Mr. David Mendelawitz, Managing Director of Cleveland Mining Company (ASX: CDG): An Australian Managed, Emerging Low-Cost Gold Producer with Assets in Brazil

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/26/2016

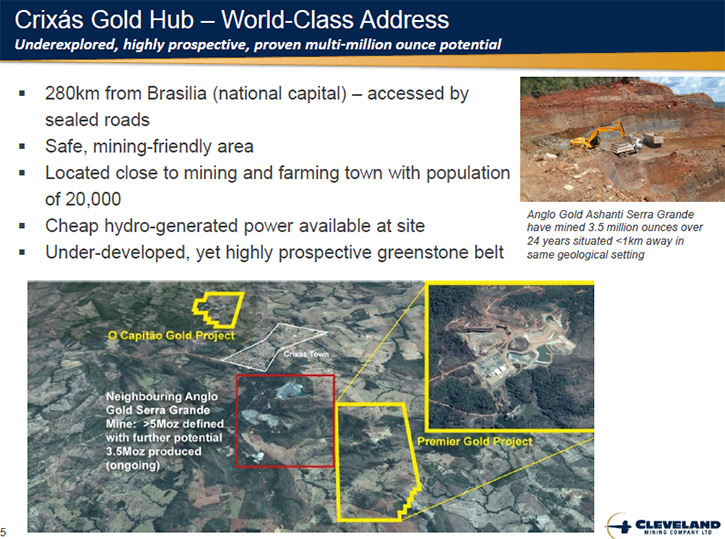

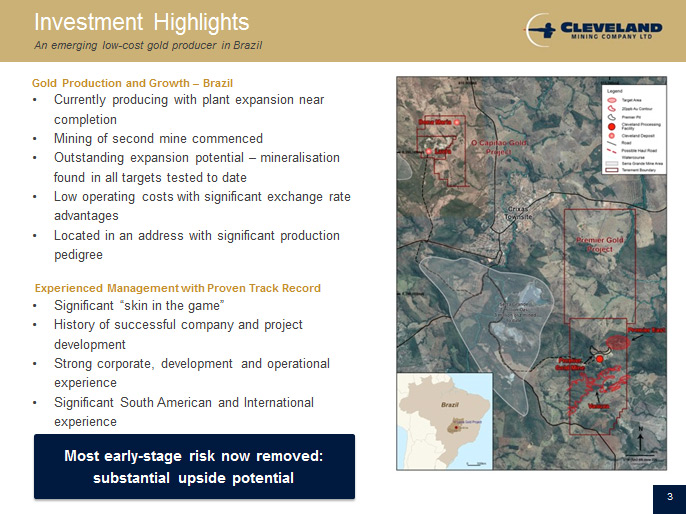

Cleveland Mining Company (ASX: CDG) is an Australian managed, emerging low-cost gold producer with assets in Brazil. The company’s most advanced

project is the producing Premier Gold Mine in the Crixás Gold Hub, located right next to AngloGold Ashanti's multi-million ounces Sierra Grande Project.

Premier Gold started as a small-scale operation designed to allow for rapid expansion and holds a huge upside exploration potential. The expansion and

exploration programs are currently under way drilling multiple high-grade targets across the project to expand the resource. Mr. David Mendelawitz,

Managing Director of Cleveland Mining, believes that by the end of this year we will see a completely different company with large resources, a larger

process plant, more through-put and a clean balance sheet.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, interviewing Mr. David Mendelawitz, who is managing director of Cleveland

Mining. Could you tell me a bit about your company and what differentiates it from other companies? I know you're an Australian company with properties in

Brazil.

Mr. David Mendelawitz: Sure. Our way of developing the company was almost backwards compared to most other listed companies. The strategy came

out of the background of being a geologist who has been involved in running projects from exploration all the way through to selling final product. I saw

that basically a lot of projects were chosen on parameters that weren't really amenable to successful mining in the end.

Most projects don't work at the bottom of the cycle. When I set up the company, I decided that we would look across the world, across the

commodities and say, "Well, what makes the most amount of sense at the bottom of the market, so when things go awry, which they always do, we can have the

greatest chance of making a profit?" Our analysis showed that the center of Brazil in gold was about the safest bet in regard to the metrics, but the

history of junior miners in Brazil was pretty atrocious.

The fact is we went to where we thought the numbers made the most sense as opposed to where we just found a deal. Then instead of building a big

resource, and doing a big feasibility study and then building a mine, we decided, just to check the initial metrics of the area, to check the project, and

build a mine on a initial very small resource. If it worked out, then we would expand off that resource. If it didn't, we'd pack up and leave and sell the

equipment and get the most amount of money back as opposed to us spending years before we'd actually know what we saw on paper was actually working. We

built a small resource next to a very large Anglo Gold Ashanti project and then quite quickly we built a processing plant and started mining. We started

to learn rapidly why it was that people had really struggled in Brazil and how to overcome those hurdles that people had faced and make a productive mine.

It's been a very long haul, as far as, compared to how we'd like it, but we're now one of only a handful of junior gold producers in Brazil and

looking to expand off that.

Dr. Allen Alper: That sounds very good. What are your plans for 2016 and could you tell me more about your deposits in Brazil?

Mr. David Mendelawitz: Our plans are just to finally get right what we've been working on for all these years. We started with a small mill and

processing plant. We've been expanding that plant to get better through-put, over the last few years. We've been doing this while having very little money

and low production. We will finish that expansion very shortly. We've done the bulk of the work now and it's very easy for us to finish the rest of it.

Then we'll expand the resources as well. We have 24 square kilometers of tenements right next to AngloGold’s Ashanti Sierra Grande Project. The tenements

are prospective over most of the ground similar to the mineralization next door.

We've now got enough information to see that the majority of the rocks there are shallow-dipping graphitic schist, with mineralization tending to

be about three meters thick, where it's mineralized. I think we've got very large potential, sitting next door to Anglo, which is about 800 meters away.

They've defined something in the order of 8 million ounces so far and taken out about 4 million ounces to date over the last 30 years. Seeing what they've

got and seeing the correlation between the rock types that they're mining and the ore, with the rock types that we're seeing under our properties, we're

very confident that we're going to get a lot more ounces.

At the moment, we've got multiple rigs drilling across the project to expand the resource space. We've just started mining a very high grade area to the

north of our tenements, a project called Lavra. Lavra was the sight of “garimpeiro” - artisanal mining pits and some shafts there about 30 years ago. They

took out a reportedly 300 thousand ounces out of a very, very small pit by hand. We're back in there now, and have commenced small scale mining. We're

extremely confident that there's a lot of gold on the site.

We're drilling on a place called Don Maria, about a kilometer to the north of Lavra. We've now extended the strike of our initial resource by

about 1.5 to 1.7 kilometers. We're also drilling down to the south of our Premier mine, which is where our process plant is, 10km from Lavra. To date the

results look very promising.

There's a lot happening this year. I suppose the other thing that's been overhanging us is we've had some debt that we have to deal with. It' was due and

payable recently, but we have just finished re-structuring the debt on very favorable terms. We have refinanced packages available to us now and are now

in the final stages to complete this refinance process. I think by the end of this year we will see a completely different company with large resources, a

larger process plant, more through-out and the debt not strangling us.

Dr. Allen Alper: That sounds very good. Could you tell me a little bit more about your background and your team and your board?

Mr. David Mendelawitz: Sure. My background is I was a geologist. I've been in the industry for 23 years now. I've spent most of my career in gold

and iron ore, lots of exploration, lots of mining as well. I suppose, in terms of where my career changed, around 13 years ago, I was employed to work for

a guy called Andrew Forrest in a little start-up at the time called Fortescue Metals Group. I started there, out in the field in Geology. Then within a

year, I was their Registered Manager of Mining for the company, running trial mining operations and then I became the Head of Business Improvement for the

company.

We started with nothing and within 4 years we were a 32 billion dollar company and now it's the fourth biggest iron ore producer in the world. I

had a very hands-on involvement there from first drill holes to the first production of 40 million tons per annum into China. Now, since I've left there 7

years ago, they've gone on to much, much bigger and better things, producing something like 160 million tons of ore per annum. It's something near and

dear to my heart. I have had lots of experience across the globe and that was definitely the highlight, prior to starting Cleveland which started 7 years

ago.

My board: Alex Sundich, is a former merchant banker, who has worked with the big guys across the world. He's also running a boutique advisory firm

out of Sydney. Very calm, very intelligent, very experienced financier. Rick Stroud, mining engineer. Rick has over 45 years of experience now. Once

again, very hands-on experience. He was a Registered Manager of Argyle for a period. He started Optiro Mining Consultants and also he was Head Engineer

for Snowden Mining Consultants, a very technically competent guy. Glenn Simpson. Glenn's the charter of accounting with about 30 years of experience,

really across the globe, but working with mining companies, working insurance and other industries.

All of our management in Brazil, apart from two people, are Brazilian. We have a Peruvian CO. Our CFO in Brazil is an Australian who's been living

in Brazil for a number of years. The rest of our 160 people over there are all Brazilians. We're building up their small company experience, which is very

limited in Brazil. We have some really good hands-on guys there. In the background, as a consultant, we have Mr. Ludovico Costa, who served as the

President of Yamana Gold, Inc. since August 2009 and also served as its Chief Operating Officer until February 2015. Then over here in Australia we've got

a couple of other geo's who are very experienced who go into Brazil reasonably regularly just to look after the work and meet Australian standards.

Dr. Allen Alper: That's a great thought. Could you tell me a little bit about your capital structure?

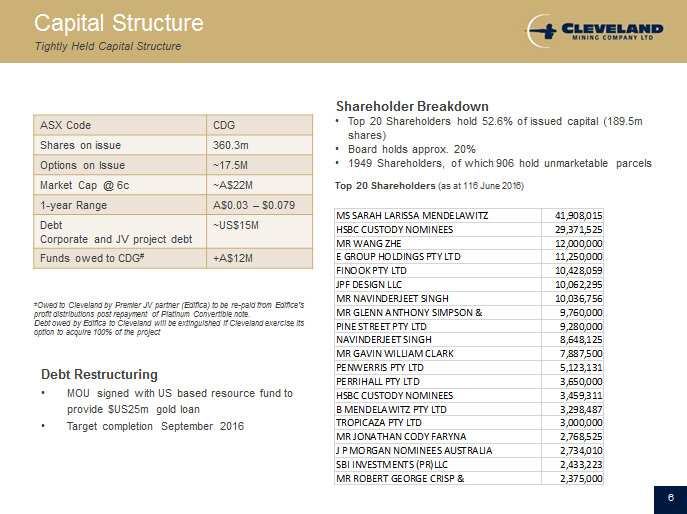

Mr. David Mendelawitz: We've got about 390 million shares on issue at the moment. We don't have a lot of options out there as well. The top 20

own about 52% of the company and friends and family extend that probably to around 80% or maybe even more. It's fairly tightly held. There aren't big

funds on the register at the moment. It's mainly high-net-worths across the board there. There's a couple of smaller funds, but nothing major. We do have

some debt at the moment, but we've got options here to refinance that shortly into something quite palatable. At the moment, we also have a 50-50 JV on

our project, but we have an agreement with the joint venture partners to buy their 50% out which we will be doing over the next couple of months.

Dr. Allen Alper: That sounds good. Could you tell me your thoughts on what's going to happen with gold, a gold forecast?

Mr. David Mendelawitz: I suppose my belief is probably going to make me sounds like a bit of an extremist, so I've got to be cautious with it,

but I think that what people are looking at, in terms of the drivers of the gold market, is mainly irrelevant. I think the real drivers of the gold market

are the Indian economy and the Chinese economy.

I have recently returned from India. The Indians have done there, they've put in a buy back system where they're trying to take most of the gold

out of circulation. India has about 22 thousand tons of gold in circulation. That includes about 5 thousand tons of gold hammered onto statues and

deities.

The rest of it, 17 or 18 thousand tons or there about is mainly kept as jewelry or small ingots. Most of the jewelry is around 22 karat and it's

really a form of wealth. It's actually the banking system there beyond the actual official banking system. It's just a part of their culture, so the

Indian government is trying to take most of their gold out of circulation to support the government's development of India at the moment. That process has

now started and I think will be hotly discussed over the next few days with the International Gold Conference in Agra. I think that that will be a fairly

major driver because the Indian market there is just phenomenal. They use somewhere between 30 and 40 million ounces a year just for weddings. You've got

a culture of relying on this commodity and it's very difficult for them to get. They're not producing gold. They're only importing it or recycling it, but

the majority of it, at least 90% of it, comes from recycling, and if they withdraw that from circulation, then it will have to be replaced.

Now, whilst they are probably not going to be successful with the buy back, it will still put pressure on the gold market.

On the other side, I think that the Chinese government has been collecting gold for a long period, directly or through the populous, through

encouraging the population to actually collect gold, buy gold, and sell it. That's been going on for a long time and my strong belief is that it's because

the Chinese would like to back their currency with gold. I think they will do so soon. I think that once they do that they will have to start pushing the

price of gold up by basically telling the world that they need more gold.

I see that these are two actions that have been going on for a long time and will have a very, very strong influence on the gold price. I think we

could see the gold price go up by a multiple of what it is now as opposed to slowly edging its way up. It may not happen, but I do know that they strike

havoc with the buyback system in India and I do know that almost 100% of the gold being produced in Australia is going to China at the moment. That

doesn't reconcile with what the Chinese government is saying.

Dr. Allen Alper: That's very interesting.

Mr. David Mendelawitz: The conference I went to is around 300 delegates representing refiners, banks, assayers, jewelers - the guys who actually

need and use the gold every day of their lives. They're not just pure investors who change commodities or industries just because they think something

else looks better. This is what they do for a living every day to support this massive industry over in India and Middle East and the like. I was the only

gold producers in the world that's going to this conference of around 300 of the most sophisticated gold buyers in the world. I think there's a massive

disconnect between the gold producing industry and the gold using industry.

Dr. Allen Alper: I appreciate your insights and your prospective. That's very interesting. What are the primary reasons our high-net-worth

readers/investors should consider investing in Cleveland Mining?

Mr. David Mendelawitz: I think that I look at mining as a speculative asset class. Though, I think it's an asset class that is unlike any other

speculative asset. With mining, unlike biotech or technology, or oil and gas, it's much easier to measure the potential of a project at an early stage,

with a small amount of capital introduced into it. Via way of rock chip sampling, drilling, metallurgy and the like, as opposed to 20 year-long drug

testing campaigns or the like or 30 million dollar oil and gas drilling programs. As an industry, it can provide spectacular returns, though as it is very

risky you need to take care with your approach. The approach that Cleveland has taken is to, look for the upsides, but we're trying to mitigate the risk

along the way by first positioning ourselves in the right jurisdiction, with the right commodity, at the right scale and then taking an approach where we

get to know it first, before building up. We've eliminated a good proportion of the risks that come with developing a project. Look, we still have some of

those risks. We don't know how much gold we're going to find there. We've demonstrated that this site we have, has the capacity for a very large amount of

gold and the cost basis is one of the cheapest in the world. Our unit cost is so much cheaper than most other jurisdictions in the world that our

potential profitability is much, much higher. So we've removed much of the risk, but we still have the upsides there. I think beyond that, we've

demonstrated our resolve, that we can survive through one of the toughest times in mining in history with one of the smallest bank accounts in the mining

industry and still be there. We're sitting there completely under-valued with a very low market cap, but we think by demonstrating a few more of the

metrics, we will be able to convert that into a very high market cap very quickly just by demonstrating the amount of gold there or the profitability

through the production.

Dr. Allen Alper: That sounds very good, very strong reasons why our high-net-worth readers/investors should take a close look at your company.

David, is there anything else you'd like to add?

Mr. David Mendelawitz: No, I suppose just watch us, because we believe that we can convert a low market cap, low production company to completely

the opposite, to a high market cap, highly profitable company very quickly.

Dr. Allen Alper: That sounds excellent.

http://clevelandmining.com.au/

Registered Address:

Suite 1, 41 Walters Drive

Osborne Park WA 6017

Postal Address:

PO Box 1471 Osborne Park WA 6916

Phone: +61 (08) 6389 6000

Fax: +61 (08) 6389 6099

Email: info@clevelandmining.com.au

|

|