Interview with Mick McMullen, President, CEO of Stillwater Mining Company (NYSE:SWC): Only U.S. Producer of Platinum Group Metals (PGMs) Including Palladium and Platinum

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/12/2016

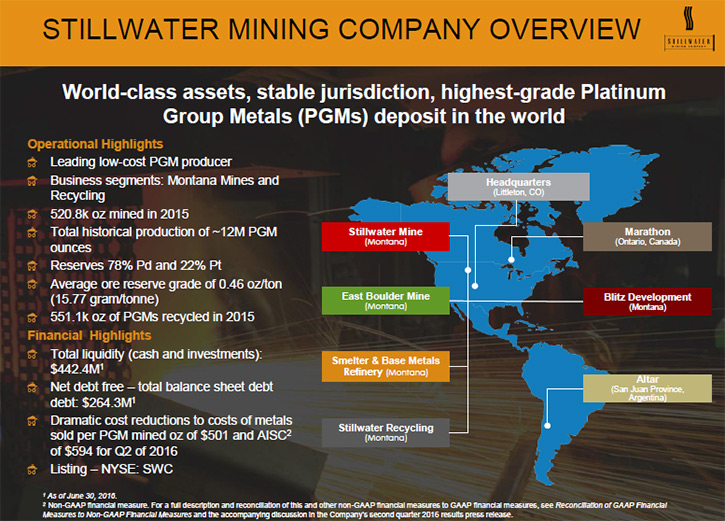

Stillwater Mining Company (NYSE:SWC) is the only U.S. producer of platinum group metals (PGMs) including palladium and platinum. The company owns a large long-life world class asset in central Montana recognized as the J-M Reef, which is the only known significant source of PGMs in the U.S. and the highest-grade PGM deposit known in the world. In addition to that, Stillwater is the world leader in recovering PGMs from catalytic converters out of cars. According to Mick McMullen, President, CEO of Stillwater Mining, the company reduced all-in sustaining costs down to just under 600 dollars an ounce and now has one of the best balance sheets in the midcap mining space globally, which allows them to invest for the future even during the down turn.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mick McMullen, who is President, CEO, of Stillwater Mining. Mick, could you tell our readers about Stillwater Mining Company. I know you're the only platinum and palladium mining and manufacturing company in the United States and you're located primarily in Montana, but fill me in on what differentiates your company from other companies.

Mr. Mick McMullen: Well I guess in the PGM space most of our competitors are located in Russia, South Africa, or Zimbabwe, so from a political risk point of view I think Montana would rank well ahead of those jurisdictions. Also, we have an asset that's of a scale that truly is world class. It's 28 miles long, the ore body, over a mile vertical, and very high grade, about a half an ounce to the ton. It's about three times the grade of our competitors. Our asset is in a pretty good jurisdiction. It's a very large asset. It's a very high grade asset. The company is now in its 30th year. We also have a smelting business, where we smelt our own concentrate.

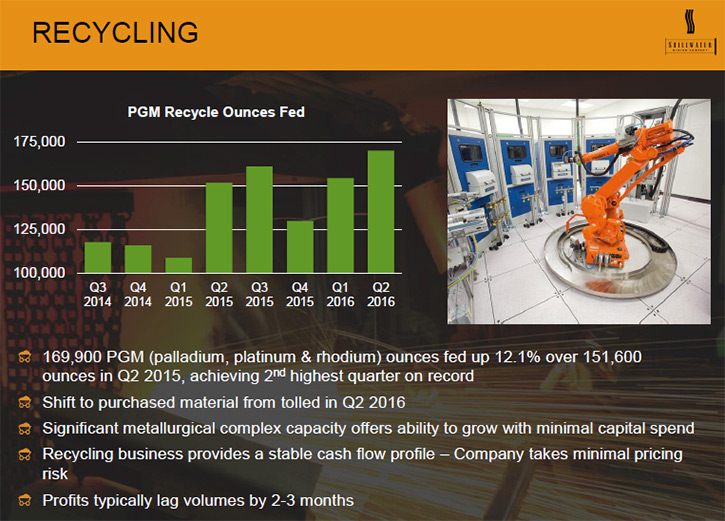

Also we take in catalytic converters from cars and recover metal from them. We're actually the largest in the world for recovering PGMs from catalytic converters out of cars. You know, we have a very long mine life. One mine has 25 years mine life, but we're doing an extension on that now, which should add a lot more. The other mine already has a 50 year mine life. This and the size of the ore body distinguishes us from other mining companies in general, not just in the PGM space, but I think the high grade and the very long life nature of the assets is unusual.

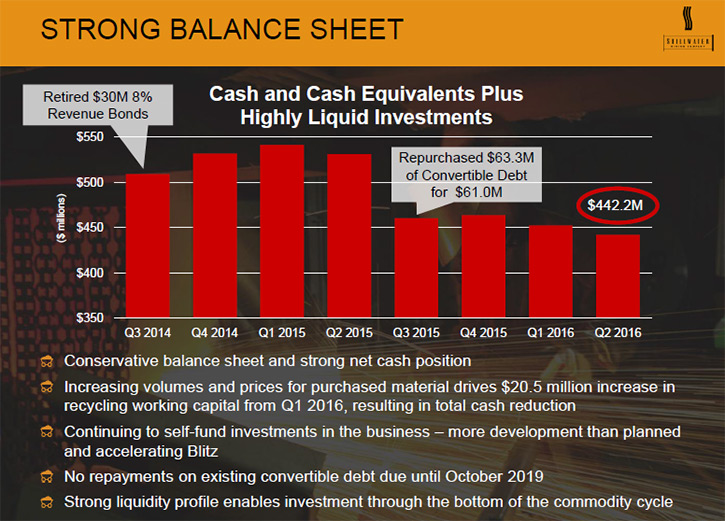

The other thing I think is we have a very solid balance sheet. We probably have one of the best balance sheets in the midcap mining space globally. We run the business in the net cash position. At the end of last quarter we had about 440 million dollars of cash and about 300 million dollars of debt, so unlike many other mining companies, we're actually in a pretty good position which allows us to invest for the future and not have to contract during the down turn.

Dr. Allen Alper: That sounds great. That's a great position to be in. Could you tell me a little bit more about your operations and your results?

Mr. Mick McMullen: Sure. We have two mines on this ore body. One is called the Stillwater Mine and the other the East Boulder Mine. Between them, they're running at about 550 thousand ounces of platinum and palladium per annum. It's fair to say that historically they weren't run optimally. Since I've became the CEO, just over two and a half years ago, it's all been about improving our productivity, which we've done quite well. Still quite a bit of room to go, in terms of getting us up to where we should be on a global productivity scale. We've reduced all-in sustaining costs for our production down to just under 600 dollars an ounce. Three years ago it was about 900 dollars an ounce so it's been a huge reduction in costs.

Dr. Allen Alper: That's fantastic! Brilliant!

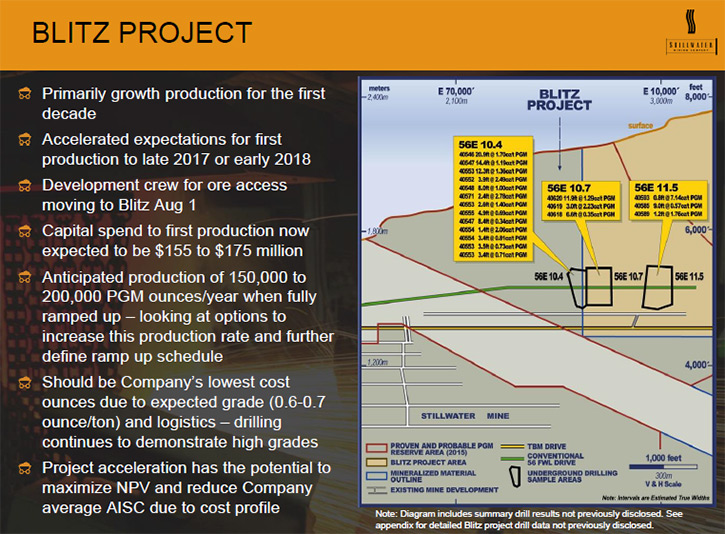

Mr. Mick McMullen: Yeah, and at today's prices we're making some reasonable money. Our sales price, our basket price, is under 800 dollars an ounce, so we have a good margin. We're spending 200 million dollars on a project called Blitz, which is really an extension of the Stillwater mine. We'll see Blitz’s first production come on line late in 2017, early 2018. For the first 10 years of its life, we expect it to be predominantly growth production. We will ramp up the production profile, adding ounces and producing 150 to 200 thousand ounces a year, in addition to what we produce now. Given the grade of the mineralization and the logistics, they should be our lowest cost ounces.

Dr. Allen Alper: That sounds great. It sounds like your company is in a great position.

Mr. Mick McMullen: Yeah, I think we are in a pretty strong position. The other part of our business is our recycling business, a different style of business. We don't have any price risk in the recycling business. It's very much a volume business. It makes money day in day out, almost regardless of the metal process. It's a good counter for our mining business where we take full price risk and opportunity. The recycling business is a very good stable long term source of earnings. The scrap comes to us and we process it. If you look at annualized last quarter, the mines were doing say 550 thousand ounces a year annualized, but the recycling business was actually over 700 thousand ounces a year annualized, based on last quarter.

Dr. Allen Alper: That's great. Could you tell me a little bit about your background, and the team, and the board?

Mr. Mick McMullen: I came to the board, along with some of the other board members in May of 2013. There was an activist campaign to change the board. The shareholders were not happy with the way the business was being run. So about half the board changed. At the time I was running a private equity business focused on mining. It was effectively a family office. But with my money and my partner out of Switzerland, who's an ex Glencore partner, we've been doing mines, and advanced development projects, almost all over the world.

I was a geologist originally, 20 something years ago. 25 years ago I guess I qualified. Spent most of my early career in Africa. I was in the Philippines for 6 years. Then I sort of moved into actually investing my own money and building mines. At one stage I was a partner in a very large mining consultancy and I sold that business. I guess I've done a bit of everything. I've been based out of Australia, Canada, South America, Africa, Switzerland, and I've been a metal trader as well, given that I partnered up with an ex Glencore partner. We had a trading business. I've done a bit of everything I guess.

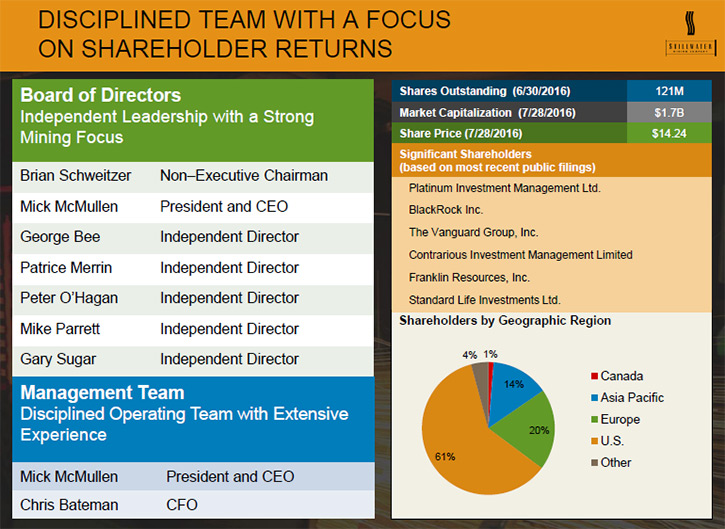

The board, the chairman of the company is the former governor of Montana. He came on as part of that activist campaign. We have an ex Goldman Sachs banker, actually metal trader. We have a few other bankers, a mining engineer who worked at Barrick for a long period of time. Patrice Merrin came on as part of the activist campaign. She's still on the board, and she's now become the first female director on the Glencore board as well. I'd say, a lot of operating experience, a lot of financial experience, a lot of capital marketing experience on the board. Probably for the size company we have, a pretty high level board.

Dr. Allen Alper: It sounds like a very strong diversified board. Tell us a little bit about your capital structure?

Mr. Mick McMullen: The face value of the debt we have outstanding is 335 million dollars. Because it has an equity component in the accounts, it's sort of less then that, but we have to pay it back in October of 2019, it'll be 335 million dollars. It has a cheap cash rate of 1.75 percent. We have no other debt. The vast majority of investments are US treasuries.

Dr. Allen Alper: That sounds good. Tell us about your share structure? It sounds like a large percent is United States stock holders and European. Could you tell me a little bit more about that?

Mr. Mick McMullen: Yeah, well we have about 121 million shares in issue. About 60 percent of the registry is US holdings. Virtually all of the registry is institutional. We have almost no retail in the stock. Then Asia Pacific, which is really Australia, is about another 14 percent. Europe is 20 percent, which is predominantly out of London, although a little bit of Switzerland and a little bit of Paris. A couple in South Africa owns a bit of us as well. I guess the registry is dominated by US, European and a couple Australian.

Dr. Allen Alper: The sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Mick McMullen: Well, I think we have an asset base that's second to none. The fundamentals, for the palladium market especially, look to be very strong, probably the strongest of any metal. There’s a big deficit in the palladium market, probably approaching a million ounces a year, and it appears to be structural. The expectation is that we're going to see prices continue to trend up. We have a very solid balance sheet. We think there's more room to go on improving productivity, which will mean more production at lower cost. We do see margin expansion out of the operations and we see the ability, particularly once Blitz comes online, to expand production quite a bit. We have a lot of excess capacity in our processing facilities, so the capital hurdles to expanding are relatively low. Yeah, I think we're a safe bet, we're in a safe jurisdiction, we have a safe balance sheet, and a fantastic ore body and a safety and environmental tract record, second to none. I think, overall, we tic the boxes when people are looking to invest in a T1 asset. I think we have the potential to be generating some pretty strong cash flow here shortly.

We have a lot of growth opportunities internally, so we're building the Blitz project. We actually have another one called Lower East Boulder. We can develop another mine there. We have a lot undeveloped that we can push into.

Dr. Allen Alper: What is happening in Argentina? What are your plans there?

Mr. Mick McMullen: Well, it's a non-core asset, so at some point we're going to want to realize value out of that. We've been spending a small amount of money on it, advancing it to a stage where we think people would be interested in it. I think we're getting the conditions in place that might actually bring about a reasonable result for shareholders. The money we're spending on it is relatively small, but actually making a big difference in the project. At the right time, we look to realize some value out of that.

Dr. Allen Alper: It sounds like you have a very strong company. The market seems to be increasing. It sounds like you are well positioned for the future.

Mr. Mick McMullen: Yeah, that's our plan.

http://stillwatermining.com/

CONTACT:

Mike Beckstead

(720) 502-7671

investor-relations@stillwatermining.com

|

|