Braga has gone to great lengths to put together what he refers to as “the best operational team probably in the world.” Lithium is integral to clean technology and Lithium X will help reduce world dependency on fossil fuels. With roughly 20% insider ownership, management has significant commitment to the success of Lithium X.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Brian Paes-Braga, founder and CEO of Lithium X. You have built a pretty impressive lithium company. What differentiates your company from other lithium companies and a bit about your two great deposits and your plans?

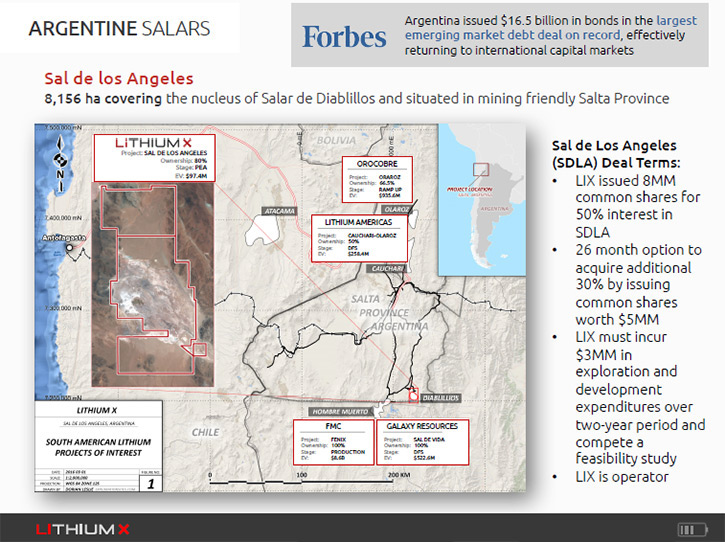

Brian Paes-Braga: Lithium-X was actually formed about a year ago and we went public November 30th last year. We've built the company around what we believe to be a world-class team. With our world-class team we got funded with about $23 million of equity and acquired the largest land position in Clayton Valley adjacent to the only producing lithium mine in North America. Then we acquired our flagship asset in Argentina and just announced an updated resource of over two million tons of about 500 ppm LCE, which puts us in a rare category of having millions of tons of lithium carbonate in our resource.

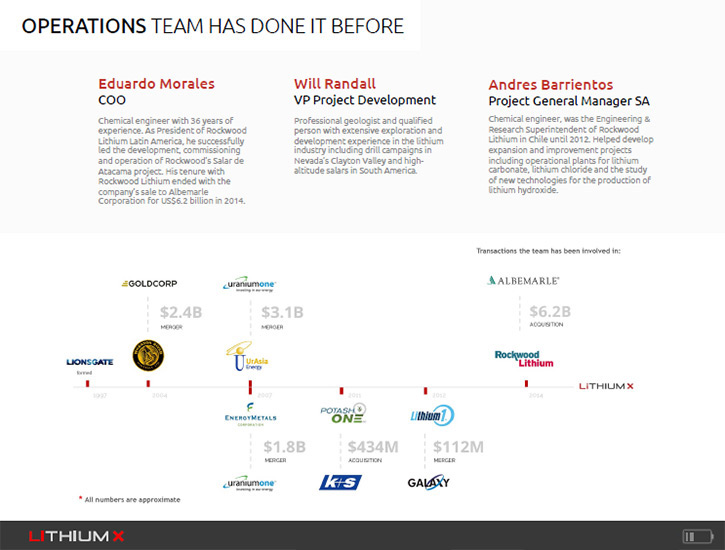

Others in the industry are developing resources, but our team is outstanding. In the resource development space some people have a track record of building companies. That's led by my co-founder Frank Giustra, who founded Lions Gate Entertainment and was instrumental in many successful resource companies, including Wheaton River, which is now Goldcorp, Silver Wheaton, which is a spin-off of that, Eurasia, which became Uranium One, and many, many others. Our executive chairman is Paul Matysek. Paul has sold his last four companies in the resource development space for just under two-and-a-half billion dollars.

From that entrepreneurial background, we hired what we believe to be the best operational team in the lithium industry, led by Eduardo Morales, who was the past CEO and President of Rockwood Lithium South America, which was taken out for $6.2 billion two years ago. Eduardo, over his almost 30-year career with Rockwood, put into production the single largest lithium brine operation in the world at Salar de Atacama. As we develop our projects, having that operational team is key. It's not like the gold space or the oil market where there's a breadth of talent, it's really quite a rare find to get an operator like Eduardo and his team.

Dr. Allen Alper: That's an amazing team you have! Really fantastic, and amazing properties! That's really excellent.

Brian Paes-Braga: Thank you.

Dr. Allen Alper: You put this together in a short time. You must've had all your ducks in a row before you even started.

Brian Paes-Braga: We had a vision. If you look at our website, our vision from the very beginning was to bring on world-class people, fund our company, and go get world-class projects. We've been lucky to be able to do it all. We definitely had a vision and we've executed on it. We believe it is early days in the space. The big winners in the lithium space are just getting started.

Dr. Allen Alper: That's excellent. I noticed you have some rather important investors. Could you tell our readers about your investors, your share structure and capital structure?

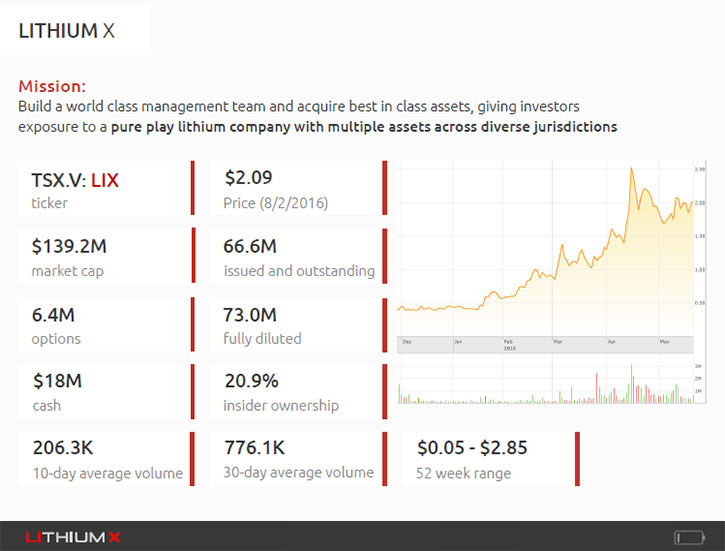

Brian Paes-Braga: We have about 66 million shares outstanding. The only convertible securities are employee stock options, so we don't have any warrant overhang in the stock. We have about $17 million in the bank, we have no debts, and we have about 20% insider ownership. It's a structure that I'm very proud of because I think capital structure in any business is very important, especially in the small cap public world, because structures are just so sensitive when you have to start to raise lots of capital for these capital-hungry projects. I don't like to dilute current shareholders. We, as insiders and founders, are big shareholders, and we respect and value and are very considerate of all of our other shareholders, as well.

I think having a structure like ours gives the investor the best opportunity and I call it torque in the equity. Any investor likes to buy lower and sell higher. I've seen too many stories where companies have raised lots of money, but they continue to do it at very diluted prices. We haven't done that. We've started with a small seed financing at 15 cents and then 30 cents and then $1.02 and then $1.65, progressively moving from retail investors to institutional investors along the way as we acquired assets, de-risked them and brought on strong management. Our structure is something I'm very proud of. LIX has a lot of torque for pure play exposure to the lithium space as we develop our assets and grow the company.

Dr. Allen Alper: Could you tell me a bit more about your own background, Brian?

Brian Paes-Braga: I've been in the capital markets for almost 10 years. I started out as a stock broker, raising capital for early-stage companies and building a book of business, handling clients' high-risk capital. Then I joined a family office where I ran a merchant bank. I raised capital and put companies together. Then I left and built a very strong relationship with Frank Giustra, who is a very, very successful entrepreneur and founder in Canada and a big philanthropist. I brought him this idea in the lithium market last summer and said, "You know, I think there's a real opportunity to build a preeminent name in the lithium space, and here are all the fundamental demand and supply reasons why I think it's going to work."

I'm a big believer in helping wean the world off fossil fuels. It's really where the passion came from. I drive an electric car. Batteries are a core component of not only electric vehicles but of energy storage and allowing renewable energy like wind and solar to be more efficient and effective through the storage of energy. I think I'm an entrepreneur at heart. I'm very passionate about the capital markets, but I'm more of an entrepreneur and team-builder at heart.

Dr. Allen Alper: It sounds like you have an excellent background, excellent team, and that your team is well-invested in your company, they believe in it. That's great.

Brian Paes-Braga: Yeah. I should mention that actually, sorry to interrupt, I should mention that management's participated in every single financing as well. We absolutely are big believers in the company and we've put a lot of money into this company and continue to be believers. Please go ahead.

Dr. Allen Alper: That's excellent! Could you tell me more about why the lithium market is so important and what's happening in lithium?

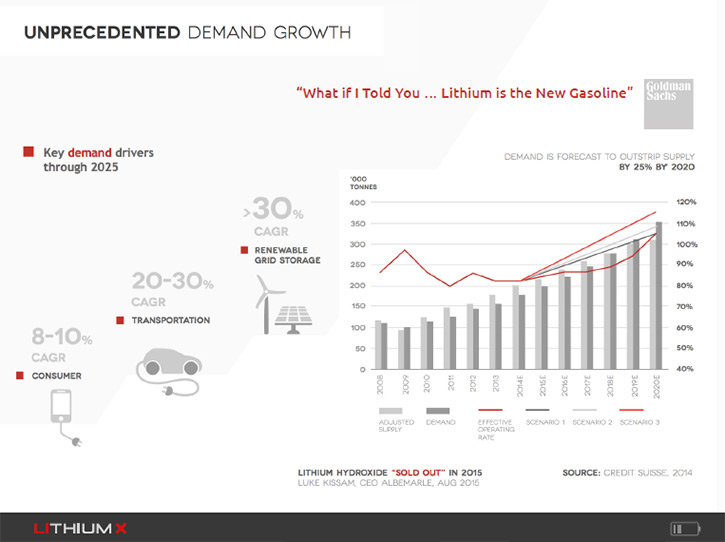

Brian Paes-Braga: It's an amazing marketplace. It's a marketplace that is controlled by four players. I find it really interesting, that those four players, FMC, Albemarle, and SQM, all New York Stock Exchange listed companies, and China's Tianqi Lithium Industries Inc., have great, great control of the market. There's been a great price movement to the upside from $2,000-$3,000 in the early 2000s to over $10,000 today. Some quotes like Bloomberg have shown over $20,000 in the spot market in China. Like any bullish move in a commodity price, new entrants, so-called "independents" will come into the marketplace and start to fill those demand needs.

I think we're early, early days in the lithium space on the demand side. The consensus I've seen from a lot of the Wall Street firms and independent research is that the market will move from 160,000 tons a year to over half-a-million tons a year by 2025. If you do the rough numbers around a lithium brine operation doing 25,000 tons a year or a hard rock operation doing 25,000 to 35,000 tons a year, you need 10 to 20 new operations to come online unless the existing mines increase capacity dramatically. There are a lot of reasons why they won't do that, including government restrictions as well as just sheer stress on the resource. I think that there's going to be some really great winners that come out of this demand rise, and I believe Lithium X to be one of them.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Brian Paes-Braga: I think it really does come down to team. We have a vision to build a big company. Many of our team members have built multi-billion dollar companies in the past. If investors like the lithium space, they should look at the track record of management and their intentions and more importantly, the ability of the operational team to take these assets forward and eventually produce cash flow.

It's also tough to find a pure play way to play the lithium space. The majority of the business, of the three big players in lithium that are New York Stock Exchange listed companies, is not lithium. It is chlorine and iodine and potash. Furthermore, lithium is not traded on the London Metals Exchange or in Chicago, so there's no real way to play any call options or trade at a commodity level. The way to play it is companies like Lithium X. Our target is to be the preeminent pure play name in the lithium space and allow investors to have exposure to, as you said, this revolution in the energy market.

Dr. Allen Alper: That sounds great. Is there anything else you'd like to add, Brian?

Brian Paes-Braga: No. I've enjoyed talking with you. We'll definitely keep in touch.

http://www.lithium-x.com/

#3123 – 595 Burrard Street,

Bentall III, PO Box 49139

Vancouver, BC V7X 1A0

Canada

604-609-6138

info@lithium-x.com

|

|