Interview with Ari Sussman, CEO of Continental Gold Inc. (TSX: CNL, OTCQX: CGOOF): 3.7 Million Ounces of Proven and Probable High Grade Gold, Plus over 10 Million Ounces of Silver

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/2/2016

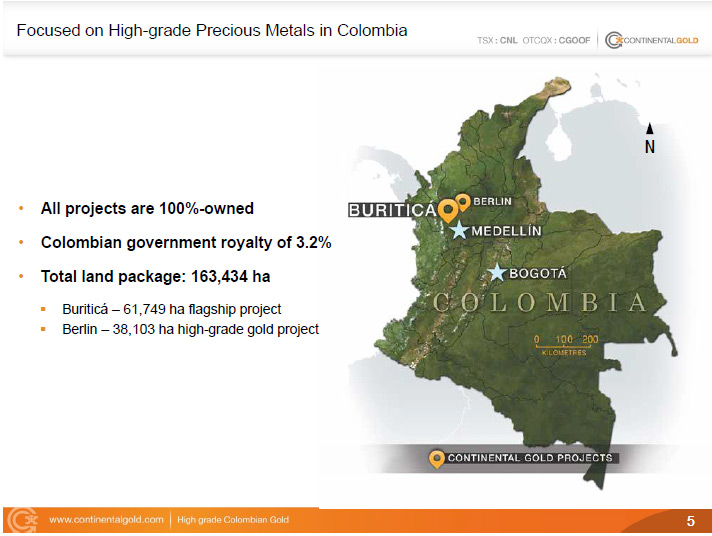

According to Ari Sussman, CEO of Continental Gold Inc. (TSX: CNL, OTCQX: CGOOF), Colombia is the last untapped

gold producer in Latin America. Historically it has been rich in gold, but companies were scared off due to

Colombia’s instability. Now that this is no longer an issue, Continental Gold is exploring high grade properties

there. The flagship asset, Buriticá, has three point seven million ounces of proven and probable gold at eight point

four grams per ton, plus over ten million ounces of silver at around twenty-four grams per ton, and room to grow.

Having completed the feasibility study, they are currently waiting on a permit before starting construction. Once in

construction and ultimately production, the market will revalue Continental Gold.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Ari Sussman, CEO of

Continental Gold. Could you tell me a bit about Continental Gold, and what differentiates it from other companies? I

know you have a lot of gold in your resource, and you're located in Colombia.

Mr. Ari Sussman: Continental Gold was put together to explore high-grade precious metal projects in Colombia.

Although everyone is very familiar with Colombia as a global coal producer, the Country is really just emerging onto

the modern day precious metal scene. Being the richest historical producer of gold in Latin American history, the

potential has always been enormous. However, due to security concerns, primarily in the 1980s and 1990s, Colombia

missed the technological wave in mining that advanced global exploration efforts drastically leading to large-scale

discoveries. To the benefit of Continental Gold and other mining companies in Colombia, that same potential

remains in place today and major greenfield discoveries will come with money and time. Continental Gold was put

together to look for high-grade gold deposits and take advantage of this wonderful opportunity.

Dr. Allen Alper: Could you tell us a bit more about the deposits and the resource?

Mr. Ari Sussman: Sure. Our flagship asset is named Buriticá. It is located in the Department of Antioquia,

Colombia and has been subject to colonial mining for hundreds of years. There's literature dating back to the

fourteen hundreds highlighting the Spaniards mining gold at Buriticá and returning back to their home country with

chests full of gold for the King of Spain. Amazingly, until Continental Gold arrived on the scene, the project was

never subjected to any modern exploration. We were the first to ever put a drill-hole into the project.

Geologically, The Yaraguá and Veta Sur deposits are Carbonate Base Metal Vein systems and these system types tend to

grow into very large resources elsewhere in the world. Effectively, the veins found in the deposits at Buriticá are

cracks in rocks which acted as conduits for precious metal bearing fluids to passed through emanating from a deep-

seated porphyry-related intrusion. Typically, the lateral and vertical dimensions of these vein systems become very

large. Examples elsewhere in the world of operating mines from this deposit type are Barrick Gold’s Porgera mine in

Papua New Guinea and Goldcorp’s Peñasquito mine in Mexico. Both mines have had mineral inventories well in excess of

20 million ounces of gold.

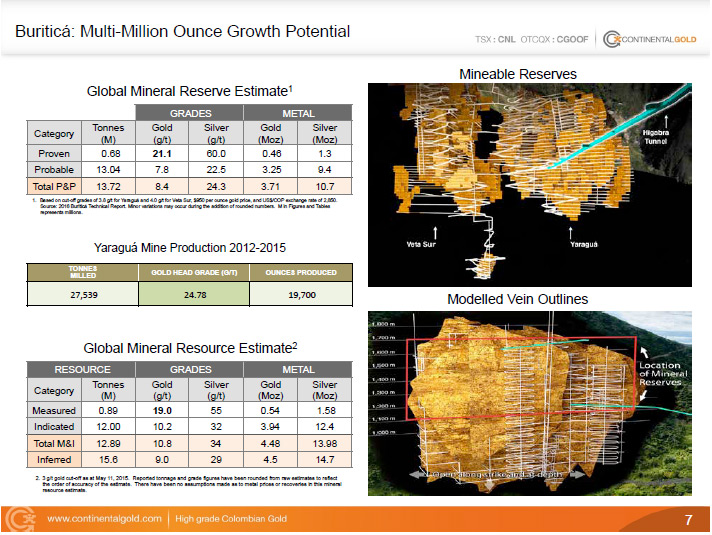

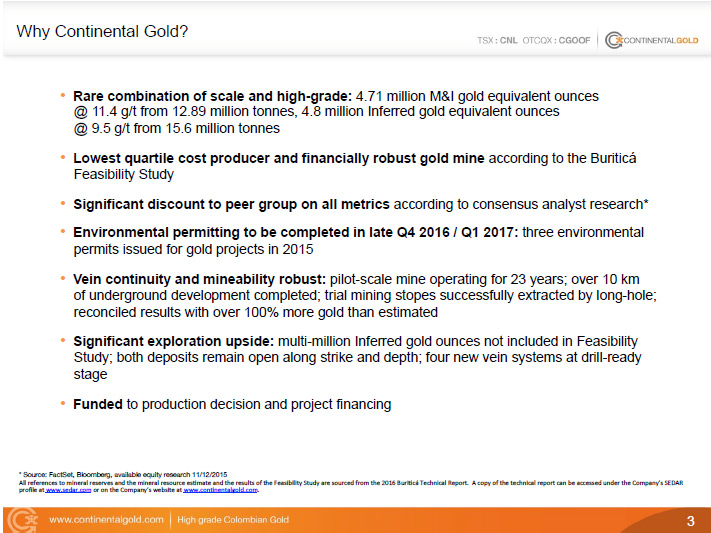

We're definitely onto something quite special at Buriticá. Aggressive drilling really only began for Buriticá in

2010 and since then there have been three iterations of resource estimates completed. The most recent resource

estimate outlined a mineral inventory approaching five million ounces of measured and indicated gold, at over eleven

grams per tonne, plus almost another five million ounces in the inferred category at over nine grams per tonne.

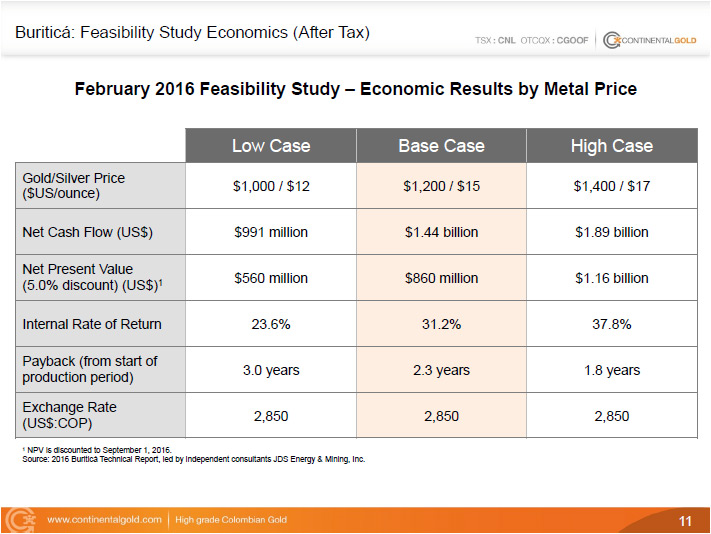

In February, 2016 we announced a robust feasibility study (outlined in the following chart). Lot's more potential to

grow our reserves! We fully expect this deposit will get much larger over time.

Dr. Allen Alper: That's great! That sounds very promising. Could you tell me a bit about your background, and

your team, and board? I know one of the significant accomplishments.

Mr. Ari Sussman: I started, of all things unrelated to mining, in the hedge fund industry in the 1990’s. I

was involved in a limited partnership hedge fund, which invested in non-mining related sophisticated hedging

strategies for the most part. However, a small portion of the money in the fund was allocated to speculative

investments and a toe was dipped into the world of mining investments. Soon afterwards, I found my calling. I have

strong affinity for Latin America, dating all the way back to my backpacking era (when I was young and reckless) and

continuing into my business travel for the past 20 years.

The time-tested key, to successful operating in any foreign jurisdiction, is predicated on the strength of

local management and technical capabilities in building mines. The president of Continental Gold Inc. is Mateo

Restrepo, a Colombian national who worked in the public sector directly under former president Uribe for almost

seven years. Upon finishing his time in the Presidency, Mateo moved into the private sector and most recently was

one of the key individuals in charge of Glencore Xstrata’s coal operations in the country.

Don Gray, our COO, will build the mine. Don is a proven mine-builder with solid experience in narrow vein

systems and has just come off the success of building Tahoe's Escobal mine in Guatemala. He was the first guy with

boots on the ground for that project and was key in assembling the team, constructing, and getting that project

commissioned.

The Chairman of the Board of Directors, Leon Teicher, is Colombian, well actually a hybrid Colombian-

Canadian today, as he spends half his time in Vancouver. Leon has a strong local mining background as a former CEO

of Cerrejón Coal, which is the owner of the largest open pit coal-mine in the world. It's in Colombia, and the

company is owned in three parts by Anglo-American, BHP, and Glencore Xstrata.

I would be remiss if I didn’t mention the former Chairman of the Board, Robert Allen, as it was his vision for

Continental Gold to start amassing mineral titles in Colombia years before the competition. Our portfolio is a

result of his bravado.

Dr. Allen Alper: That sounds very good. Could you tell me about operating in Colombia?

Mr. Ari Sussman: Colombia is a wonderful country. For more than forty years, it's been a very pro-business

environment in which to operate with a strong rule of law. The challenge in Colombia for many years has been

security. However, as your readers likely know by now, there has been constant improvement in Colombia’s security

since the turn of this century. This doesn’t mean that security related challenges do not still exist. In fact,

our shareholders know that we had some recent problems with illegal mining on our titles, but the Government

intervened and responsibly moved out the miners from our site while adhering to the strictest human rights

protocols. I do need to mention that the most exciting event in many years took place recently for Colombia when the

Government signed a peace deal with FARC. A major accomplishment!

Dr. Allen Alper: That's great news. I've been watching it on TV, and reading about it.

Mr. Ari Sussman: Yeah. Very exciting! Very, very exciting time!

Colombia has an internationally aligned set of laws and fully protects foreign investment. Foreign Direct

Capital has been pouring into the country for a few years now with a particular emphasis on infrastructure and oil

investments. As most mining investors are aware, the revival of a mining sector in an emerging market is always last

to join the economic party as the timeline from discovery to production for a mine is significantly longer than

other industries. In Colombia, the oil industry took off first, beginning in 2005, and has multiple success stories

to show for it. Today, there are numerous foreign companies operating and producing oil at low cost in Colombia.

With Continental Gold being the first to plan on building a large-scale gold mine in modern day Colombia, we have

had to clear away many cobwebs and overcome numerous hiccups to advance to where we are now.

It’s a big responsibility and not an easy task. Our long-time shareholders are all too familiar with the setbacks we

have endured, but overall progress has been enormous and accelerating swiftly this year. Today, I am proud to say

our project enjoys full support from the national, state and municipal level governments, even in the face of the

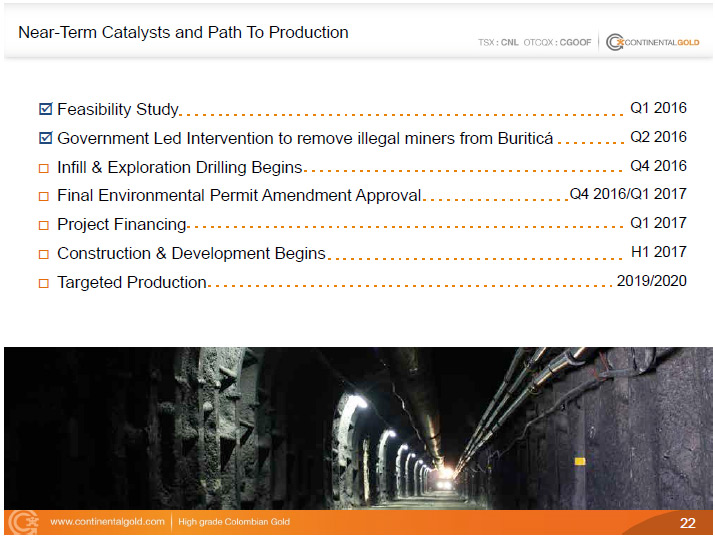

illegal mining challenges, we faced earlier this year. The culmination of our hard work will be validated once the

National Government grants us the last remaining environmental permit required to commence construction. We

anticipate a final ruling on this permit in the coming months. We are very close to being able to create meaningful

new jobs for the Buriticá region by starting construction, which in turn will have a positive net effect on the

communities.

Dr. Allen Alper: That sounds very good. Could you elaborate on the construction and your plans going forward?

Mr. Ari Sussman: Absolutely. The mine we are going to build is based on the Feasibility Study we announced

earlier this year. It outlines a very robust gold mine; a fourteen year mine that will cost just under four hundred

million dollars to build. Over the 14-year life-of-mine, production will average over two hundred fifty thousand

ounces annually, with a much higher production rate of around two hundred eighty thousand ounces per year in the

first five years. It promises to be low in terms of cost, which also means high in terms of profit margins.

The all in sustaining cost per ounce will be, according to the study, somewhere around five hundred dollars per

ounce, putting it in the lowest quartile on a cost basis industry-wide. Hence it will generate significant free cash

flow. The project compares very well to peer groups on various operating cost per tonne metrics. In fact, we

benchmarked our costs against many of recently constructed underground mines and it lines up quite well in that

regard. I should also mention that we are actively running a financing process for the construction capital

required to build the mine and plan to have a solution in place when we receive our final environmental permit.

Dr. Allen Alper: That sounds great! It sounds like you have very solid plans going forward.

Mr. Ari Sussman: Buriticá will be a robust gold mine and its combination of size and high-grade is

particularly appealing within an industry that continues to struggle to find high quality ounces.

Dr. Allen Alper: Sounds like you've made progress in the frontier of gold mining in Colombia.

Mr. Ari Sussman: Yeah. I expect there will be a huge rush into Colombia over the next two or three years, if

not sooner. As I mentioned before, the potential really is unparalleled in terms of a jurisdiction favorable to

foreign investment with such unexplored geological potential. We’re convinced there are more Buriticá gold deposits

to be found in Colombia, not to mention numerous other types of metal deposits. The Andean Cordillera, which has

blessed neighboring countries with so many mines, runs through Colombia. Additionally, Colombia enjoys a triple

plate junction; three tectonic plates coalesce beneath Colombia. Where this occurrence happens elsewhere on our

planet, some of the largest mineral deposits exist. I would be remiss if I didn’t mention that Colombia is fabled to

host El Dorado or the Lost City of Gold. Maybe in 50 years’ time we will look back at Buriticá and say that is it!

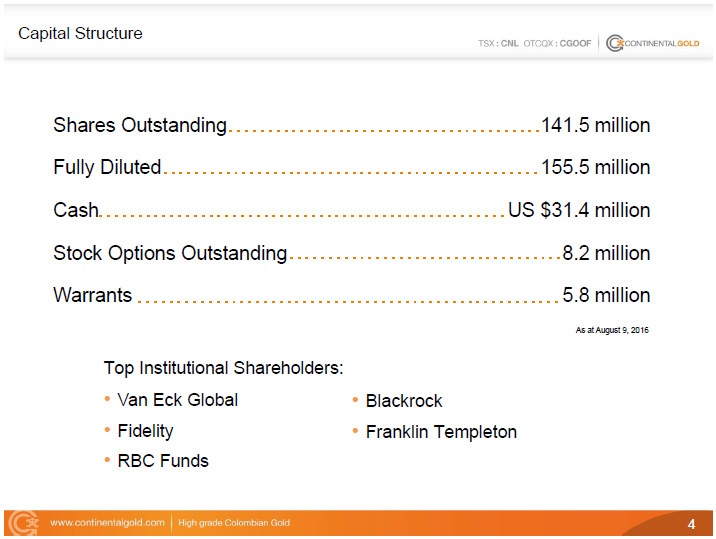

Dr. Allen Alper: That sounds very good. Could you tell me a bit about your share and capital structure? I

know you have had some exciting announcements, recently.

Mr. Ari Sussman: Share capital structure - We have a hundred forty-one million shares outstanding and are

comfortably financed with about thirty-one million dollars cash in the bank. All figures are in US dollars. That is

plenty of money to carry us into a construction decision. Also, we have a strong institutional shareholder registry,

led by Fidelity, Black Rock, Van Eck Global and Franklin Templeton.

Dr. Allen Alper: That sounds great! Where are the shares trading?

Mr. Ari Sussman: Our shares trade on the TSX and we're currently trading at around four dollars Canadian.

We've been doing quite well in 2016, but if you look at the consensus of third party analysts’ research, we do trade

at a discount to our peers. Analysts are unanimous in stating that once we receive our final permit our valuation

will move into alignment with our construction stage peer group.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors

should consider investing in your company?

Mr. Ari Sussman: It's really simple: size and grade. We're in a world where it's becoming increasingly

difficult to find economic gold deposits, and even more so to find deposits that are very large and high-grade. I am

very confident that our mineral resource inventory will continue to grow in time to well over ten million ounces at

high-grades. That is a rare commodity indeed. Operating where we do in Colombia, in an area with excellent

infrastructure, a high-grade mineral reserve and straight-forward metallurgy will lead to a low cost mine with

robust profit margins. In the short term, being awarded our final permit in order to commence construction from the

Colombian authorities, should be a positive catalyst subject to market conditions of course. The valuation gap that

exists today between companies like Continental Gold that are not permitted and financed for construction, and those

that are permitted, financed, and in construction is very large, indeed. Our short-term goal is to join the latter

ranks!

Dr. Allen Alper: That sounds great!

http://www.continentalgold.com/

155 Wellington Street West, Suite 2920

Toronto, Ontario, Canada M5V 3H1

T +1(416)583-5610

F +1(416)595-9918

Investor Relations

info@continentalgold.com

|

|