Interview with Jeff Quartermaine, Managing Director and CEO of Perseus Mining (ASX/TSX: PRU): A Strong, Diversified, West African-Focused, Gold Production, Development and Exploration Company

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/23/2016

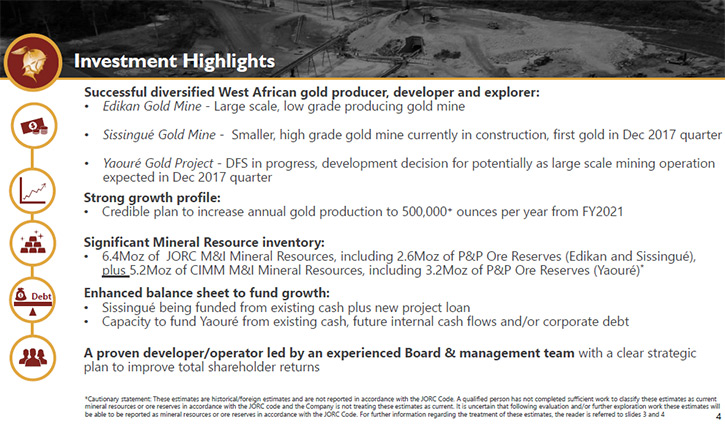

Perseus Mining Limited (ASX/TSX: PRU) is a strong, diversified, West African-focused, gold production, development and exploration company, with a strong growth profile and a significant mineral resource inventory. We learned from Jeff Quartermaine, Managing Director and CEO of Perseus Mining, that over the last three years he used the downturn in gold to hire where possible, the best in the industry and successfully build a steady pipeline of projects that provide a clear path to material growth. According to Mr. Quartermaine, the company not only owns the pipeline of assets, but has the financial capacity to deliver the projects within that pipeline. And finally, they have a very strong social license in the countries in which they operate.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Jeff Quartermaine, who is Managing Director and CEO of Perseus Mining.

Dr. Allen Alper: Could you tell our readers/investors a bit about Perseus Mining’s properties. I understand you have mining, development and exploration properties. Tell us what differentiates your company from other mining companies.

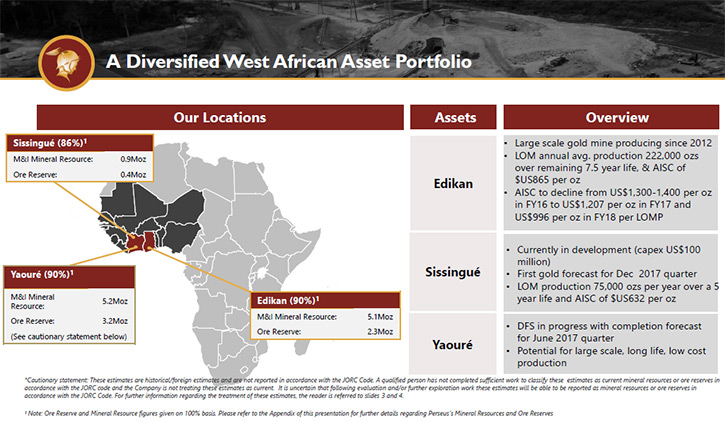

Mr. Jeff Quartermaine: We have a portfolio of assets located in West Africa. We have an existing mine, that has been operating since 2012 and we have a second property that is currently in construction and will be producing gold in the Fourth Quarter of 2017. We have a third project in an advanced stage feasibility study. We expect a development decision during the course of 2017.

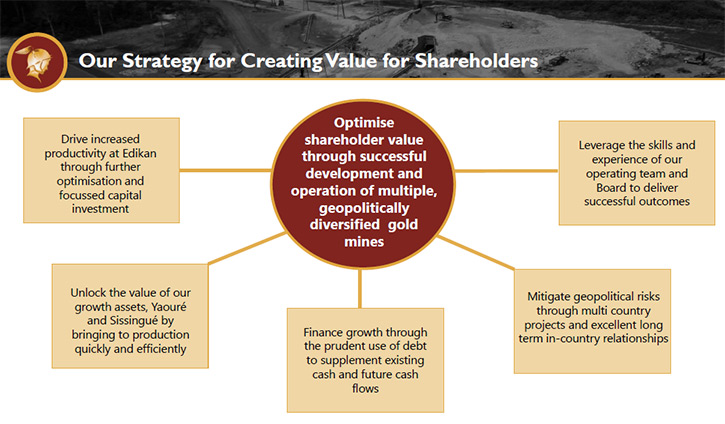

We have a steady pipeline of projects, with a clear path to material growth. What differentiates us from many others in our sector, is that they may claim to be poised for growth, but we actually own the assets. We don't need to discover them or buy them. We own them today. Secondly, we have a team of people that are very well-qualified and experienced, who not only can discover projects but can build them and operate them. We don't need to recruit additional people. We have the team in place today. Thirdly, we have the financial capacity to deliver the projects within that pipeline. We have existing cash, we have very strong projected cash flow going forward. We currently have no debt and we have a significant borrowing capacity.

We have the financial wherewithal to deliver that strategy. Finally we have a very strong social license in the countries where we operate. Both at regional local level and at the government level. Perseus is implementing a growth strategy designed to transform the Company into a producer of 500,000 ounces of gold per year from three operating mines in West Africa within the next five years. That certainly sets us aside from many of our peers.

Dr. Allen Alper: Sounds great! Really terrific. Could you tell us a bit about yourself, the board, and your team?

Mr. Jeff Quartermaine: We have a very experienced board of seven people. We have people who are technically oriented. We have people who are commercially oriented, and legally oriented. We have representatives from each of the major markets in which we operate. We have directors from the United Kingdom, North America, and Australia. So we have a very good blend of experience, both in a technical and geographical sense.

Because of the recent downturn in the Gold sector, we were able to recruit extremely high quality people at a time when there were not a lot of jobs in our sector. Several years ago we simply couldn't have afforded the people and they wouldn't have joined us. But now with a clear path to growth, and the wherewithal to deliver that, we are in a position to attract very good people. So we have a very strong team.

The most recent appointment to our team was Chris Woodall who was appointed as Chief Operating Officer, a matter of weeks ago. It is necessary for us to have a Chief Operating Officer now. With two mines in the near-term, and three not far behind, we've decided to expand our operating capability. Prior to coming to us, Chris had a very senior role. I believe it was Senior Vice President of Operations at Gold Corp North America, where he had responsibility for quite a number of properties. Prior to that, he was Global Director of Mining Services for Barrick. So Chris comes to us with a wealth of experience. He's indicative of the caliber of people that I put on my team.

I joined Perseus about six years ago. Originally I was appointed to the role of Chief Financial Officer. After a couple of years, I was asked to take on the role of CEO. I have engineering and management qualifications, so I do have the capacity to cover commercial and technical disciplines. I became CEO in January 2013. It's been an interesting journey. I am very well supported by a high caliber group of people.

Dr. Allen Alper: That sounds excellent! Sounds like you have a very strong team, with excellent experience and background. That's terrific! Could you tell us a bit more about your operations, your production, your cash flow, etc.?

Mr. Jeff Quartermaine: The existing operation, the Edikan mine in Ghana, has been in commercial production since January 2012. It's a large-scale operation, relatively low-grade. It involves mining a number of pits on our tenements in Ghana, West Africa. Edikan has had something of a checkered career. It promised a lot in the early days. It was promoted very heavily. Our company found it was quite different promoting an operating mine to actually delivering outcomes.

We have spent the last couple of years getting things right. I am very pleased to say the mine is running very well and running on plan.

We are in the process of a fairly hefty investment program, which will be completed at the end of this calendar year. As a result of this investment program, our costs are quite high at the present time. But following the end of this year, when the work on the plant is complete, our costs will move down quite materially. In fact, over the remaining life of the mine, we should be producing around 220,000 ounces per year, with a weighted average cost of $865.00 dollars per ounce, US. The costs, at the moment, are higher than others, given the high capital expenditure. But, at the end of this year we start to reap the benefit of the investment that we're doing right now.

We are investing in long-term performance of the property. We recently installed a power station because in Africa it is needed for reliability of power. So we built our own power station.

We've also had to build a residential sub-division, in which to relocate people who were previously either living or farming on the land we are mining currently or planning to mine. That involved constructing 179 structures in an area that's paved, and has electricity and water. It was an expensive exercise.

Later this month, in October, we'll be shutting down for a couple of weeks to implement a fairly significant program to make a number of modifications to our processing plant, take out some substandard design features that came with the original build. After we get those things in place, the plant will work very well and we'll have far greater reliability and performance. It's been a challenging time to get where we are now, but we're poised to reap the benefits of all that hard work and to be able to put that experience into play and to start to deliver some serious outcomes for shareholders.

Dr. Allen Alper: That's excellent! That's very good. You're making very impressive progress. Could you tell me a bit about your share structure, capital structure?

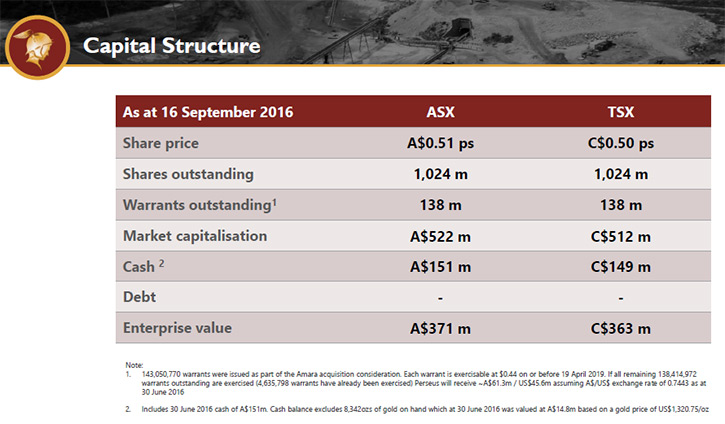

Mr. Jeff Quartermaine: The shares are held fairly uniformly between three jurisdictions: The United States, Australia, and United Kingdom/Europe. And it's pretty evenly spread. It's a very high quality share register. It's quite tightly held so the top twenty would hold probably fifty-five percent of the stock. And the caliber of the investor is extremely good. We're very pleased with that. We've had very strong support from our shareholders who share the vision that we have for turning Perseus into a material mid-tier gold producer within a fairly short period of time.

Dr. Allen Alper: That's very good. That's very impressive. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Jeff Quartermaine: Well, the first and most obvious reason is that right now the share price is underpriced relative to its value. Our costs, right at this moment, are relatively high. The market has a very heavy focus on short-term cash flow as a guide to investment value, at this time. That will turn around quite significantly, come the end of this year, when our investment program is complete, the plant is running consistently well and we're accessing newer higher-grade ore.

We are undervalued compared to our peer group. While our share price has appreciated this year, we haven't had the multiplier effect like some of our peers because we are going through this investment period. Also we have not had the benefit of the US dollar/Australian dollar exchange rate. Most of the Australian listed companies have had a very healthy run on the back of the exchange rate. Our cost structure is tied to US dollars and of course we sell our gold in US dollars.

High-net-worth readers/investors should also look at us because we have one of the larger inventories of gold resources and reserves on the Australian stock exchange, certainly. Between all of our properties, we have approximately eleven million ounces in resource and approximately six million ounces in reserve. Now I do make the observation that some of those resources and reserves have been estimated in accordance with the Australian standards, and the balance has been estimated using North American Ni-43-101. So strictly speaking, we're not supposed to add the two together. But just to give you a general idea, we do have a very large inventory of gold.

And that does set us aside from many others. We do have a very clear growth path in front of us. We're expecting to produce around 220,000 ounces of gold this year. But by 2020, with three operations running, we should be producing around 500,000 ounces of gold per year. Our cost should be around 850 dollars an ounce. That would be the weighted cost between the three operations. What your high-net-worth readers/ investors may be looking for is a company that has very strong potential to perform extremely well in the event of a rising gold price, which seems to be something that many observers are considering a possibility in the short to medium term.

Dr. Allen Alper: That sounds excellent. Very strong reasons why our readers/investors might consider Perseus Mining Limited.

Mr. Jeff Quartermaine: I guess the thing about us that is very valuable is that we have been operating in West Africa for quite some time now. Our strategy is to get geo-political, geographic and technical diversification in our portfolio.

Our three properties are located in two countries to spread the risk a little. At the present time only one mine is in operation in Ghana. Our other two operations are in Côte d'Ivoire, currently one of Africa’s most attractive destinations for foreign investment with outstanding infrastructure in comparison to other developing economies. West Africa’s largest share of greenstone belts, prospective for gold Discoveries, are in northern Côte d'Ivoire and have been significant in regards to the ease of discovery, size, grade and mine profitability.

Dr. Allen Alper: That sounds very good.

http://www.perseusmining.com/

Level 2, 437 Roberts Road

Subiaco, Western Australia 6008

Australia

Ph: +61 8 6144 1700

Fax: +61 8 6144 1799

Email: info@perseusmining.com

|

|