Interview with Scott Close, Director of Investor Relations Eurasian Minerals (TSX: EMX, NYSE MKT: EMXX): Generating Royalties by Following an Inexpensive Royalty Generation Plan

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/30/2016

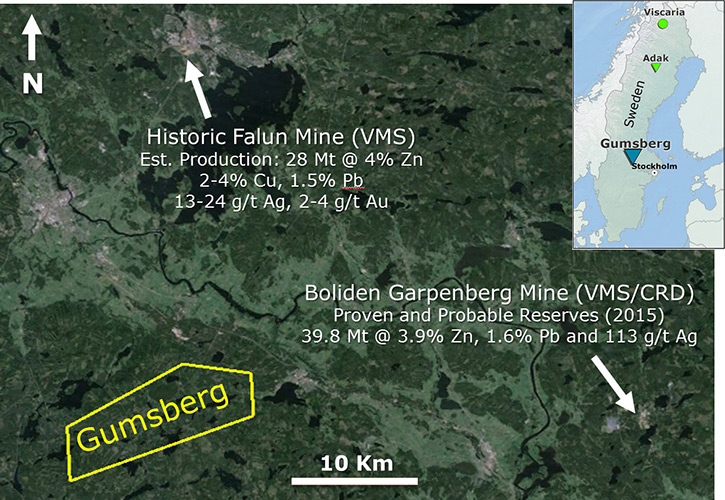

Recently, 17.9 percent zinc, 6.9 percent lead, a half a percent copper and 68.9 grams of silver were found at

Eurasian Minerals’ Gumsberg property, in the Bergslagen mining district, Sweden. The following is an interview with

Scott Close, Director of Investor Relations at Eurasian Minerals, Inc. (TSX: EMX, NYSE MKT: EMXX), who discusses how

Eurasian generates royalties by following an inexpensive royalty generation model. They find promising properties,

do enough surface and near surface exploration to get other companies interested in development, and then collect a

royalty when the property advances into production. This, coupled with strategic acquisitions, has built a

substantial royalty portfolio for Eurasian Minerals.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Scott Close, Director

of Investor Relations for Eurasian Minerals.

Well, this has been an exciting year for Eurasian minerals. Could you tell us what's happening with your

various projects?

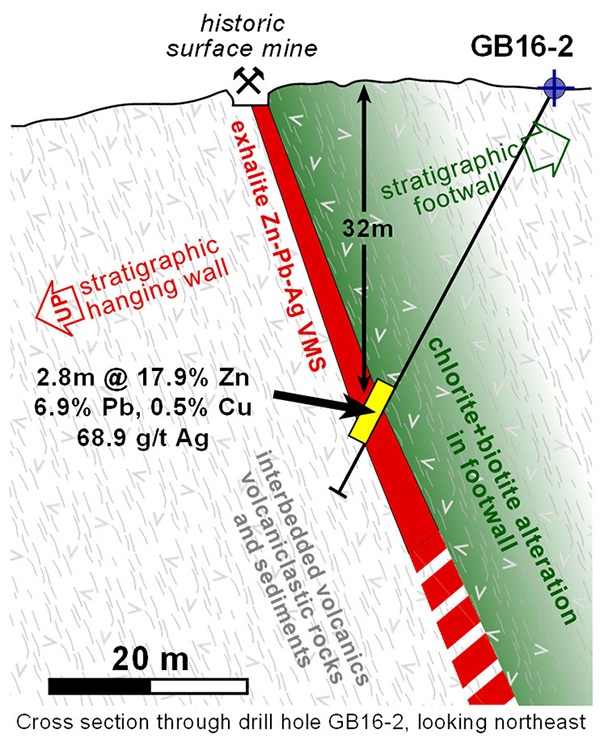

Mr. Scott Close: Well we just issued a news release regarding one of our projects in Sweden called Gumsberg.

This is a volcanogenic massive sulfide type deposit or VMS for short. We had drill results that included 2.8 meters

of 17.9 percent zinc, 6.9 percent lead, a half a percent copper and about three ounces of silver, as well as some

other very significant hits. That was a very positive development for Eurasian Minerals in a very famous mining

district, called the Bergslagen. Incredibly, this district has been active for over two thousand years.

Dr. Allen Alper: Wow, that's great! Could you tell me a little bit more about that area? Infrastructure, et

cetera.

Mr. Scott Close: The infrastructure up there is really quite good because it's in Sweden. The area is known

for polymetallic mineralization. Primarily VMS, but also some carbonate replacement deposits and things like that.

Gumsberg - Historic Östrasilvberg pit (up to 250 m depth)

There's plenty of electricity, roads, telecommunication, rail and so on. There's also plenty of water. There's

probably more water than a lot of people need at times up there, but it's an excellent place for mining, and

certainly Sweden is a very favorable jurisdiction for mining. The Swedish Geological Survey is also very helpful and

manages a massive trove of geological data that companies can use for reference and research.

Dr. Allen Alper: That sounds excellent. Could you elaborate on Eurasian minerals’ business model of being a

royalty generator and elaborate on your projects?

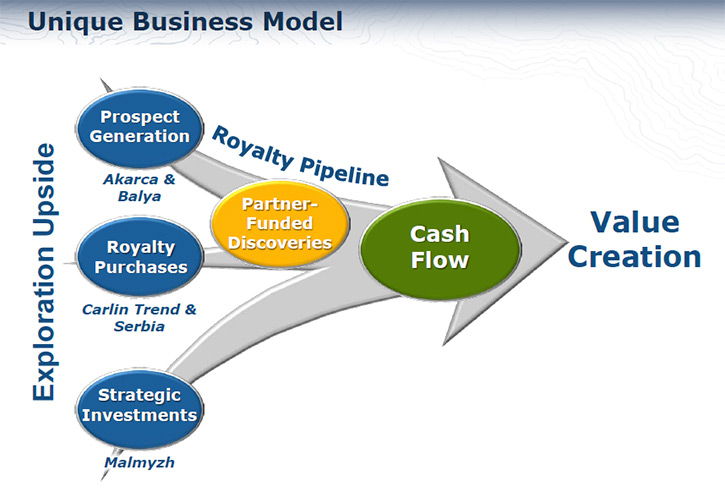

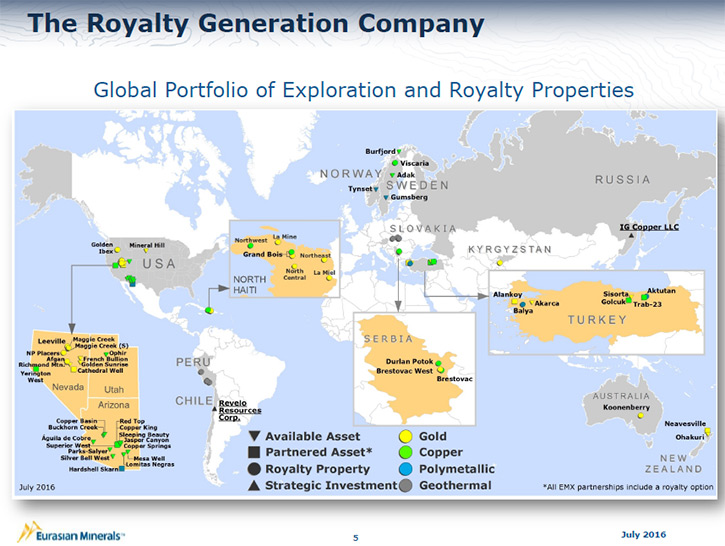

Mr. Scott Close: We refer to ourselves as The Royalty Generator, buy really we are a royalty company; we just

don't subscribe to the traditional royalty business model. In the traditional business model, companies acquire

royalties by writing really big checks. That's certainly an expeditious way to build a royalty portfolio but it's

also excessively capital intensive.

What we do is largely build our portfolio of royalty properties organically from our own portfolio of

exploration properties and projects around the globe. We go out and do basic, inexpensive exploration on properties

we have acquired. We don't do much drilling because that can become very expensive, very quickly. We typically

stick to surface or near surface exploration methodologies: rock sampling, Bulk Leach Extractable Gold sampling of

stream sediments or BLEG for short, soil geo-chem, outcrop sampling, a variety of geophysical surveys, a lot of

mapping, things like that. Then hopefully we find enough mineralization or signs of mineralization to entice another

company to come in and pick up the project. When they buy the project from us, we hold back a royalty. The new

property holder is then responsible for advancing the project. With some luck, that property will go into

production. When that happens, we start realizing cash flow from the royalty on the production of the metals.

That is obviously a much less capital intensive way to build a royalty portfolio. It's a slower process, but it's

also less risky. We aren’t putting all of that money out there to be at risk. We also have a very deep understanding

of the project because we have been involved with it since day one.

I can draw an analogy with the whiskey business. When you start a whiskey distillery, you don’t produce

product for the first few years. You then begin to slowly bottle a few of your first batches and sell them off, but

you still aren’t making any money. The real payday has yet to begin. As the years pass, your inventory builds and

you release more and more bottles as your product matures. You now begin to generate positive cash flow which

continues to multiple. It takes time, patience, perseverance and a lot of hard work, but in the end you’ve built a

company with a bright future. That’s where we are now.

We have spent the past thirteen years exploring the world, building a portfolio of properties that are now

maturing into that 13 year old, finely aged whiskey. We are on the cusp of having multiple, organically derived

royalties beginning to cash flow. That is why both Dave Cole and I have been buying shares in the company. When

these properties that we have so carefully cultivated over the years begin throwing out cash flow and we cease to

consume cash and instead generate more and more, I think we will see a dramatic re-pricing of our shares in the

upward direction.

Dr. Allen Alper: That sounds like an excellent model. Could you give our readers examples of some of the

royalty projects you have. Who your partners are.

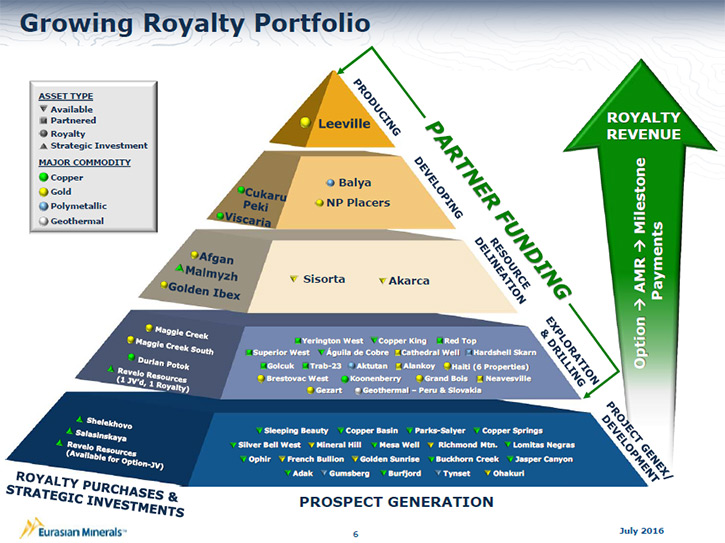

Mr. Scott Close: Of course. We have a cash flowing royalty right now coming out of some Newmont’s gold mines

on Carlin Trend in Nevada. Now that is not one that we grew out of our own portfolio. This is one we uncovered that

was favorably priced and we firmly believe has huge upside potential. We acquired it using Eurasian shares as the

primary currency with the addition of some cash. That royalty helps sustain us by providing solid, long term cash

flow and should for many years to come.

- We also have royalties on the incredible Cukaru Peki copper discovery in Serbia that is now owned by Nevsun

and the property immediately adjacent to that to the west. We also have a royalty on the very mineral rich lead-

zinc-silver project in Turkey called Balya with Dedeman Madencilik, a Turkish concern that is currently in small

scale production, but may not be small scale much longer. The Viscaria copper-iron property with Avalon Minerals in

Sweden. Sono Global Holdings in Haiti on the Grand Bois gold-copper property. A number of other properties in Haiti

that we have a half a percent NSR on that Newmont holds. Along with Desert Star, Arizona Minerals, Kennecott which

is an arm of Rio Tinto, Ely Gold, Entrée Gold, Pasinex Resources, Tumad Madencilik which is another Turkish company,

Black Sea Copper and Gold, and Land and Mineral Limited out of New Zealand.

As for partners, we have a lot of them. Chief among them are Rio Tinto, Newmont and Freeport McMoRan as

well as long list of non-majors.

Dr. Allen Alper: That sounds great. Could you tell about your plans for the rest of 2016 going into 2017?

Mr. Scott Close: We will continue to execute our business model by going out and finding perspective mineral

real estate, performing basic exploration, then vending those properties out, while holding a royalty back. That's

always the plan going forward. We'll perform further exploration in Sweden on the Gumsberg project along with some

exploration activities in Arizona where we have a number of copper properties. Arizona is a world renowned province

for large copper deposits, so we are down there looking for the elephants.

Dr. Allen Alper: That sounds very good. Could you tell us about your background, the team's background, the

Board?

Mr. Scott Close: That would be my pleasure. I studied geology at Colorado State University. I have worked in

mining for about 15 years. I've worked at an In Situ Uranium Mine for Westinghouse, an underground lead zinc silver

mine for Asarco and wire line services in the oil & gas sector. Additionally, in the planning department for a coal

mine of Occidental Minerals. When things got slow in the sector, I was actually in the restaurant business and when

things heated back up, I'd go back into the minerals sector, which I really love. I particularly like working

underground, I find it pretty exciting. And of course I’ve worked here at Eurasian Minerals for over nine years now

and have loved every minute of it.

Dr. Allen Alper: That sounds great. Could you tell me more about the management, Dave's background, the other

team members and the Board?

Mr. Scott Close: Dave Cole is the founder of Eurasian Minerals and is the CEO and a director. I've known Dave

for about thirty years. Dave is an exceedingly capable geologist, coupled with being a very shrewd business man. I

know you have been around the sector for a long time yourself Al, and I’m sure you recognize that those two

qualities rarely occur together.

Dave spent eighteen years working for Newmont. He has worked as a geologist all over the world including

stints in Southeast Asia, South America, Eastern Europe, Central Asia, and a lot of time working in Nevada on the

Carlin Trend.

Dave earned his undergraduate here in Colorado at Fort Lewis College. Then he received his master’s degree

in geology from Colorado State University under the guidance of Dr. Tommy Thompson who's a very well know economic

geologist. Upon graduation, he went back to work for Newmont, then eventually left the company to found Eurasian

Minerals.

Dr. Eric Jensen, is our general manager of exploration. He's worked for a number of big name companies. His

specialty is porphyry-style deposits, high-and-low-sulfidation epithermal gold deposits, and alkaline gold systems

such as the Cripple Creek Mine in Colorado. Eric literally wrote the book on that deposit, which their mining

geologists still utilize today. Additionally, he’s very fluent in IOCG deposits or Iron Oxide Copper Gold. He

received his PhD in economic geology from the Center of Mineral Resources at the University of Arizona in 2003,

which is arguably the best school of economic geology in the country.

Coupled with him is Dr. Dave Johnson, our chief geologist, who studied with Eric at the U of A where Dave also

received his PhD. Dave's specialties are IOCG and copper porphyry deposits. I call Dave and Eric our geo-savants as

they truly have an enormous, encyclopedic knowledge of geology.

That's why we're so engaged in Arizona. Those two gentlemen along with some other guys in the company such

as Dr. Dave Maher and Dr. Doug Kriner are also products of the University of Arizona’s economic geology programs.

Their real focus is on porphyry style copper deposits, which Arizona is known for. If you find a large

copper porphyry deposit that's economically viable to develop, the contained value of the metal in those can be

denominated in tens of billions of dollars. You can only imagine if we had a one percent royalty on something like

that. How much money would that earn for our shareholders over decades of production?

Dr. Allen Alper: That sounds great.

Mr. Scott Close: Our chief legal officer is Jan Steiert. She is an attorney who has counseled a long list of

high profile mining companies. She is the immediate past President of the Rocky Mountain Mineral Law Foundation, a

past President of the Colorado Bar Association Section on Energy and Natural Resources Law, and was listed for many

years in The Best Lawyers in America and Who's Who of Mining Lawyers.

The initial structuring and basic agreements of deals with companies are relatively easy to put together,

but coming to terms on the full blown contractual agreement can be an agonizingly protracted affair. We have found

that having an in-house attorney, familiar with that whole process is very useful in condensing those durations.

Mike Sheehan takes care of our geo information systems; the computer mapping, organizing and compiling data

sets and such. Mike has his Masters from the Colorado School of Mines in geological engineering. He also works as a

field geologist part of the time. He’s an amazingly smart guy. We're really lucky to have him on board.

Dr. Allen Alper: That sounds like you’ve built a very, very strong team.

Mr. Scott Close: Yes, it’s an astonishingly team of very clever people.

Dr. Allen Alper: It's nice to have the right team.

Mr. Scott Close: It is.

Dr. Allen Alper: People should be very interested in your company. Could you tell me a bit about your share

structure, your capital structure?

Mr. Scott Close: We currently have just under 74 million shares outstanding. We have just over 3.7 million

options. We have no outstanding warrants. On a fully diluted basis we have about 77,667,210 shares. We have zero

debt.

Dr. Allen Alper: That's great.

Mr. Scott Close: Most of our shares are traded in the US under the symbol EMXX. We're also traded in Canada

on the Venture Exchange under EMX. The US has five to ten times the amount of liquidity compared to the Canadian

side. If people are looking to buy our shares they can buy them on either exchange. The US is probably the best one

because there is the most liquidity available.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors

should consider investing in your company?

Mr. Scott Close: Well we have spent a lot of time dissecting the mining and exploration business. We've taken

a really hard look at who makes money in this business and how they do it. Specifically what vehicle or vehicles are

they utilizing to make money and create shareholder value? Everything we do has a business focus. There's no sense

engaging in a project or chasing something down if you can't make money. We are here to make money for our

shareholders, that is our goal.

Take a look at mining. Mining is a massively capital intensive business. Geo business statistics tell us the

average time horizon between the initial exploration on a gold project and the first pour at a gold mine is about

ten years. When you take a look at a large porphyry copper project, the time horizon from initial exploration to the

first production at the mine is expanded out to about 24 years. Who in their right mind would wait around for a

decade or two plus decades just to begin to realize an ROI? That's lunacy.

Moreover, as a miner you take on a long litany of risks such as political risk, social risk, commodity pricing risk,

environmental risk, geologic risk, metallurgical risk, labor risk and so on. That’s a lot of risk.

Let’s examine one more benefit of royalty companies. Let’s assume that you have a royalty on a mine with a

moderate to long mine life. The general rule of thumb is that from the initial resource, when a mine first begins

production to the end of mine life, the resource doubles in size. When you bought that royalty, if that's the route

you took, you only paid for that initial resource. Not only that, the royalty holder paid ZERO for all of the

additional exploration, mine expansion, intellectual capital and so forth to facilitate the doubling of the

resource.

What we found was a segment of the industry that makes the most money with the least capital and the lowest

effort and trades at the highest multiples relative to other segments of the industry.

The royalty space is where we want to be and that's where we are staying.

Dr. Allen Alper: That sounds excellent! You are clearly a brilliant business man as well as a

geologist/mining expert. Our readers/investors are going to appreciate your informed summary of what a royalty

company does.

Mr. Scott Close: Thank you, Dr. Alper.

http://www.eurasianminerals.com/

10001 Titan Road

Littleton, CO USA 80125

Phone: +1 (303) 973-8585

Fax: +1 (303) 973-0715

info@eurasianminerals.com

|

|